Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anton Company manufactures wooden magazine stands. An accountant for Anton just completed the variance report for the current month. After printing the report, his computer's

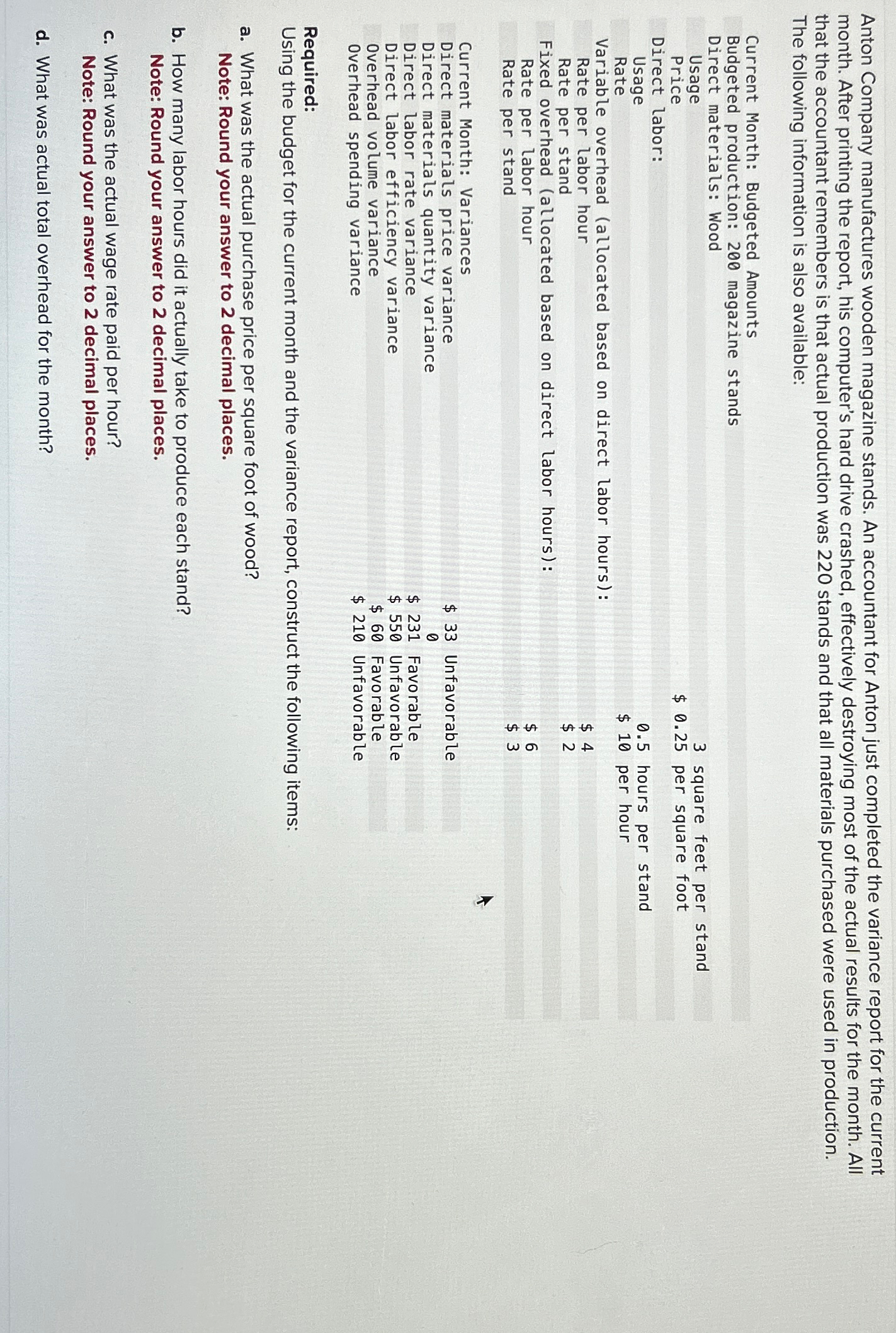

Anton Company manufactures wooden magazine stands. An accountant for Anton just completed the variance report for the current month. After printing the report, his computer's hard drive crashed, effectively destroying most of the actual results for the month. All that the accountant remembers is that actual production was stands and that all materials purchased were used in production. The following information is also available:

Current Month: Budgeted Amounts

Budgeted production: magazine stands

Direct materials: Wood

Usage

Price

$ square feet per stand

Direct labor:

Usage

Rate

hours per stand

Variable overhead allocated based on direct labor hours:

Rate per labor hour

Rate per stand

Fixed overhead allocated based on direct labor hours:

Rate per labor hour

Rate per stand

$ per hour

Current Month: Variances

Direct materials price variance

Direct materials quantity variance

Direct labor rate variance

Direct labor efficiency variance

Overhead volume variance

Overhead spending variance

$

$

$

$

$

Required:

Using the budget for the current month and the variance report, construct the following items:

a What was the actual purchase price per square foot of wood?

Note: Round your answer to decimal places.

b How many labor hours did it actually take to produce each stand?

Note: Round your answer to decimal places.

c What was the actual wage rate paid per hour?

Note: Round your answer to decimal places.

d What was actual total overhead for the month?

PLEASE USE IMAGE FOR INFORMATION AND ANSWER ALL PARTS AD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started