Anyone wanna try dumbing down part C & D???

Not understanding it in the slightest, original question didn't have an amortization table by the way.

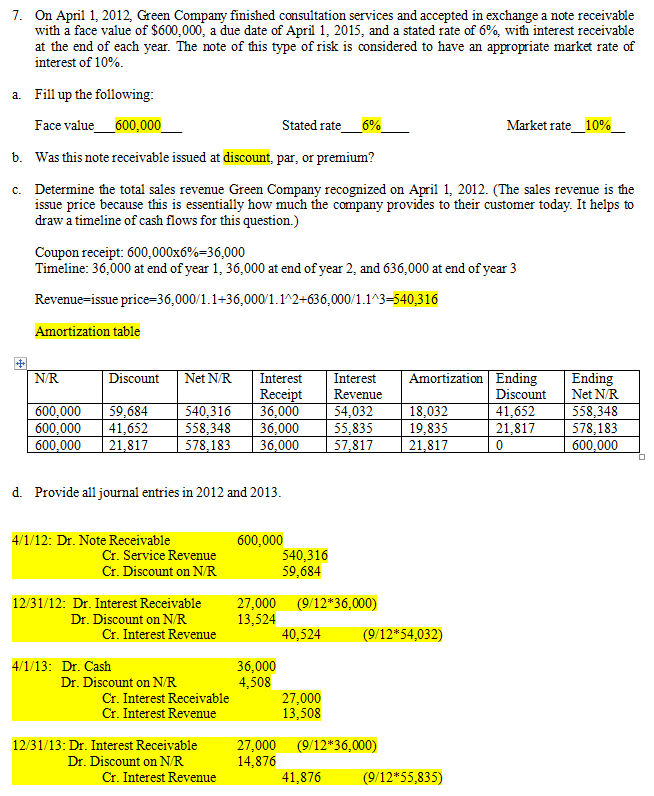

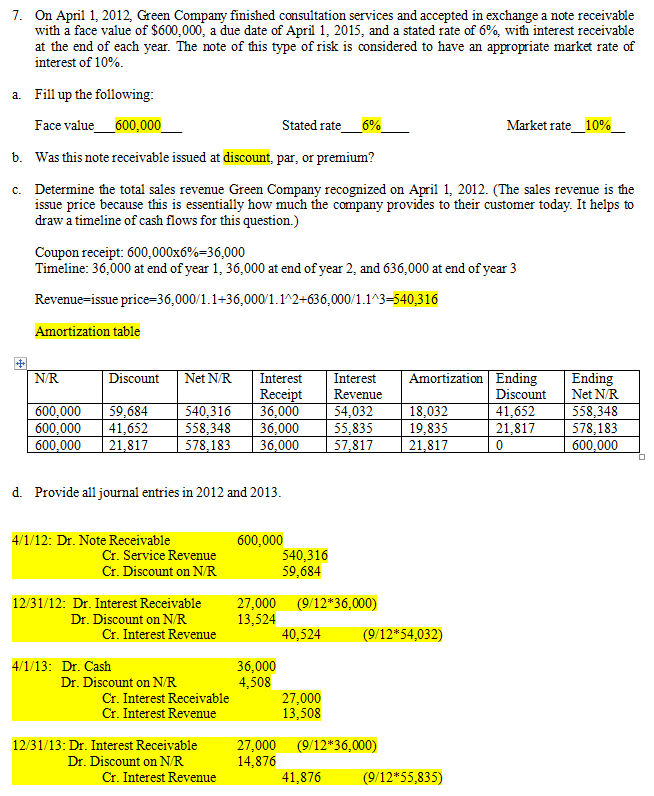

7. On April 1, 2012, Green Compary finished consultation services and accepted in exchange a note receivable with a face value of $600,000, a due date of April 1, 2015, and a stated rate of 6%, with interest receivable at the end of each year. The note of this type of risk is considered to have an appropriate market rate of interest of 10% Fill up the following Face value 600,000 Was this note receivable issued at discount, par, or premium? a. Stated rate 6% Market rate 10% b. Determine the total sales revenue Green Company recognized on April 1, 2012. (The sales revenue is the issue price because this is essentially how much the company provides to their customer today. It helps to draw a timeline of cash flows for this question.) c. Coupon receipt: 600,000x6%-36,000 Timeline: 36,000 at end of year 1, 36,000 at end of year 2, and 636,000 at end of year!3 Revenue-issue price-36,000/1.1+36,000/1.12+636,000/1.1A3-540,316 Amortization table N/R Ending Discount Net NR 558,348 578,183 600,000 Discount Net N/RInterest Interest Amortization| Ending Receipt Revenue 600,000 59,684 600,000 41,652 600,000 21,817 540,316 36,000 558.348 36,000 578,183 36,000 55,835 57,817 18,032 19,835 21,817 41,652 21,817 d. Provide all journal entries in 2012 and 2013 4/1/12: Dr. Note Receivable 600,000 Cr. Service Revenue Cr. Discount on NR 540,316 59,684 12/31/12: Dr. Interest Receivable27,000 9/12*36,000) Dr. Discount on N/R 13,524 Cr. Interest Revenue 40,524 (9/12*54,032) 4/1/13: Dr. Cash 36,000 4,508 Dr. Discount on NR Cr. Interest Receivable Cr. Interest Revenue 27,000 13,508 12/31/13: Dr. Interest Receivable 27,000 14,876 (9/12*36,000) Dr. Discount on N/R Cr. Interest Revenue 41,876 (9/12*55,835) 7. On April 1, 2012, Green Compary finished consultation services and accepted in exchange a note receivable with a face value of $600,000, a due date of April 1, 2015, and a stated rate of 6%, with interest receivable at the end of each year. The note of this type of risk is considered to have an appropriate market rate of interest of 10% Fill up the following Face value 600,000 Was this note receivable issued at discount, par, or premium? a. Stated rate 6% Market rate 10% b. Determine the total sales revenue Green Company recognized on April 1, 2012. (The sales revenue is the issue price because this is essentially how much the company provides to their customer today. It helps to draw a timeline of cash flows for this question.) c. Coupon receipt: 600,000x6%-36,000 Timeline: 36,000 at end of year 1, 36,000 at end of year 2, and 636,000 at end of year!3 Revenue-issue price-36,000/1.1+36,000/1.12+636,000/1.1A3-540,316 Amortization table N/R Ending Discount Net NR 558,348 578,183 600,000 Discount Net N/RInterest Interest Amortization| Ending Receipt Revenue 600,000 59,684 600,000 41,652 600,000 21,817 540,316 36,000 558.348 36,000 578,183 36,000 55,835 57,817 18,032 19,835 21,817 41,652 21,817 d. Provide all journal entries in 2012 and 2013 4/1/12: Dr. Note Receivable 600,000 Cr. Service Revenue Cr. Discount on NR 540,316 59,684 12/31/12: Dr. Interest Receivable27,000 9/12*36,000) Dr. Discount on N/R 13,524 Cr. Interest Revenue 40,524 (9/12*54,032) 4/1/13: Dr. Cash 36,000 4,508 Dr. Discount on NR Cr. Interest Receivable Cr. Interest Revenue 27,000 13,508 12/31/13: Dr. Interest Receivable 27,000 14,876 (9/12*36,000) Dr. Discount on N/R Cr. Interest Revenue 41,876 (9/12*55,835)