Answer these questions keenly. Solve for all parts. Please no guess work.

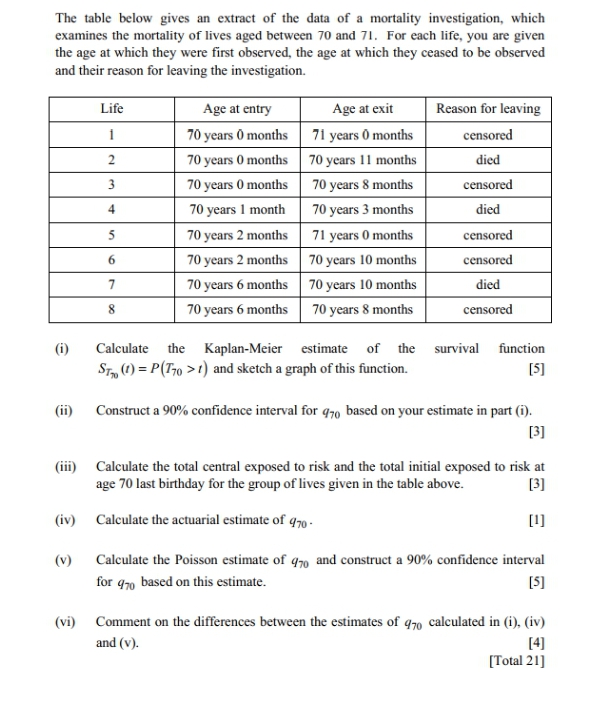

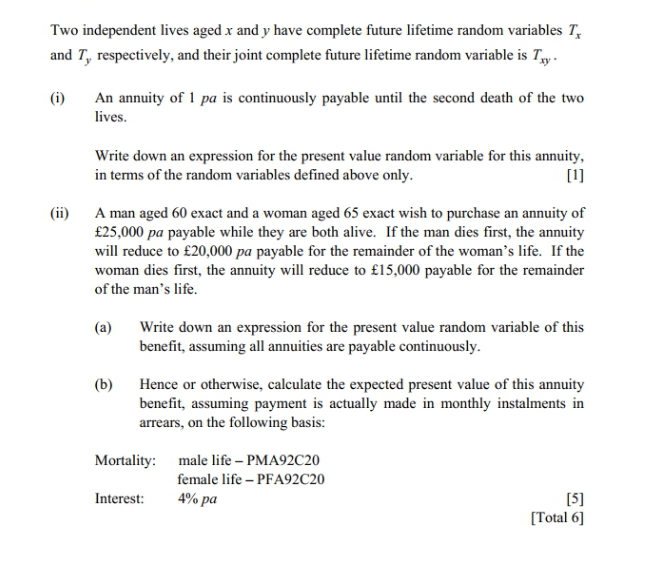

The table below gives an extract of the data of a mortality investigation, which examines the mortality of lives aged between 70 and 71. For each life, you are given the age at which they were first observed, the age at which they ceased to be observed and their reason for leaving the investigation. Life Age at entry Age at exit Reason for leaving 1 70 years 0 months 71 years 0 months censored N 70 years 0 months 70 years 11 months died 3 70 years 0 months 70 years 8 months censored 4 70 years 1 month 70 years 3 months died 70 years 2 months 71 years 0 months censored 6 70 years 2 months 70 years 10 months censored 7 70 years 6 months 70 years 10 months died 8 70 years 6 months 70 years 8 months censored (i) Calculate the Kaplan-Meier estimate of the survival function STTO (1) = P(770 > 1) and sketch a graph of this function. [5] (ii) Construct a 90% confidence interval for 970 based on your estimate in part (i). [3] (iii) Calculate the total central exposed to risk and the total initial exposed to risk at age 70 last birthday for the group of lives given in the table above. [3] (iv) Calculate the actuarial estimate of 970 - [1] (v) Calculate the Poisson estimate of 97, and construct a 90% confidence interval for 970 based on this estimate. [5] (vi) Comment on the differences between the estimates of 970 calculated in (i), (iv) and (v). [4] [Total 21]Two independent lives aged x and y have complete future lifetime random variables T. and T, respectively, and their joint complete future lifetime random variable is Try . (i) An annuity of 1 pa is continuously payable until the second death of the two lives. Write down an expression for the present value random variable for this annuity, in terms of the random variables defined above only. [1] (ii) A man aged 60 exact and a woman aged 65 exact wish to purchase an annuity of 125,000 pa payable while they are both alive. If the man dies first, the annuity will reduce to f20,000 pa payable for the remainder of the woman's life. If the woman dies first, the annuity will reduce to $15,000 payable for the remainder of the man's life. (a) Write down an expression for the present value random variable of this benefit, assuming all annuities are payable continuously. (b) Hence or otherwise, calculate the expected present value of this annuity benefit, assuming payment is actually made in monthly instalments in arrears, on the following basis: Mortality: male life - PMA92C20 female life - PFA92C20 Interest: 4% pa [5] [Total 6]