Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answered in Excel with formulas please 1. Suppose that XTel currently is selling at $40 per share. You buy 500 shares using $10,000 of your

Answered in Excel with formulas please

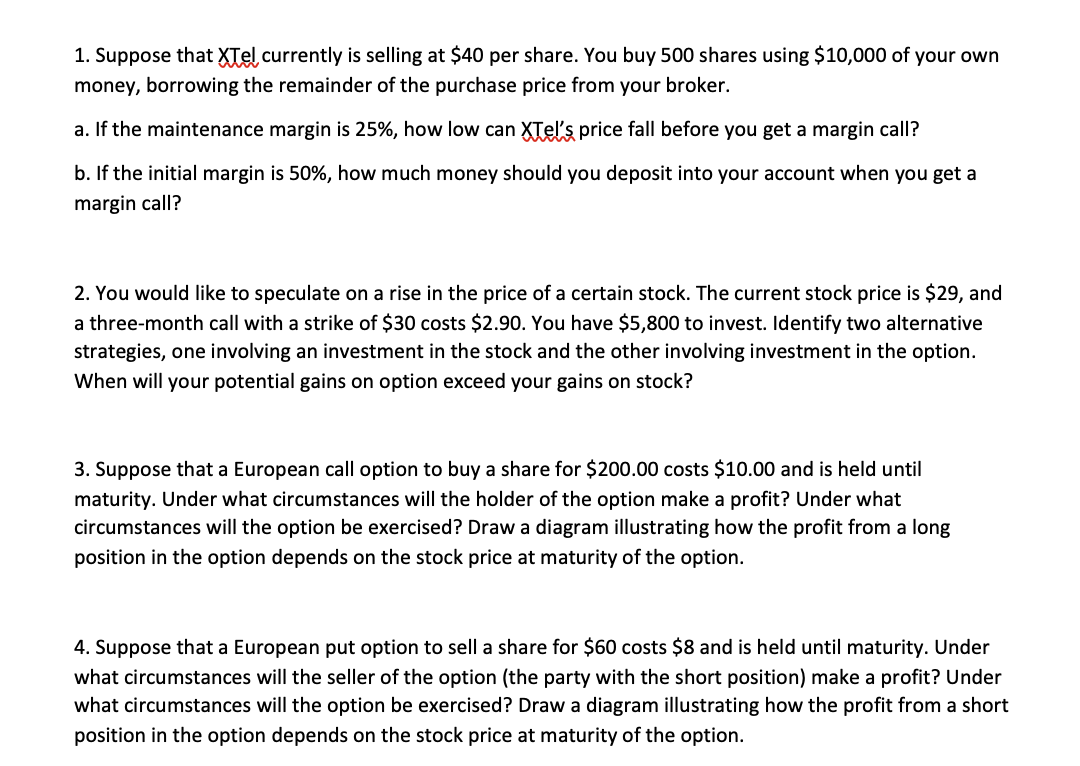

1. Suppose that XTel currently is selling at $40 per share. You buy 500 shares using $10,000 of your own money, borrowing the remainder of the purchase price from your broker. a. If the maintenance margin is 25%, how low can XTel's price fall before you get a margin call? b. If the initial margin is 50%, how much money should you deposit into your account when you get a margin call? 2. You would like to speculate on a rise in the price of a certain stock. The current stock price is $29, and a three-month call with a strike of $30 costs $2.90. You have $5,800 to invest. Identify two alternative strategies, one involving an investment in the stock and the other involving investment in the option. When will your potential gains on option exceed your gains on stock? 3. Suppose that a European call option to buy a share for $200.00 costs $10.00 and is held until maturity. Under what circumstances will the holder of the option make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a long position in the option depends on the stock price at maturity of the option. 4. Suppose that a European put option to sell a share for $60 costs $8 and is held until maturity. Under what circumstances will the seller of the option (the party with the short position) make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a short position in the option depends on the stock price at maturity of the option. 1. Suppose that XTel currently is selling at $40 per share. You buy 500 shares using $10,000 of your own money, borrowing the remainder of the purchase price from your broker. a. If the maintenance margin is 25%, how low can XTel's price fall before you get a margin call? b. If the initial margin is 50%, how much money should you deposit into your account when you get a margin call? 2. You would like to speculate on a rise in the price of a certain stock. The current stock price is $29, and a three-month call with a strike of $30 costs $2.90. You have $5,800 to invest. Identify two alternative strategies, one involving an investment in the stock and the other involving investment in the option. When will your potential gains on option exceed your gains on stock? 3. Suppose that a European call option to buy a share for $200.00 costs $10.00 and is held until maturity. Under what circumstances will the holder of the option make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a long position in the option depends on the stock price at maturity of the option. 4. Suppose that a European put option to sell a share for $60 costs $8 and is held until maturity. Under what circumstances will the seller of the option (the party with the short position) make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a short position in the option depends on the stock price at maturity of the optionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started