Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following using the Accrued income and Accrued expense. 1. A warehouse has been leased to Ohio Company for P50,000 per month beginning

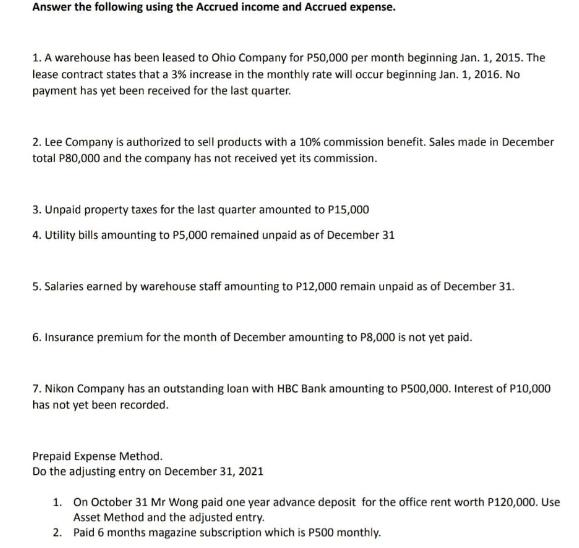

Answer the following using the Accrued income and Accrued expense. 1. A warehouse has been leased to Ohio Company for P50,000 per month beginning Jan. 1, 2015. The lease contract states that a 3% increase in the monthly rate will occur beginning Jan. 1, 2016. No payment has yet been received for the last quarter. 2. Lee Company is authorized to sell products with a 10% commission benefit. Sales made in December total P80,000 and the company has not received yet its commission. 3. Unpaid property taxes for the last quarter amounted to P15,000 4. Utility bills amounting to P5,000 remained unpaid as of December 31 5. Salaries earned by warehouse staff amounting to P12,000 remain unpaid as of December 31. 6. Insurance premium for the month of December amounting to P8,000 is not yet paid. 7. Nikon Company has an outstanding loan with HBC Bank amounting to P500,000. Interest of P10,000 has not yet been recorded. Prepaid Expense Method. Do the adjusting entry on December 31, 2021 1. On October 31 Mr Wong paid one year advance deposit for the office rent worth P120,000. Use Asset Method and the adjusted entry. 2. Paid 6 months magazine subscription which is P500 monthly.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Accrued Income Debit Rent Income P50000 and Credit Accrued Income P50000 2 Accrued Expense Debit Accrued Expense P15000 and Credit Property Tax Expense P15000 3 Accrued Expense Debit Accrued ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started