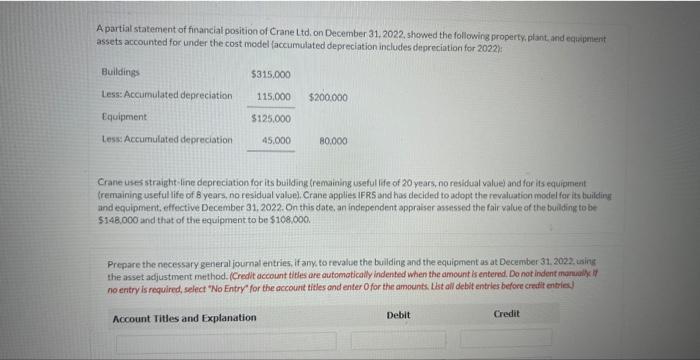

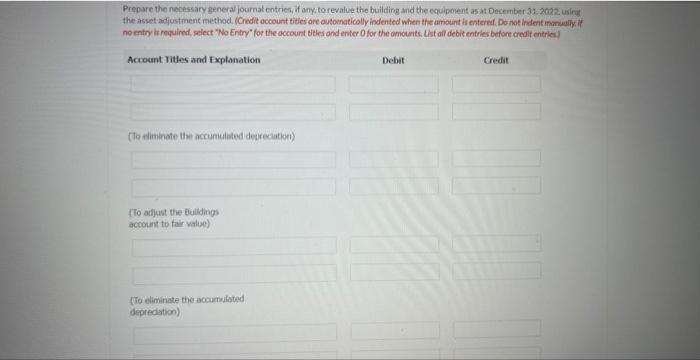

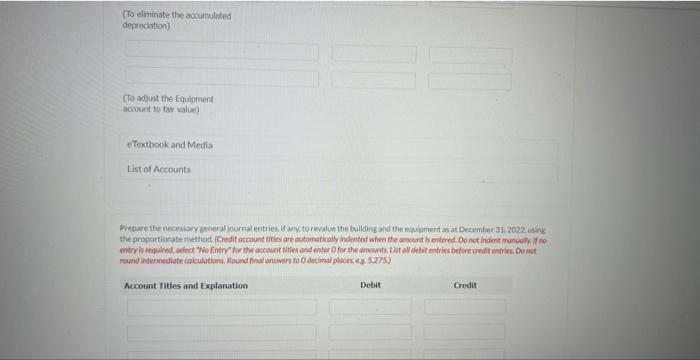

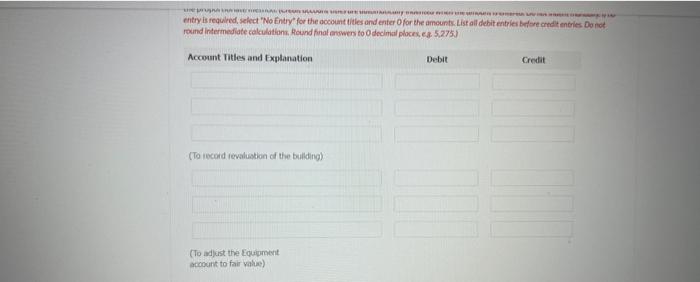

Apartial statement of financial position of Crane Ltd, on December 31, 2022, shewed the following property, plant and equibment assets accounted for under the cost model \{accumbiated depreciation includes depreciation for 2022): Crane uses straight-line depreciation for its building (remaining useful lfe of 20 years, no residual valuel and for its equipineeit \{remaining useful life of B years, no residual value). Crane applies IFRS and has decided to adopt the revaluation modiel for its buifding and equipment, effective December 31,2022. On this date, an independent appraiser assessed the fair value of the tuilding to be $148.000 and that of the equipment to be $108,000. Prepare the necessary general journal entries, if any, to revalue the building and the equipment as at December 31. 2022, using the asset adjustment method. (Credlt account titles are outomatically indented when the amount is entered, Do not indent manmallk if no entry is required, select "No Entry" for the account titles and enter Ofor the amounts tist all debit entries before credit entries) Prenare the necessary general journat entries, if any torevalve the building and the equipenent as at December 31.2622 usins the asset adjustinent method. (Credit account tities are automaticolly indented when the amount is entered. Do not indent innnumiy if no entry is required, gelect "Mo Entry" for the occount tibles and enter O for the amounts. (ist all debit entries before credit entries.) Prepare she necessary general journal entsies, if any, to revalue the bollding and the equipinent as at Decumber 31, 2022, iaing the proportibnate method. (Credit account titles are automablcaly indented when the aragant li entered Do not indent mancale if no entry as requined, weiect "No Enery" for the account dites and enter of for che ameunts. List al detit entries before ardit entr les. Do ase round intermediate colculotians. Round final anowers to 0 decimal plices e g. 5.275) entry is requlend, select "No Endry" for the ocoount tities and enter Of for the amounts List ali dehit entriei belse cored t enteres Do bot round indermeflate celculations, Round finol erowen to 0 decinal ploces, eg. 5.275.) Apartial statement of financial position of Crane Ltd, on December 31, 2022, shewed the following property, plant and equibment assets accounted for under the cost model \{accumbiated depreciation includes depreciation for 2022): Crane uses straight-line depreciation for its building (remaining useful lfe of 20 years, no residual valuel and for its equipineeit \{remaining useful life of B years, no residual value). Crane applies IFRS and has decided to adopt the revaluation modiel for its buifding and equipment, effective December 31,2022. On this date, an independent appraiser assessed the fair value of the tuilding to be $148.000 and that of the equipment to be $108,000. Prepare the necessary general journal entries, if any, to revalue the building and the equipment as at December 31. 2022, using the asset adjustment method. (Credlt account titles are outomatically indented when the amount is entered, Do not indent manmallk if no entry is required, select "No Entry" for the account titles and enter Ofor the amounts tist all debit entries before credit entries) Prenare the necessary general journat entries, if any torevalve the building and the equipenent as at December 31.2622 usins the asset adjustinent method. (Credit account tities are automaticolly indented when the amount is entered. Do not indent innnumiy if no entry is required, gelect "Mo Entry" for the occount tibles and enter O for the amounts. (ist all debit entries before credit entries.) Prepare she necessary general journal entsies, if any, to revalue the bollding and the equipinent as at Decumber 31, 2022, iaing the proportibnate method. (Credit account titles are automablcaly indented when the aragant li entered Do not indent mancale if no entry as requined, weiect "No Enery" for the account dites and enter of for che ameunts. List al detit entries before ardit entr les. Do ase round intermediate colculotians. Round final anowers to 0 decimal plices e g. 5.275) entry is requlend, select "No Endry" for the ocoount tities and enter Of for the amounts List ali dehit entriei belse cored t enteres Do bot round indermeflate celculations, Round finol erowen to 0 decinal ploces, eg. 5.275.)