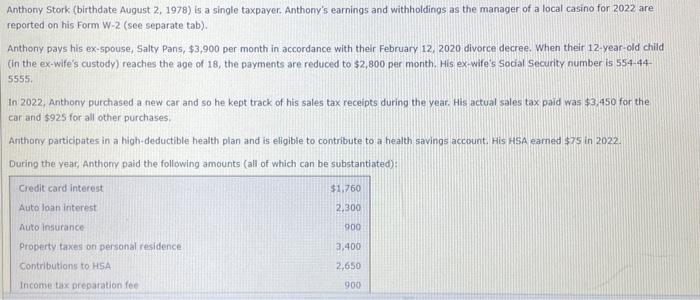

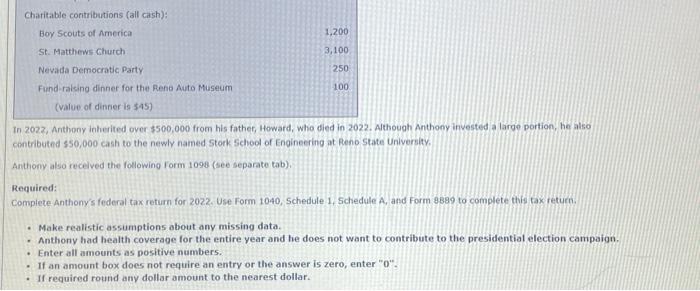

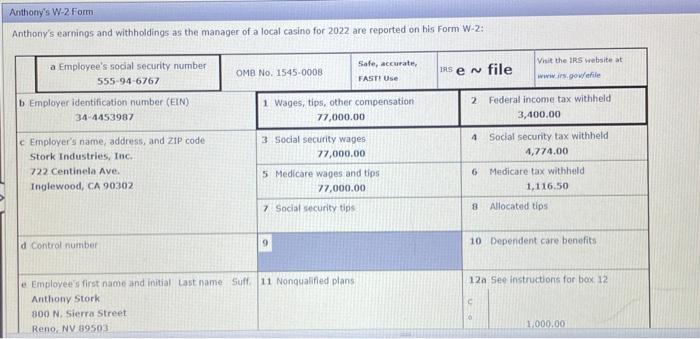

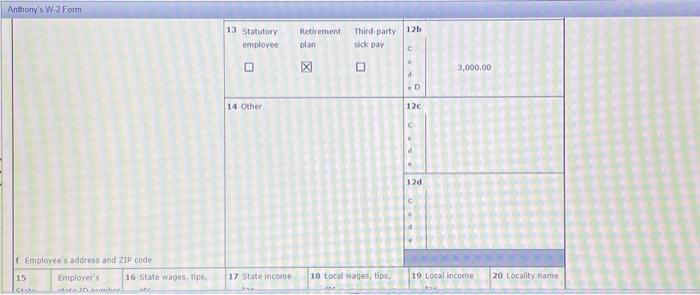

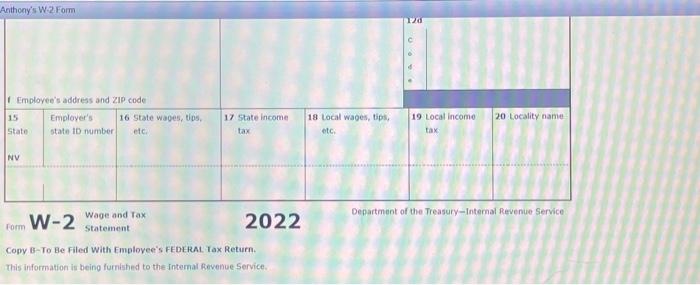

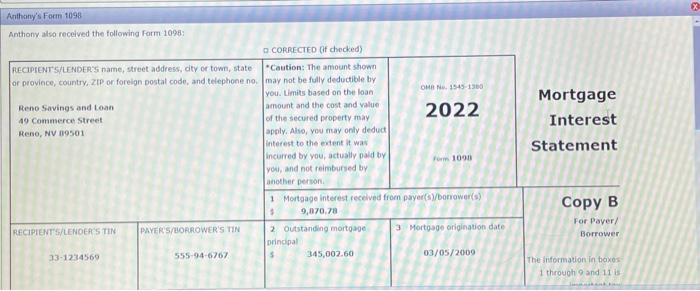

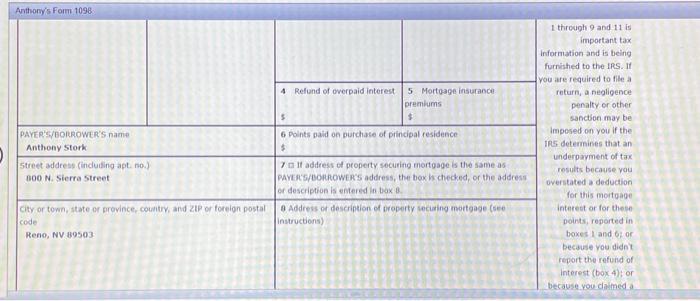

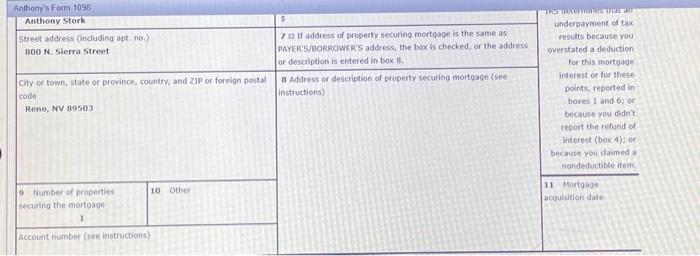

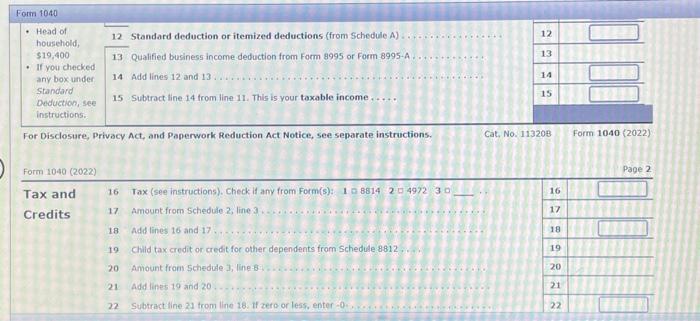

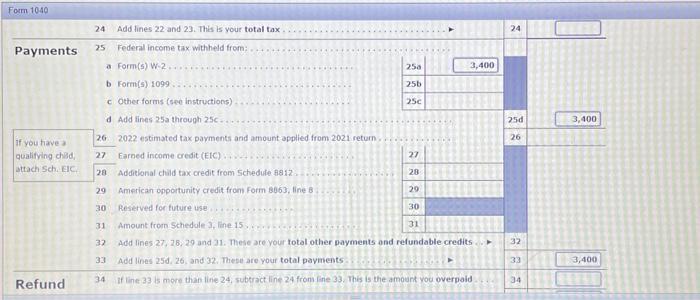

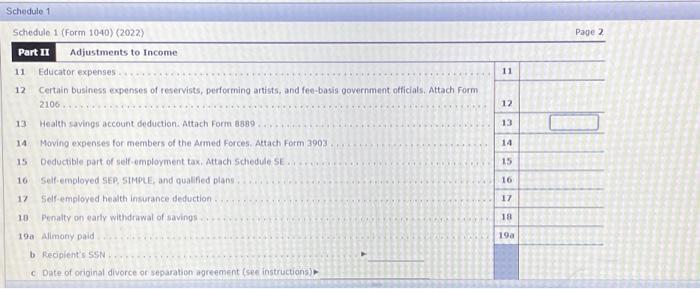

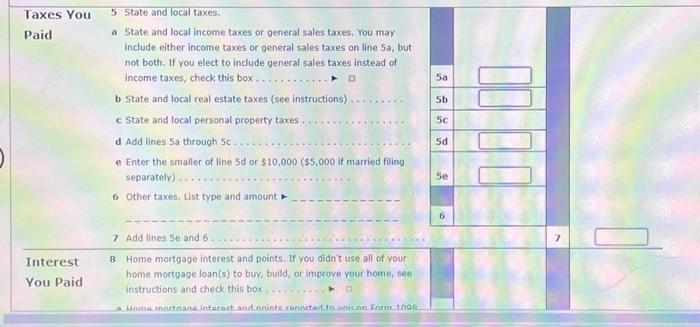

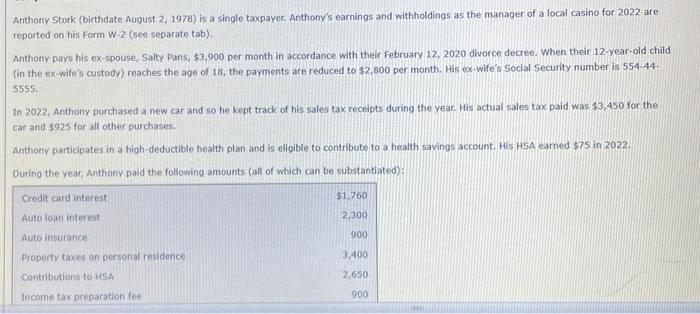

Anthony Stork (birthdate August 2,1978 ) is a single taxpayer. Anthony's earning5 and withholdings as the manager of a local casino for 2022 are reported on his Form W-2 (see separate tab). Anthony pays his ex-5pouse, Salty Pans, \$3,900 per month in accordance with their February 12, 2020 divorce decree. When their 12-year-old child (in the ex-wife's custody) reaches the age of 18, the payments are reduced to $2,800 per month. His ex-wife's 5 ocial Security number is 554 -44- In 2022, Anthony purchased a new car and so he kept track of his sales tax receipts during the year. His actual sales tax paid was $3,450 for the car and 5925 for all other purchases. Anthony participates in a high-deductible health plan and is ellgible to contribute to a health savings account. His HSA earned 575 in 2022 . During the year, Anthory paid the following amounts (all of which can be substantiated): in 2022, Anthony inherited over $500,000 from his father, Howard, who died in 2022. Athough Anthony invested a large portion, he also ontributed 550,000 cash to the newly named Stork School of Engineering at Reno State University. anthony also recelved the following form 1098 (see separate tab). Required: Complete Anthony's federal tax return for 2022. Use Form 1040, Schedule 1, Schedule A, and Form 9889 to complete this tax returm. - Make realistic assumptions about any missing data. - Anthony had health coverage for the entire year and he does not want to contribute to the presidential election campaign. - Enter all amounts as positive numbers. - If an amount box does not require an entry or the answer is zero, enter "0". - If required round any dollar amount to the nearest dollar. Anthony's W-2 Form Anthony's earmings and withholdings as the manager of a local casino for 2022 are reported on his Form W-2: Anthony's W-2 Form Copy B-To Be Filed With Emplovee's FEDERAL Iax Return. This information is being furnished to the intemal fevenue Service. Arthany's Form 1098 Anthony also received the following form 1096 : D CORRECTED (if chocked) Anthony's Fort 1098 \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline \end{tabular} Anthorry's Form 1098 Form 1040 - Head of household, For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040(2022) page 2 Tax and 16 Tax (see instructions). Check if any from Form(s): 1088142497230 19 Child tax credit or credit for other dependents from Schedule 8812 . 20 Amount from 5chedide J, line-8: 21. Add lines 19 and 20 22. Subtract line 21 trom line 18. If zero or less, enter -0 ............................... \begin{tabular}{|l|c|} \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline \end{tabular} Form 1040 Schedule1 Schedule 1 (Form 1040) (2022) Page 2 Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government otficials, Attach Form 13 Health savings account deduction. Attach Form 8889 14. Moving expenses for members of the Armed Forces. Attach Form 3903. 15. Deductible part of self-employment tax. Attach Schedule SE. 16. Self-emoloyed SEp: StMptE and quallifed plans. 17 Self-emsloved health insurance alduction 13. Penalty on early withdrawal of savinos. 19a Alimony paid b. Reciplent's 5Sid c Date- of original divorce or separabon agreement (see instructions) Taxes You 5 state and local taxes. Paid a State and local income taxes or qeneral sales taxes. You may include either income taxes or general sales taxes on line 5 , but not both. If you elect to include general sales taxes instead of income taxes, check this box............ b State and local real estate taxes (see instructions) c state and local personal property taxes ................. d Add lines 5 a through 5c...................... e Enter the smaller of line 5d or $10,000 ( $5,000 if married filing separately) ........................... 6 Other taxes. Ust type and amount \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{} \\ \hline 5a & \\ \hline 5b & \\ \hline 5c & \\ \hline 5d & \\ \hline 5e & \\ \hline & \\ \hline 6 & \\ \hline \end{tabular} Sichedule A Interest 8. Home mortgage interest and points. If you didn't use all of your home mortoage loan(s) to buy, build, or improve your home, see You Paid instructions and check this box. Caution: a Home mortgage interest and points reported to you on Form 1098. See instructions if limited Your mortgage intarest b Home mortgage interest not reported to you on Form 1098. See deduction may instructions if limited. If paid to the person from whom you bought be limited (see the home; see instructions and show that person's name, identifying instructions). no., and address. c points not reported to you on Form 1098. See instructions for special rules d Reserved for future use e Add lines 8a through id 9 Investment interest. Attach Form 4952 If required. See instructions. 10 Add lines 8e and 9 10 Schedule A Gifts to 11 Gifts by cash or check. If you made any oift of $250 or more. Caution: If you 12 Other than by cash or check. If you made any gift of $250 or more, made a gift and see instructions. You must attach Form 8283 if over $500. got a benefit for Theft tosses losses). Attach Form 4684 and enter the amount fron line 18 of that form. See instructions 15 Other 16 Other-from list in instructions. Ust type and amount Itemired Deductions Total 17 Add the anounts in the far rioht column for lines 4 through 16. Aso, enter this amount on Itemized Form 1040 of 10405s,line12a. Deductions 10 If you elect to itemire deductions even though they are less than your standard deduction: For Paperwork Redaction Act Notice, see the Instructions for Cat. No. 17145C Schedule A (form 1040) 2022 Forms ifan and inan-sn Form es89 Part I HSA Contributions and Deduction. See the instructions before completing this part. If you are filing Jointly and both you and your spouse each have separate HSAs, complete a separate Part I for each spouse. 1 Check the box to indicate your coverage under a hlgh-deductible health plan (HDHP) during 2022. See instructions 2. HSA contributions you made for 2022 (or those made on your behalf), inctuding those made in 2023 by the unextended due date of your tax retura that were for 2022. Do not include employer contributions, contributions through a cafeteria plan, or rollovers, See instructions. 3. If you vere under age 55 at the end of 2022 and, on the first day of every month during 2022, you were, or were considered, an eligible individual with the same coverage, enter $3,650($7,300 for family coverage). Al othern, see the instructions for the amount to enter ........... A Enter the amount you and yout employer contributed to your Archer MSAs for 2022 from form 8853. lines 1 and 2. If you or your spouse had family coverage under an HDHP at any time during 2022. also include any amount contributed to your spouse's Archer MSAs 5 Subtract une 4 from line 3. Hzero or less, enter -0 - 6. Enter the amount from line 5. But if you and your spouse each bave separate HsAs and had family coverage under an HDHD at any time during 2022, see the instructions for the amount to enter 7 If vou were age 55 or older at the end of 2022 , mimded, and you or your spouse had family coverage under an HDAP at any time during 2022, enter your additional cootribution amount. 5 ee instructions. HSA Distributions. If you are filing Jointly and both you and your spouse each have separate HSAs, complete a separate Part II for eath spouse. Anthony Stork (birthdate August.2, 1978) is a single taxpayer. Anthony's earnings and withholdings a5 the manager of a local casino for 2022 are reported on his Form W-2.(see separate tab). Anthony pays his ex-spouse, Salty Pans, $3,900 per month in accordance with their February 12, 2020 divorce decree. When their 12 -year-old child (in the ex-wife's custody) reaches the age of 18, the payments are reduced to $2,800 per month. His ex-wife's 50 -ial Security number is 554 -445555. In 2022, Anthony purchased a new car and so he kept track of his sales tax receipts during the year. His actual sales tax paid was $3,450 for the car and $925 for all other purchases. Anthony participates in a high-deductible health plan and is eligible to contribute to a health savings account. His HSA earned $75 in 2022. During the year, Anthony paid the following amounts (all of which can be substantiated): Anthony Stork (birthdate August 2,1978 ) is a single taxpayer. Anthony's earning5 and withholdings as the manager of a local casino for 2022 are reported on his Form W-2 (see separate tab). Anthony pays his ex-5pouse, Salty Pans, \$3,900 per month in accordance with their February 12, 2020 divorce decree. When their 12-year-old child (in the ex-wife's custody) reaches the age of 18, the payments are reduced to $2,800 per month. His ex-wife's 5 ocial Security number is 554 -44- In 2022, Anthony purchased a new car and so he kept track of his sales tax receipts during the year. His actual sales tax paid was $3,450 for the car and 5925 for all other purchases. Anthony participates in a high-deductible health plan and is ellgible to contribute to a health savings account. His HSA earned 575 in 2022 . During the year, Anthory paid the following amounts (all of which can be substantiated): in 2022, Anthony inherited over $500,000 from his father, Howard, who died in 2022. Athough Anthony invested a large portion, he also ontributed 550,000 cash to the newly named Stork School of Engineering at Reno State University. anthony also recelved the following form 1098 (see separate tab). Required: Complete Anthony's federal tax return for 2022. Use Form 1040, Schedule 1, Schedule A, and Form 9889 to complete this tax returm. - Make realistic assumptions about any missing data. - Anthony had health coverage for the entire year and he does not want to contribute to the presidential election campaign. - Enter all amounts as positive numbers. - If an amount box does not require an entry or the answer is zero, enter "0". - If required round any dollar amount to the nearest dollar. Anthony's W-2 Form Anthony's earmings and withholdings as the manager of a local casino for 2022 are reported on his Form W-2: Anthony's W-2 Form Copy B-To Be Filed With Emplovee's FEDERAL Iax Return. This information is being furnished to the intemal fevenue Service. Arthany's Form 1098 Anthony also received the following form 1096 : D CORRECTED (if chocked) Anthony's Fort 1098 \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline \end{tabular} Anthorry's Form 1098 Form 1040 - Head of household, For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040(2022) page 2 Tax and 16 Tax (see instructions). Check if any from Form(s): 1088142497230 19 Child tax credit or credit for other dependents from Schedule 8812 . 20 Amount from 5chedide J, line-8: 21. Add lines 19 and 20 22. Subtract line 21 trom line 18. If zero or less, enter -0 ............................... \begin{tabular}{|l|c|} \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline \end{tabular} Form 1040 Schedule1 Schedule 1 (Form 1040) (2022) Page 2 Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis government otficials, Attach Form 13 Health savings account deduction. Attach Form 8889 14. Moving expenses for members of the Armed Forces. Attach Form 3903. 15. Deductible part of self-employment tax. Attach Schedule SE. 16. Self-emoloyed SEp: StMptE and quallifed plans. 17 Self-emsloved health insurance alduction 13. Penalty on early withdrawal of savinos. 19a Alimony paid b. Reciplent's 5Sid c Date- of original divorce or separabon agreement (see instructions) Taxes You 5 state and local taxes. Paid a State and local income taxes or qeneral sales taxes. You may include either income taxes or general sales taxes on line 5 , but not both. If you elect to include general sales taxes instead of income taxes, check this box............ b State and local real estate taxes (see instructions) c state and local personal property taxes ................. d Add lines 5 a through 5c...................... e Enter the smaller of line 5d or $10,000 ( $5,000 if married filing separately) ........................... 6 Other taxes. Ust type and amount \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{} \\ \hline 5a & \\ \hline 5b & \\ \hline 5c & \\ \hline 5d & \\ \hline 5e & \\ \hline & \\ \hline 6 & \\ \hline \end{tabular} Sichedule A Interest 8. Home mortgage interest and points. If you didn't use all of your home mortoage loan(s) to buy, build, or improve your home, see You Paid instructions and check this box. Caution: a Home mortgage interest and points reported to you on Form 1098. See instructions if limited Your mortgage intarest b Home mortgage interest not reported to you on Form 1098. See deduction may instructions if limited. If paid to the person from whom you bought be limited (see the home; see instructions and show that person's name, identifying instructions). no., and address. c points not reported to you on Form 1098. See instructions for special rules d Reserved for future use e Add lines 8a through id 9 Investment interest. Attach Form 4952 If required. See instructions. 10 Add lines 8e and 9 10 Schedule A Gifts to 11 Gifts by cash or check. If you made any oift of $250 or more. Caution: If you 12 Other than by cash or check. If you made any gift of $250 or more, made a gift and see instructions. You must attach Form 8283 if over $500. got a benefit for Theft tosses losses). Attach Form 4684 and enter the amount fron line 18 of that form. See instructions 15 Other 16 Other-from list in instructions. Ust type and amount Itemired Deductions Total 17 Add the anounts in the far rioht column for lines 4 through 16. Aso, enter this amount on Itemized Form 1040 of 10405s,line12a. Deductions 10 If you elect to itemire deductions even though they are less than your standard deduction: For Paperwork Redaction Act Notice, see the Instructions for Cat. No. 17145C Schedule A (form 1040) 2022 Forms ifan and inan-sn Form es89 Part I HSA Contributions and Deduction. See the instructions before completing this part. If you are filing Jointly and both you and your spouse each have separate HSAs, complete a separate Part I for each spouse. 1 Check the box to indicate your coverage under a hlgh-deductible health plan (HDHP) during 2022. See instructions 2. HSA contributions you made for 2022 (or those made on your behalf), inctuding those made in 2023 by the unextended due date of your tax retura that were for 2022. Do not include employer contributions, contributions through a cafeteria plan, or rollovers, See instructions. 3. If you vere under age 55 at the end of 2022 and, on the first day of every month during 2022, you were, or were considered, an eligible individual with the same coverage, enter $3,650($7,300 for family coverage). Al othern, see the instructions for the amount to enter ........... A Enter the amount you and yout employer contributed to your Archer MSAs for 2022 from form 8853. lines 1 and 2. If you or your spouse had family coverage under an HDHP at any time during 2022. also include any amount contributed to your spouse's Archer MSAs 5 Subtract une 4 from line 3. Hzero or less, enter -0 - 6. Enter the amount from line 5. But if you and your spouse each bave separate HsAs and had family coverage under an HDHD at any time during 2022, see the instructions for the amount to enter 7 If vou were age 55 or older at the end of 2022 , mimded, and you or your spouse had family coverage under an HDAP at any time during 2022, enter your additional cootribution amount. 5 ee instructions. HSA Distributions. If you are filing Jointly and both you and your spouse each have separate HSAs, complete a separate Part II for eath spouse. Anthony Stork (birthdate August.2, 1978) is a single taxpayer. Anthony's earnings and withholdings a5 the manager of a local casino for 2022 are reported on his Form W-2.(see separate tab). Anthony pays his ex-spouse, Salty Pans, $3,900 per month in accordance with their February 12, 2020 divorce decree. When their 12 -year-old child (in the ex-wife's custody) reaches the age of 18, the payments are reduced to $2,800 per month. His ex-wife's 50 -ial Security number is 554 -445555. In 2022, Anthony purchased a new car and so he kept track of his sales tax receipts during the year. His actual sales tax paid was $3,450 for the car and $925 for all other purchases. Anthony participates in a high-deductible health plan and is eligible to contribute to a health savings account. His HSA earned $75 in 2022. During the year, Anthony paid the following amounts (all of which can be substantiated)