Answered step by step

Verified Expert Solution

Question

1 Approved Answer

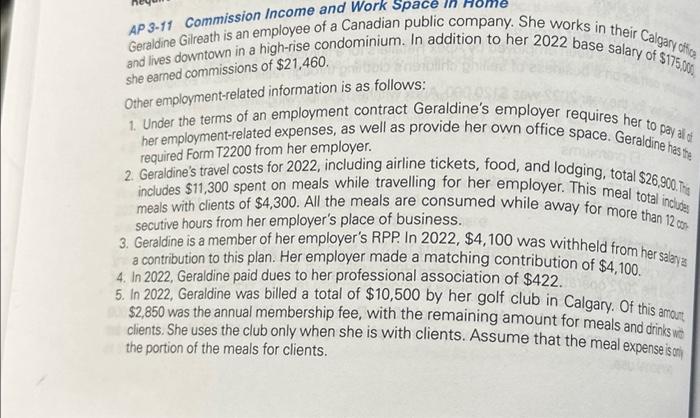

AP 3-11 Commission Income and Work Space In Home and lives downtown in a high-rise condominium. In addition to her 2022 base salary of $175,000,

AP 3-11 Commission Income and Work Space In Home and lives downtown in a high-rise condominium. In addition to her 2022 base salary of $175,000, Geraldine Gilreath is an employee of a Canadian public company. She works in their Calgary office 1,700 she earned commissions of $21,460. Mp Other employment-related information is as follows: 1. Under the terms of an employment contract Geraldine's employer requires her to pay all of her employment-related expenses, as well as provide her own office space. Geraldine has the required Form T2200 from her employer. 2. Geraldine's travel costs for 2022, including airline tickets, food, and lodging, total $26,900. This I meals with clients of $4,300. All the meals are consumed while away for more than 12 con- includes $11,300 spent on meals while travelling for her employer. This meal total includes secutive hours from her employer's place of business. 3. Geraldine is a member of her employer's RPP. In 2022, $4,100 was withheld from her salary as a contribution to this plan. Her employer made a matching contribution of $4,100. 4. In 2022, Geraldine paid dues to her professional association of $422. 5. In 2022, Geraldine was billed a total of $10,500 by her golf club in Calgary. Of this amount 000 $2,850 was the annual membership fee, with the remaining amount for meals and drinks with clients. She uses the club only when she is with clients. Assume that the meal expense is only the portion of the meals for clients.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started