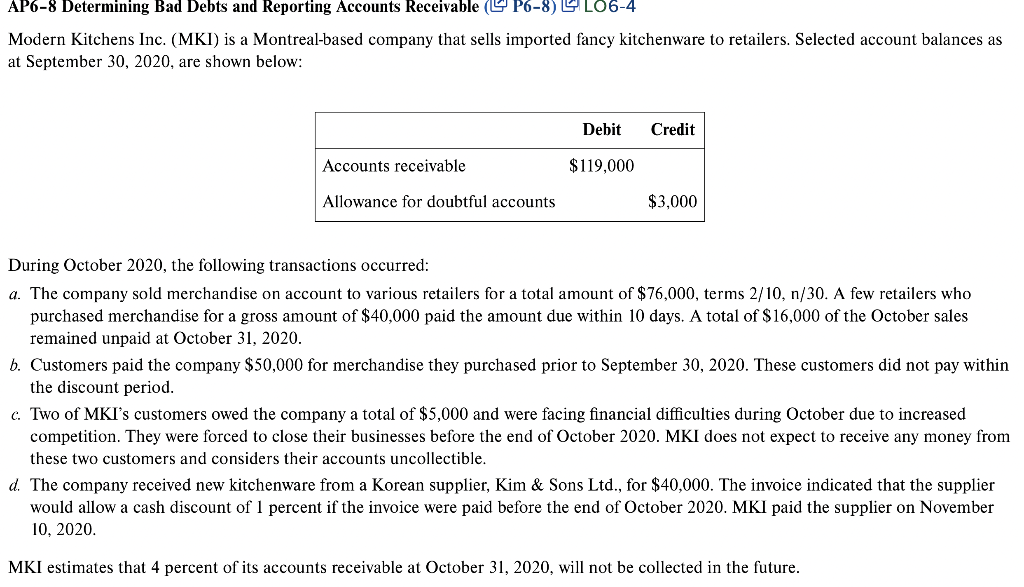

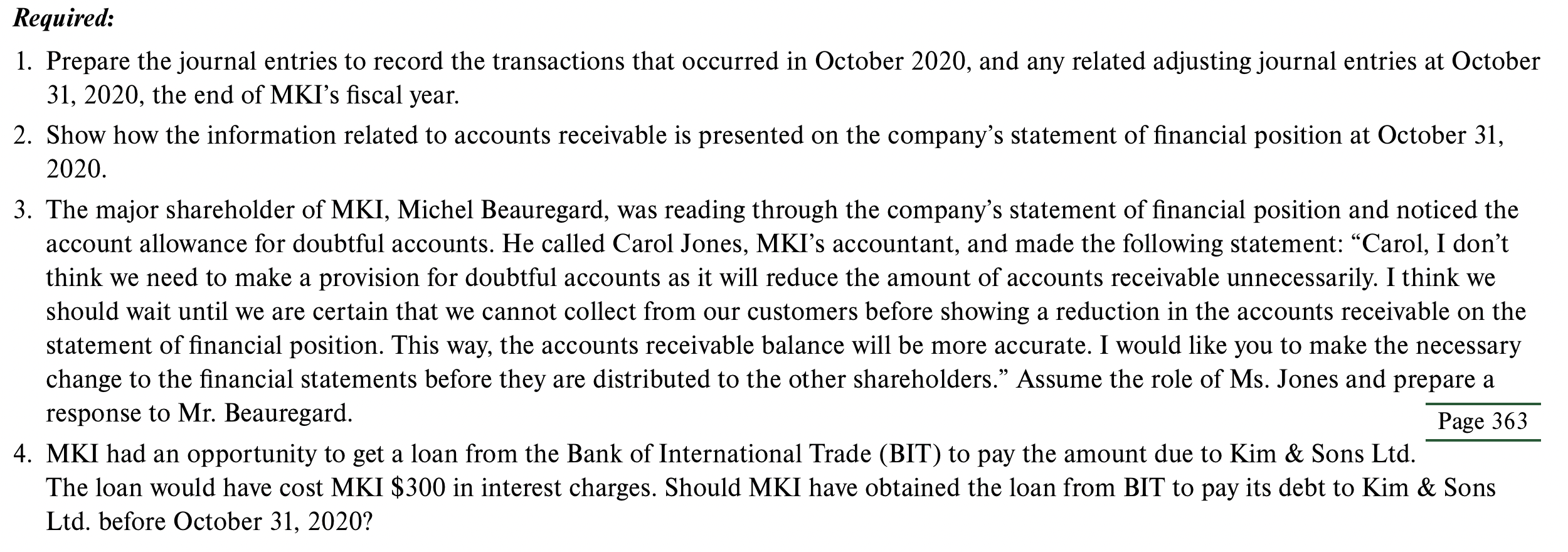

AP6-8 Determining Bad Debts and Reporting Accounts Receivable ( P6-8) LO6-4 Modern Kitchens Inc. ( MKI ) is a Montreal-based company that sells imported fancy kitchenware to retailers. Selected account balances as at September 30, 2020, are shown below: During October 2020, the following transactions occurred: a. The company sold merchandise on account to various retailers for a total amount of $76,000, terms 2/10,n/30. A few retailers who purchased merchandise for a gross amount of $40,000 paid the amount due within 10 days. A total of $16,000 of the October sales remained unpaid at October 31, 2020. b. Customers paid the company $50,000 for merchandise they purchased prior to September 30 , 2020. These customers did not pay within the discount period. c. Two of MKI's customers owed the company a total of $5,000 and were facing financial difficulties during October due to increased competition. They were forced to close their businesses before the end of October 2020. MKI does not expect to receive any money from these two customers and considers their accounts uncollectible. d. The company received new kitchenware from a Korean supplier, Kim \& Sons Ltd., for $40,000. The invoice indicated that the supplier would allow a cash discount of 1 percent if the invoice were paid before the end of October 2020. MKI paid the supplier on November 10,2020. MKI estimates that 4 percent of its accounts receivable at October 31,2020 , will not be collected in the future. 1. Prepare the journal entries to record the transactions that occurred in October 2020, and any related adjusting journal entries at October 31, 2020, the end of MKI's fiscal year. 2. Show how the information related to accounts receivable is presented on the company's statement of financial position at October 31 , 2020. 3. The major shareholder of MKI, Michel Beauregard, was reading through the company's statement of financial position and noticed the account allowance for doubtful accounts. He called Carol Jones, MKI's accountant, and made the following statement: "Carol, I don't think we need to make a provision for doubtful accounts as it will reduce the amount of accounts receivable unnecessarily. I think we should wait until we are certain that we cannot collect from our customers before showing a reduction in the accounts receivable on the statement of financial position. This way, the accounts receivable balance will be more accurate. I would like you to make the necessary change to the financial statements before they are distributed to the other shareholders." Assume the role of Ms. Jones and prepare a response to Mr. Beauregard. 4. MKI had an opportunity to get a loan from the Bank of International Trade (BIT) to pay the amount due to Kim \& Sons Ltd. The loan would have cost MKI $300 in interest charges. Should MKI have obtained the loan from BIT to pay its debt to Kim \& Sons Ltd. before October 31, 2020