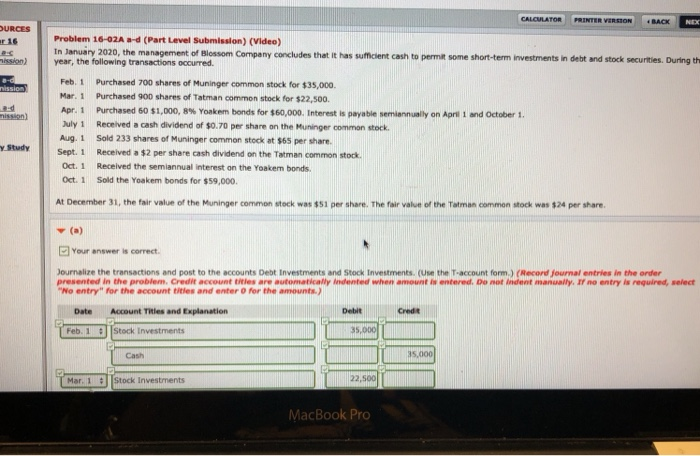

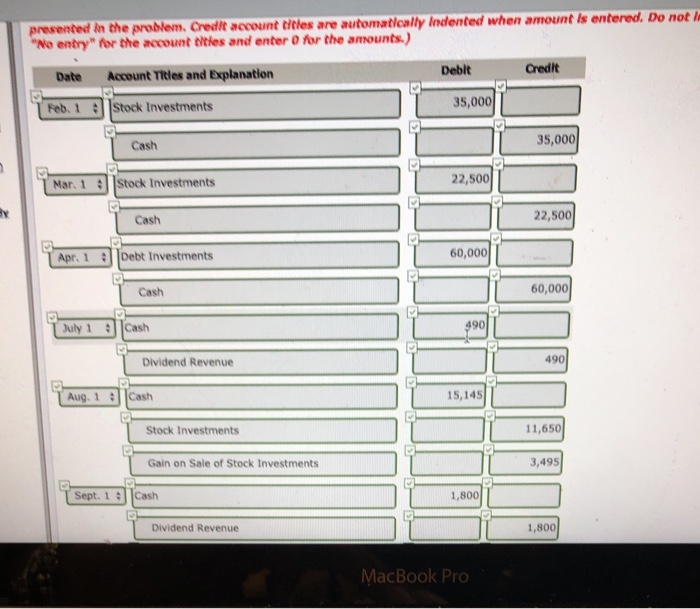

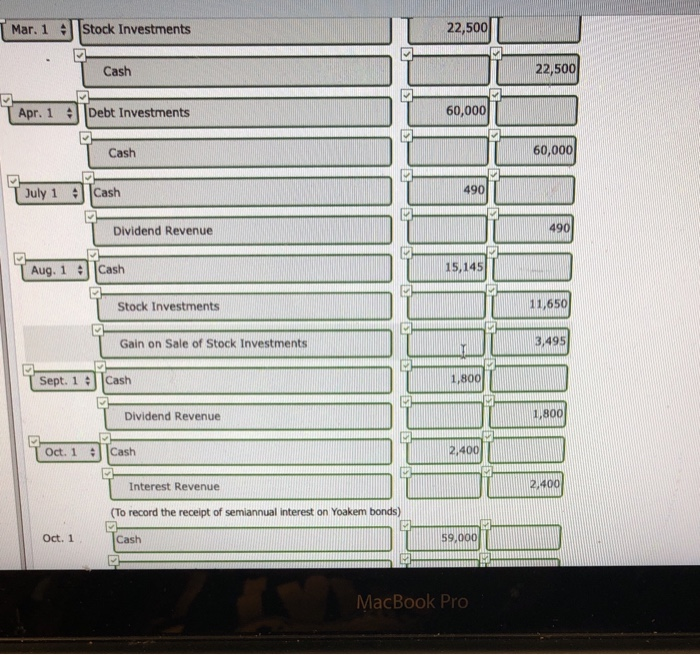

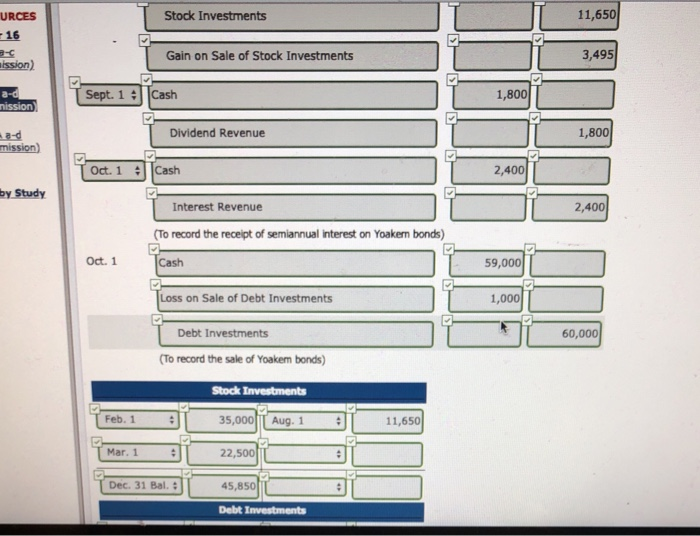

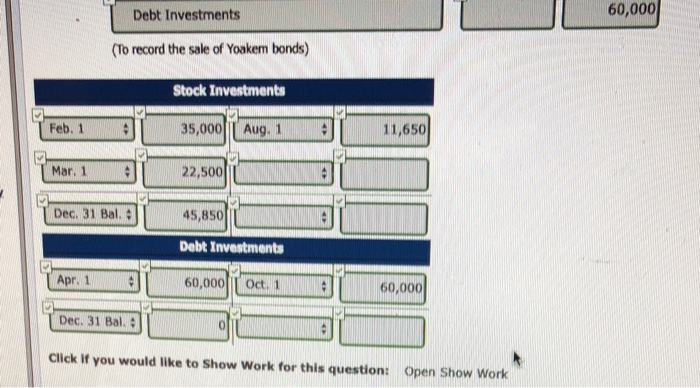

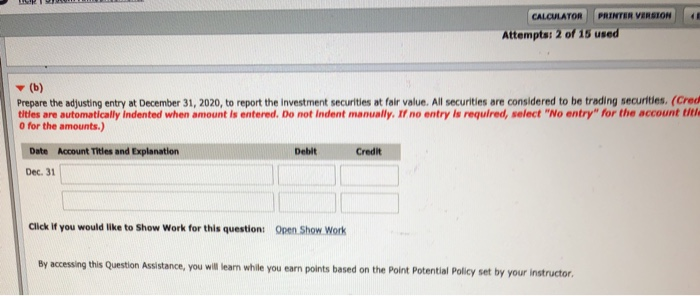

CALCULATOR PRINTER VERSSON URCES Problem 16-02A ad (Part Level Submission) (Video) In Janury 2020, year, the following transactions occurred. r 16 the management of Blossom Company concludes that it has sufficient cash to permit some short-term i investments in debt and stock securities. During th ssion Feb. 1 Purchased 700 shares of Muninger common stock for $35,000. Mar. 1 Apr. 1 July 1 Aug. 1 Sept. 1 Oct. 1 Oct. 1 Sold the Yoakem bonds for $59,000 Purchased 900 shares of Tatman common stock for $22,500 Purchased 60 $1,000. 8% Yoakem bonds fo $60,000. Interest is payable semiannually on Apri 1 and October 1. Received a cash dividend of so.70 per share on the Muninger common stock. Sold 233 shares of Muninger common stock at s6s per share. Received a $2 per share cash dividend on the Tatman common st Received the semiannual interest on the Yoakem bonds. ission) StudyS At December 31, the fair value of the Muninger common stock was $51 per share. The fair value of the Tatman common stock was $24 per share. Y (a) Your enswer is correct ournalize the transactions and post to the accounts Debt Investments and Stock Investments. (Use the T-account form,) (Record journal entries in the order presented in the problem. Credit account tihles are automatically Indented when amount in entered. Do not indent manually, It no entry is required, select No entry" for the account titles and enter 0 for the amounts Date Account Ttles and Explanation Debit Credt Feb. 1 Stock Investments Cash Is,0oo Mar. 1 Stock Investments MacBook Pro presented in the problem. Credlt account Gitles are automaticalty Indented when amount is entered. Do not l No entry" for the account tiies and enter 0 for the amounts) Deblt Credit Date Account Titles and Explanation Feb. 1 |Stock Investments 35,000 Cash 35,000 Mar. 1 Stock Investments 22,500 Cash 22,500 60,000 Apr. 1 |Debt Investments Cash 60,000 490 uly 1 Cash Dividend Revenue 490 Aug. 1 : [cash 15,145 Stock Investments 11,650 Gain on Sale of Stock Investments 3,495 Sept. 1Cash 1,800 Dividend Revenue 1,800 MacBook Pro Mar. 1 Stock Investments 22,500 Cash 22,500 Apr. 1 Debt Investments 60,000 Cash 60,000 490 July 1 Cash Dividend Revenue 490 Aug. 1 Cash 15,145 Stock Investments 11,650 Gain on Sale of Stock Investments 3,495 Sept. 1 Cash 1,800 Dividend Revenue 1,800 Oct. 1 Cash 2,400 Interest Revenue 2.400 (To record the receipt of semiannual interest on Yoakem bonds) Oct. 1 Cash 59,000 MacBook Pro T-11,650 URCES Stock Investments 16 Gain on Sale of Stock Investments 3,495 ssion) Sept. 1 Cash 1,800 Dividend Revenue 1,800 mission Oct. 1 Cash 2,400 y Study Interest Revenue To record the receipt of semiannual interest on Yoakem bonds) Cash 2,400 Oct. 1 59,000 Loss on Sale of Debt Investments 1,000 Debt Investments To record the sale of Yoakem bonds) Stock Investments Feb. 1 35,000 Aug. 1 11,650 Mar. 1 22,500 Dec. 31 Bal.: 45,850 Debt I Debt Investments 60,000 (To record the sale of Yoakem bonds) Stock Investments Feb. 1 hoi 35,00011 aug. 1 31 11,650 Mar. 1 22,500 Dec. 31 Bal. Debt Investments Apr. 1 60,000 I Oct. 1 60,000 Dec. 31 Bal. Click If you would like to Show Work for this question: Open Show Work CALCULATOR PRINTER VERSION E Attempts! 2 of 15 used Prepare the adjusting entry at December 31, 2020, to report the investment securities at fair value. All securities are considered to be trading securities. (Cred titles are automatically Indented when amount is entered. Do not Indent manually,If no entry is required, select "No entry" for the account ttl 0 for the amounts.) Date Account Titles and Explanation Dec. 31 Debit Credit Click If you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you willlarn whil you earn points based on the Point Potential Policy set by your instructor Policy set by your instructor