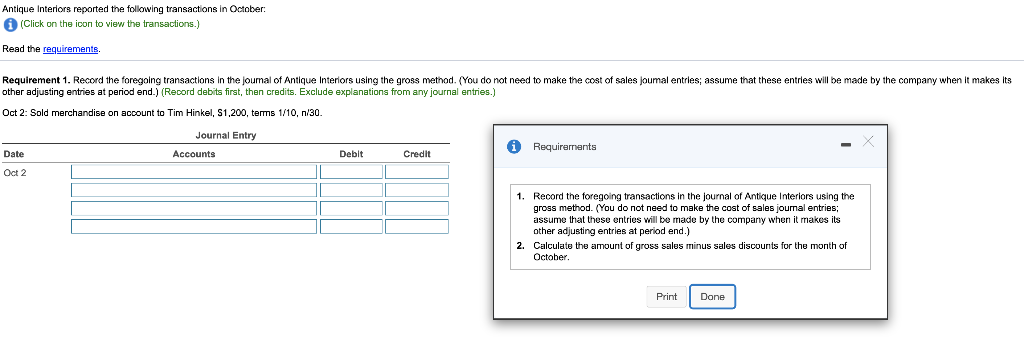

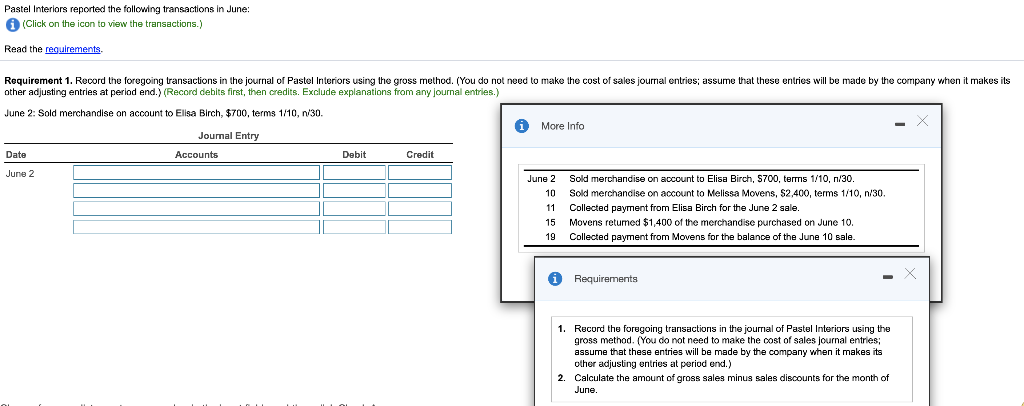

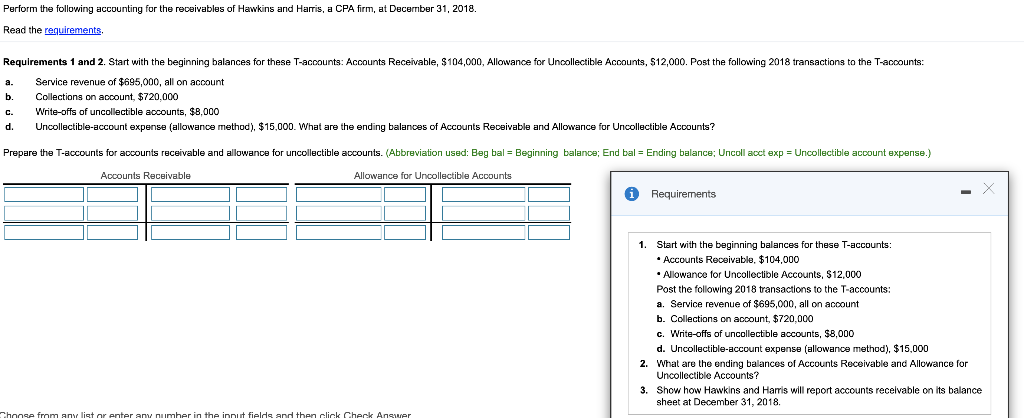

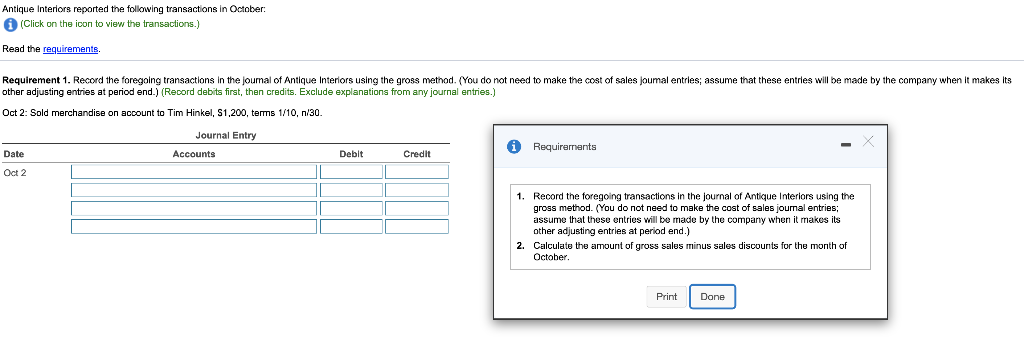

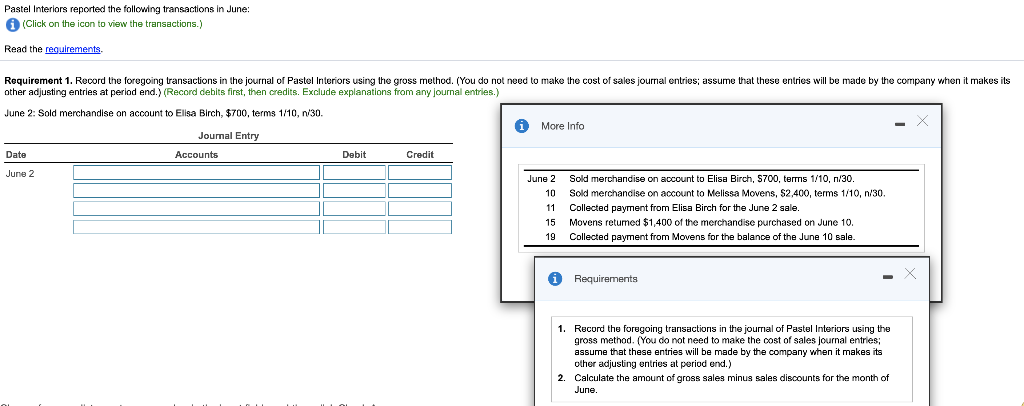

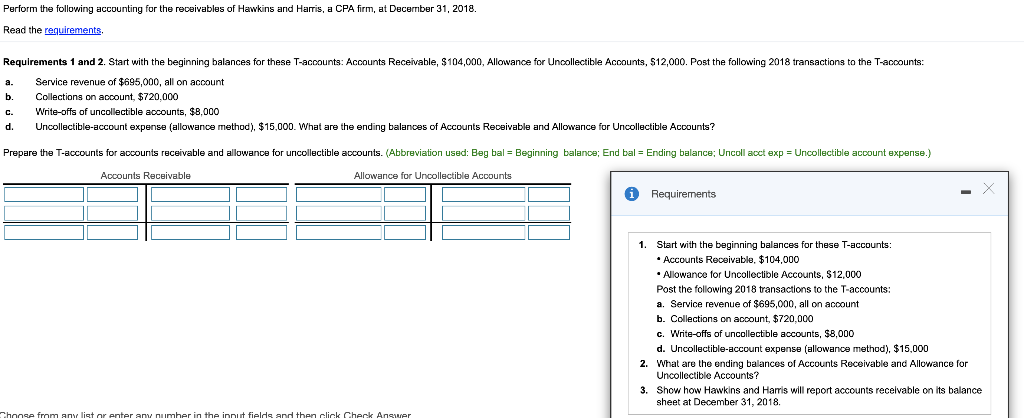

Antique Interiors reported the following transactions in October (Click on the icon to view the transactions.) Read the requirements need make the cost of sales joumal entries: assume that these entries will be made by the company when it makes its Oct 2: Sold merchandise on account to Tim Hinkel, S1.200, terms 1/10, n/30. Journal Entry iRequiremants Date Accounts Debit Credit Oct 2 Record the foregoing transactions in the journal of Antique Interiors using the 1. e t t e antrig uill ba made by the compamy when it makes its period end.) other adjusting entries 2 Calculate the amount of gross sales minus sales discounts for the month of October Print Done Pastel Interiors reported the following transactions June: (Click on the icon to view the transactions. Read the requirements make the cost of sales journal entries; assume that these entries will be made by the company when it makes its Requirement 1. Record the foregoing transactions in the journal of Pastel Interiors using the gross method. (You do not need other adjusting entries at period end.) (Record debits first, then credits. Exclude explanations from any journal entries.) June 2: Sold merchandise on account to Elisa Birch, $700, terms 1/10, n/30. More Info Joumal Entry Date Accounts Debit Credit June 2 Sold merchandise on account to Elisa Birch, S700, terms 1/10, n/30. June 2 Sold merchandise on account to Melissa Movens, $2,400, terms 1/10, n/30. 10 Collected payment from Elisa Birch for the June 2 sale. 11 1.400 of the merchandise purchased on June 10. 15 Movens retumed Collected payment from Movens for the balance of the June 10 sale 1 i Requirements 1. Record the foregoing transactions in the joumal of Pastel Interiors using the aSSume that thase antriss will be made hy the company wwhen it makes its other adjusting ontries at poriod end.) 2. Calculate the amount of gross sales minus sales discounts for the month of June Perform the following accounting for the receivables of Hawkins and Haris, a CPA firm, at December 31, 2018. Read the requirements these T-accounts: Accounts Receivable, S104,000, Allowance for Uncollectible Accounts, $12,000. Post the following 2018 transactions to the T-accounts: Requirements 1 and 2. Start with the beginning balancess Service revenue of $695.0 on account Write-offs of uncollectible accounts, $8.000 Uncollectible-account expense (allowance method), $15,000. What are the ending balances of Accounts Receivable and Allowance for Uncollectible Acoounts? d. Prepare the T-accounts for accounts receivable and allowance for uncollectible accounts. (Abbreviation used: Beg bal Beginning balance; End bal Ending balance; Uncoll acct exp Uncollectible account expense.) Allowance for Uncollectible Accounts Accounts Receivable Requirements 1. Start with the beginning balances for these T-accounts Accounts Receivable, $104.000 Allowance for Uncollectible Accounts, $12,000 ccounts: PO ollowing2 . $695 000 all Service n b. Collections on account, $720,000 c. Write-offs of uncollectible accounts, $8,000 d. Uncollectible-account expense (allowance method), $15,000 2. What are the ending balances of Accounts Receivable and Allowance for Uncollectible Accounts? 3. Show how Hawkins and Hamis will report accounts recelvable on balance December 31, 2018. sheeta hoose from any ligt or enter amy number in the input fielde and then click Check Anewer