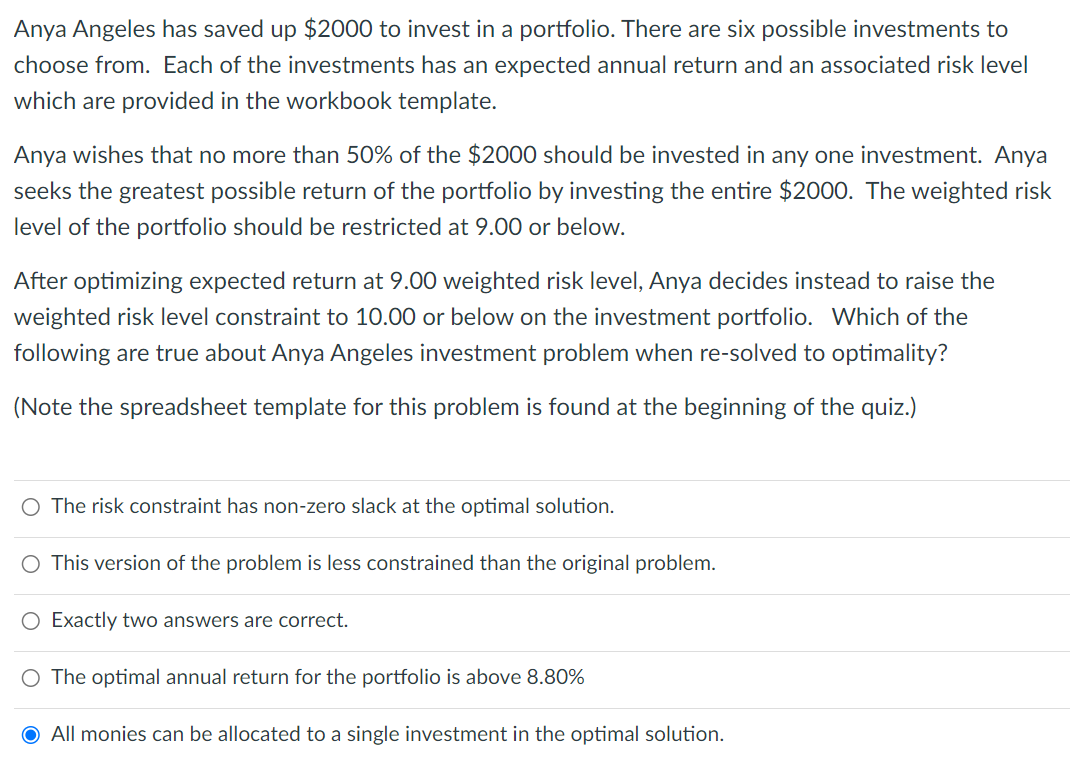

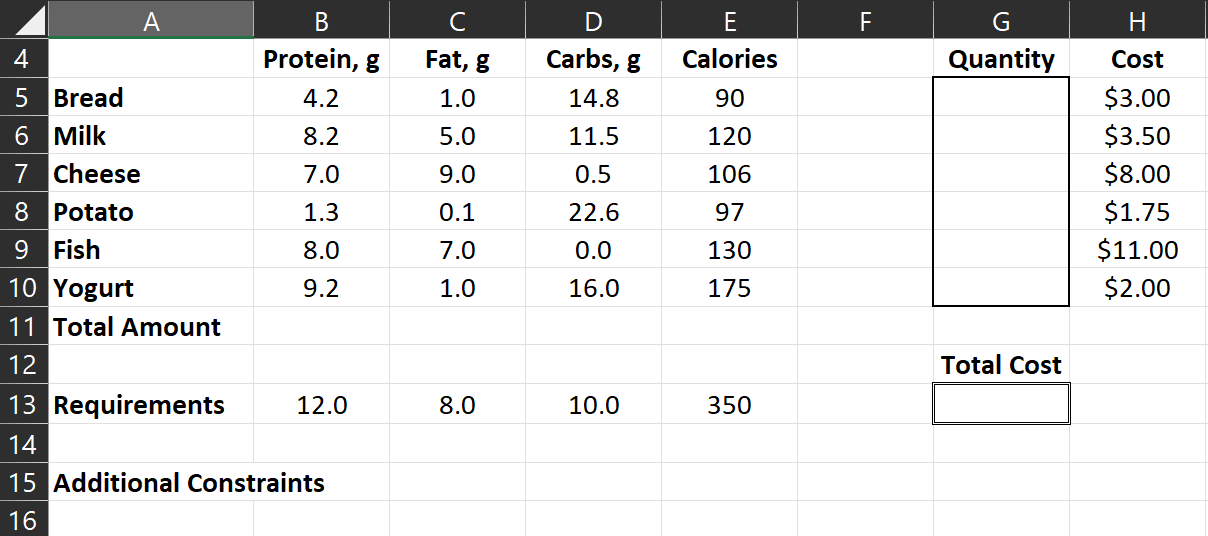

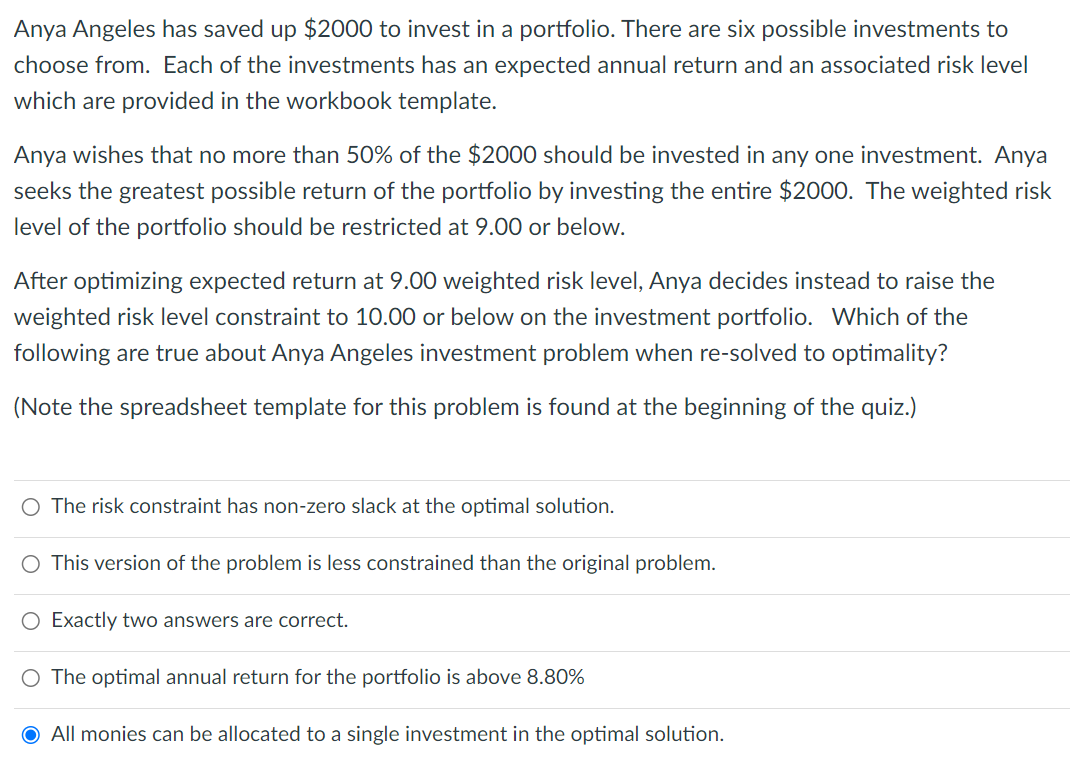

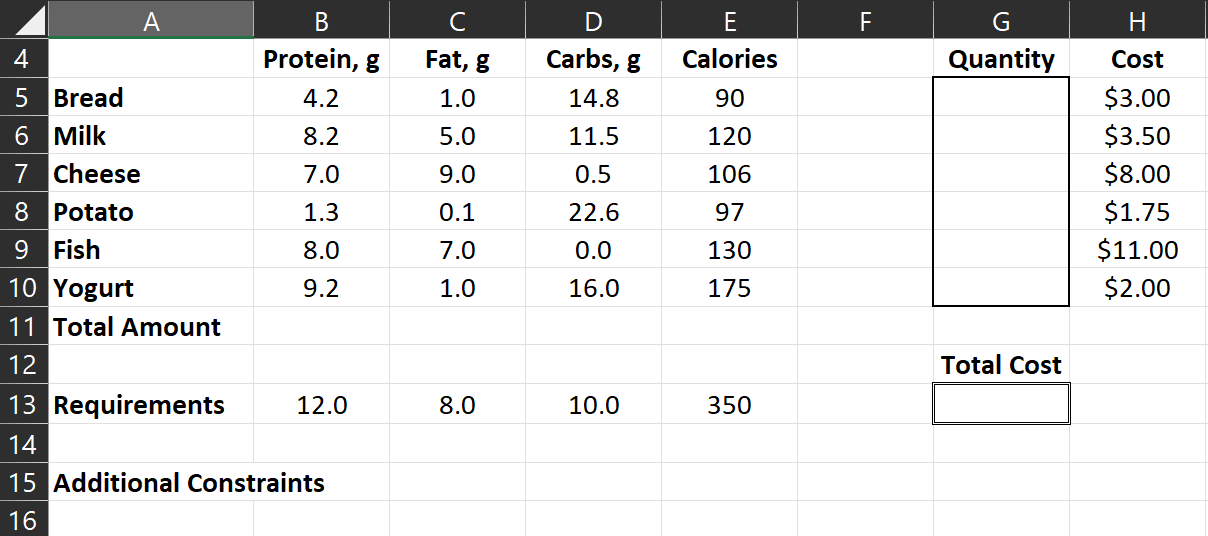

Anya Angeles has saved up $2000 to invest in a portfolio. There are six possible investments to choose from. Each of the investments has an expected annual return and an associated risk level which are provided in the workbook template. Anya wishes that no more than 50% of the $2000 should be invested in any one investment. Anya seeks the greatest possible return of the portfolio by investing the entire $2000. The weighted risk level of the portfolio should be restricted at 9.00 or below. After optimizing expected return at 9.00 weighted risk level, Anya decides instead to raise the weighted risk level constraint to 10.00 or below on the investment portfolio. Which of the following are true about Anya Angeles investment problem when re-solved to optimality? (Note the spreadsheet template for this problem is found at the beginning of the quiz.) The risk constraint has non-zero slack at the optimal solution. This version of the problem is less constrained than the original problem. Exactly two answers are correct. The optimal annual return for the portfolio is above 8.80% All monies can be allocated to a single investment in the optimal solution. \begin{tabular}{|l|c|c|c|c|c|c|c|} \hline \multicolumn{1}{|c|}{ A } & B & C & D & E & F & G \\ \hline 4 & & Protein, g & Fat, g & Carbs, g & Calories & \multicolumn{1}{|c|}{ Quantity } \\ \hline 5 & Bread & 4.2 & 1.0 & 14.8 & 90 & & \\ \hline 6 & Milk & 8.2 & 5.0 & 11.5 & 120 & & \\ \hline 7 & Cheese & 7.0 & 9.0 & 0.5 & 106 & & \\ \hline 8 & Potato & 1.3 & 0.1 & 22.6 & 97 & & \\ \hline 9 & Fish & 8.0 & 7.0 & 0.0 & 130 & & \\ \hline 10 & Yogurt & 9.2 & 1.0 & 16.0 & 175 & & \\ \hline 11 & Total Amount & & & & & & \\ \hline 12 & & & & & Total Cost \\ \hline 13 & Requirements & 12.0 & 8.0 & 10.0 & 350 & \\ \hline \end{tabular} Additional Constraints Anya Angeles has saved up $2000 to invest in a portfolio. There are six possible investments to choose from. Each of the investments has an expected annual return and an associated risk level which are provided in the workbook template. Anya wishes that no more than 50% of the $2000 should be invested in any one investment. Anya seeks the greatest possible return of the portfolio by investing the entire $2000. The weighted risk level of the portfolio should be restricted at 9.00 or below. After optimizing expected return at 9.00 weighted risk level, Anya decides instead to raise the weighted risk level constraint to 10.00 or below on the investment portfolio. Which of the following are true about Anya Angeles investment problem when re-solved to optimality? (Note the spreadsheet template for this problem is found at the beginning of the quiz.) The risk constraint has non-zero slack at the optimal solution. This version of the problem is less constrained than the original problem. Exactly two answers are correct. The optimal annual return for the portfolio is above 8.80% All monies can be allocated to a single investment in the optimal solution. \begin{tabular}{|l|c|c|c|c|c|c|c|} \hline \multicolumn{1}{|c|}{ A } & B & C & D & E & F & G \\ \hline 4 & & Protein, g & Fat, g & Carbs, g & Calories & \multicolumn{1}{|c|}{ Quantity } \\ \hline 5 & Bread & 4.2 & 1.0 & 14.8 & 90 & & \\ \hline 6 & Milk & 8.2 & 5.0 & 11.5 & 120 & & \\ \hline 7 & Cheese & 7.0 & 9.0 & 0.5 & 106 & & \\ \hline 8 & Potato & 1.3 & 0.1 & 22.6 & 97 & & \\ \hline 9 & Fish & 8.0 & 7.0 & 0.0 & 130 & & \\ \hline 10 & Yogurt & 9.2 & 1.0 & 16.0 & 175 & & \\ \hline 11 & Total Amount & & & & & & \\ \hline 12 & & & & & Total Cost \\ \hline 13 & Requirements & 12.0 & 8.0 & 10.0 & 350 & \\ \hline \end{tabular} Additional Constraints