answers must be in formula form

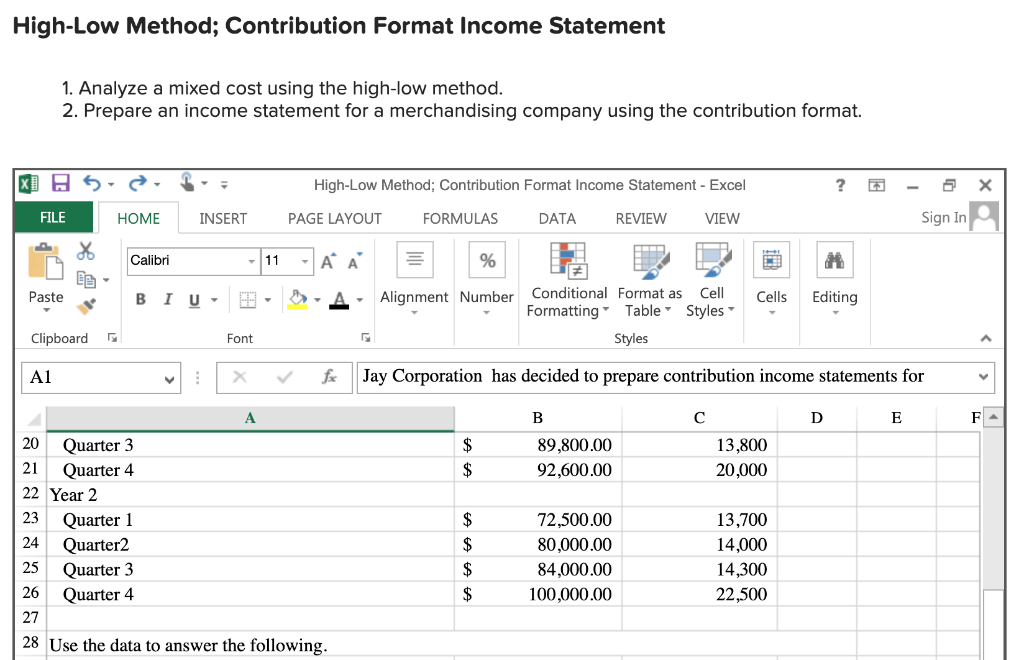

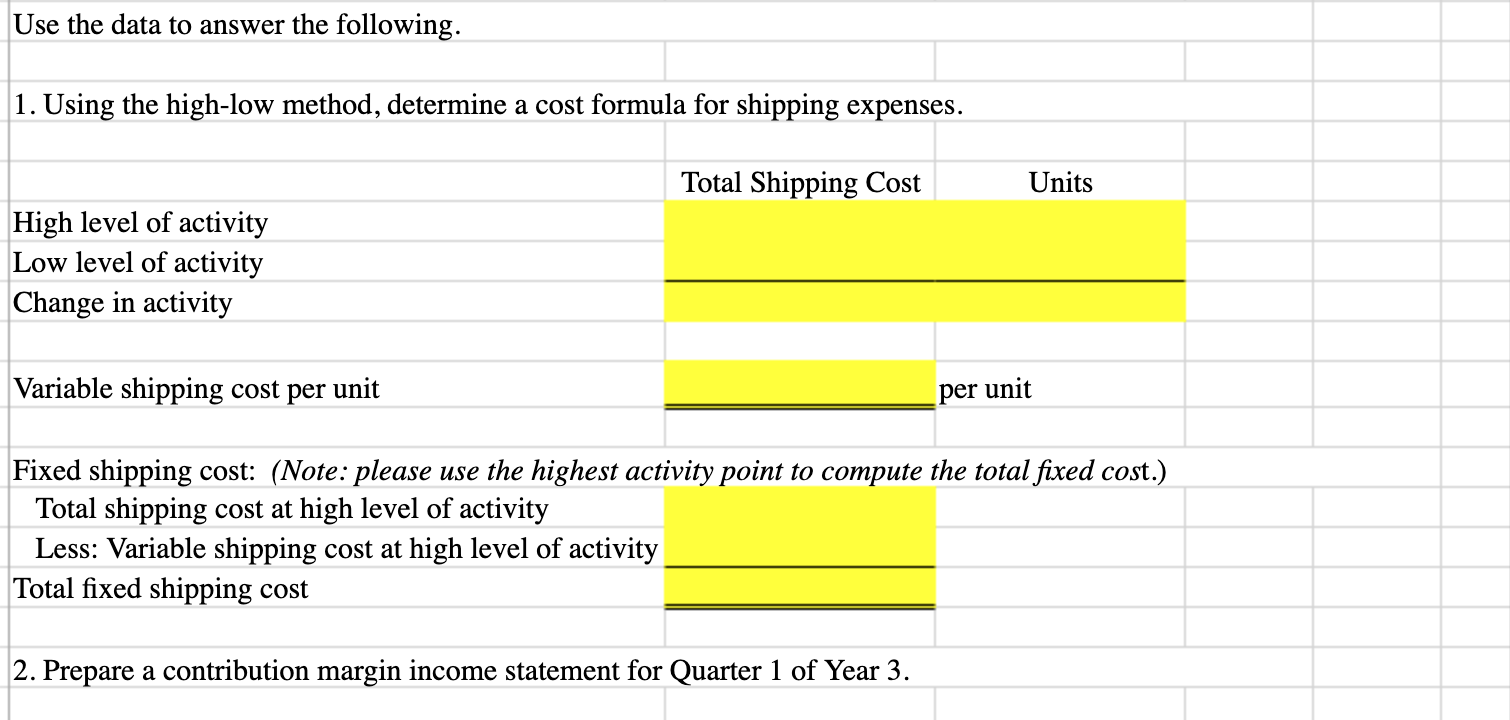

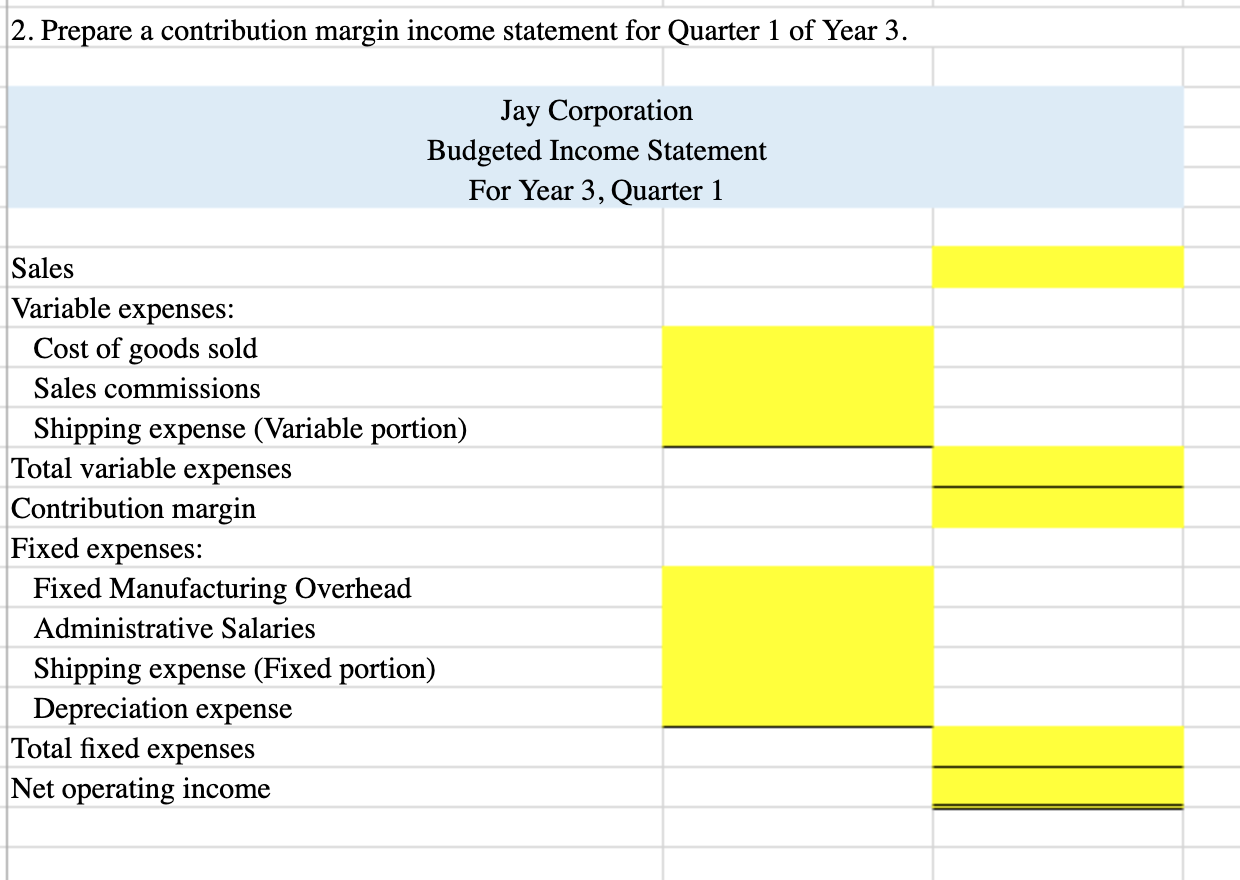

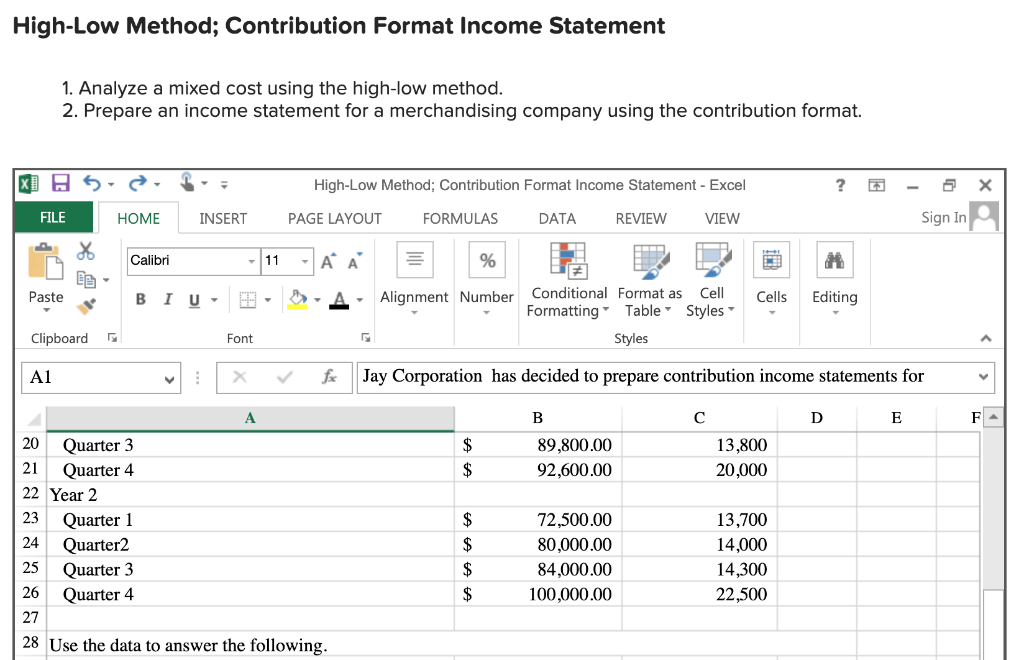

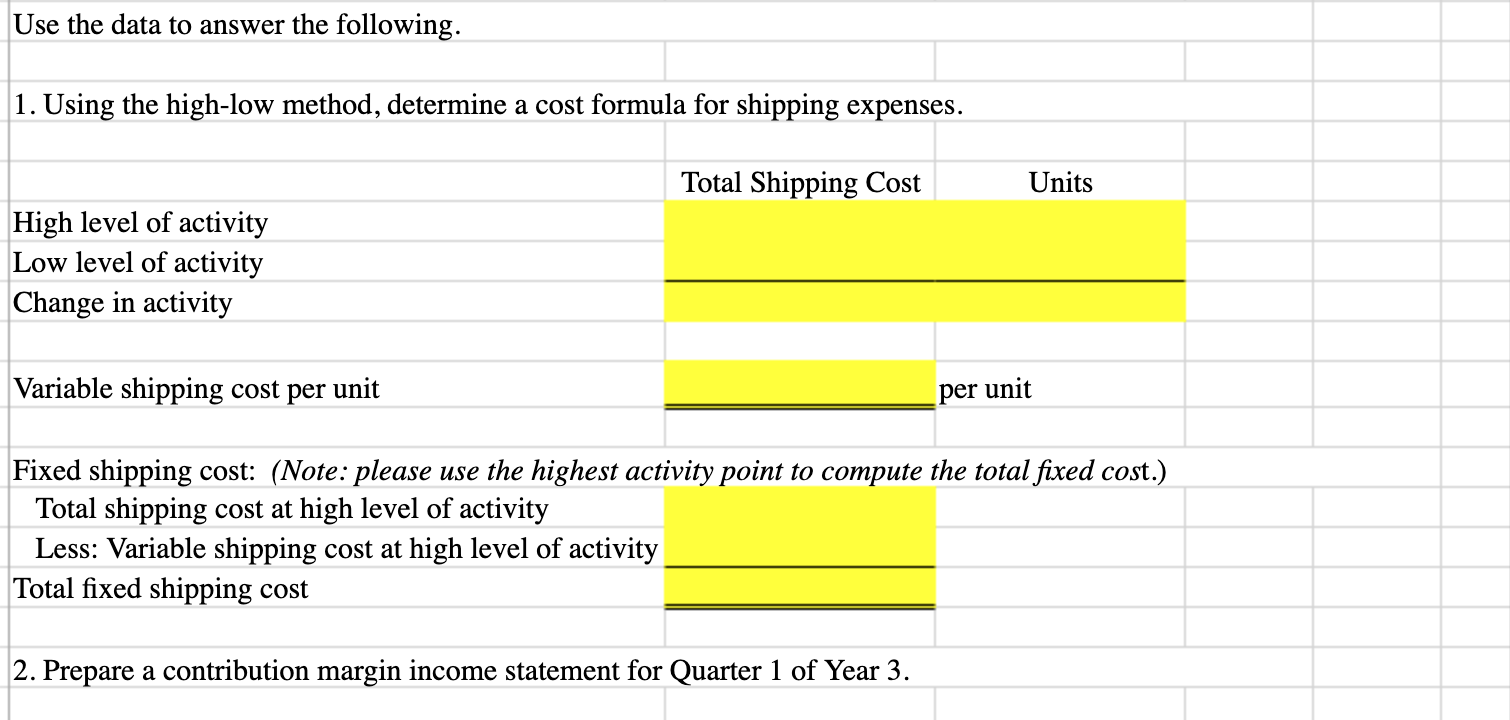

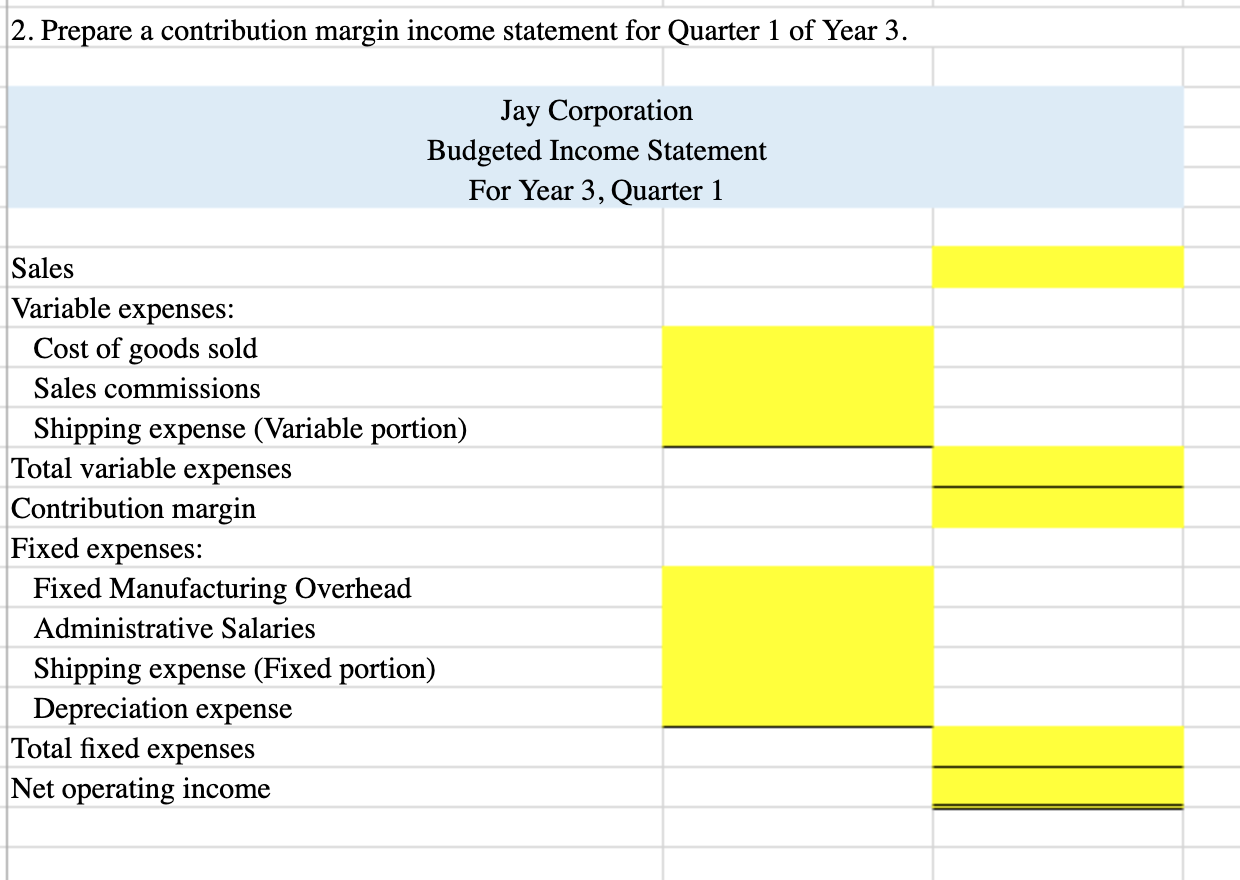

High-Low Method; Contribution Format Income Statement 1. Analyze a mixed cost using the high-low method. 2. Prepare an income statement for a merchandising company using the contribution format. x] High-Low Method; Contribution Format Income Statement - Excel ? FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 AA % Paste BIU- A- Alignment Number Conditional Format as Cell Formatting Table Styles Cells Editing Clipboard Font Styles A1 fx Jay Corporation has decided to prepare contribution income statements for A B D E $ $ 89,800.00 92,600.00 13,800 20,000 $ 20 Quarter 3 21 Quarter 4 22 Year 2 23 Quarter 1 24 Quarter 25 Quarter 3 26 Quarter 4 27 28 Use the data to answer the following. $ 72,500.00 80,000.00 84,000.00 100,000.00 13,700 14,000 14,300 22,500 $ $ Use the data to answer the following. 1. Using the high-low method, determine a cost formula for shipping expenses. Total Shipping Cost Units High level of activity Low level of activity Change in activity Variable shipping cost per unit per unit Fixed shipping cost: (Note: please use the highest activity point to compute the total fixed cost.) Total shipping cost at high level of activity Less: Variable shipping cost at high level of activity Total fixed shipping cost 2. Prepare a contribution margin income statement for Quarter 1 of Year 3. 2. Prepare a contribution margin income statement for Quarter 1 of Year 3. Jay Corporation Budgeted Income Statement For Year 3, Quarter 1 Sales Variable expenses: Cost of goods sold Sales commissions Shipping expense (Variable portion) Total variable expenses Contribution margin Fixed expenses: Fixed Manufacturing Overhead Administrative Salaries Shipping expense (Fixed portion) Depreciation expense Total fixed expenses Net operating income High-Low Method; Contribution Format Income Statement 1. Analyze a mixed cost using the high-low method. 2. Prepare an income statement for a merchandising company using the contribution format. x] High-Low Method; Contribution Format Income Statement - Excel ? FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 AA % Paste BIU- A- Alignment Number Conditional Format as Cell Formatting Table Styles Cells Editing Clipboard Font Styles A1 fx Jay Corporation has decided to prepare contribution income statements for A B D E $ $ 89,800.00 92,600.00 13,800 20,000 $ 20 Quarter 3 21 Quarter 4 22 Year 2 23 Quarter 1 24 Quarter 25 Quarter 3 26 Quarter 4 27 28 Use the data to answer the following. $ 72,500.00 80,000.00 84,000.00 100,000.00 13,700 14,000 14,300 22,500 $ $ Use the data to answer the following. 1. Using the high-low method, determine a cost formula for shipping expenses. Total Shipping Cost Units High level of activity Low level of activity Change in activity Variable shipping cost per unit per unit Fixed shipping cost: (Note: please use the highest activity point to compute the total fixed cost.) Total shipping cost at high level of activity Less: Variable shipping cost at high level of activity Total fixed shipping cost 2. Prepare a contribution margin income statement for Quarter 1 of Year 3. 2. Prepare a contribution margin income statement for Quarter 1 of Year 3. Jay Corporation Budgeted Income Statement For Year 3, Quarter 1 Sales Variable expenses: Cost of goods sold Sales commissions Shipping expense (Variable portion) Total variable expenses Contribution margin Fixed expenses: Fixed Manufacturing Overhead Administrative Salaries Shipping expense (Fixed portion) Depreciation expense Total fixed expenses Net operating income