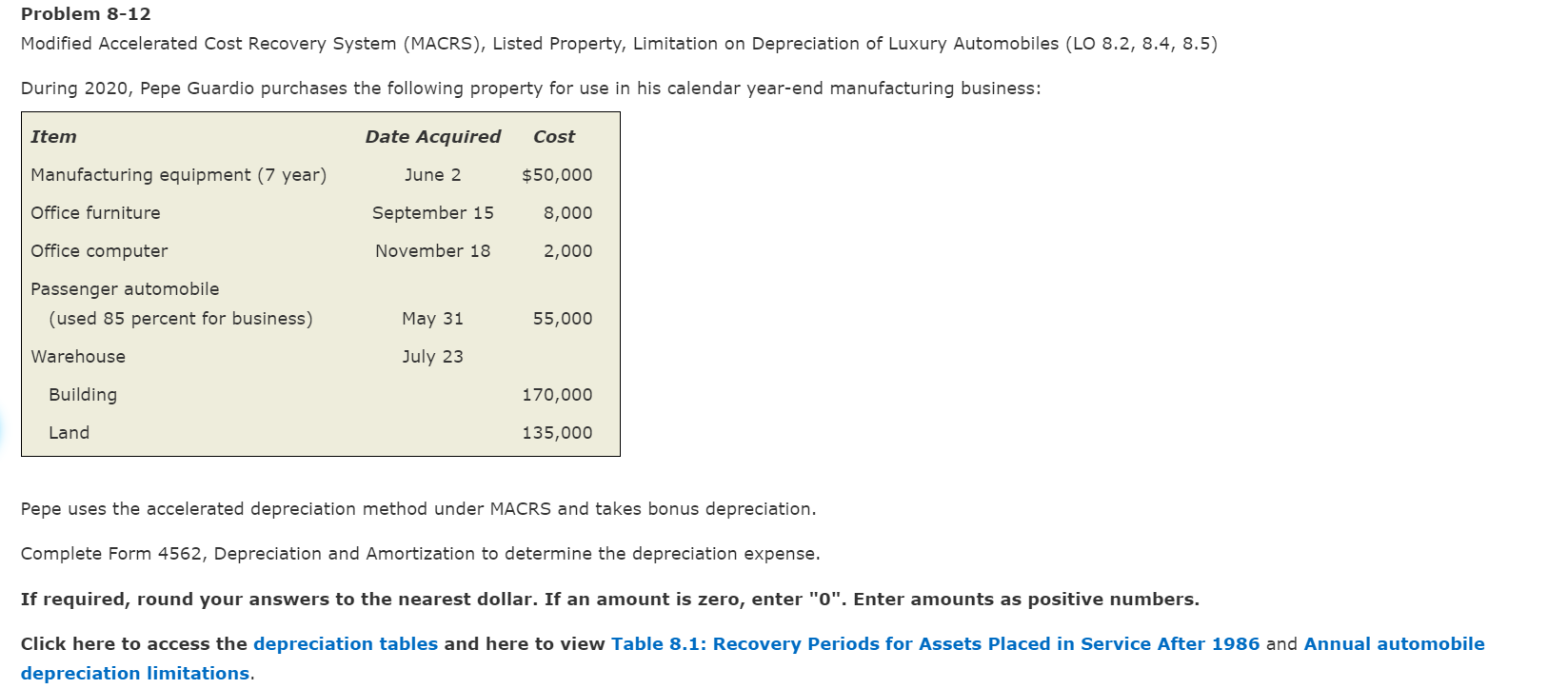

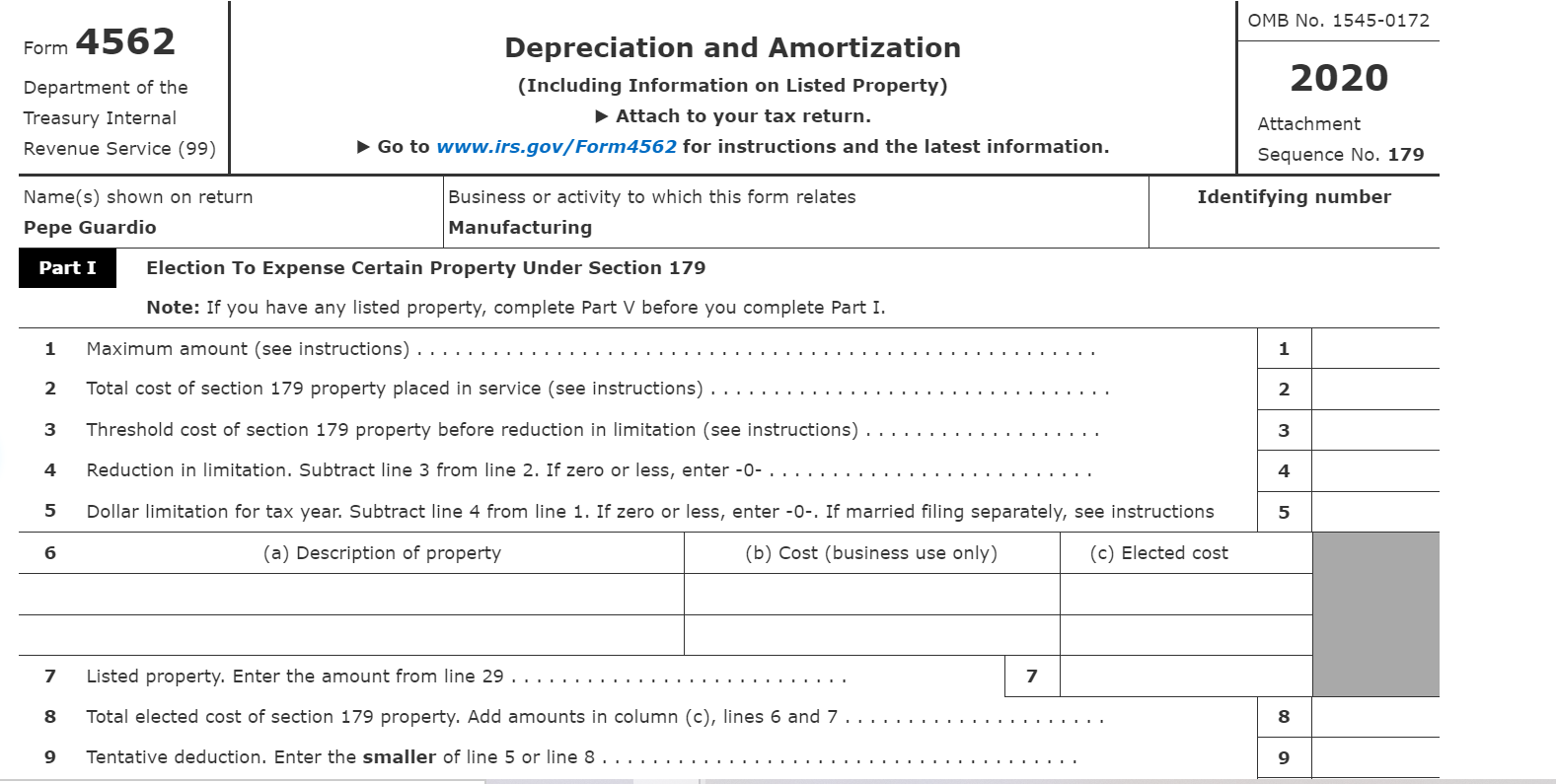

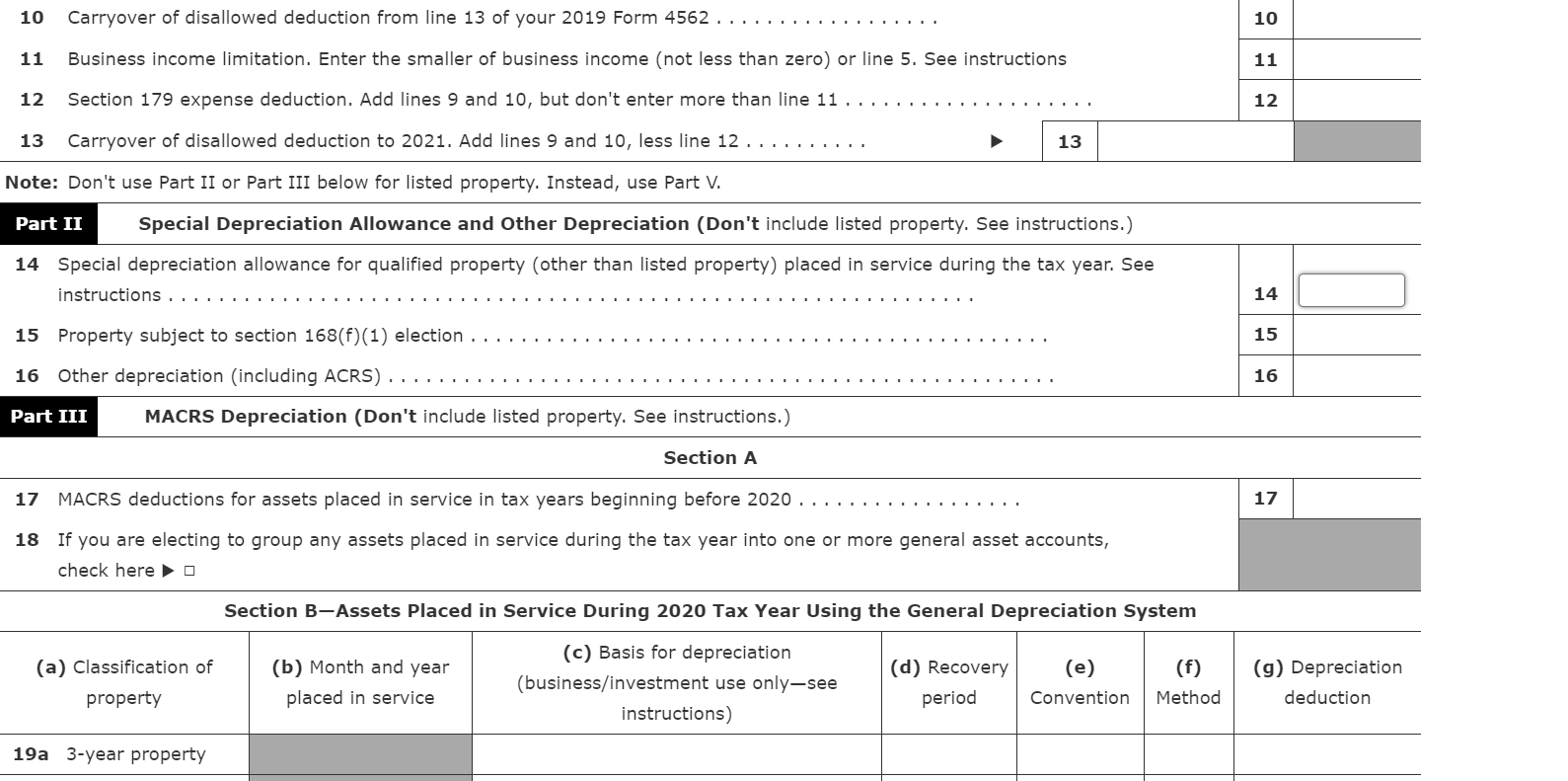

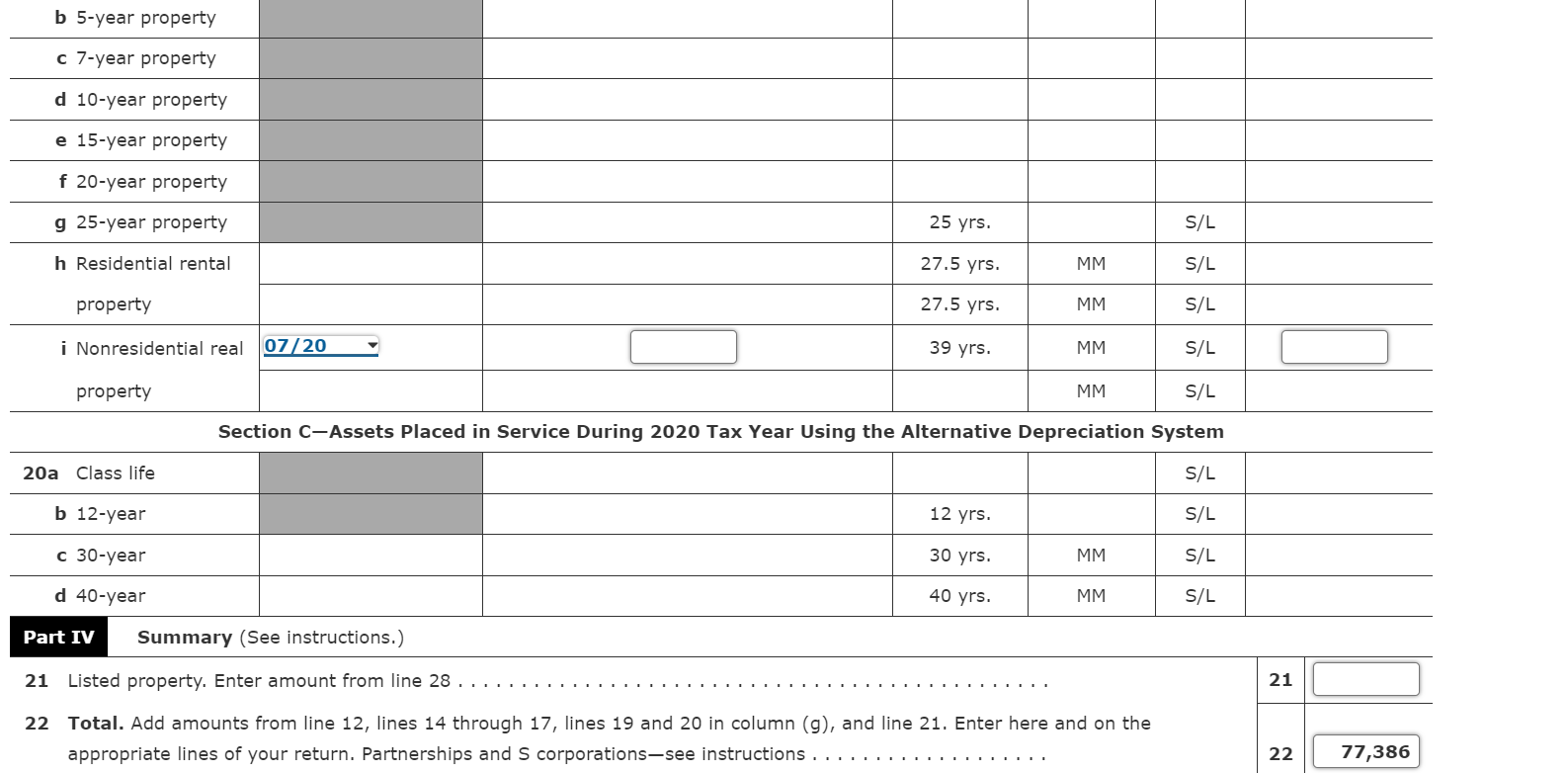

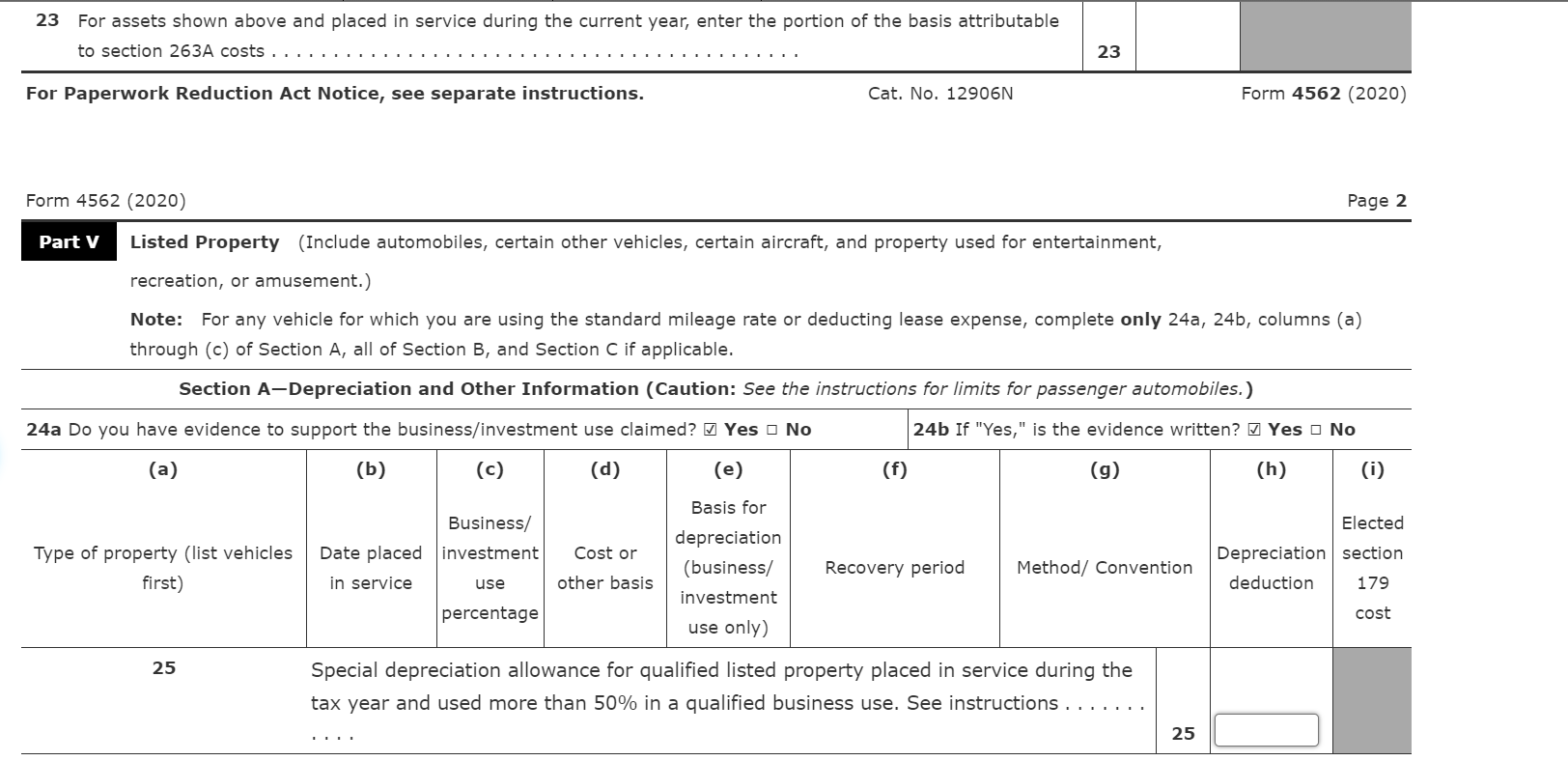

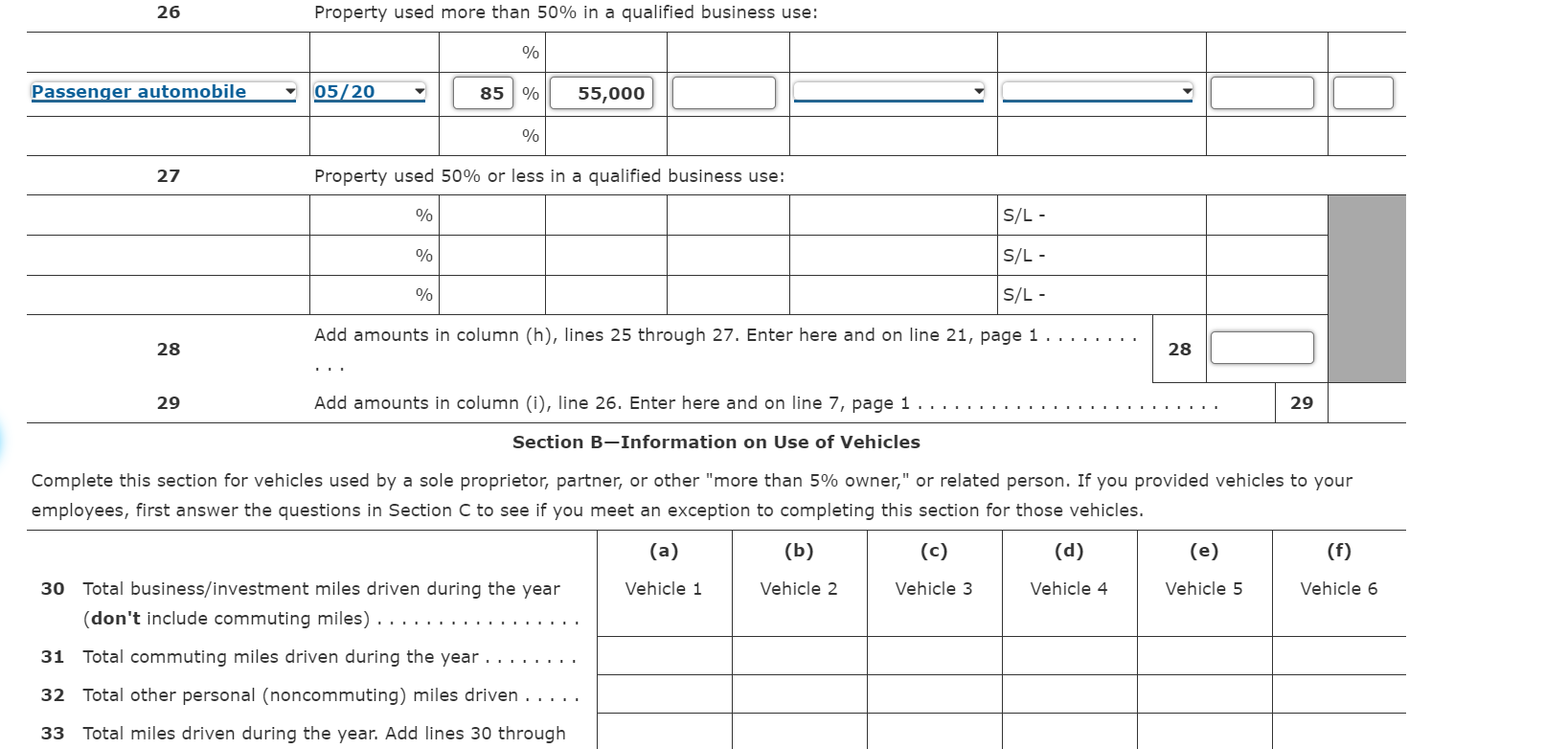

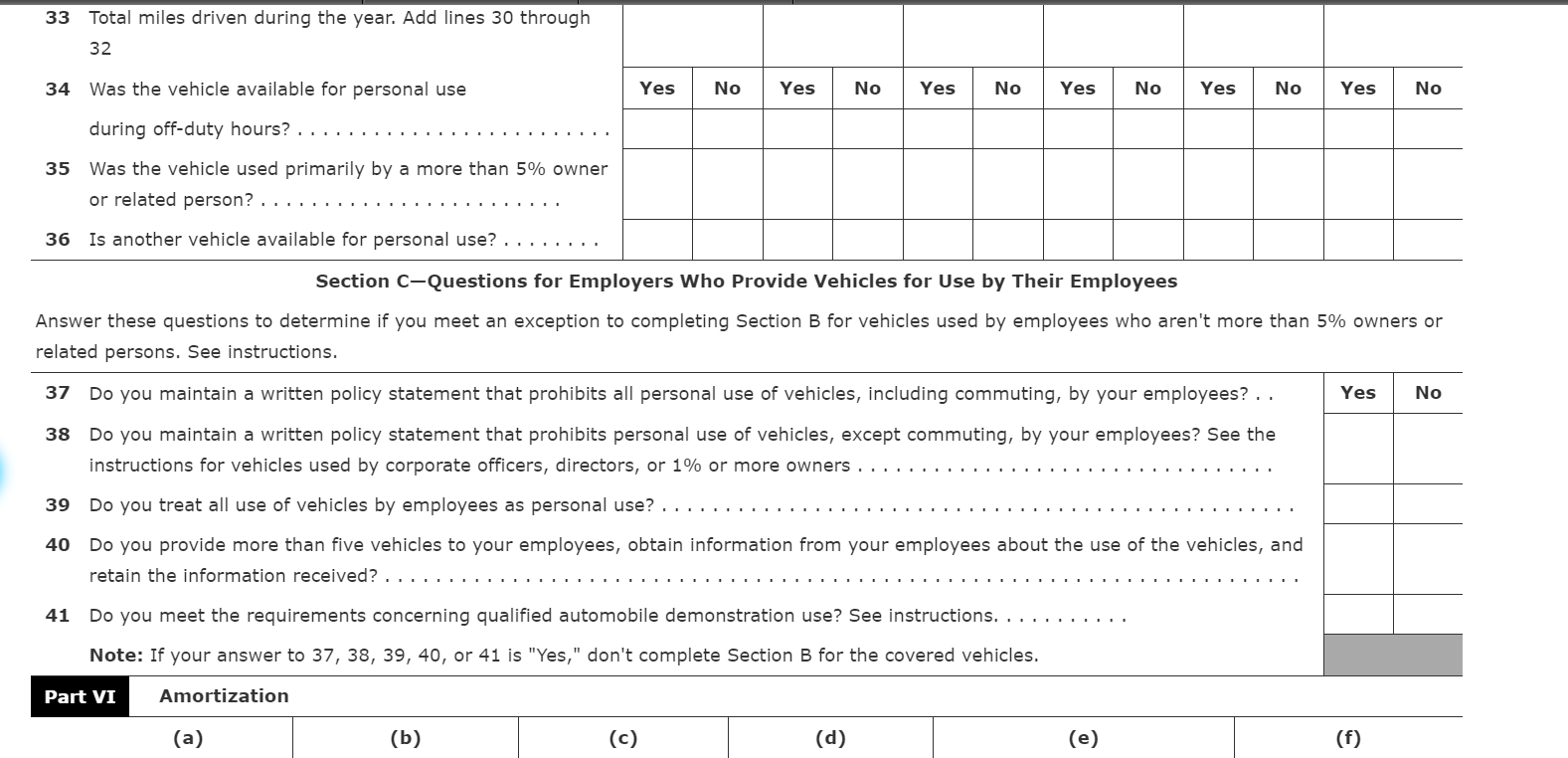

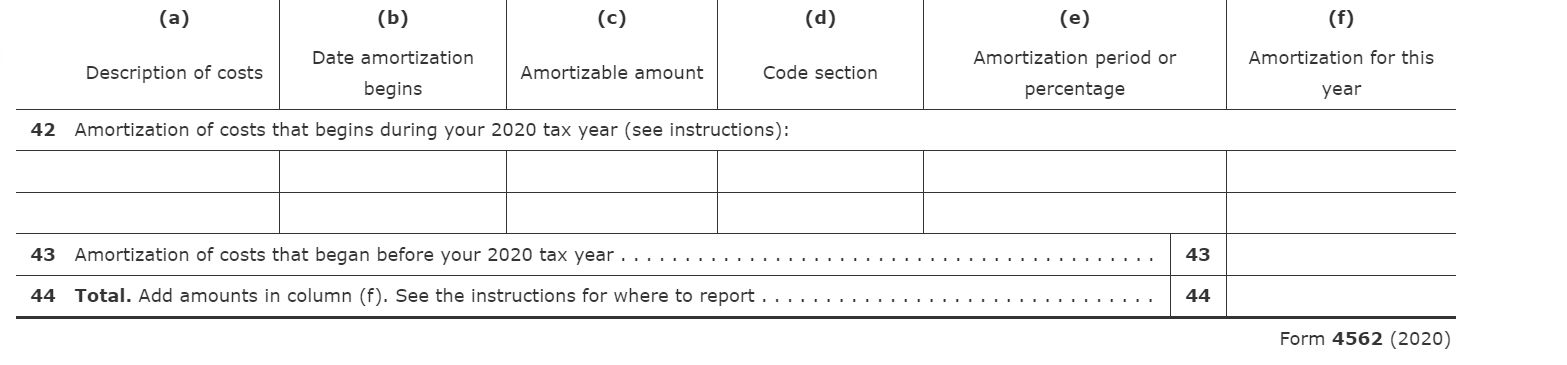

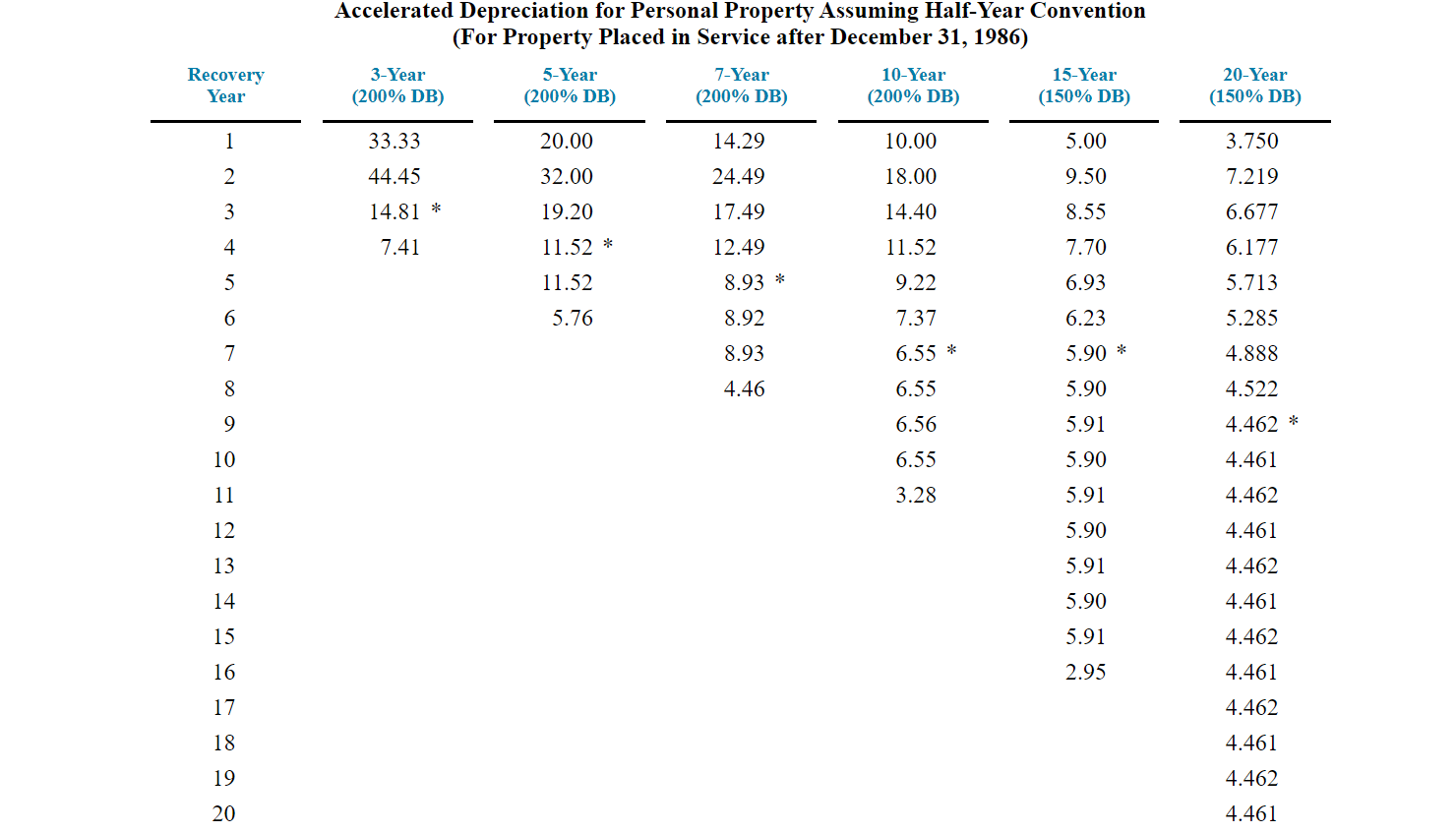

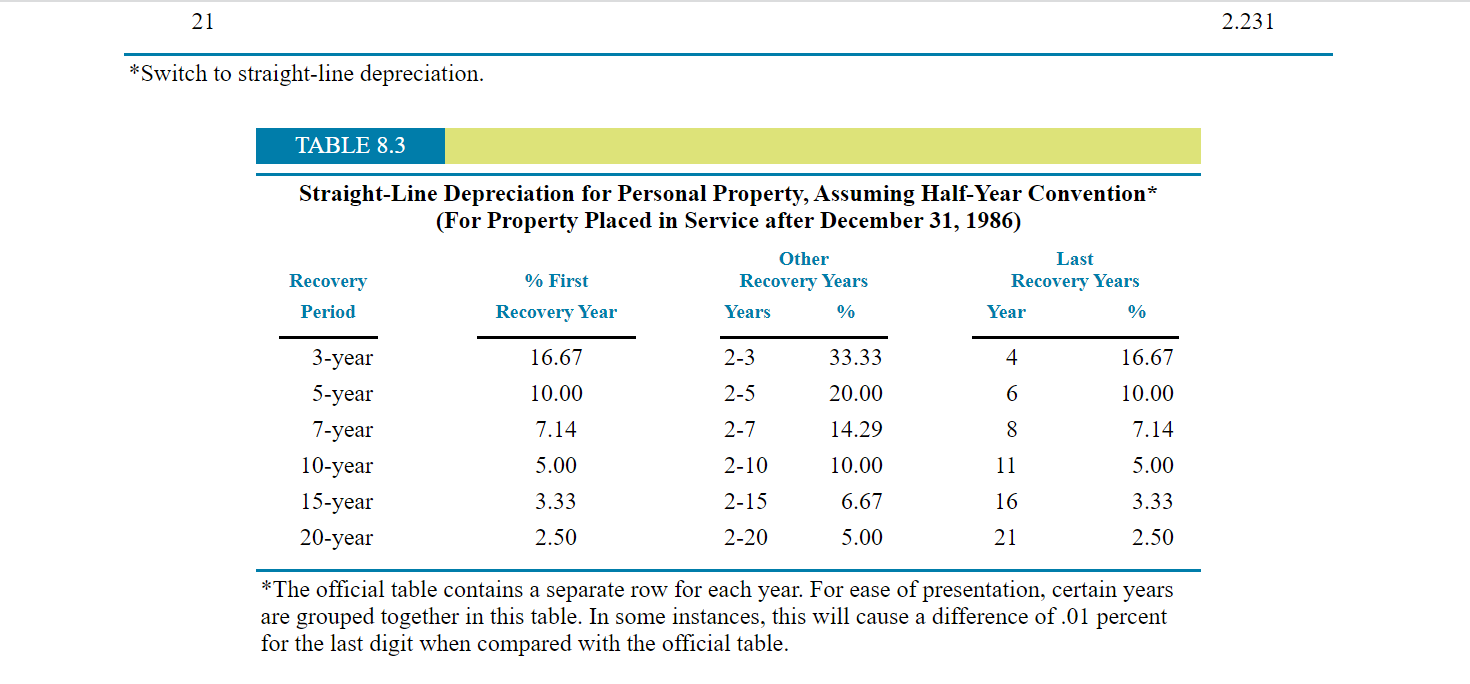

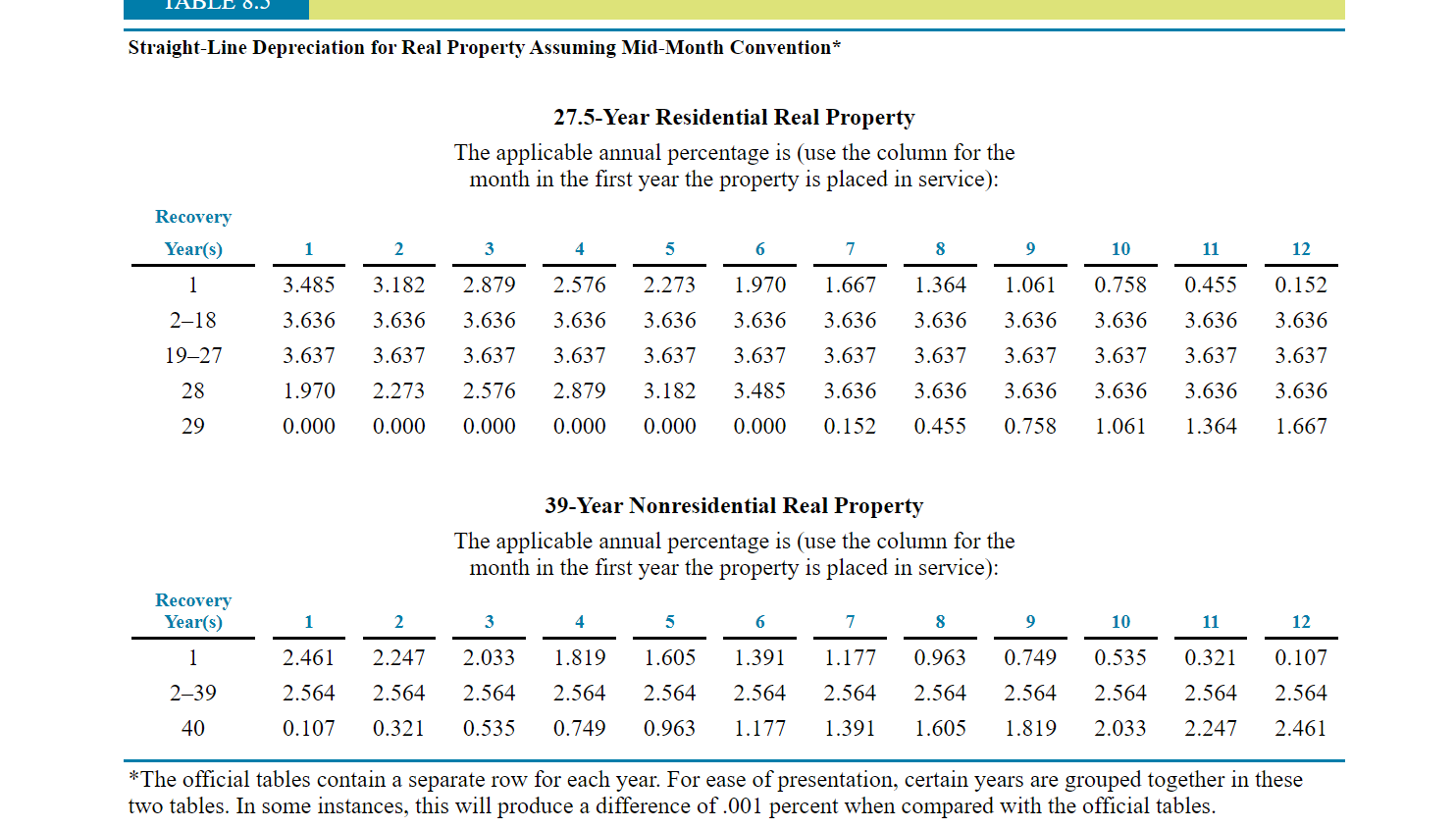

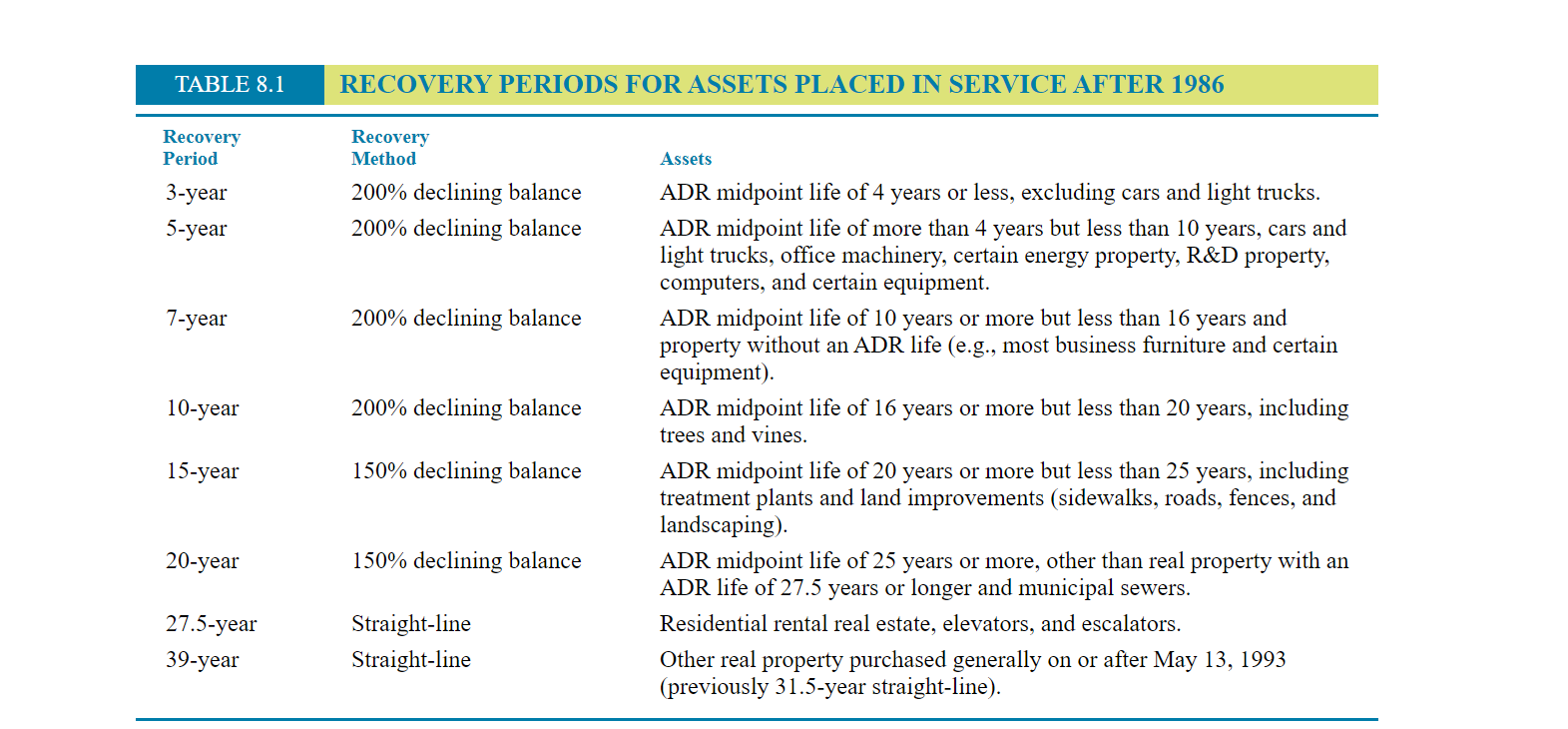

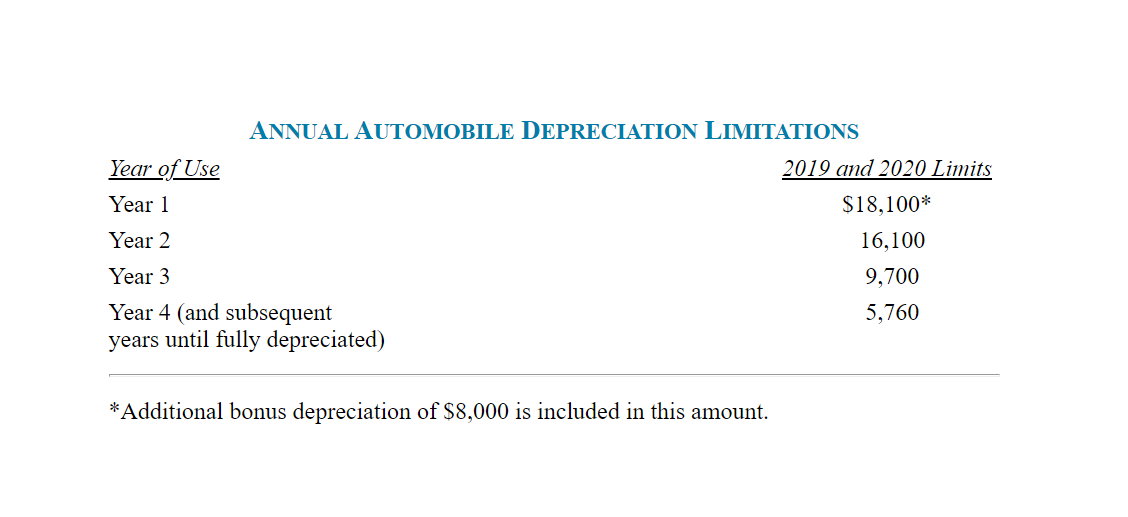

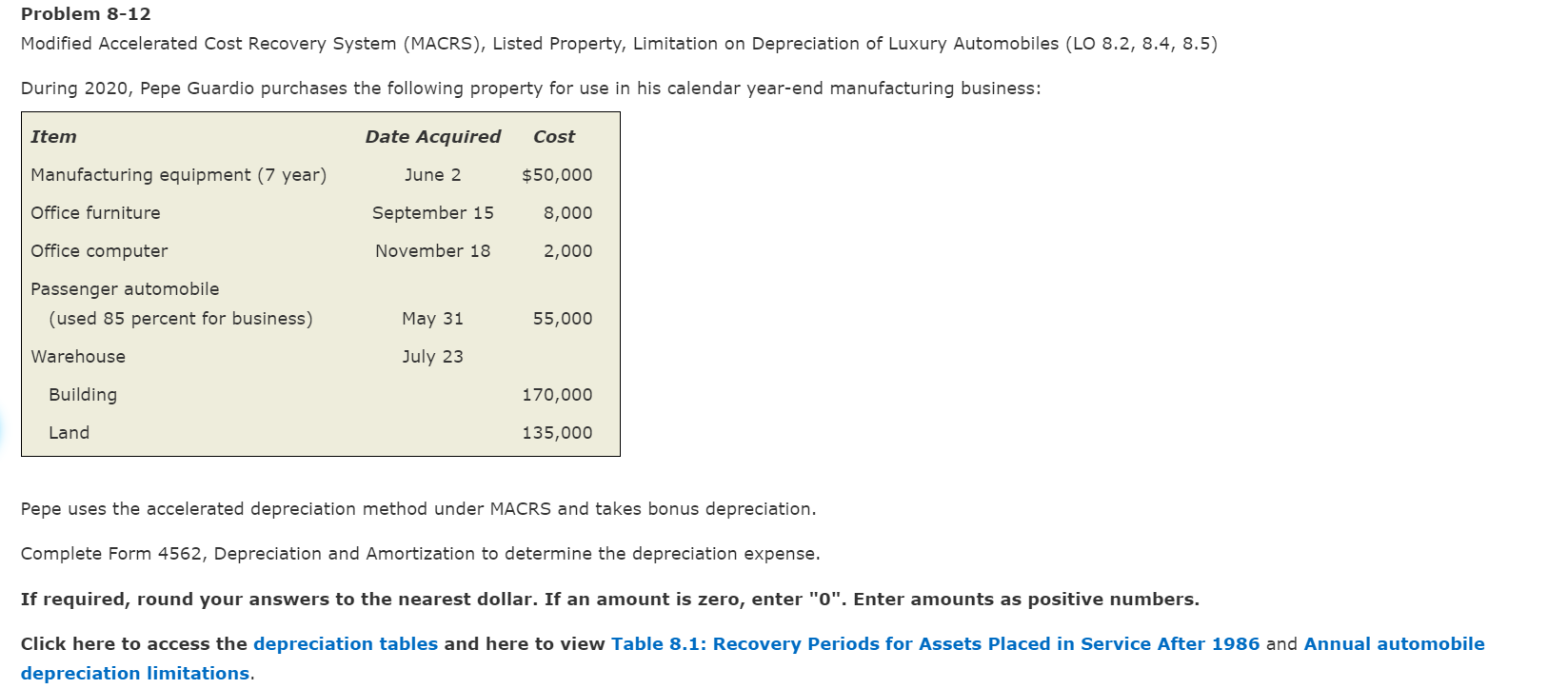

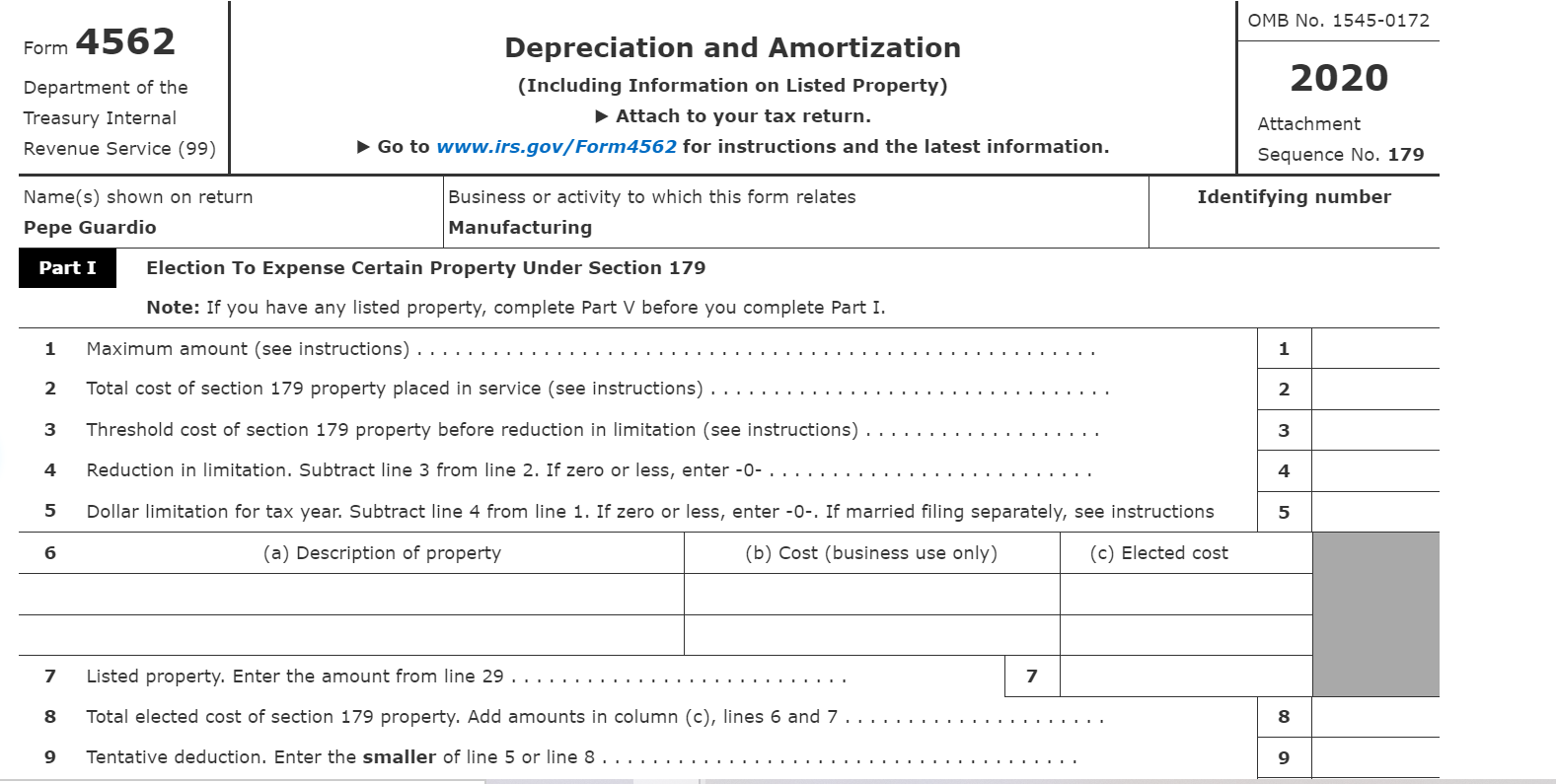

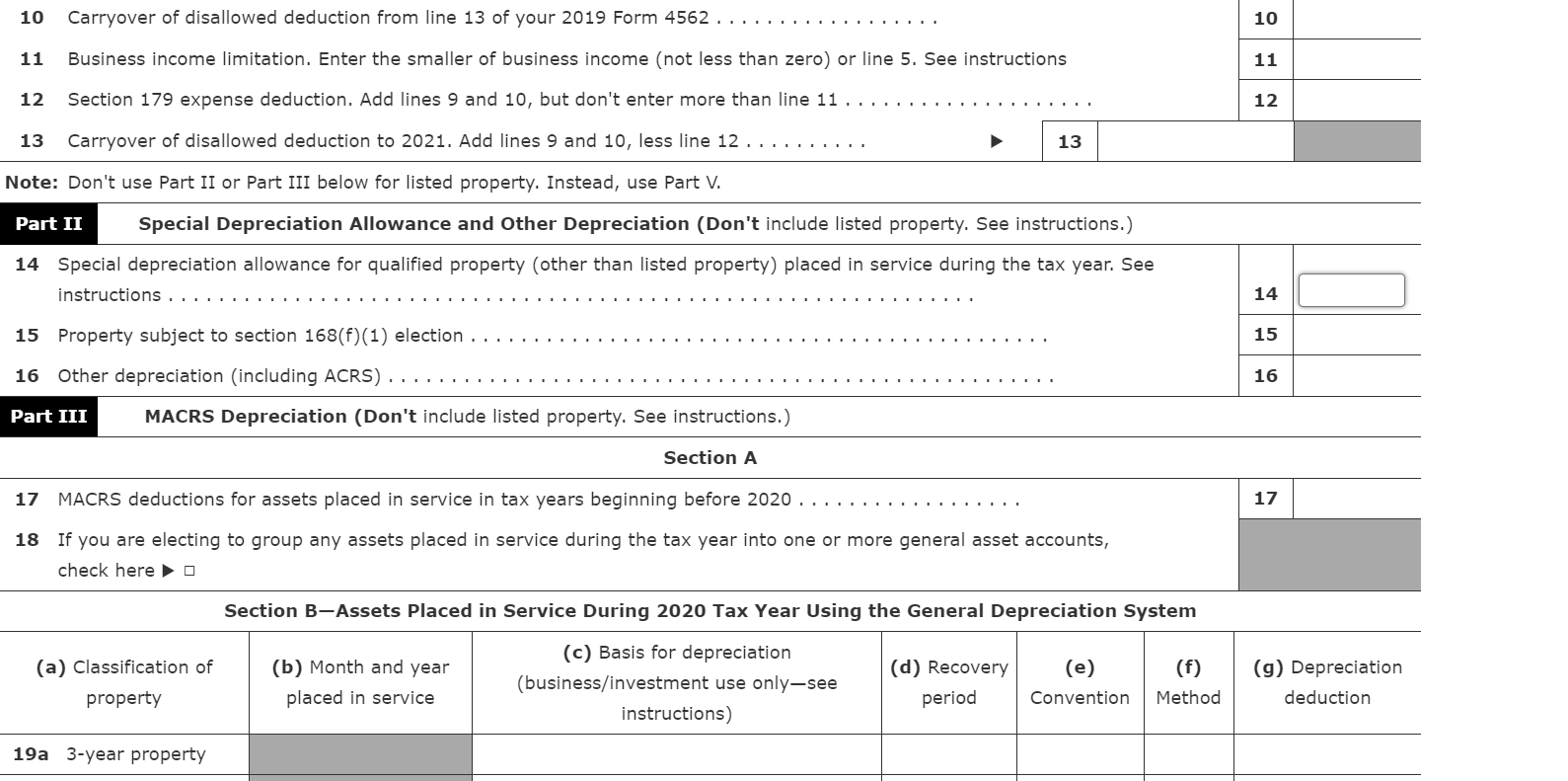

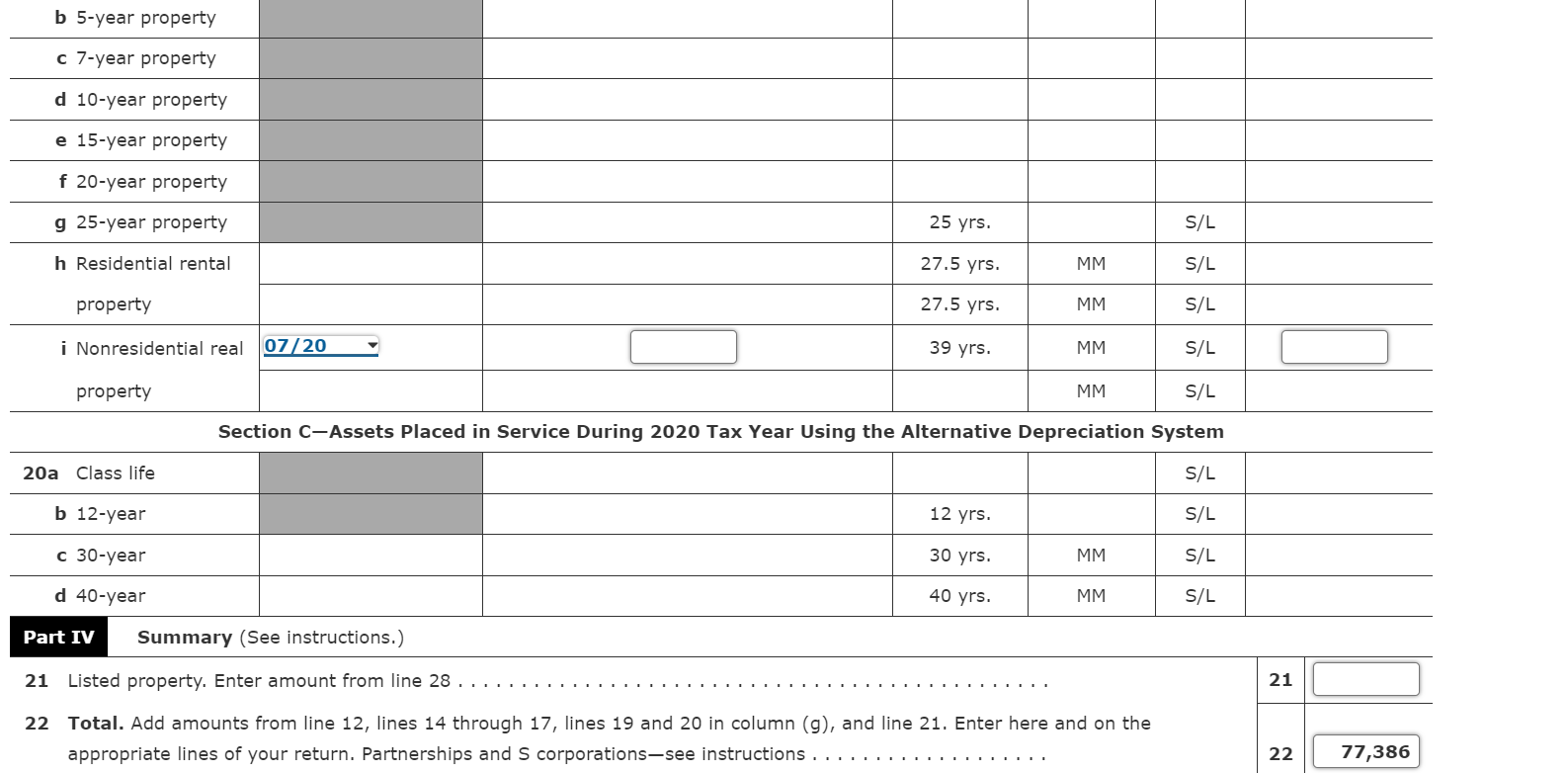

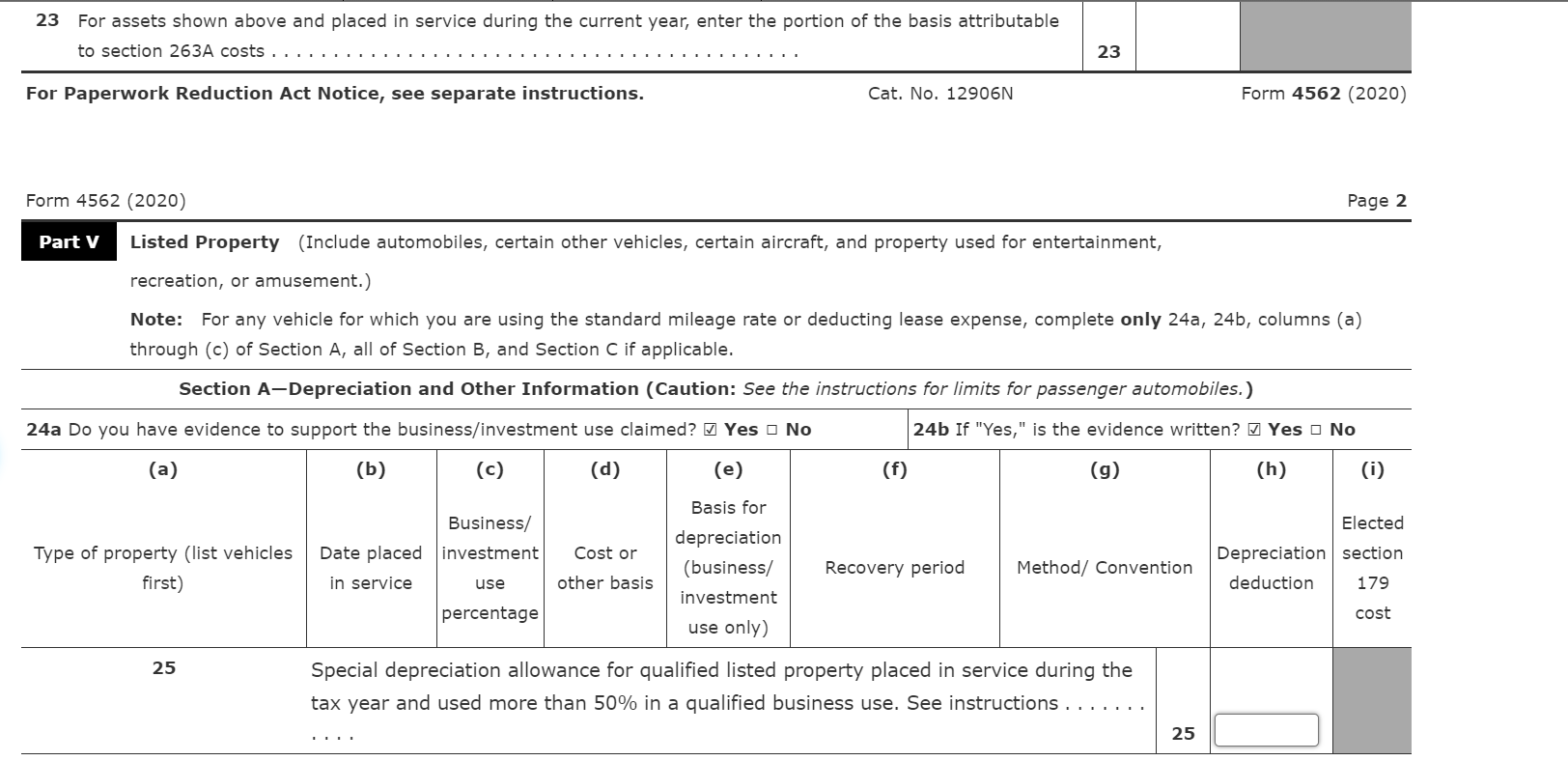

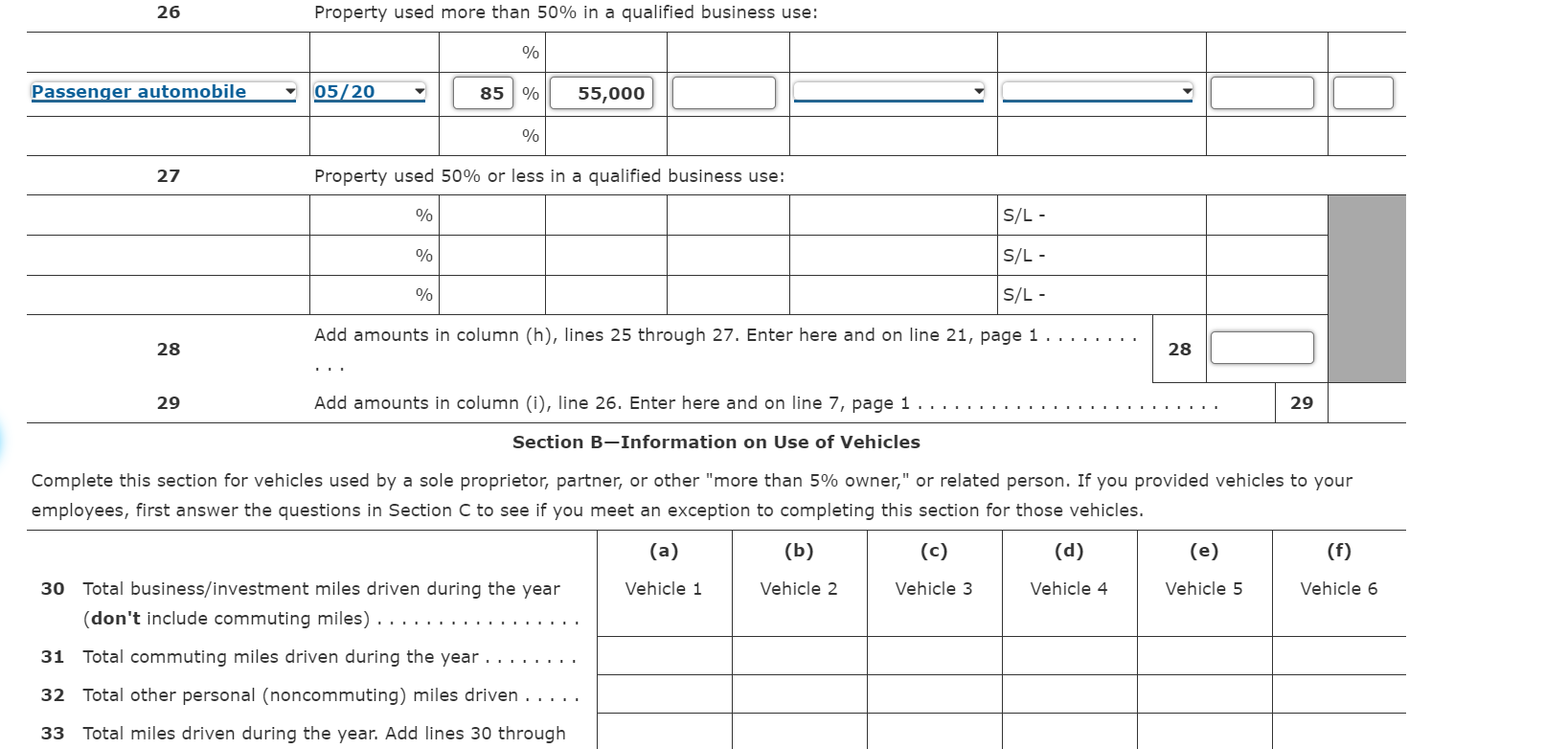

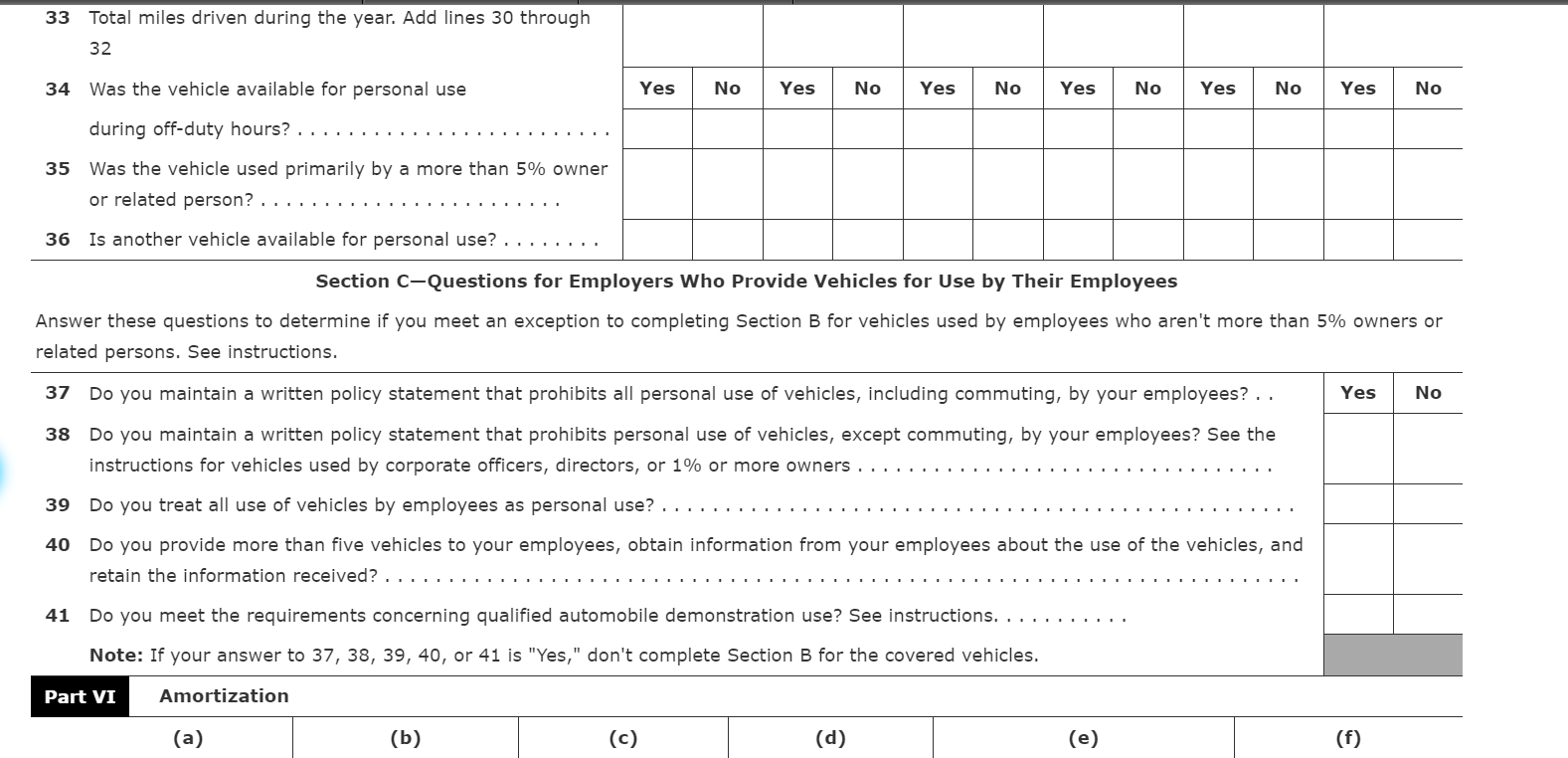

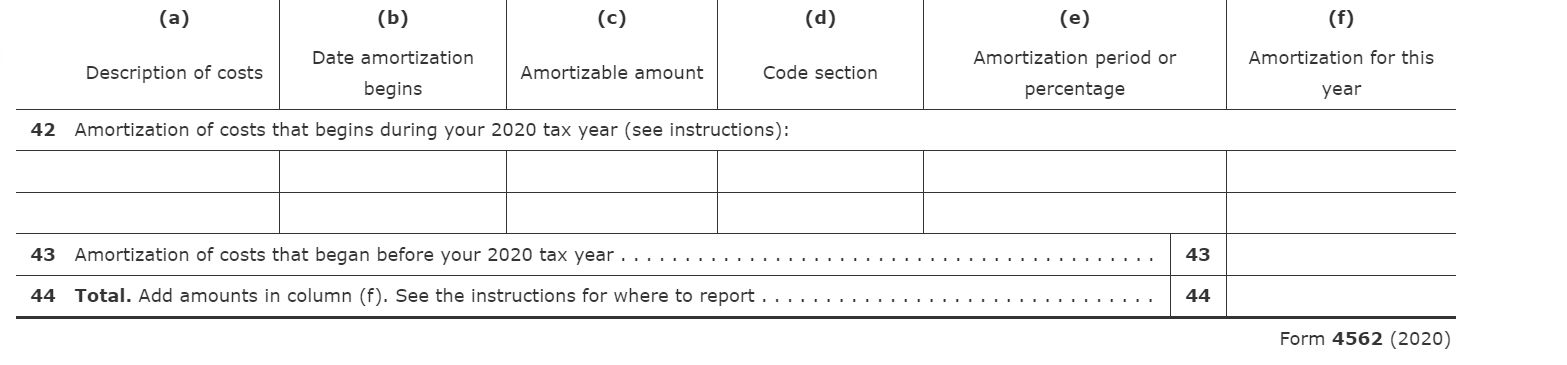

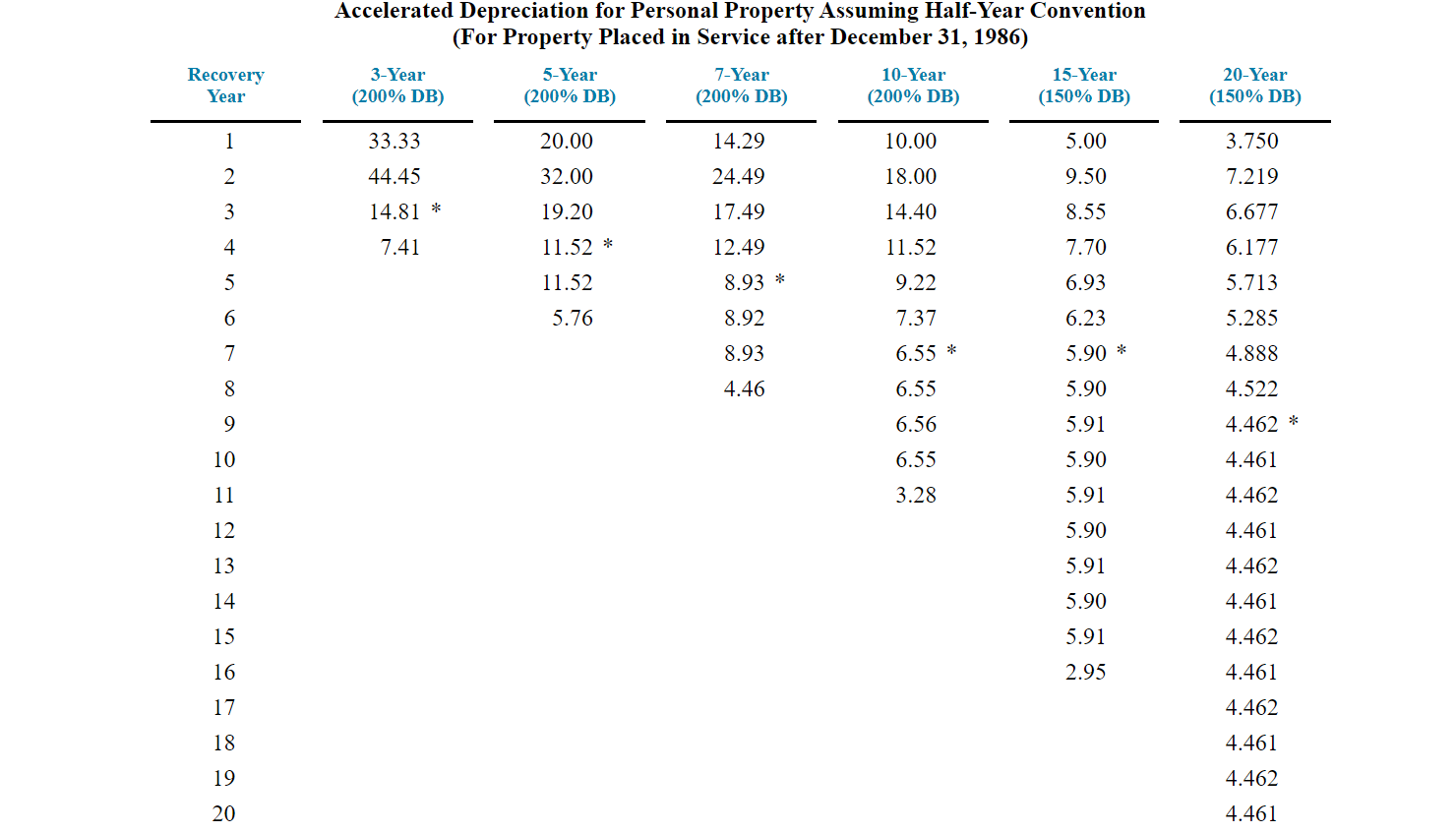

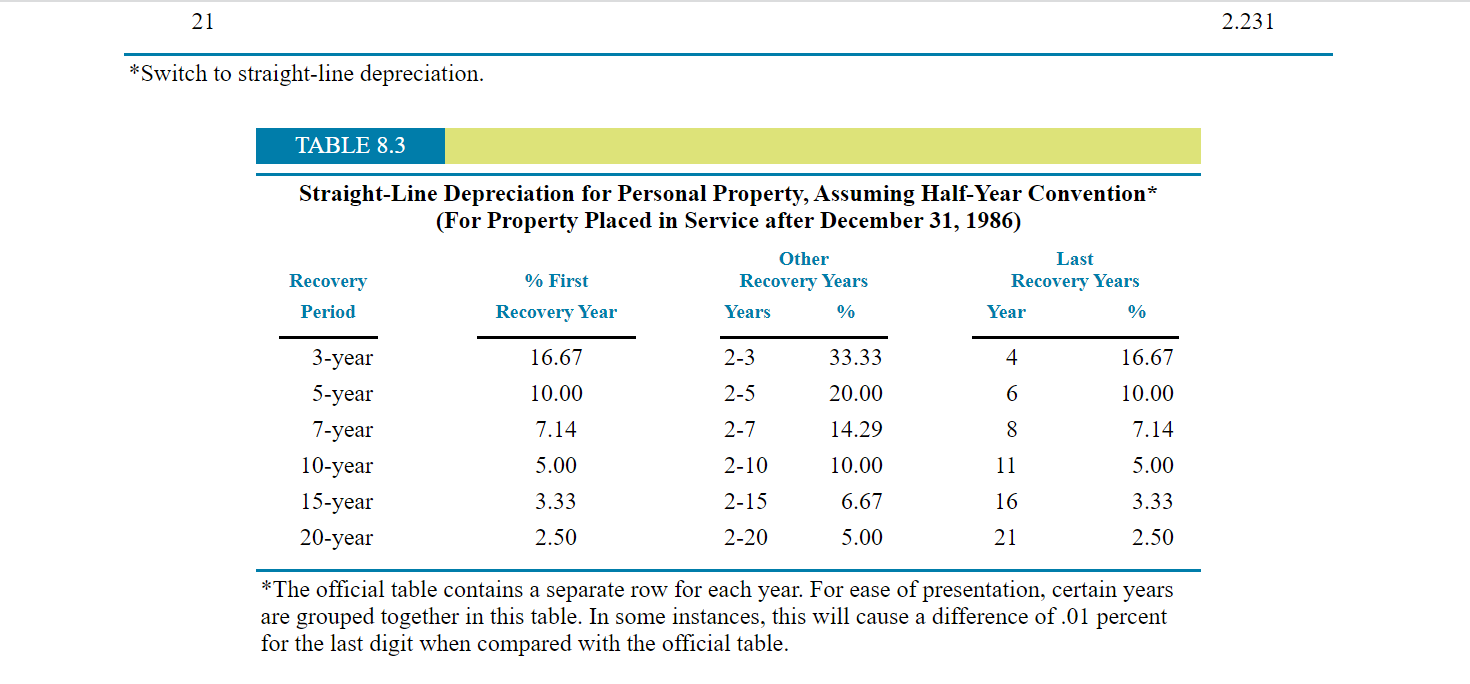

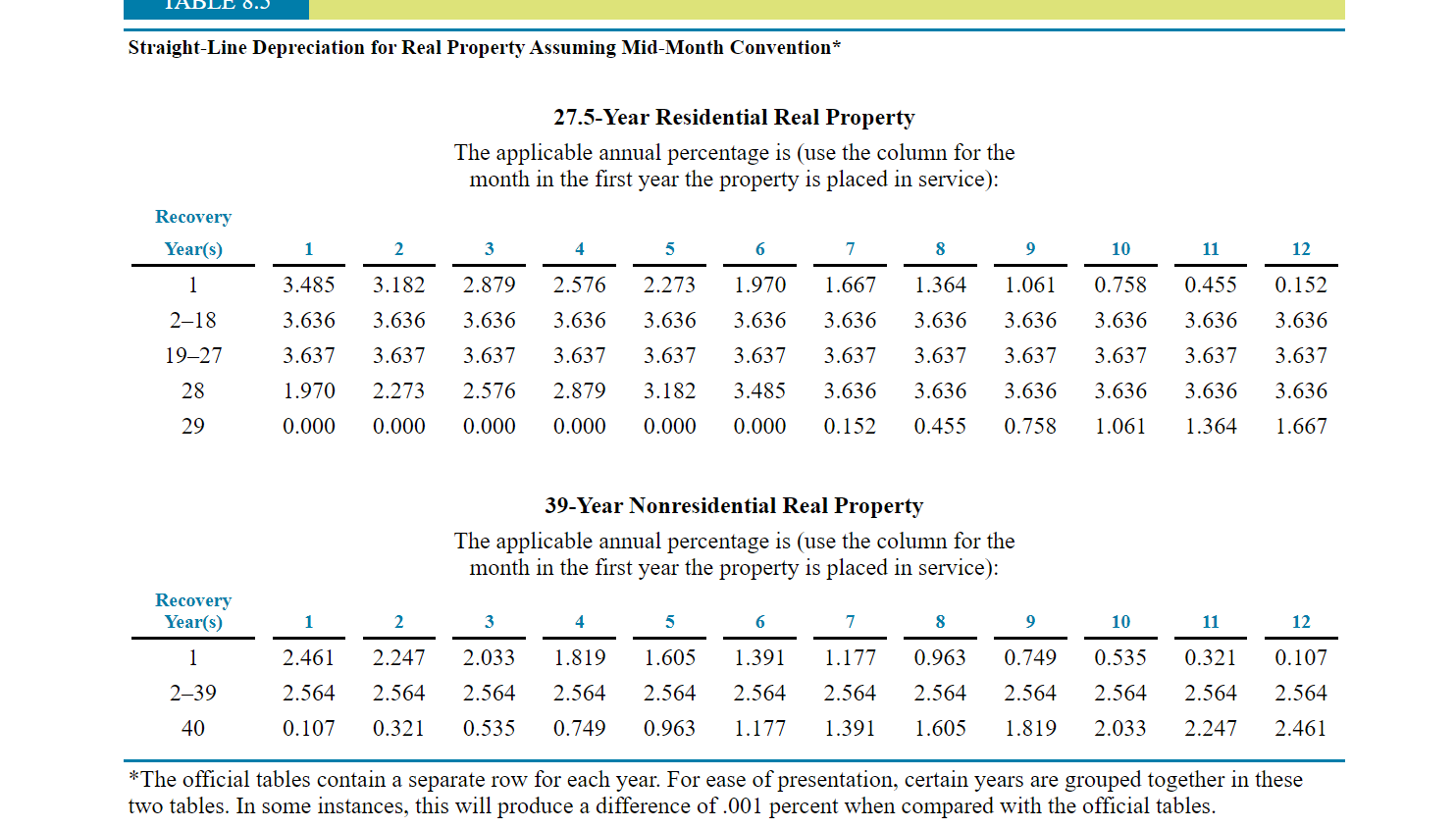

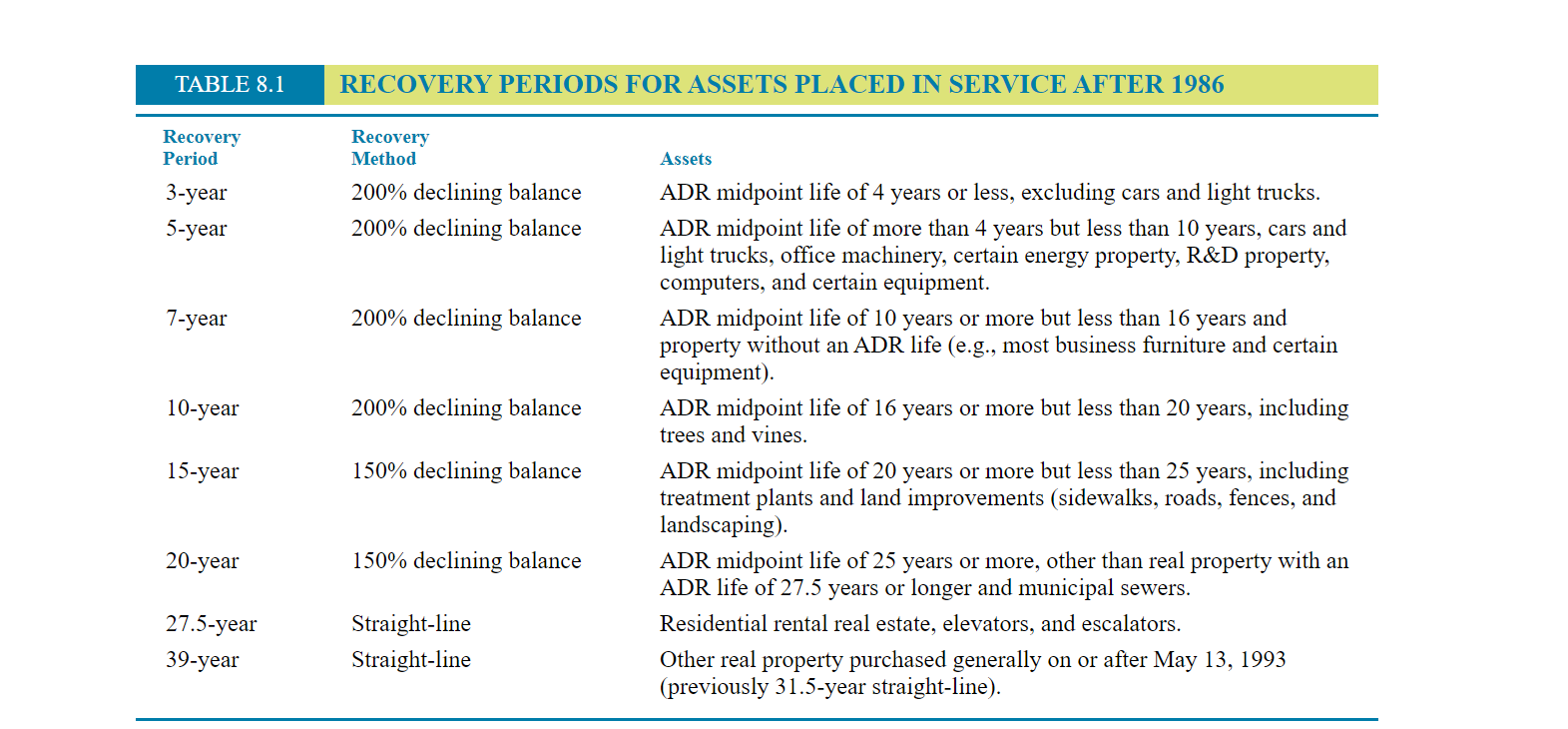

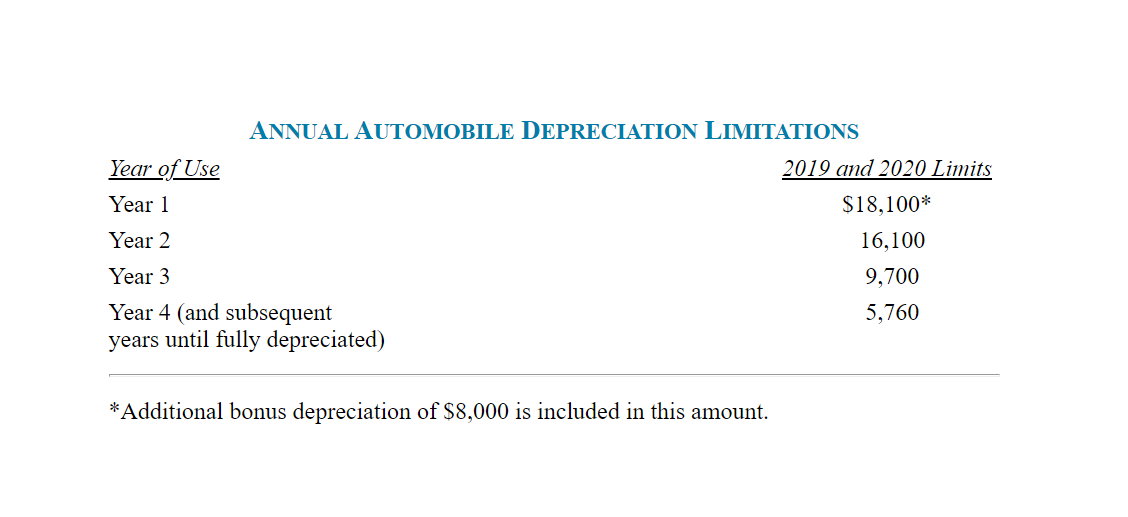

Problem 8-12 Modified Accelerated Cost Recovery System (MACRS), Listed Property, Limitation on Depreciation of Luxury Automobiles (LO 8.2, 8.4, 8.5) During 2020, Pepe Guardio purchases the following property for use in his calendar year-end manufacturing business: Item Date Acquired Cost Manufacturing equipment (7 year) June 2 $50,000 Office furniture September 15 8,000 Office computer November 18 2,000 Passenger automobile (used 85 percent for business) May 31 55,000 Warehouse July 23 Building 170,000 Land 135,000 Pepe uses the accelerated depreciation method under MACRS and takes bonus depreciation. Complete Form 4562, Depreciation and Amortization to determine the depreciation expense. If required, round your answers to the nearest dollar. If an amount is zero, enter "O". Enter amounts as positive numbers. Click here to access the depreciation tables and here to view Table 8.1: Recovery Periods for Assets Placed in Service After 1986 and Annual automobile depreciation limitations. OMB No. 1545-0172 Form 4562 2020 Department of the Treasury Internal Revenue Service (99) Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return. Go to www.irs.gov/Form4562 for instructions and the latest information. Attachment Sequence No. 179 Identifying number Name(s) shown on return Pepe Guardio Business or activity to which this form relates Manufacturing Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. 1 Maximum amount (see instructions)..... 1 2 Total cost of section 179 property placed in service (see instructions). 2 3 Threshold cost of section 179 property before reduction in limitation (see instructions) 3 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0-...... 4 5 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions 5 6 (a) Description of property (b) Cost (business use only) (C) Elected cost 7 Listed property. Enter the amount from line 29 7 8 Total elected cost of section 179 property. Add amounts in column (C), lines 6 and 7. 8 9 Tentative deduction. Enter the smaller of line 5 or line 8. 9 10 Carryover of disallowed deduction from line 13 of your 2019 Form 4562 .. 10 11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5. See instructions 11 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 12 13 Carryover of disallowed deduction to 2021. Add lines 9 and 10, less line 12.. 13 Note: Don't use Part II or Part III below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year. See instructions ...... 14 15 Property subject to section 168(f)(1) election 15 16 Other depreciation (including ACRS).. 16 Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2020. 17 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here Section B-Assets Placed in Service During 2020 Tax Year Using the General Depreciation System (a) Classification of property (b) Month and year placed in service (c) Basis for depreciation (business/investment use only-see instructions) (d) Recovery period (e) Convention (f) Method (g) Depreciation deduction 19a 3-year property b 5-year property c 7-year property d 10-year property e 15-year property f 20-year property g 25-year property 25 yrs. S/L h Residential rental 27.5 yrs. MM S/L property 27.5 yrs. MM S/L i Nonresidential real 07/20 39 yrs. MM S/L property MM S/L Section C-Assets Placed in Service During 2020 Tax Year Using the Alternative Depreciation System 20a Class life S/L b 12-year 12 yrs. S/L c 30-year 30 yrs. MM S/L d 40-year 40 yrs. MM S/L Part IV Summary (See instructions.) 21 Listed property. Enter amount from line 28 21 22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter here and on the appropriate lines of your return. Partnerships and S corporations-see instructions .. 22 77,386 23 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs. 23 For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12906N Form 4562 (2020) Form 4562 (2020) Page 2 Part V Listed Property (Include automobiles, certain other vehicles, certain aircraft, and property used for entertainment, recreation, or amusement.) Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable. Section A-Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles.) 24a Do you have evidence to support the business/investment use claimed? Yes No 24b If "Yes," is the evidence written? Yes No (a) (b) (c) (d) (e) (f) (g) (h) (0) Cost or Type of property (list vehicles first) Business/ Date placed investment in service use percentage Basis for depreciation (business/ investment use only) Elected Depreciation section deduction 179 Recovery period Method/ Convention other basis cost 25 Special depreciation allowance for qualified listed property placed in service during the tax year and used more than 50% in a qualified business use. See instructions ... 25 26 Property used more than 50% in a qualified business use: % Passenger automobile 05/20 85 % 55,000 % 27 Property used 50% or less in a qualified business use: % S/L- % S/L- % S/L - Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 1 28 28 29 Add amounts column (i), line 26. Enter here and on line 7, page 1 29 Section B-Information on Use of Vehicles Complete this section for vehicles used by a sole proprietor, partner, or other "more than 5% owner," or related person. If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles. (a) (b) (c) (d) (e) (f) Vehicle 1 Vehicle 2 Vehicle 3 Vehicle 4 Vehicle 5 Vehicle 6 30 Total business/investment miles driven during the year (don't include commuting miles). 31 Total commuting miles driven during the year .. 32 Total other personal (noncommuting) miles driven .... 33 Total miles driven during the year. Add lines 30 through 33 Total miles driven during the year. Add lines 30 through 32 34 Was the vehicle available for personal use Yes No Yes No Yes No Yes No Yes No Yes No during off-duty hours? .. 35 Was the vehicle used primarily by a more than 5% owner or related person? ... 36 Is another vehicle available for personal use? ........ Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who aren't more than 5% owners or related persons. See instructions. 37 Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, by your employees? .. Yes No 38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your employees? See the instructions for vehicles used by corporate officers, directors, or 1% or more owners . . 39 40 Do you treat all use of vehicles by employees as personal use? . Do you provide more than five vehicles to your employees, obtain information from your employees about the use of the vehicles, and retain the information received? 41 Do you meet the requirements concerning qualified automobile demonstration use? See instructions. . Note: If your answer to 37, 38, 39, 40, or 41 is "Yes," don't complete Section B for the covered vehicles. Part VI Amortization (a) (b) (C) (d) (e) (f) (a) (b) (c) (d) (d) (e) (f) Amortization for this Description of costs Date amortization begins Amortizable amount Code section Amortization period or percentage year 42 Amortization of costs that begins during your 2020 tax year (see instructions): 43 Amortization of costs that began before your 2020 tax year. 43 44 Total. Add amounts in column (f). See the instructions for where to report. 44 Form 4562 (2020) Accelerated Depreciation for Personal Property Assuming Half-Year Convention (For Property Placed in Service after December 31, 1986) Recovery Year 3-Year (200% DB) 5-Year (200% DB) 7-Year (200% DB) 10-Year (200% DB) 15-Year (150% DB) 20-Year (150% DB) 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 24.49 18.00 9.50 7.219 32.00 19.20 3 14.81 * 17.49 14.40 8.55 6.677 4 7.41 11.52 * 12.49 11.52 7.70 6.177 5 8.93 * 9.22 6.93 5.713 11.52 5.76 6 8.92 7.37 6.23 5.285 7 8.93 6.55 * 5.90 * 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462 * 10 6.55 5.90 4.461 11 3.28 5.91 4.462 4.461 12 5.90 13 5.91 4.462 4.461 14 5.90 15 5.91 4.462 4.461 16 2.95 17 4.462 4.461 18 19 4.462 20 4.461 21 2.231 *Switch to straight-line depreciation. TABLE 8.3 Straight-Line Depreciation for Personal Property, Assuming Half-Year Convention* (For Property Placed in Service after December 31, 1986) Recovery Period % First Recovery Year Other Recovery Years Years % Last Recovery Years Year % 16.67 2-3 33.33 4 16.67 10.00 10.00 2-5 20.00 6 7.14 2-7 14.29 8 7.14 3-year 5-year 7-year 10-year 15-year 20-year 5.00 2-10 10.00 11 5.00 3.33 2-15 6.67 16 3.33 2.50 2-20 5.00 21 2.50 *The official table contains a separate row for each year. For ease of presentation, certain years are grouped together in this table. In some instances, this will cause a difference of .01 percent for the last digit when compared with the official table. TADLL 0. Straight-Line Depreciation for Real Property Assuming Mid-Month Convention* 27.5-Year Residential Real Property The applicable annual percentage is (use the column for the month in the first year the property is placed in service): Recovery Year(s) 1 2 3 4 5 6 7 8 9 10 11 12 1 3.485 3.182 2.879 2.273 1.970 1.667 1.364 1.061 0.758 0.455 0.152 2.576 3.636 218 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.637 19-27 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 28 1.970 2.273 2.576 2.879 3.182 3.485 3.636 3.636 3.636 3.636 3.636 3.636 29 0.000 0.000 0.000 0.000 0.000 0.000 0.152 0.455 0.758 1.061 1.364 1.667 39-Year Nonresidential Real Property The applicable annual percentage is (use the column for the month in the first year the property is placed in service): Recovery Year(s) 1 2 3 4 5 6 7 8 9 10 11 12 1 2.461 2.247 2.033 1.819 1.391 1.177 0.963 0.749 0.535 0.321 0.107 1.605 2.564 2-39 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 40 0.107 0.321 0.535 0.749 0.963 1.177 1.391 1.605 1.819 2.033 2.247 2.461 *The official tables contain a separate row for each year. For ease of presentation, certain years are grouped together in these two tables. In some instances, this will produce a difference of .001 percent when compared with the official tables. TABLE 8.1 RECOVERY PERIODS FOR ASSETS PLACED IN SERVICE AFTER 1986 Recovery Period Recovery Method Assets 3-year 5-year 200% declining balance 200% declining balance 7-year 200% declining balance 10-year 200% declining balance ADR midpoint life of 4 years or less, excluding cars and light trucks. ADR midpoint life of more than 4 years but less than 10 years, cars and light trucks, office machinery, certain energy property, R&D property, computers, and certain equipment. ADR midpoint life of 10 years or more but less than 16 years and property without an ADR life (e.g., most business furniture and certain equipment). ADR midpoint life of 16 years or more but less than 20 years, including trees and vines. ADR midpoint life of 20 years or more but less than 25 years, including treatment plants and land improvements (sidewalks, roads, fences, and landscaping). ADR midpoint life of 25 years or more, other than real property with an ADR life of 27.5 years or longer and municipal sewers. Residential rental real estate, elevators, and escalators. Other real property purchased generally on or after May 13, 1993 (previously 31.5-year straight-line). 15-year 150% declining balance 20-year 150% declining balance 27.5-year 39-year Straight-line Straight-line ANNUAL AUTOMOBILE DEPRECIATION LIMITATIONS Year of Use 2019 and 2020 Limits Year 1 $18,100* Year 2 16,100 Year 3 9,700 Year 4 (and subsequent 5,760 years until fully depreciated) *Additional bonus depreciation of $8,000 is included in this amount. Problem 8-12 Modified Accelerated Cost Recovery System (MACRS), Listed Property, Limitation on Depreciation of Luxury Automobiles (LO 8.2, 8.4, 8.5) During 2020, Pepe Guardio purchases the following property for use in his calendar year-end manufacturing business: Item Date Acquired Cost Manufacturing equipment (7 year) June 2 $50,000 Office furniture September 15 8,000 Office computer November 18 2,000 Passenger automobile (used 85 percent for business) May 31 55,000 Warehouse July 23 Building 170,000 Land 135,000 Pepe uses the accelerated depreciation method under MACRS and takes bonus depreciation. Complete Form 4562, Depreciation and Amortization to determine the depreciation expense. If required, round your answers to the nearest dollar. If an amount is zero, enter "O". Enter amounts as positive numbers. Click here to access the depreciation tables and here to view Table 8.1: Recovery Periods for Assets Placed in Service After 1986 and Annual automobile depreciation limitations. OMB No. 1545-0172 Form 4562 2020 Department of the Treasury Internal Revenue Service (99) Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return. Go to www.irs.gov/Form4562 for instructions and the latest information. Attachment Sequence No. 179 Identifying number Name(s) shown on return Pepe Guardio Business or activity to which this form relates Manufacturing Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. 1 Maximum amount (see instructions)..... 1 2 Total cost of section 179 property placed in service (see instructions). 2 3 Threshold cost of section 179 property before reduction in limitation (see instructions) 3 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0-...... 4 5 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions 5 6 (a) Description of property (b) Cost (business use only) (C) Elected cost 7 Listed property. Enter the amount from line 29 7 8 Total elected cost of section 179 property. Add amounts in column (C), lines 6 and 7. 8 9 Tentative deduction. Enter the smaller of line 5 or line 8. 9 10 Carryover of disallowed deduction from line 13 of your 2019 Form 4562 .. 10 11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5. See instructions 11 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 12 13 Carryover of disallowed deduction to 2021. Add lines 9 and 10, less line 12.. 13 Note: Don't use Part II or Part III below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property (other than listed property) placed in service during the tax year. See instructions ...... 14 15 Property subject to section 168(f)(1) election 15 16 Other depreciation (including ACRS).. 16 Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2020. 17 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here Section B-Assets Placed in Service During 2020 Tax Year Using the General Depreciation System (a) Classification of property (b) Month and year placed in service (c) Basis for depreciation (business/investment use only-see instructions) (d) Recovery period (e) Convention (f) Method (g) Depreciation deduction 19a 3-year property b 5-year property c 7-year property d 10-year property e 15-year property f 20-year property g 25-year property 25 yrs. S/L h Residential rental 27.5 yrs. MM S/L property 27.5 yrs. MM S/L i Nonresidential real 07/20 39 yrs. MM S/L property MM S/L Section C-Assets Placed in Service During 2020 Tax Year Using the Alternative Depreciation System 20a Class life S/L b 12-year 12 yrs. S/L c 30-year 30 yrs. MM S/L d 40-year 40 yrs. MM S/L Part IV Summary (See instructions.) 21 Listed property. Enter amount from line 28 21 22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter here and on the appropriate lines of your return. Partnerships and S corporations-see instructions .. 22 77,386 23 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 263A costs. 23 For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12906N Form 4562 (2020) Form 4562 (2020) Page 2 Part V Listed Property (Include automobiles, certain other vehicles, certain aircraft, and property used for entertainment, recreation, or amusement.) Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a, 24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable. Section A-Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles.) 24a Do you have evidence to support the business/investment use claimed? Yes No 24b If "Yes," is the evidence written? Yes No (a) (b) (c) (d) (e) (f) (g) (h) (0) Cost or Type of property (list vehicles first) Business/ Date placed investment in service use percentage Basis for depreciation (business/ investment use only) Elected Depreciation section deduction 179 Recovery period Method/ Convention other basis cost 25 Special depreciation allowance for qualified listed property placed in service during the tax year and used more than 50% in a qualified business use. See instructions ... 25 26 Property used more than 50% in a qualified business use: % Passenger automobile 05/20 85 % 55,000 % 27 Property used 50% or less in a qualified business use: % S/L- % S/L- % S/L - Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 1 28 28 29 Add amounts column (i), line 26. Enter here and on line 7, page 1 29 Section B-Information on Use of Vehicles Complete this section for vehicles used by a sole proprietor, partner, or other "more than 5% owner," or related person. If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles. (a) (b) (c) (d) (e) (f) Vehicle 1 Vehicle 2 Vehicle 3 Vehicle 4 Vehicle 5 Vehicle 6 30 Total business/investment miles driven during the year (don't include commuting miles). 31 Total commuting miles driven during the year .. 32 Total other personal (noncommuting) miles driven .... 33 Total miles driven during the year. Add lines 30 through 33 Total miles driven during the year. Add lines 30 through 32 34 Was the vehicle available for personal use Yes No Yes No Yes No Yes No Yes No Yes No during off-duty hours? .. 35 Was the vehicle used primarily by a more than 5% owner or related person? ... 36 Is another vehicle available for personal use? ........ Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who aren't more than 5% owners or related persons. See instructions. 37 Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, by your employees? .. Yes No 38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your employees? See the instructions for vehicles used by corporate officers, directors, or 1% or more owners . . 39 40 Do you treat all use of vehicles by employees as personal use? . Do you provide more than five vehicles to your employees, obtain information from your employees about the use of the vehicles, and retain the information received? 41 Do you meet the requirements concerning qualified automobile demonstration use? See instructions. . Note: If your answer to 37, 38, 39, 40, or 41 is "Yes," don't complete Section B for the covered vehicles. Part VI Amortization (a) (b) (C) (d) (e) (f) (a) (b) (c) (d) (d) (e) (f) Amortization for this Description of costs Date amortization begins Amortizable amount Code section Amortization period or percentage year 42 Amortization of costs that begins during your 2020 tax year (see instructions): 43 Amortization of costs that began before your 2020 tax year. 43 44 Total. Add amounts in column (f). See the instructions for where to report. 44 Form 4562 (2020) Accelerated Depreciation for Personal Property Assuming Half-Year Convention (For Property Placed in Service after December 31, 1986) Recovery Year 3-Year (200% DB) 5-Year (200% DB) 7-Year (200% DB) 10-Year (200% DB) 15-Year (150% DB) 20-Year (150% DB) 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 24.49 18.00 9.50 7.219 32.00 19.20 3 14.81 * 17.49 14.40 8.55 6.677 4 7.41 11.52 * 12.49 11.52 7.70 6.177 5 8.93 * 9.22 6.93 5.713 11.52 5.76 6 8.92 7.37 6.23 5.285 7 8.93 6.55 * 5.90 * 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462 * 10 6.55 5.90 4.461 11 3.28 5.91 4.462 4.461 12 5.90 13 5.91 4.462 4.461 14 5.90 15 5.91 4.462 4.461 16 2.95 17 4.462 4.461 18 19 4.462 20 4.461 21 2.231 *Switch to straight-line depreciation. TABLE 8.3 Straight-Line Depreciation for Personal Property, Assuming Half-Year Convention* (For Property Placed in Service after December 31, 1986) Recovery Period % First Recovery Year Other Recovery Years Years % Last Recovery Years Year % 16.67 2-3 33.33 4 16.67 10.00 10.00 2-5 20.00 6 7.14 2-7 14.29 8 7.14 3-year 5-year 7-year 10-year 15-year 20-year 5.00 2-10 10.00 11 5.00 3.33 2-15 6.67 16 3.33 2.50 2-20 5.00 21 2.50 *The official table contains a separate row for each year. For ease of presentation, certain years are grouped together in this table. In some instances, this will cause a difference of .01 percent for the last digit when compared with the official table. TADLL 0. Straight-Line Depreciation for Real Property Assuming Mid-Month Convention* 27.5-Year Residential Real Property The applicable annual percentage is (use the column for the month in the first year the property is placed in service): Recovery Year(s) 1 2 3 4 5 6 7 8 9 10 11 12 1 3.485 3.182 2.879 2.273 1.970 1.667 1.364 1.061 0.758 0.455 0.152 2.576 3.636 218 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.637 19-27 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 28 1.970 2.273 2.576 2.879 3.182 3.485 3.636 3.636 3.636 3.636 3.636 3.636 29 0.000 0.000 0.000 0.000 0.000 0.000 0.152 0.455 0.758 1.061 1.364 1.667 39-Year Nonresidential Real Property The applicable annual percentage is (use the column for the month in the first year the property is placed in service): Recovery Year(s) 1 2 3 4 5 6 7 8 9 10 11 12 1 2.461 2.247 2.033 1.819 1.391 1.177 0.963 0.749 0.535 0.321 0.107 1.605 2.564 2-39 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 40 0.107 0.321 0.535 0.749 0.963 1.177 1.391 1.605 1.819 2.033 2.247 2.461 *The official tables contain a separate row for each year. For ease of presentation, certain years are grouped together in these two tables. In some instances, this will produce a difference of .001 percent when compared with the official tables. TABLE 8.1 RECOVERY PERIODS FOR ASSETS PLACED IN SERVICE AFTER 1986 Recovery Period Recovery Method Assets 3-year 5-year 200% declining balance 200% declining balance 7-year 200% declining balance 10-year 200% declining balance ADR midpoint life of 4 years or less, excluding cars and light trucks. ADR midpoint life of more than 4 years but less than 10 years, cars and light trucks, office machinery, certain energy property, R&D property, computers, and certain equipment. ADR midpoint life of 10 years or more but less than 16 years and property without an ADR life (e.g., most business furniture and certain equipment). ADR midpoint life of 16 years or more but less than 20 years, including trees and vines. ADR midpoint life of 20 years or more but less than 25 years, including treatment plants and land improvements (sidewalks, roads, fences, and landscaping). ADR midpoint life of 25 years or more, other than real property with an ADR life of 27.5 years or longer and municipal sewers. Residential rental real estate, elevators, and escalators. Other real property purchased generally on or after May 13, 1993 (previously 31.5-year straight-line). 15-year 150% declining balance 20-year 150% declining balance 27.5-year 39-year Straight-line Straight-line ANNUAL AUTOMOBILE DEPRECIATION LIMITATIONS Year of Use 2019 and 2020 Limits Year 1 $18,100* Year 2 16,100 Year 3 9,700 Year 4 (and subsequent 5,760 years until fully depreciated) *Additional bonus depreciation of $8,000 is included in this amount