Answer the following questions on a separate Microsoft Word or Excel document. Explain how you reached the answer or show your work if a mathematical

Answer the following questions on a separate Microsoft Word or Excel document. Explain how you reached the answer or show your work if a mathematical calculation is needed, or both. Submit your assignment using the assignment link in Blackboard.

Exercises

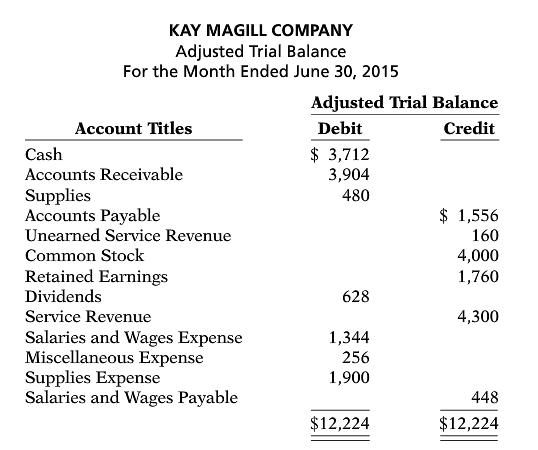

Kay Magill Company had the following adjusted trial balance.

Instructions

- Prepare closing entries at June 30, 2015.

- Prepare a post-closing trial balance.

. Keenan Company has an inexperienced accountant. During the first 2 weeks on the job, the accountant made the following errors in journalizing transactions. All entries were posted as made.

- A payment on account of $840 to a creditor was debited to Accounts Payable $480 and credited to Cash $480.

- The purchase of supplies on account for $560 was debited to Equipment $56 and credited to Accounts Payable $56.

- A $500 cash dividend was debited to Salaries and Wages Expense $500 and credited to Cash $500.

Instructions

Prepare the correcting entries.

KAY MAGILL COMPANY Adjusted Trial Balance For the Month Ended June 30, 2015 Account Titles Cash Accounts Receivable Supplies Accounts Payable Unearned Service Revenue Common Stock Retained Earnings Dividends Service Revenue Salaries and Wages Expense Miscellaneous Expense Supplies Expense Salaries and Wages Payable Adjusted Trial Balance Debit Credit $ 3,712 3,904 480 628 1,344 256 1,900 $12,224 $1,556 160 4,000 1,760 4,300 448 $12,224

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

June June 30 June 30 30 June 30 Sewig Revenue Income Summery To close Revenue account Income Summer...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started