answer two out of the three questions and show work on excel thank you

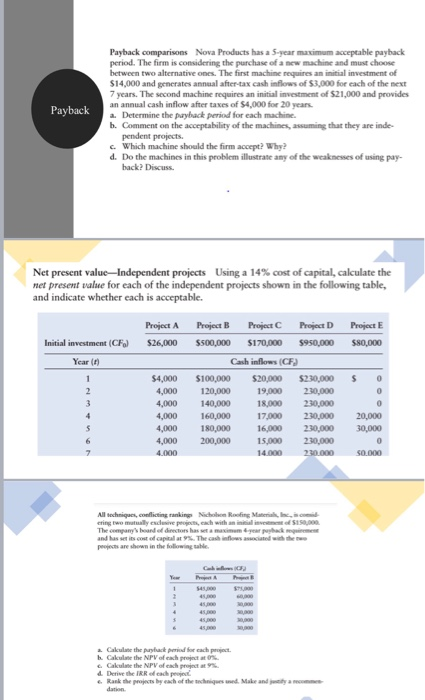

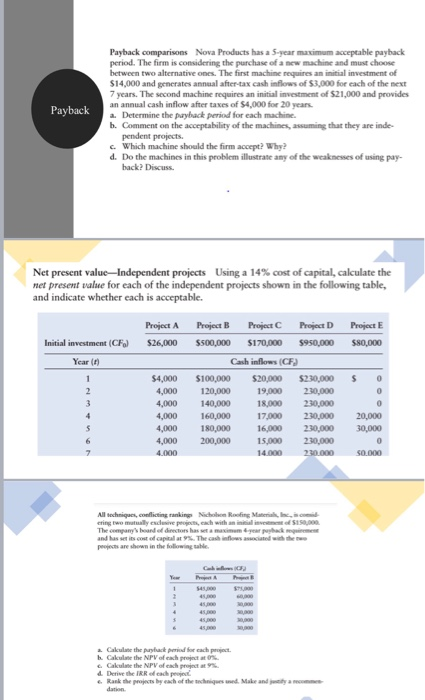

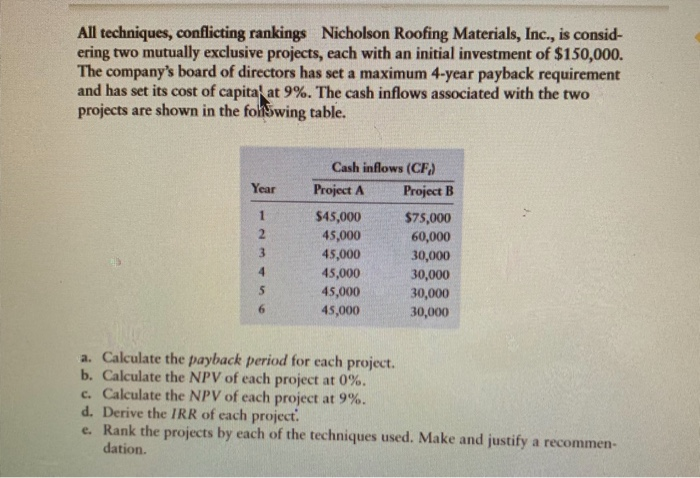

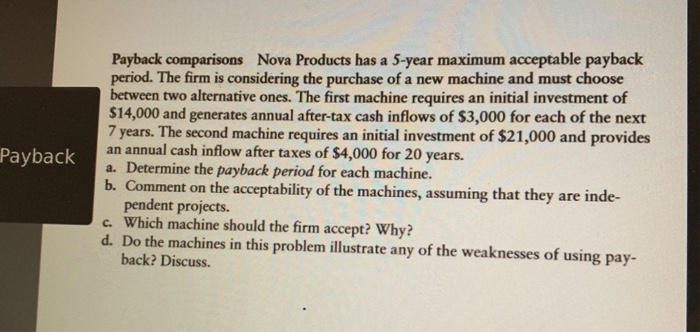

Payback Payback comparisons Nova Products has a 5-year maximum acceptable payback period. The firm is considering the purchase of a new machine and must choose between two alternative ones. The first machine requires an initial investment of $14,000 and generates annual after-tax cash inflows of $3,000 for each of the next 7 years. The second machine requires an initial investment of S21,000 and provides an annual cash inflow after taxes of $4,000 for 20 years a. Determine the payback period for each machine. b. Comment on the acceptability of the machines, assuming that they are inde pendent projects, Which machine should the firm accept? Why? d. Do the machines in this problem illustrate any of the weaknesses of using pay- back? Discuss. Net present value-Independent projects Using a 14% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. Project A Project B Project Project D Project E Initial investment (CF) $26,000 $500,000 $170,000 $950,000 $80,000 Year (6) Cash inflows (CF $4,000 $100,000 $20,000 $230,000 $ 0 4,000 120,000 19,000 230,000 0 3 4,000 140,000 18,000 230,000 0 4,000 160,000 17,000 230,000 20,000 5 4,000 180,000 16,000 230,000 30,000 4,000 200,000 15,000 230,000 0 4.000 14.000 230.000 50.000 2 4 All techniques, conflicting ranking Nichole Roofing Materiale.com ering two mutually exclusive projects, each with an este 150,00 The company's board of directors has set a maximum your poshack requirement and has set its cost of capital at %. The cash infosited with the projects are shown in the following the 1 450,00 s. 200 Calculate the placed for each project Calculate the NPV of each Calculate the NPV of each project d. Derive the IRR of each 6. Rank the projects by each of the techniques wed. Make and dation All techniques, conflicting rankings Nicholson Roofing Materials, Inc., is consid- ering two mutually exclusive projects, each with an initial investment of $150,000. The company's board of directors has set a maximum 4-year payback requirement and has set its cost of capital at 9%. The cash inflows associated with the two projects are shown in the following table. Year 1 Cash inflows (CF) Project A Project B $45,000 $75,000 45,000 60,000 45,000 30,000 45,000 30,000 45,000 30,000 45,000 30,000 3 4 5 6 a. Calculate the payback period for each project. b. Calculate the NPV of each project at 0%. c. Calculate the NPV of each project at 9%. d. Derive the IRR of each project e. Rank the projects by each of the techniques used. Make and justify a recommen- dation. Payback Payback comparisons Nova Products has a 5-year maximum acceptable payback period. The firm is considering the purchase of a new machine and must choose between two alternative ones. The first machine requires an initial investment of $14,000 and generates annual after-tax cash inflows of $3,000 for each of the next 7 years. The second machine requires an initial investment of $21,000 and provides an annual cash inflow after taxes of $4,000 for 20 years. a. Determine the payback period for each machine. b. Comment on the acceptability of the machines, assuming that they are inde- pendent projects. c. Which machine should the firm accept? Why? d. Do the machines in this problem illustrate any of the weaknesses of using pay- back? Discuss