Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AP3-5 Analyzing the Effects of Transactions by Using T-Accounts, Preparing Financial Statements, and Evaluating the Total Asset Turnover Ratio and the Return on Assets I

AP3-5 Analyzing the Effects of Transactions by Using T-Accounts, Preparing Financial Statements, and Evaluating the Total Asset Turnover Ratio and the Return on Assets

I need the answers for Questions 1 to 4.

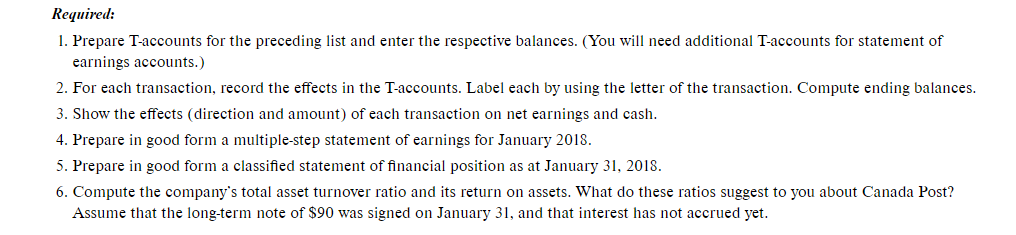

AP3-5 Analyzing the Effects of Transactions by Using T-Accounts, Preparing Financial Statements, and Evaluating the Total Asset Turnover Ratio and the Return on Assets ( P3-5) LO3-4, 3-5, 3-6 Canada Post The following are several account balances (in millions of dollars) from the 2017 annual report of Canada Post Corporation, followed by several typical transactions. The corporation's vision is described in the annual report as follows: Canada Post will be a world leader in providing innovative physical and electronic delivery solutions, creating value for our customers, employees, and all Canadians. These accounts have normal debit or credit balances, except for equity, which has a debit balance. The following hypothetical transactions (in millions of dollars) occurred the next month (from January 1, 2018 to January 31, 2018): a. Provided delivery service to customers, receiving $564 in accounts receivable and $60 in cash. b. Purchased new equipment costing $540; signed a long-term note. c. Paid $74 in cash to rent equipment, with $64 for rental this month and the rest for rent for the first few days in February. d. Spent $396 in cash to maintain and repair facilities and equipment during the month. e. Collected $675 from customers on account. f. Borrowed $90 by signing a long-term note (ignore interest). g. Paid employees $279 earned during the month. h. Purchased for cash and used $49 in supplies. i. Paid $184 on accounts payable. j. Ordered $72 in spare parts and supplies. 1. Prepare T-accounts for the preceding list and enter the respective balances. (You will need additional T-accounts for statement of earnings accounts.) 2. For each transaction, record the effects in the T-accounts. Label each by using the letter of the transaction. Compute ending balances. 3. Show the effects (direction and amount) of each transaction on net earnings and cash. 4. Prepare in good form a multiple-step statement of earnings for January 2018. 5. Prepare in good form a classified statement of financial position as at January 31, 2018. 6. Compute the company's total asset turnover ratio and its return on assets. What do these ratios suggest to you about Canada Post? Assume that the long-term note of $90 was signed on January 31 , and that interest has not accrued yet. AP3-5 Analyzing the Effects of Transactions by Using T-Accounts, Preparing Financial Statements, and Evaluating the Total Asset Turnover Ratio and the Return on Assets ( P3-5) LO3-4, 3-5, 3-6 Canada Post The following are several account balances (in millions of dollars) from the 2017 annual report of Canada Post Corporation, followed by several typical transactions. The corporation's vision is described in the annual report as follows: Canada Post will be a world leader in providing innovative physical and electronic delivery solutions, creating value for our customers, employees, and all Canadians. These accounts have normal debit or credit balances, except for equity, which has a debit balance. The following hypothetical transactions (in millions of dollars) occurred the next month (from January 1, 2018 to January 31, 2018): a. Provided delivery service to customers, receiving $564 in accounts receivable and $60 in cash. b. Purchased new equipment costing $540; signed a long-term note. c. Paid $74 in cash to rent equipment, with $64 for rental this month and the rest for rent for the first few days in February. d. Spent $396 in cash to maintain and repair facilities and equipment during the month. e. Collected $675 from customers on account. f. Borrowed $90 by signing a long-term note (ignore interest). g. Paid employees $279 earned during the month. h. Purchased for cash and used $49 in supplies. i. Paid $184 on accounts payable. j. Ordered $72 in spare parts and supplies. 1. Prepare T-accounts for the preceding list and enter the respective balances. (You will need additional T-accounts for statement of earnings accounts.) 2. For each transaction, record the effects in the T-accounts. Label each by using the letter of the transaction. Compute ending balances. 3. Show the effects (direction and amount) of each transaction on net earnings and cash. 4. Prepare in good form a multiple-step statement of earnings for January 2018. 5. Prepare in good form a classified statement of financial position as at January 31, 2018. 6. Compute the company's total asset turnover ratio and its return on assets. What do these ratios suggest to you about Canada Post? Assume that the long-term note of $90 was signed on January 31 , and that interest has not accrued yetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started