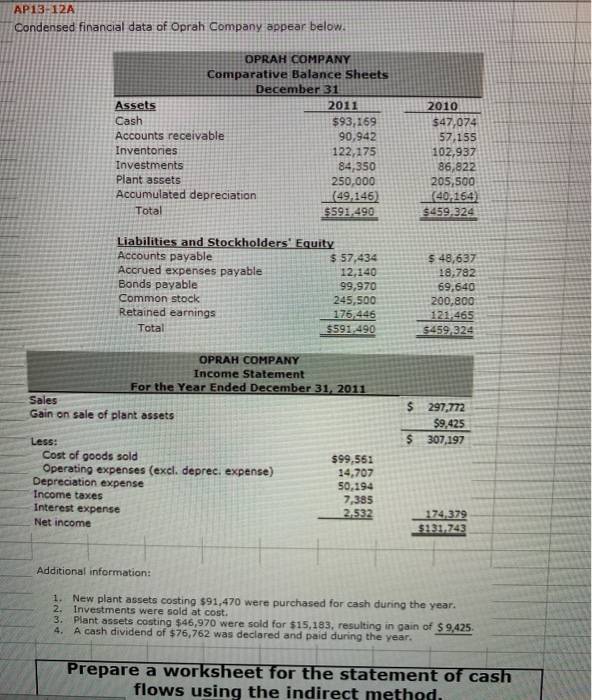

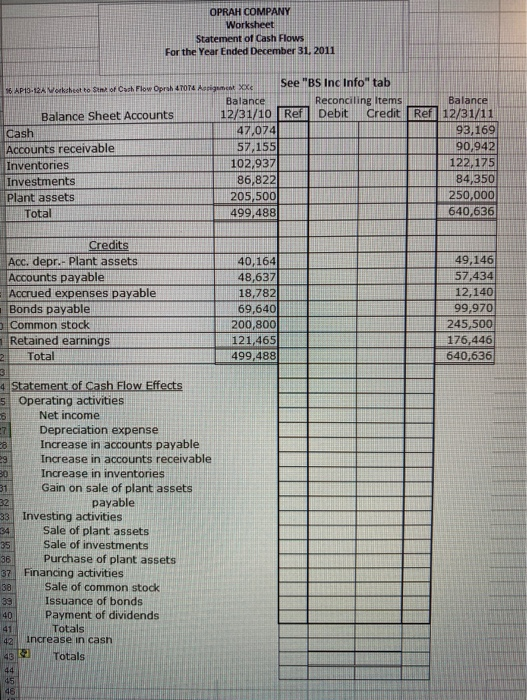

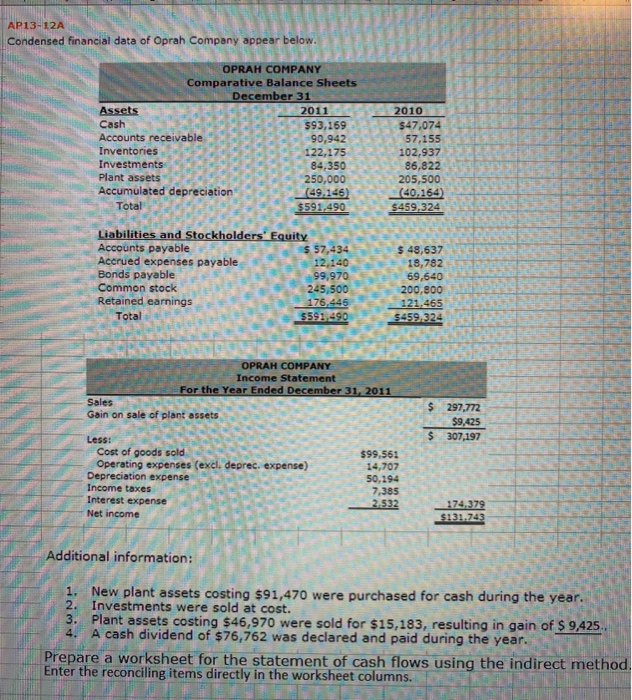

AP13-12A Condensed financial data of Oprah Company appear below. 2010 OPRAH COMPANY Comparative Balance Sheets December 31 Assets 2011 Cash $93,169 Accounts receivable 90,942 Inventories 122,175 Investments 84,350 Plant assets 250,000 Accumulated depreciation (49,146) Total $591,490 $47,074 57,155 102,937 86,822 205,500 (40,164) $459.324 Liabilities and Stockholders' Equity Accounts payable $ 57,434 Accrued expenses payable 12,140 Bonds payable 99,970 Common stock 245,500 Retained earnings 176,446 Total $591,490 $ 48,637 18,782 69,640 200,800 121.465 $459,324 OPRAH COMPANY Income Statement For the Year Ended December 31, 2011 Sales Gain on sale of plant assets $ 297,772 $9,425 307,197 $ Less: Cost of goods sold Operating expenses (excl. deprec. expense) Depreciation expense Income taxes Interest expense Net income $99,561 14,707 50,194 7,385 2,532 174.379 $131,743 Additional information: 1. New plant assets costing $91,470 were purchased for cash during the year. 2. Investments were sold at cost. 3. Plant assets costing $46,970 were sold for $15,183, resulting in gain of $ 9,425 4. A cash dividend of $76,762 was declared and paid during the year. Prepare a worksheet for the statement of cash flows using the indirect method. OPRAH COMPANY Worksheet Statement of Cash Flows For the Year Ended December 31, 2011 16 AP15-12 Vol to Sint of Cush Flow Oprah 4 TOTA Aerig See "BS Inc Info tab Balance Reconciling Items Balance Balance Sheet Accounts 12/31/10 Refl Debit Credit Refill 12/31/11 Cash 47,074 93,169 Accounts receivable 57,155 90,942 Inventories 102,9371 122,175 Investments 86,822 84.350 Plant assets 205,500 250,000 Total 499,488 640,636 Credits Acc. depr.- Plant assets Accounts payable Accrued expenses payable Bonds payable Common stock Retained earnings Total 40,1641 48,6371 18,782 69,6401 200,800 121,4651 499,488 49,146 57,434 12,140 99,970 245,500 176,446 640,636 2 4 Statement of Cash Flow Effects 5 Operating activities Net income Depreciation expense Increase in accounts payable Increase in accounts receivable Increase in inventories Gain on sale of plant assets 32 payable 33 Investing activities Sale of plant assets Sale of investments 36 Purchase of plant assets 37 Financing activities Sale of common stock Issuance of bonds 40 Payment of dividends Totals 42 increase in cash 432 Totals 38 45 AP13 AP13-12A Condensed financial data of Oprah Company appear below. Assets OPRAH COMPANY Comparative Balance Sheets December 31 2011 Cash 593,169 Accounts receivable 90,942 Inventories 122,175 Investments 84,350 Plant assets 250,000 Accumulated depreciation 49.146) Total $591,490 2010 5 47,074 5 7,155 102,937 102.93 8 6,822 205,500 (40.164) $459,324 Liabilities and Stockholders' Equity Accounts payable $ 57,434 Accrued expenses payable Bonds payable yable Common stock 2 $ 48,637EE $ 48,637 18,782 59,640 200,800 121.465 5459.324 45,500 176.445 Retained earnings Total 5593,490 OPRAH COMPANY Income Statement For the Year Ended December 31, 2011 Sales Gain on sale of plant assets 297,772 $9,425 307,197 Less: $ Cost of goods sold Operating expenses (excl. deprec. expense) Depreciation expense Income taxes Interest expense Net income $99,561 14,707 50.194 7.385 Additional information: 1. New plant assets costing $91,470 were purchased for cash during the year. 2. Investments were sold at cost. 3. Plant assets costing $46,970 were sold for $15,183, resulting in gain of $ 9,425.. 4. A cash dividend of $76,762 was declared and paid during the year. Prepare a worksheet for the statement of cash flows using the indirect method Enter the reconciling items directly in the worksheet columns