Answers in red are wrong.

Answers in red are wrong.

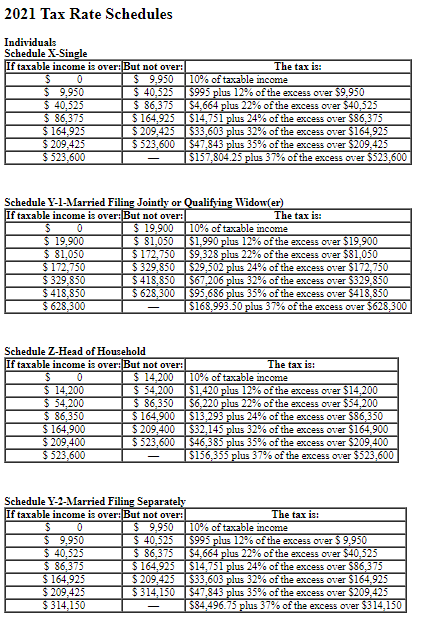

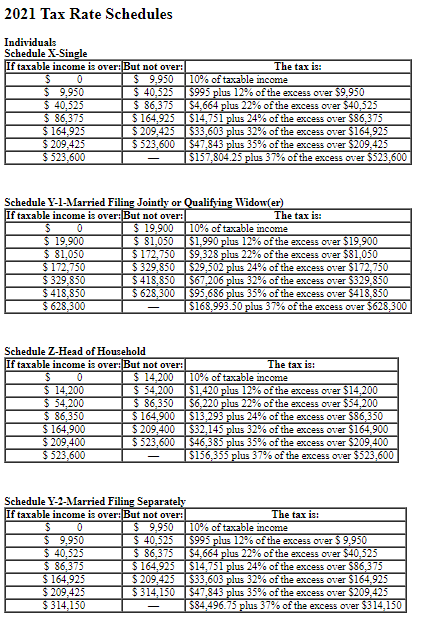

Tax schedules:

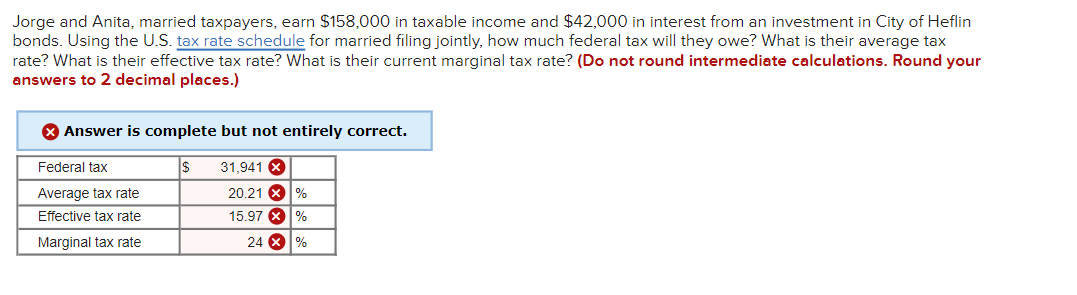

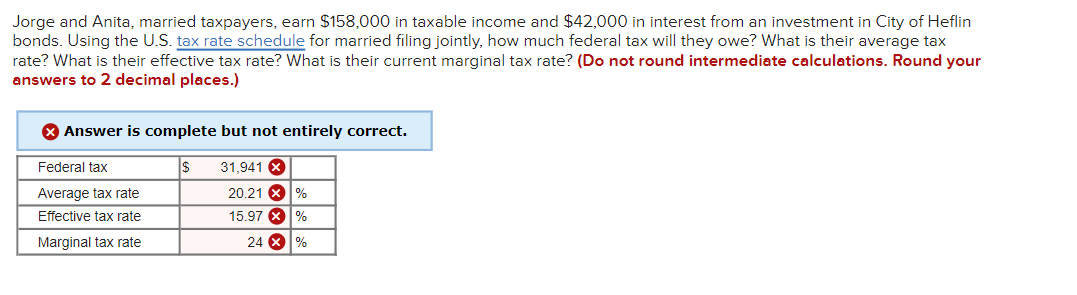

Jorge and Anita, married taxpayers, earn $158,000 in taxable income and $42,000 in interest from an investment in City of Heflin bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? (Do not round intermediate calculations. Round your answers to 2 decimal places.) > Answer is complete but not entirely correct. Federal tax $ 31,941 X Average tax rate Effective tax rate Marginal tax rate 20.21 X % 15.97 X % 24 X % 2021 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: $ 0 $ 9,950 $ 40,525 $ 86,375 $ 164,925 $ 209,425 $ 523,600 $ 0 $ 19,900 $ 81,050 $ 172,750 $329,850 $418,850 $ 628,300 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: $ 0 $ 14,200 $ 54,200 $ 86,350 $ 164,900 $ 209,400 $ 523,600 $ 9,950 $ 40,525 $ 86,375 $164,925 $209,425 $ 523,600 $ 0 $ 9,950 $ 40,525 $ 19,900 $ 81,050 Schedule Z-Head of Household If taxable income is over: But not over: $ 86,375 $ 164,925 $ 209,425 $314,150 $172,750 $329,850 $418,850 $ 628,300 10% of taxable income | $995 plus 12% of the excess over $9,950 | $4,664 plus 22% of the excess over $40,525 |$14,751 plus 24% of the excess over $86,375 $33,603 plus 32% of the excess over $164,925 $47,843 plus 35% of the excess over $209,425 | $157,804.25 plus 37% of the excess over $523,600 The tax is: Schedule Y-2-Married Filing Separately If taxable income is over: But not over: $ 9,950 $ 40,525 The tax is: | $9,328 plus 22% of the excess over $81,050 $29,502 plus 24% of the excess over $172,750 $67,206 plus 32% of the excess over $329,850 $95,686 plus 35% of the excess over $418,850 | $168,993.50 plus 37% of the excess over $628,300 10% of taxable income $1,990 plus 12% of the excess over $19,900 The tax is: $ 14,200 10% of taxable income $ 54,200 | $1,420 plus 12% of the excess over $14,200 $ 86,350 $164,900 | $6,220 plus 22% of the excess over $54,200 $13,293 plus 24% of the excess over $86,350 $209,400 |$32,145 plus 32% of the excess over $164,900 $46,385 plus 35% of the excess over $209,400 $ 523,600 | $156,355 plus 37% of the excess over $523,600 The tax is: 10% of taxable income | $995 plus 12% of the excess over $ 9,950 $ 86,375 $4,664 plus 22% of the excess over $40,525 $164,925 $14,751 plus 24% of the excess over $86,375 $ 209,425 $33,603 plus 32% of the excess over $164,925 $314,150 |$47,843 plus 35% of the excess over $209,425 | $84,496.75 plus 37% of the excess over $314,150

Answers in red are wrong.

Answers in red are wrong.