Answered step by step

Verified Expert Solution

Question

1 Approved Answer

needed Question 1 Nabi Fuhu LLC manufactures a tablet in Los Angeles, USA that is sold for $1.000 per unit in two markets: the USA

needed

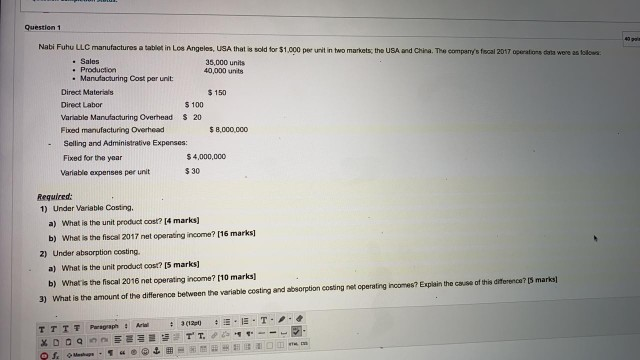

Question 1 Nabi Fuhu LLC manufactures a tablet in Los Angeles, USA that is sold for $1.000 per unit in two markets: the USA and China. The company's focal 2017 operations data were as follows 35,000 units Production 40,000 units Manufacturing Cost per unit Direct Materials $ 150 Direct Labor $ 100 Variable Manufacturing Overhead S 20 Fixed manufacturing Overhead $ 8.000.000 Selling and Administrative Expenses: Fixed for the year $ 4,000,000 Variable expenses per unit 330 Required: 1) Under Variable Costing. a) What is the unit product cost? [4 marks) b) What is the fiscal 2017 net operating income? [16 marks] 2) Under absorption costing. a) What is the unit product cost? [5 marks) b) What is the fiscal 2016 net operating income? [10 marks] 3) What is the amount of the difference between the variable costing and absorption costing net operating income? Explain the case of this diferenca? S marks] E.E.T. --- m TTTT Peragraph : AW (120 XDO Q EDETT. fc @Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started