Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer this Part 1 ) Problem 1 The Lost in Space corporation is trying to finally build as pace ship that won't end up stranding

Answer this Part Problem

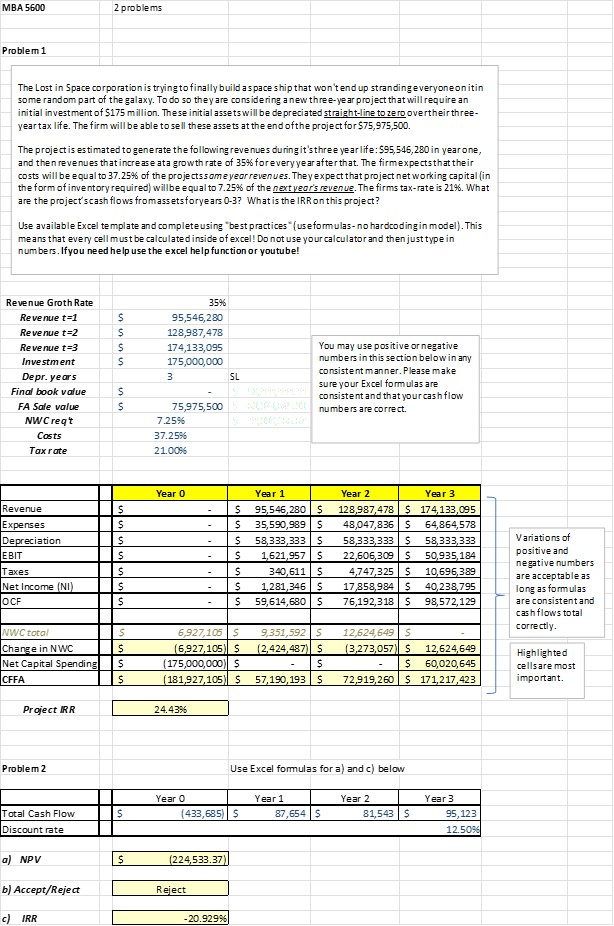

The Lost in Space corporation is trying to finally build as pace ship that won't end up stranding everyoneon itin

some random part of the galaxy. To do so they are considering a new threeyear project that will require an

initial investment of $m illion. The se initial assets will be de preciated straightline to zero overtheir three

yeartax life. The firm will be able to sell these asse ts at the end ofthe project for $

The project is es timated to generate the following revenues duringit's three year life: $ in year one,

and then revenues that increase ata growth rate of for every year after that. The firmexpects that the ir

costs will be equal to of the projectssame year revenues. They expect that project net working capital in

the form of inventory required willbe equal to of the next year's revenue. The firms taxrate is What

are the project'scash flows fromassets foryears What is the IRR on this project?

Use available Excel template and completeusing "best practices" use formulasno hardcoding in model This

means that every cell must be calculated inside of excel! Do not use your calculator and then just type in

numbers. If you need help use the excel help function or youtube!Problem

The Lost in Space corporation is trying to finally build as pace ship that won't end up stranding everyoneon itin

some random part of the galaxy. To do so they are considering a new threeyear project that will require an

initial investment of $ illion. The se initial assets will be de preciated straightline to zero overtheir three

yeartax life. The firm will be able to sell these asse ts at the end ofthe project for $

The project is es timated to generate the following revenues duringit's three year life: $ in year one,

and then revenues that increase ata growth rate of for every year after that. The firmexpects that the ir

costs will be equal to of the projectssame year revenues. They expect that project net working capital in

the form of inventory required willbe equal to of the next year's revenue. The firms taxrate is What

are the project'scash flows fromassets foryears What is the IRR on this project?

Use available Excel template and completeusing "best practices" use formulasno hardcoding in model This

means that every cell must be calculated inside of excel! Do not use your calculator and then just type in

numbers. If you need help use the excel help function or youtube!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started