Answered step by step

Verified Expert Solution

Question

1 Approved Answer

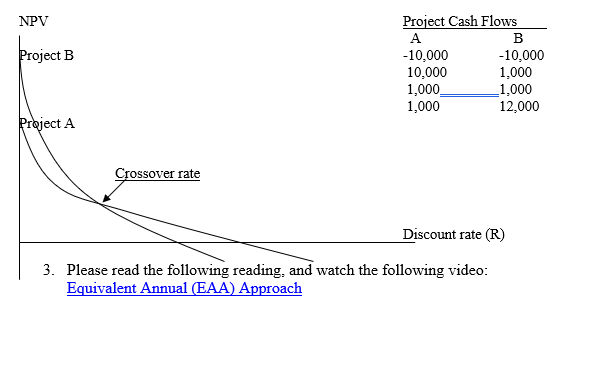

answer the following questions using the project cash flows for Project A and Project B: Label the graph below just like the class video (including

answer the following questions using the project cash flows for Project A and Project B:

- Label the graph below just like the class video (including axis labels) with numbers for the 2 mutually exclusive projects (below)

- Identify which project you would choose using IRR

- Identify which project you would choose using NPV for these discount rates: 0%, 8%, & 12%

- Write a brief explanation of why your NPV decision changes and at what rate that decision begins to conflict with the IRR choice.

Now, using this video, and the class video on EAA, answer the following question using the cash flows for mutually exclusive Project A and Project B (below)

Year: 0 1 2 3 4 5 6

Project A CF ($): (18,000) 4,500 6,500 6,500 6,500 5,500 4,500

Project B CF ($): (9,000) 3,000 7,000 6,000 0 0 0

- Compute the net present value for both projects using a 15% discount rate.

- Compute the equivalent annual annuity using a 15 percent discount rate

- Identify which project you would choose using NPV and which project you would choose using EAA

- Finally, identify which decision criteria is the most appropriate one to use in this situation and why.

Please show how you got your answer clearly with excel

NPV Project B Project Cash Flows A B -10,000 -10,000 10,000 1,000 1,000 _1,000 1,000 12,000 Project A Crossover rate Discount rate (R) 3. Please read the following reading, and watch the following video: Equivalent Annual (EAA) ApproachStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started