Answered step by step

Verified Expert Solution

Question

1 Approved Answer

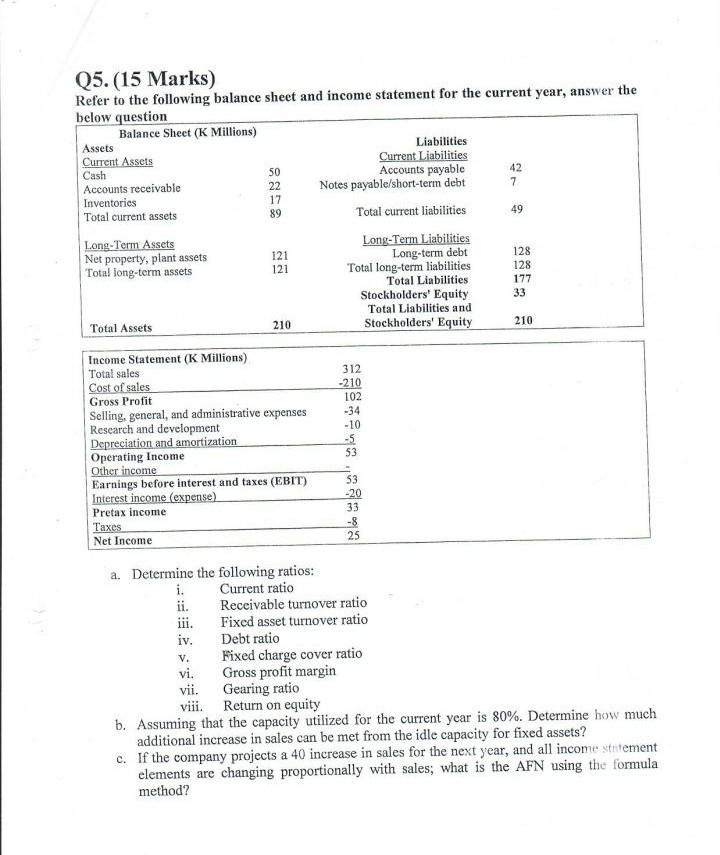

answers for financial management and risk appraisal please Q5. (15 Marks) Refer to the following balance sheet and income statement for the current year, answer

answers for financial management and risk appraisal please

Q5. (15 Marks) Refer to the following balance sheet and income statement for the current year, answer the below question Balance Sheet (K Millions) Assets Liabilities Current Assets Current Liabilities Cash 50 Accounts payable 42 Accounts receivable 22 Notes payable/short-term debt 7 Inventories 17 Total current assets 89 Total current liabilities 49 Long-Term Assets Long-Term Liabilities Net property, plant assets 121 Long-term debt 128 Total long-term assets 121 Total long-term liabilities 128 Total Liabilities 177 Stockholders' Equity 33 Total Liabilities and Total Assets 210 Stockholders' Equity 210 Income Statement (K Millions) Total sales Cost of sales Gross Profit Selling, general, and administrative expenses Research and development Depreciation and amortization Operating Income Other income Earnings before interest and taxes (EBIT) Interest income (expense) Pretax income Taxes Net Income 312 -210 102 -34 -10 -5 53 53 -20 33 -8 25 a. Determine the following ratios: i. Current ratio ii. Receivable turnover ratio iii. Fixed asset turnover ratio iv. Debt ratio v. Fixed charge cover ratio vi. Gross profit margin Gearing ratio viii. Return on equity b. Assuming that the capacity utilized for the current year is 80%. Determine how much additional increase in sales can be met from the idle capacity for fixed assets? c. If the company projects a 40 increase in sales for the next year, and all income stuitement elements are changing proportionally with sales; what is the AFN using the formula method? viiStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started