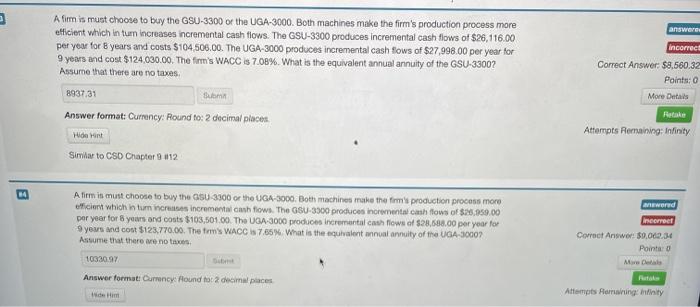

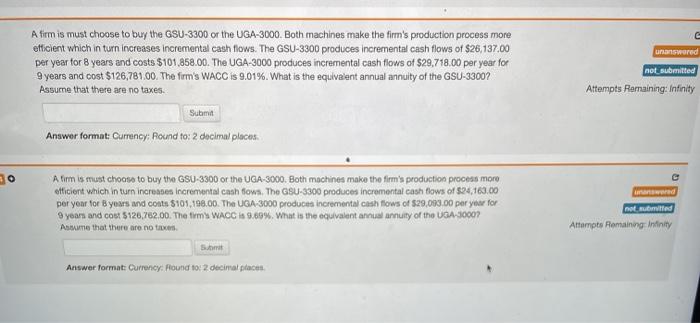

answers Afimis must choose to buy the GSU-3300 or the UGA-3000. Both machines make the firm's production process more efficient which in turn increases incremental cash flows. The GSU-3300 produces incremental cash flows of $26,116.00 per you for years and costs $104,506.00. The UGA-3000 produces incremental cash flows of $27,998.00 per year for 9 years and cost $124.000.00. The firm's WACC $ 7.08%. What is the equivalent annual annuity of the GSU-33002 Assume that there are no taxes 8937.31 Som Answer format: Currency: Round to: 2 decimal places Hidrant Similar to CSD Chapter 9 412 incorrect Correct Answer: $8,560.32 Points: 0 More Details Rake Attempts Remaining: Infinity werd A firm is must choose to buy the SU3300 or the UGA-3000. Both machines make the firm's production process more officient which in turn into increment Gash flows. The GSU-3300 produces incrementa cash flows of $25,059.00 per year for 8 years and costs $103,501.00. The UGA-3000 produces incremental cash flows of $28.688.00 per year for 9 yeus id cost $123.770.00. The firm's WACC is 7.65% What is the equivalent annual annuity of the UGA-30007 Assume that there are not Incorrect Correct Answer: $9,009.34 Pointa o Melle 10330.97 Answer format: Currency: Aound for decimal places Attempts Romaning Infinity G unanswered A firmis must choose to buy the GSU-3300 or the UGA-3000. Both machines make the firm's production process more efficient which in turn increases incremental cash flows. The GSU-3300 produces incremental cash flows of $26,137.00 per year for 8 years and costs $101.858.00. The UGA-3000 produces incremental cash flows of $29,718,00 per year for 9 years and cost $126,781.00. The firm's WACC is 9.01%. What is the equivalent annual annuity of the GSU-3300? Assume that there are no taxes. not submitted Attempts Parraining: Infinity Submit Answer format: Currency: Round to: 2 decimal places A firm is must choose to buy the GSU-3300 or the UGA-3000. Both machines make the firm's production process moro efficient which in turn increases incremental cash fown. The GSU-3300 produces incremental cash flows of $24.163.00 per year for Byears and conta $101,198.00. The UGA 3000 produces incremental cash flows of $29,000.00 per year for 9 year and cost $120.702.00. The firm's WACC 8 9,89%. What is the equivalent annual annuity of the USA 3000? Assume that there are not mand not. submitted Attempts Romaining Infinity Som Answer format: Currency: Round 0:2 decimat taon