Answered step by step

Verified Expert Solution

Question

1 Approved Answer

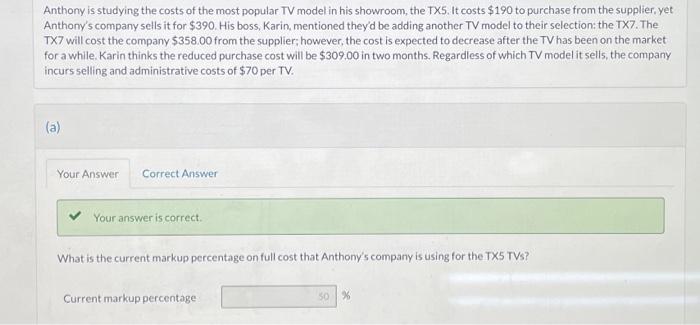

Anthony is studying the costs of the most popular TV model in his showroom, the TX5. It costs $190 to purchase from the supplier, yet

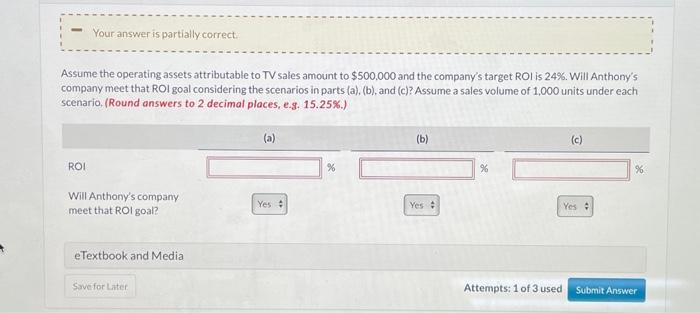

Anthony is studying the costs of the most popular TV model in his showroom, the TX5. It costs $190 to purchase from the supplier, yet Anthony's company sells it for $390. His boss, Karin, mentioned they'd be adding another TV model to their selection: the TX7. The TX7 will cost the company $358.00 from the supplier; however, the cost is expected to decrease after the TV has been on the market for a while. Karin thinks the reduced purchase cost will be $309.00 in two months. Regardless of which TV model it sells, the company incurs selling and administrative costs of $70 per TV. (a) Your Answer Correct Answer Your answer is correct. What is the current markup percentage on full cost that Anthony's company is using for the TX5 TVs? Current markup percentage 50 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started