Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answers are a, d, a please show equations used This is for my economics class, however i have been told to post it as math

Answers are a, d, a please show equations used

Answers are a, d, a please show equations used

This is for my economics class, however i have been told to post it as math and statistics. please help

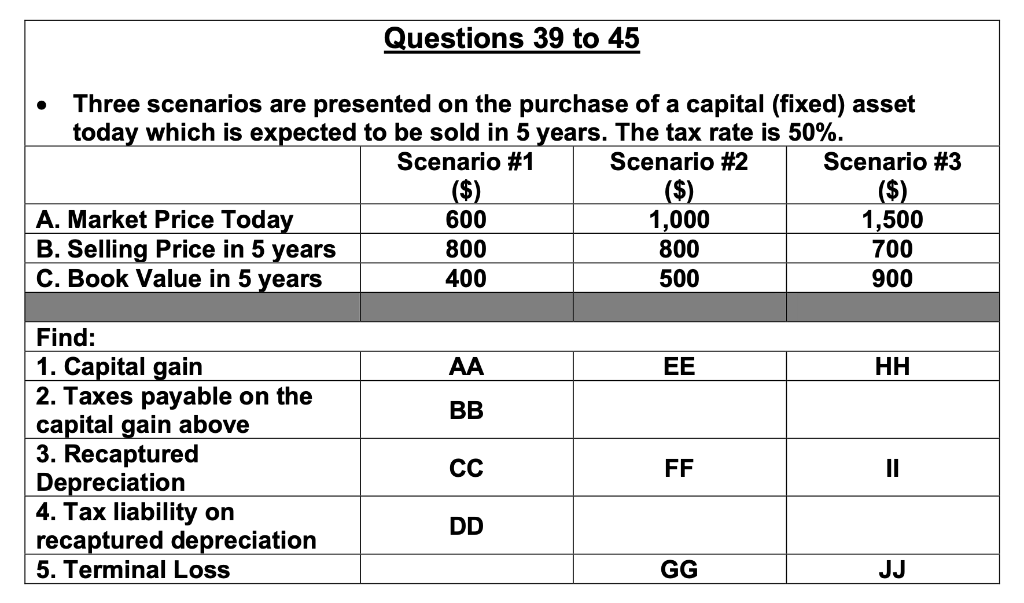

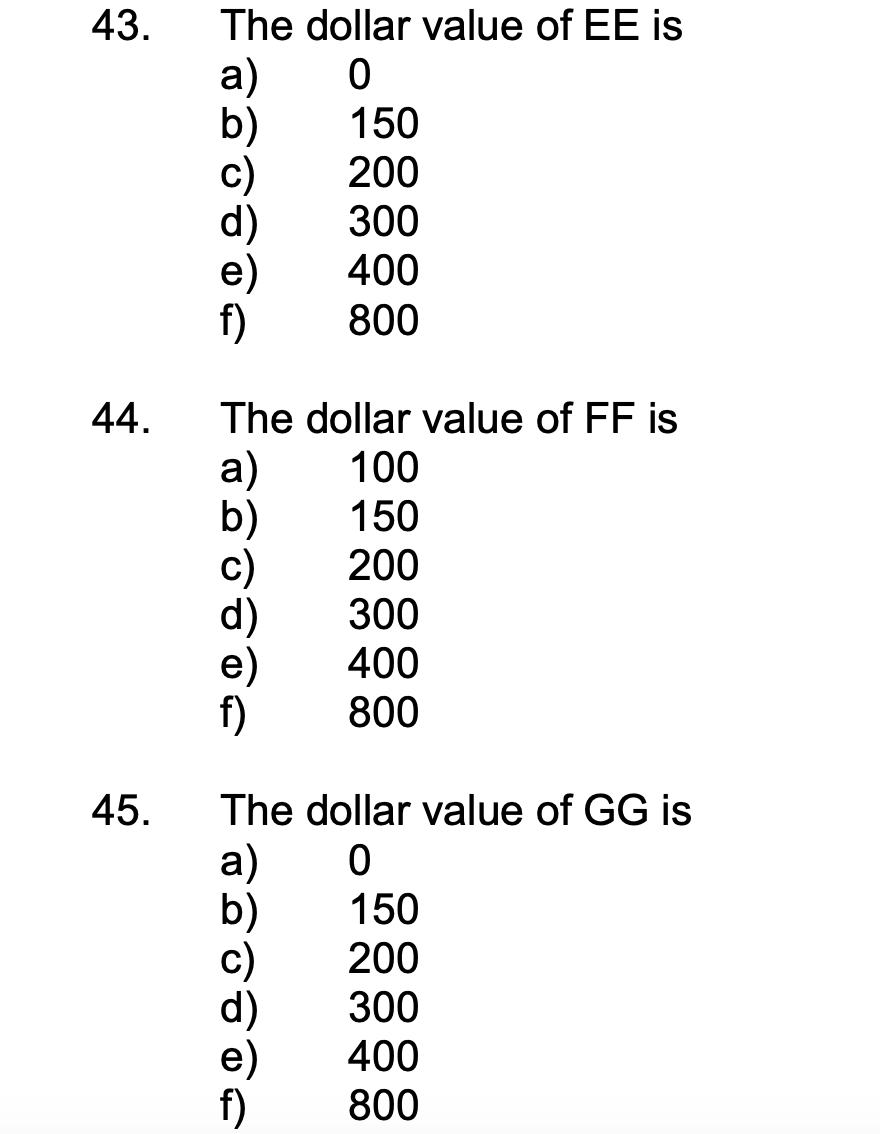

Questions 39 to 45 Three scenarios are presented on the purchase of a capital (fixed) asset today which is expected to be sold in 5 years. The tax rate is 50%. Scenario #1 Scenario #2 Scenario #3 ($) ($) ($) A. Market Price Today 600 1,000 1,500 B. Selling Price in 5 years 800 800 700 C. Book Value in 5 years 400 500 900 AA EE HH BB Find: 1. Capital gain 2. Taxes payable on the capital gain above 3. Recaptured Depreciation 4. Tax liability on recaptured depreciation 5. Terminal Loss CC FF II DD GG JJ 43. The dollar value of EE is a) 0 b) 150 200 300 e) 400 f) 800 44. The dollar value of FF is a) a 100 b) 150 C) 200 300 e) 400 f) 800 45. The dollar value of GG is a) 0 b) 150 200 300 e) 400 f) 800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started