Answered step by step

Verified Expert Solution

Question

1 Approved Answer

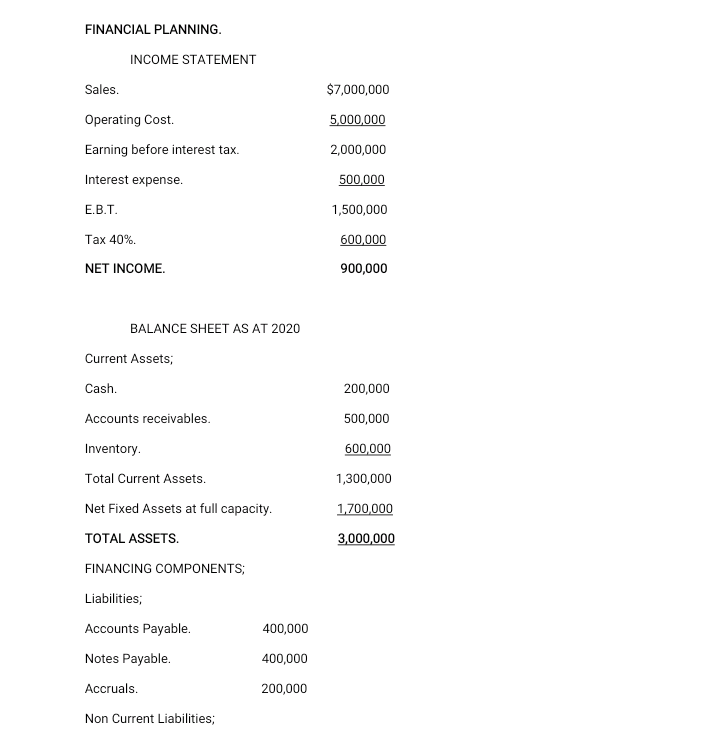

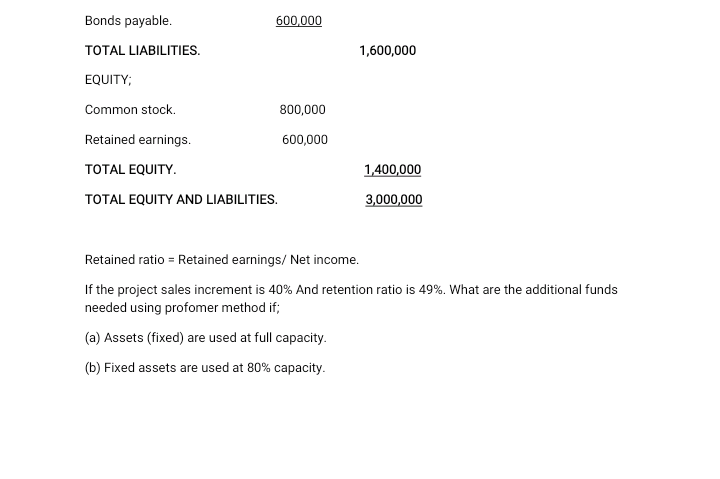

answers for financial management and risk appraisal please FINANCIAL PLANNING. INCOME STATEMENT Sales $7,000,000 5,000,000 Operating Cost. Earning before interest tax. 2,000,000 Interest expense. 500,000

answers for financial management and risk appraisal please

FINANCIAL PLANNING. INCOME STATEMENT Sales $7,000,000 5,000,000 Operating Cost. Earning before interest tax. 2,000,000 Interest expense. 500,000 E.B.T. 1,500,000 Tax 40% 600,000 NET INCOME 900,000 BALANCE SHEET AS AT 2020 Current Assets; Cash. 200,000 Accounts receivables. 500,000 Inventory 600,000 1,300,000 1,700,000 Total Current Assets. Net Fixed Assets at full capacity. TOTAL ASSETS. FINANCING COMPONENTS; 3,000,000 Liabilities; Accounts Payable. 400,000 Notes Payable 400,000 Accruals. 200,000 Non Current Liabilities; Bonds payable. 600,000 TOTAL LIABILITIES 1,600,000 EQUITY Common stock 800,000 Retained earnings. 600,000 TOTAL EQUITY. TOTAL EQUITY AND LIABILITIES. 1,400,000 3,000,000 Retained ratio = Retained earnings/ Net income. If the project sales increment is 40% And retention ratio is 49%. What are the additional funds needed using profomer method if; (a) Assets (fixed) are used at full capacity. (b) Fixed assets are used at 80% capacityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started