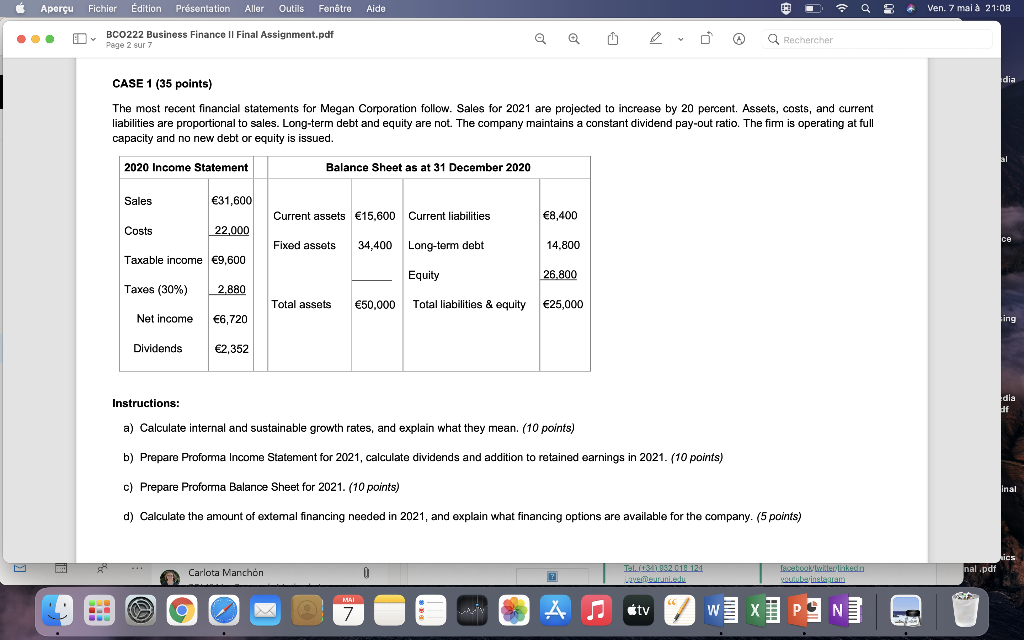

Aperu Fichier Edition Prsentation Aller Outils Fentre Aide Ven. 7 mal 21:08 BCO222 Business Finance Il Final Assignment.pdf Page 2 sur 7 Rechercher dia CASE 1 (35 points) The most recent financial statements for Megan Corporation follow. Sales for 2021 are projected to increase by 20 percent. Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant dividend pay-out ratio. The fim is operating at full capacity and no new debt or equity is issued al 2020 Income Statement Balance Sheet as at 31 December 2020 Sales 31,600 Current assets 15,600 Current liabilities 8,400 Costs 22.000 ce Fixed assets 34,400 Long-term debt 14.800 Taxable income 9,600 Equity 26.800 Taxes (30%) 2.880 Total assets 50,000 Total liabilities & equity 25,000 Net income 6,720 ing Dividends 2,352 Instructions: dia af a) Calculate internal and sustainable growth rates, and explain what they mean. (10 points) b) Prepare Profoma Income Statement for 2021, calculate dividends and addition to retained earnings in 2021. (10 points) c) Prepare Proforma Balance Sheet for 2021. (10 points) inal d) Calculate the amount of extemal financing needed in 2021, and explain what financing options are available for the company. (5 points) Mics nal.pdf Carlota Manchn TAI 31962018 124 muni.elu Tebook twiter linkedin winsteam MAI CC 7 Atv W Nix] PONT GO Aperu Fichier Edition Prsentation Aller Outils Fentre Aide Ven. 7 mal 21:08 BCO222 Business Finance Il Final Assignment.pdf Page 2 sur 7 Rechercher dia CASE 1 (35 points) The most recent financial statements for Megan Corporation follow. Sales for 2021 are projected to increase by 20 percent. Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant dividend pay-out ratio. The fim is operating at full capacity and no new debt or equity is issued al 2020 Income Statement Balance Sheet as at 31 December 2020 Sales 31,600 Current assets 15,600 Current liabilities 8,400 Costs 22.000 ce Fixed assets 34,400 Long-term debt 14.800 Taxable income 9,600 Equity 26.800 Taxes (30%) 2.880 Total assets 50,000 Total liabilities & equity 25,000 Net income 6,720 ing Dividends 2,352 Instructions: dia af a) Calculate internal and sustainable growth rates, and explain what they mean. (10 points) b) Prepare Profoma Income Statement for 2021, calculate dividends and addition to retained earnings in 2021. (10 points) c) Prepare Proforma Balance Sheet for 2021. (10 points) inal d) Calculate the amount of extemal financing needed in 2021, and explain what financing options are available for the company. (5 points) Mics nal.pdf Carlota Manchn TAI 31962018 124 muni.elu Tebook twiter linkedin winsteam MAI CC 7 Atv W Nix] PONT GO