Answered step by step

Verified Expert Solution

Question

1 Approved Answer

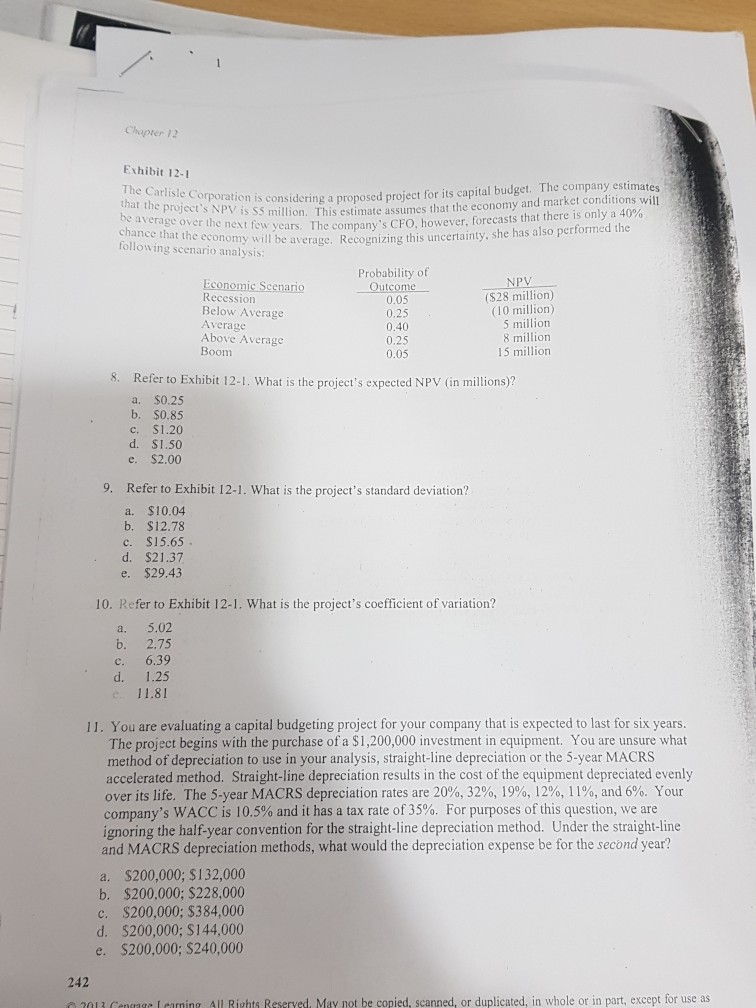

answers please Chapter 12 Exhibit 12-1 The Carlisle Corporation is considering a that the project's NPV is S5 million. This c be average over the

answers please

Chapter 12 Exhibit 12-1 The Carlisle Corporation is considering a that the project's NPV is S5 million. This c be average over the next chance that the economy will be average. Recognizi following scenario analysis ation is considering a proposed project for its capital budget. The company estimates IS SS million. This estimate assumes that the economy and market conditions will se over the next few years. The company's CFO, however, forecasts that there is only will be average. Recognizing this uncertainty, she has also performed the Economic Scenario Recession Below Average Average Above Average Boom Probability of Outcome 0.05 0.25 0.40 0.25 0.05 NPV (528 million (10 million 5 million 8 million 15 million 8. Refer to Exhibit 12-1. What is the project's expected NPV (in millions)? a. S0.25 b. $0.85 c. $1.20 d. $1.50 e. $2.00 9. Refer to Exhibit 12-1. What is the project's standard deviation? a. $10.04 b. $12.78 c. $15.65 d. $21.37 e. $29.43 10. Refer to Exhibit 12-1. What is the project's coefficient of variation? a. 5.02 b. 2.75 c. 6.39 d. 1.25 e 11.81 11. You are evaluating a capital budgeting project for your company that is expected to last for six years. The project begins with the purchase of a $1,200,000 investment in equipment. You are unsure what method of depreciation to use in your analysis, straight-line depreciation or the 5-year MACRS accelerated method. Straight-line depreciation results in the cost of the equipment depreciated evenly over its life. The 5-year MACRS depreciation rates are 20%, 32%, 19%, 12%, 11%, and 6%. Your company's WACC is 10.5% and it has a tax rate of 35%. For purposes of this question, we are ignoring the half-year convention for the straight-line depreciation method. Under the straight-line and MACRS depreciation methods, what would the depreciation expense be for the second year? a. $200,000; $132,000 b. $200,000; $228,000 c. $200,000; $384.000 d. $200,000; S144,000 e. $200,000; S240,000 242 lamina All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use asStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started