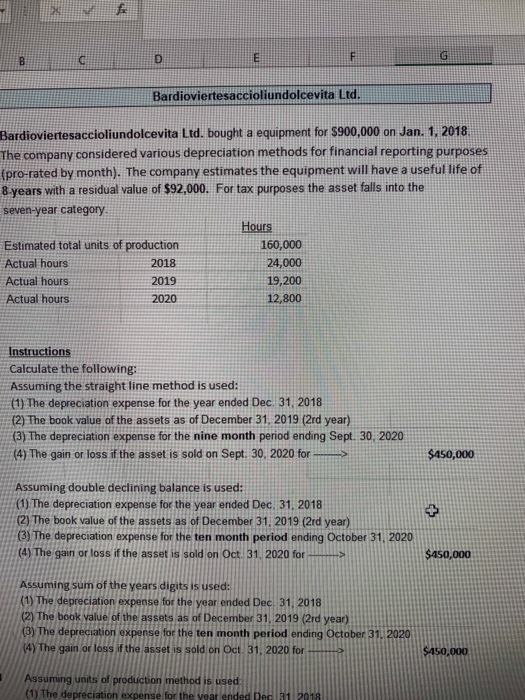

Answers A-D are done. Help solving E and F?

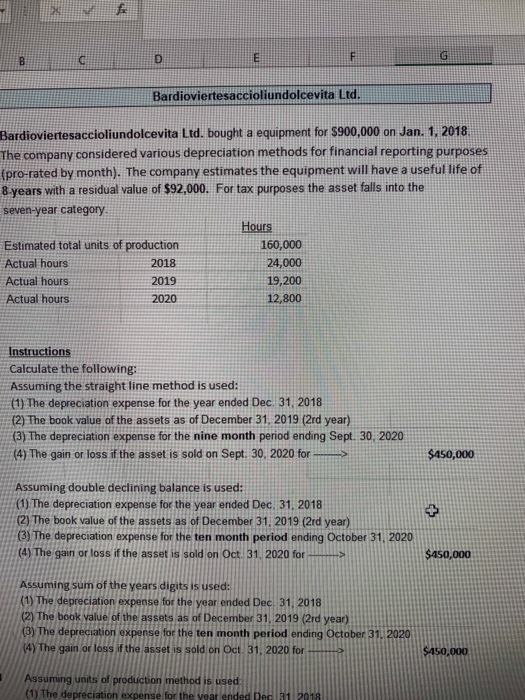

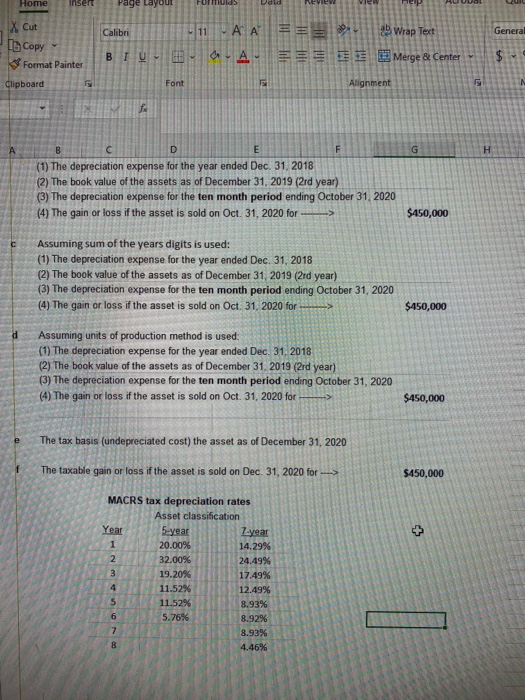

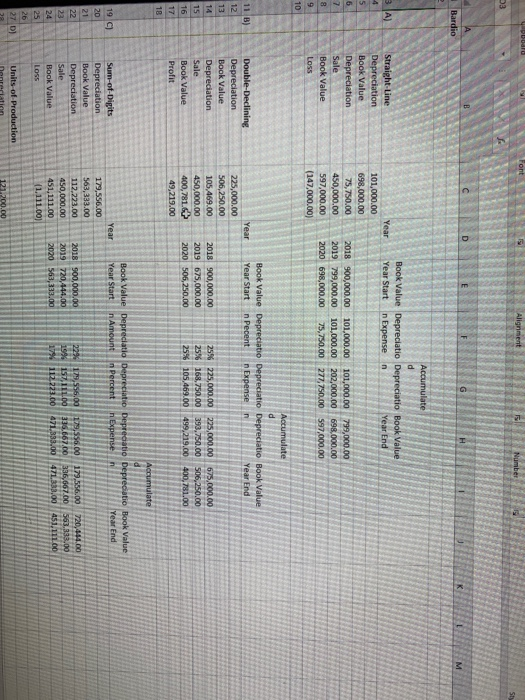

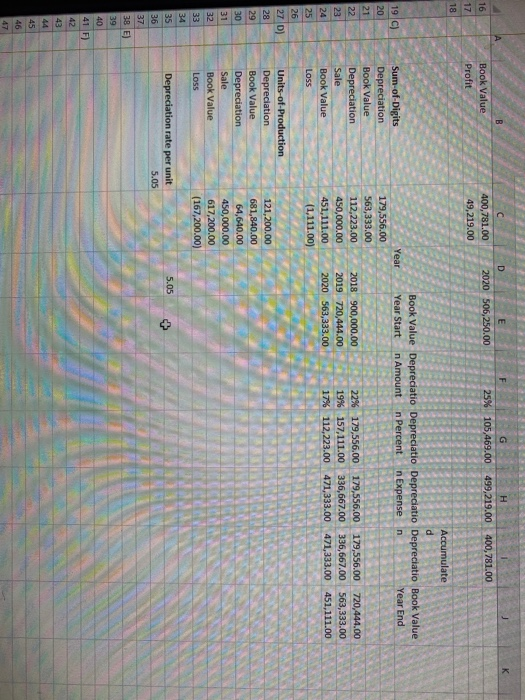

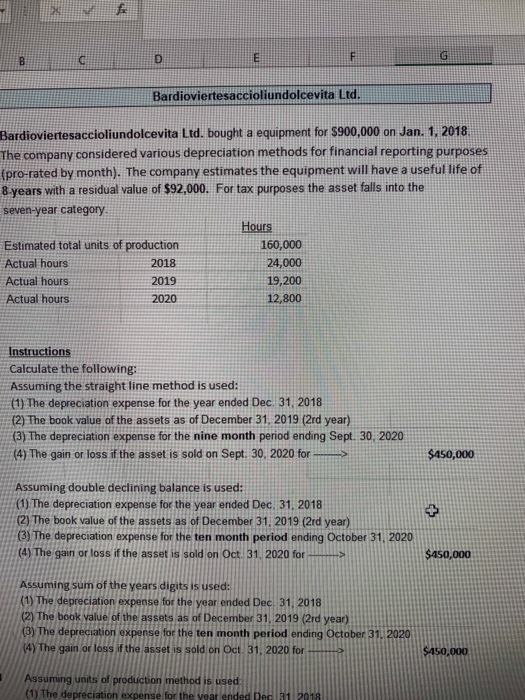

c D B E F G Bardioviertesaccioliundolcevita Ltd. Bardioviertesaccioliundolcevita Ltd. bought a equipment for $900,000 on Jan. 1. 2018 The company considered various depreciation methods for financial reporting purposes (pro-rated by month). The company estimates the equipment will have a useful life of 8-years with a residual value of $92,000. For tax purposes the asset falls into the seven-year category Hours Estimated total units of production 160,000 Actual hours 2018 24,000 Actual hours 2019 19,200 Actual hours 2020 12,800 Instructions Calculate the following: Assuming the straight line method is used: (1) The depreciation expense for the year ended Dec 31, 2018 (2) The book value of the assets as of December 31, 2019 (2rd year) (3) The depreciation expense for the nine month period ending Sept. 30, 2020 (4) The gain or loss if the asset is sold on Sept. 30, 2020 for $450,000 Assuming double declining balance is used: (1) The depreciation expense for the year ended Dec 31, 2018 (2) The book value of the assets as of December 31, 2019 (2rd year) (3) The depreciation expense for the ten month period ending October 31, 2020 (4) The gain or loss if the asset is sold on Oct. 31, 2020 for > $450,000 Assuming sum of the years digits is used: (1) The depreciation expense for the year ended Dec 31, 2018 (2) The book value of the assets as of December 31, 2019 (2rd year) (3) The depreciation expense for the ten month period ending October 31, 2020 (4) The gain or loss if the asset is sold on Oct 31, 2020 for $450,000 Assuming units of production method is used: (1) The depreciation expense for the year ended Dec 31 2018 Home insert Page Layout FORTIUS Daud Neview Calibri General X cut Copy 3 Format Painter 11 AA === Wrap Text - A Merge & Center BIU HB $ Clipboard Eont Alignment N F G H B C D E (1) The depreciation expense for the year ended Dec 31, 2018 (2) The book value of the assets as of December 31, 2019 (2rd year) (3) The depreciation expense for the ten month period ending October 31, 2020 (4) The gain or loss if the asset is sold on Oct. 31, 2020 for $450,000 Assuming sum of the years digits is used: (1) The depreciation expense for the year ended Dec 31, 2018 (2) The book value of the assets as of December 31, 2019 (2rd year) (3) The depreciation expense for the ten month period ending October 31, 2020 (4) The gain or loss if the asset is sold on Oct. 31, 2020 for $450,000 Assuming units of production method is used: (1) The depreciation expense for the year ended Dec 31, 2018 (2) The book value of the assets as of December 31, 2019 (2nd year) (3) The depreciation expense for the ten month period ending October 31, 2020 (4) The gain or loss if the asset is sold on Oct. 31, 2020 for $450,000 e The tax basis (undepreciated cost) the asset as of December 31, 2020 f The taxable gain or loss if the asset is sold on Dec. 31, 2020 for --> $450,000 MACRS tax depreciation rates Asset classification Year 5 year Z-year 1 20.00% 14.29% 2 32.0096 24.49% 3 19.20% 17.49% 11.52% 12.49% 5 11.52% 8.93% 6 5.76% 8.92% 7 8.93% 4.46% 8 DO Font Alignment Number 3 B Bardio M Accumulate d Book Value Depreciatio Depreciatio Book Value Year Start n Expensen Year End Year 3 A) 4 5 5 7 8 9 10 Straight-Line Depreciation Book Value Depreciation Sale Book Value Loss 101,000.00 698,000.00 75,750.00 450,000.00 597,000.00 (147,000.00) 2018 900,000.00 101,000.00 101,000.00 799,000.00 2019 799,000.00 101,000.00 202,000.00 698,000.00 2020 698,000.00 75,750.00 277,750.00 597,000.00 Accumulate d Book Value Depreciatio Depreciatio Depreciatio Book Value Year Start n Pecent n Expense Year End Year 12 13 14 Double-Declining Depreciation Book Value Depreciation Sale Book Value Profit 225,000.00 506,250.00 105,469.00 450,000.00 400,781.+ 49,219.00 15 2018 900,000.00 2019 675,000.00 2020 506,250.00 25% 225,000.00 225,000.00 675,000.00 25% 168,750.00 393,750.00 506,250.00 25% 105,469.00 499,219,00 400,781.00 16 17 18 Accumulate 190) 20 21 22 Sum-of-Digits Depreciation Book Value Depreciation Sale Book Value Loss Book Value Depreciatio Depreciatio Deprecatio Depreciatio Book Value Year Year Start n Amount n Percent n Expense n Year End 179,556.00 563,333.00 112,223.00 2018 900,000.00 22% 1,596.00 119,556.00 179,556.00 720,4-14.00 450,000.00 2019 720,444.00 19% 157, 111.00 336.667.00 336,667.00 563.233.00 451,111.00 2020 563,333.00 17% 112 223.00 471.293.00 471,333,00 481. 111.00 1,111.00) 24 25 26 27 D) Units of Production 123,200.00 B F D E 2020 506,250.00 G 25% 105,469.00 499,219.00 400,781.00 16 Book Value Profit 400,781.00 49,219.00 17 18 19 C) 20 Accumulate d Book Value Depreciatio Depreciatio Depreciatio Depreciatio Book Value Year Year Start n Amount n Percent n Expense Year End 179,556.00 563,333.00 112,223.00 2018 900,000.00 22% 179,556.00 179,556.00 179,556.00 720,444.00 450,000.00 2019 720,444.00 19% 157,111,00 336,667.00 336,667.00 563,333.00 451,111.00 2020 563,333.00 17% 112,223.00 471,333.00 471,333,00 451,111.00 (1,111.00) Sum-of-Digits Depreciation Book Value Depreciation Sale Book Value 21 22 23 24 25 26 27 D) 28 Loss 29 30 31 Units-of-Production Depreciation Book Value Depreciation Sale Book Value Loss 121,200.00 681,840.00 64,640.00 450,000.00 617,200.00 (167,200.00) 32 33 34 5.05 35 36 Depreciation rate per unit 5.05 3 37 38 E) 39 40 41 F 42 43 45 46