Answer the following questions based on the instructions and the computation table:

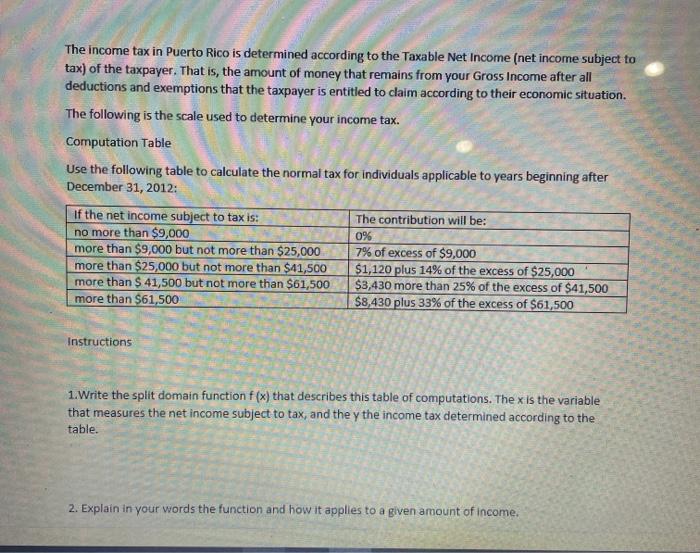

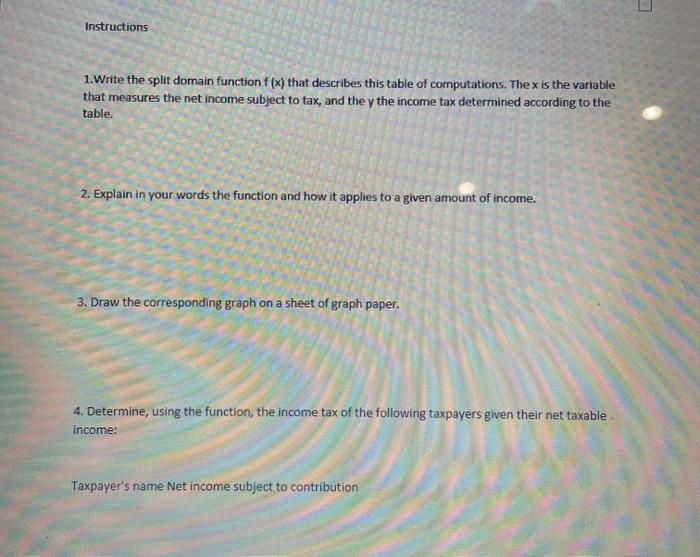

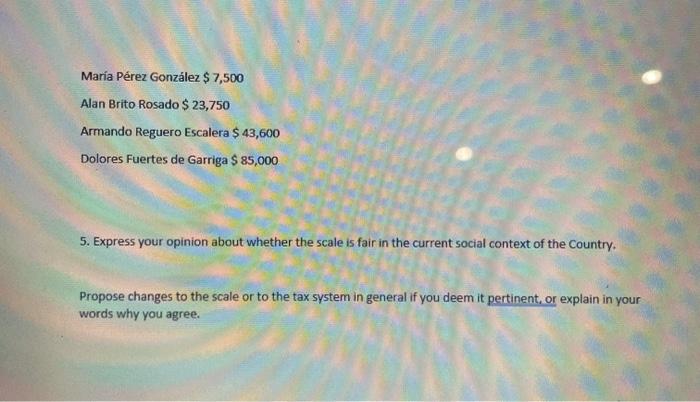

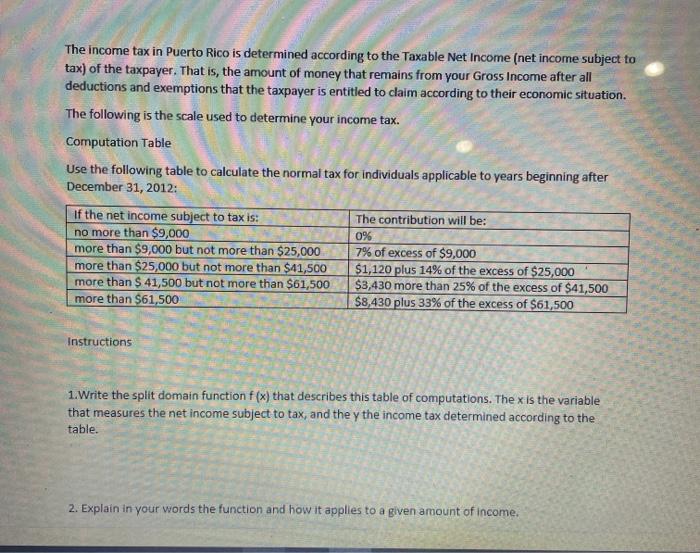

The income tax in Puerto Rico is determined according to the Taxable Net Income (net income subject to tax) of the taxpayer. That is, the amount of money that remains from your Gross Income after all deductions and exemptions that the taxpayer is entitled to claim according to their economic situation. The following is the scale used to determine your income tax. Computation Table Use the following table to calculate the normal tax for individuals applicable to years beginning after December 31, 2012: If the net income subject to tax is: The contribution will be: no more than $9,000 0% more than $9,000 but not more than $25,000 7% of excess of $9,000 more than $25,000 but not more than $41,500 $1,120 plus 14% of the excess of $25,000 more than $ 41,500 but not more than $61,500 $3,430 more than 25% of the excess of $41,500 more than $61,500 $8,430 plus 33% of the excess of $61,500 Instructions 1. Write the split domain function f(x) that describes this table of computations. The x is the variable that measures the net income subject to tax, and they the income tax determined according to the table. 2. Explain in your words the function and how it applies to a given amount of income. Instructions 1. Write the split domain function f(x) that describes this table of computations. The x is the variable that measures the net income subject to tax, and they the income tax determined according to the table, 2. Explain in your words the function and how it applies to a given amount of income. 3. Draw the corresponding graph on a sheet of graph paper. 4. Determine, using the function, the income tax of the following taxpayers given their net taxable income: Taxpayer's name Net income subject to contribution Mara Prez Gonzlez $ 7,500 Alan Brito Rosado $ 23,750 Armando Reguero Escalera $ 43,600 Dolores Fuertes de Garriga $ 85,000 5. Express your opinion about whether the scale is fair in the current social context of the Country. Propose changes to the scale or to the tax system in general if you deem it pertinent, or explain in your words why you agree. Document - Word References Mailings Review View Help Get Add-ins W My Add-ins - Wikipedia Table Design Layout tink - Bookmark Online Video Cross-reference Links SmartArt Chart Screenshot Comment Header Footer Number Header & Footer Text Box P Media Comments Addin BREDDE Instructions 1.Write the split domain function f(x) that describes this table of computations. The x is the variable that measures the net income subject to tax, and they the income tax determined according to the table, 2. Explain in your words the function and how it applies to a given amount of income. 3. Draw the corresponding graph on a sheet of graph paper. 4. Determine, using the function, the income tax of the following taxpayers given their net taxable income Tixpayer's name Net income subject to contribution o . . E ca