Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answers needed for each part with step by step solution thanks :) Define DAC. Explain why DAC are required when preparing a general insurance i)

Answers needed for each part with step by step solution thanks :)

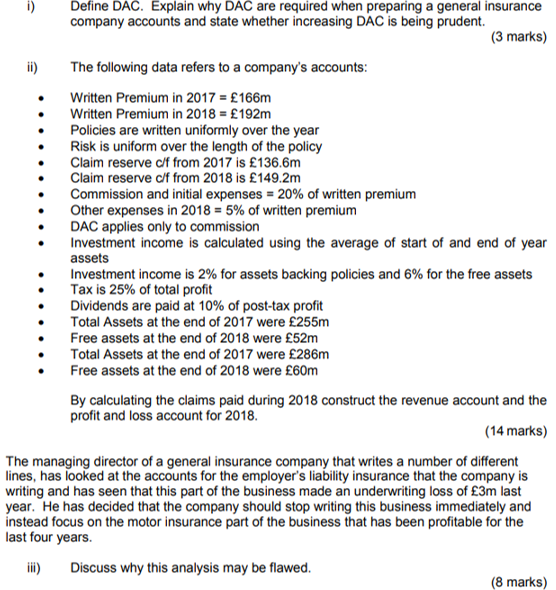

Define DAC. Explain why DAC are required when preparing a general insurance i) company accounts and state whether increasing DAC is being prudent (3 marks) The following data refers to a company's accounts: Written Premium in 2017 166m Written Premium in 2018 192m Policies are written uniformly over the year Risk is uniform over the length of the policy Claim reserve c/f from 2017 is 136.6m Claim reserve c/f from 2018 is 149.2m Commission and initial expenses 20% of written premium Other expenses in 2018 5% of written premium DAC applies only to commission Investment income is calculated using the average of start of and end of year assets Investment income is 2% for assets backing policies and 6% for the free assets Tax is 25% of total profit Dividends are paid at 10% of post-tax profit Total Assets at the end of 2017 were 255m Free assets at the end of 2018 were 52m Total Assets at the end of 2017 were 286m Free assets at the end of 2018 were 60m By calculating the claims paid during 2018 construct the revenue account and the profit and loss account for 2018. (14 marks) The managing director of a general insurance company that writes a number of different lines, has looked at the accounts for the employer's liability insurance that the company is writing and has seen that this part of the business made an underwriting loss of 3m last year. He has decided that the company should stop writing this business immediately and instead focus on the motor insurance part of the business that has been profitable for the last four years Discuss why this analysis may be flawed. (8 marks) Define DAC. Explain why DAC are required when preparing a general insurance i) company accounts and state whether increasing DAC is being prudent (3 marks) The following data refers to a company's accounts: Written Premium in 2017 166m Written Premium in 2018 192m Policies are written uniformly over the year Risk is uniform over the length of the policy Claim reserve c/f from 2017 is 136.6m Claim reserve c/f from 2018 is 149.2m Commission and initial expenses 20% of written premium Other expenses in 2018 5% of written premium DAC applies only to commission Investment income is calculated using the average of start of and end of year assets Investment income is 2% for assets backing policies and 6% for the free assets Tax is 25% of total profit Dividends are paid at 10% of post-tax profit Total Assets at the end of 2017 were 255m Free assets at the end of 2018 were 52m Total Assets at the end of 2017 were 286m Free assets at the end of 2018 were 60m By calculating the claims paid during 2018 construct the revenue account and the profit and loss account for 2018. (14 marks) The managing director of a general insurance company that writes a number of different lines, has looked at the accounts for the employer's liability insurance that the company is writing and has seen that this part of the business made an underwriting loss of 3m last year. He has decided that the company should stop writing this business immediately and instead focus on the motor insurance part of the business that has been profitable for the last four years Discuss why this analysis may be flawed. (8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started