Answered step by step

Verified Expert Solution

Question

1 Approved Answer

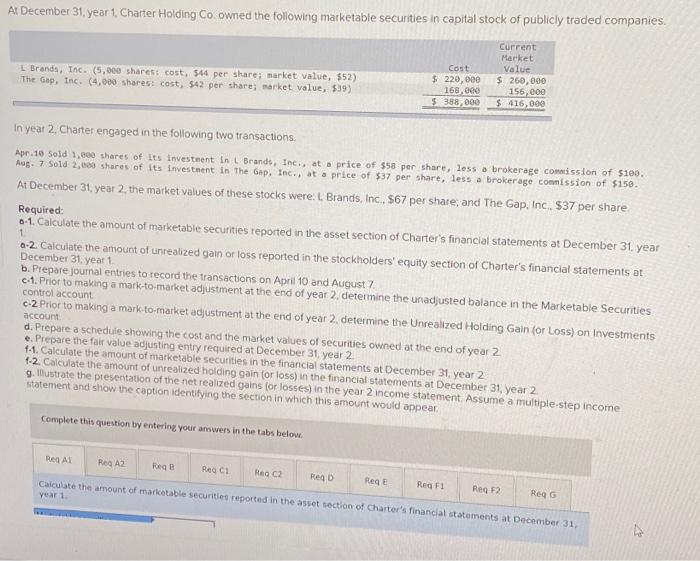

answers for a-1 through G At December 31, year 1. Charter Holding Co. owned the following marketable securities in capital stock of publicly traded companies.

answers for a-1 through G

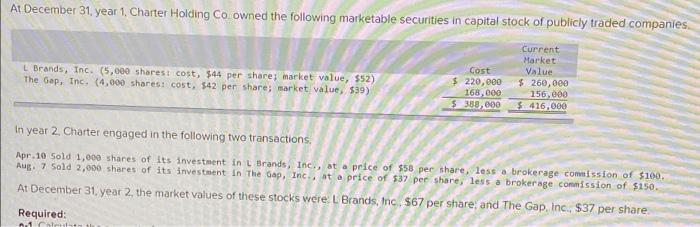

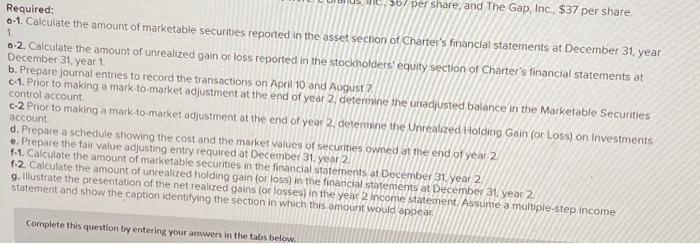

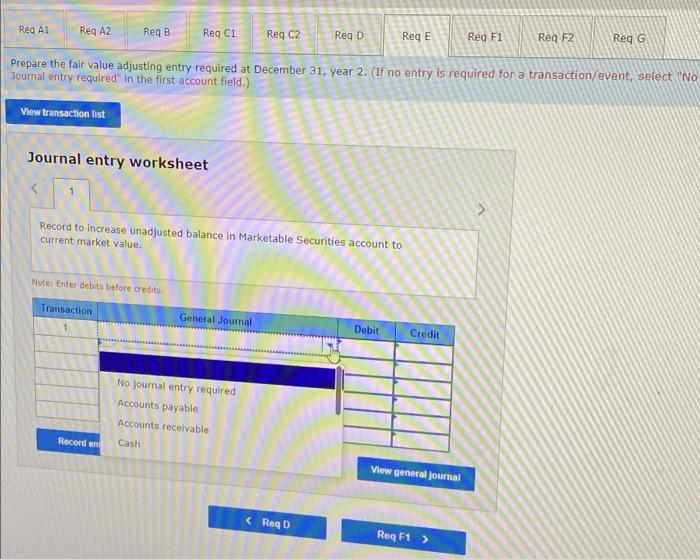

At December 31, year 1. Charter Holding Co. owned the following marketable securities in capital stock of publicly traded companies. L Brands, Inc. (5,000 sharest cost, 544 per share market value, 552) The Gap, Inc. (4,000 shares: cost, $42 per share market value, $39) Cost $ 220,000 168,000 $ 388,000 Current Macket Value $ 260,000 156,000 $416,000 In year 2, Charter engaged in the following two transactions Apr 10 Sold 1,000 shares of its investment in L Brands, Inc., at a price of 558 per share, less a brokerage commission of sieo. Aug. 7 Sold 2,000 shares of its investment in The Gap, Inc., otprice of $37 per share, less a brokerage commission of $150. At December 31, year 2 the market values of these stocks were: L Brands, Inc., 567 per share, and The Gap, Inc. $37 per share Required: 0-1. Calculate the amount of marketable securities reported in the asset section of Charter's financial statements at December 31. year 1 0-2 Calculate the amount of unrealized gain or loss reported in the stockholders' equity section of Charter's financial statements at December 31, year 1 b. Prepare journal entries to record the transactions on April 10 and August 7 0-1. Prior to making a mark-to-market adjustment at the end of year 2. determine the unadjusted balance in the Marketable Securities control account c-2 Prior to making a mark-to-market adjustment at the end of year 2 determine the Unrealized Holding Gain (or Loss) on Investments account d. Prepare a schedule showing the cost and the market values of securities owned at the end of year 2 e. Prepare the fair value adjusting entry required at December 31, year 2 1-1. Calculate the amount of marketable securities in the financial statements at December 31, year 2 1-2. Calculate the amount of unrealized holding gain for loss) in the financial statements at December 31, year 2 9. hustrate the presentation of the net realized gains for losses) in the year 2 income statement Assume a multiple-step income Statement and show the caption identifying the section in which this amount would appear Complete this question by entering your answers in the tabs below. REGAL Reg A2 Red B React Rec Reg D Calculate the amount of marketable securities reported in the asset section of Charter's financial statements at December 31 Rege Red F1 Reg F2 year 1 Rego At December 31, year 1. Charter Holding Co. owned the following marketable securities in capital stock of publicly traded companies L Brands, Inc. (5,000 sharest cost, 544 per share; market value, $52) The Gap, Inc. (4,000 shares: cost, 542 per share; market value, 539) Cost $ 220,000 168,000 $ 388,000 Current Market Value $260, eee 156,000 $416,000 In year 2. Charter engaged in the following two transactions Apr.10 Sold 1,000 shares of its investment in L Brands, Inc., at a price of $58 per share, less a brokerage commission of $100, Aug. 7 Sold 2,000 shares of its investment in the Gap, Inc., at price of 537 per share, less a brokerage commission of $150. At December 31 year 2 the market values of these stocks were. L Brands, Inc. 567 per share and The Gap, Inc., $37 per share Required: nullus ul. 56/ per share, and The Gap, Inc. $37 per share Required: 0-1 Calculate the amount of marketable securities reported in the asset section of Charter's financial statements at December 31 year 1 0-2. Calculate the amount of unrealized gain or loss reported in the stockholders' equity section of Charter's financial statements at December 31 year 1 b. Prepare journal entries to record the transactions on April 10 and August c-1. Prior to making a mark to market adjustment at the end of year 2 determine the unadjusted balance in the Marketable Securities control account c-2 Prior to making a mark-to-market adjustment at the end of year 2. determine the Unrealized Holding Gain (or Loss) on Investments account d. Prepare a schedule showing the cost and the market values of securities owned at the end of year 2 e. Prepare the fair value adjusting entry required at December 31 year 2 1.1. Calculate the amount of marketable securities in the financial statements at December 31 year 2 1.2. Calculate the amount of unrealized holding gain (or loss) in the financial statements at December 31, year 2 9. Illustrate the presentation of the net realized gains (or losses) in the year 2 Income statement. Assume a multiple-step income statement and show the caption identifying the section in which this amount would appear Complete this question by entering your answers in the tabs below. Req A1 Reg A2 Req B Reg C1 Reg C2 Reg D Reg E Reg F1 Reg F2 Reg G Prepare the fair value adjusting entry required at December 31, year 2. (If no entry is required for a transaction/event, select "No Journal entry required in the first account field.) View transaction list Journal entry worksheet Record to increase unadjusted balance in Marketable Securities account to current market value. Note: Enter debts before credits Transaction General Journal Debit Credit No joumal entry required Accounts payable Accounts receivable Record en Cash View general journal Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started