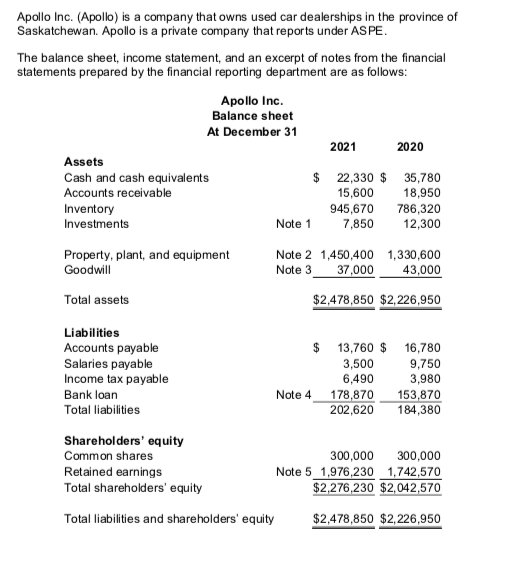

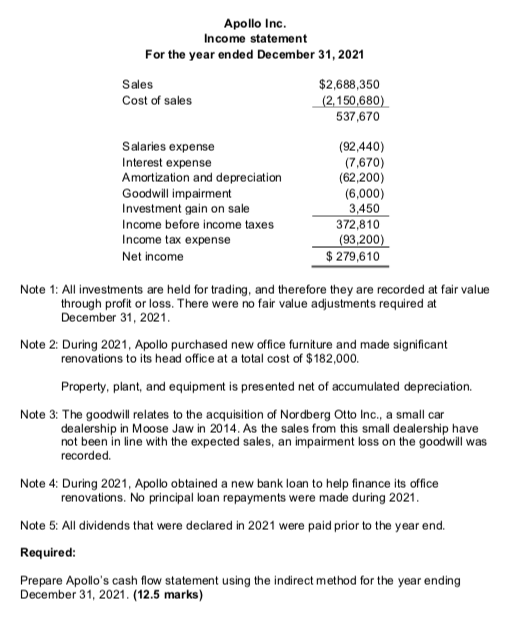

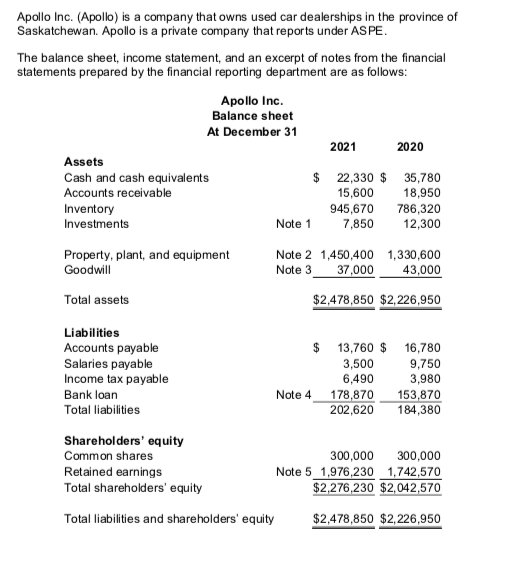

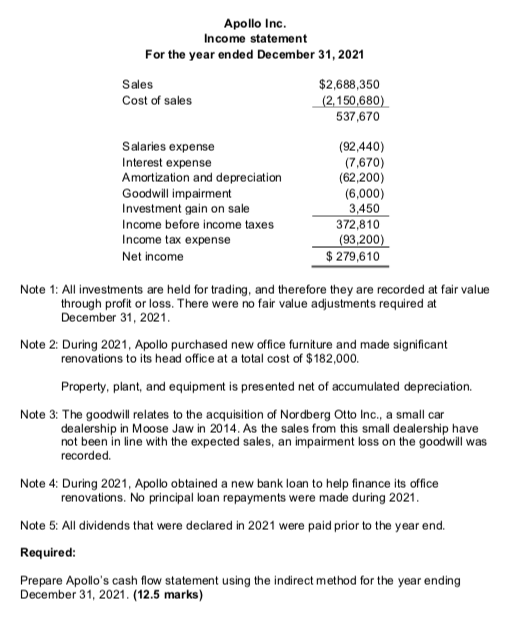

Apollo Inc. (Apollo) is a company that owns used car dealerships in the province of Saskatchewan. Apollo is a private company that reports under ASPE. The balance sheet, income statement, and an excerpt of notes from the financial statements prepared by the financial reporting department are as follows: Apollo Inc. Balance sheet At December 31 2021 2020 Assets Cash and cash equivalents $ 22,330 $ 35,780 Accounts receivable 15,600 18,950 Inventory 945,670 786,320 Investments Note 1 7,850 12,300 Property, plant, and equipment Goodwill Note 2 1,450,400 1,330,600 Note 3 37,000 43,000 Total assets $2,478,850 $2,226,950 Liabilities Accounts payable $ 13,760 $ 16,780 Salaries payable 3,500 9,750 Income tax payable 6,490 3,980 Bank loan Note 4 178,870 153,870 Total liabilities 202,620 184,380 Shareholders' equity Common shares 300,000 300,000 Retained earnings Note 51,976,230 1,742,570 Total shareholders' equity $2,276,230 $2,042,570 Total liabilities and shareholders' equity $2,478,850 $2,226,950 Apollo Inc. Income statement For the year ended December 31, 2021 Sales $2,688,350 Cost of sales (2,150,680) 537,670 Salaries expense Interest expense Amortization and depreciation Goodwill impairment Investment gain on sale Income before income taxes Income tax expense Net income (92,440) (7,670) (62,200) (6,000) 3,450 372,810 (93,200) $ 279,610 Note 1: All investments are held for trading, and therefore they are recorded at fair value through profit or loss. There were no fair value adjustments required at December 31, 2021 Note 2: During 2021, Apollo purchased new office furniture and made significant renovations to its head office at a total cost of $182,000. Property, plant, and equipment is presented net of accumulated depreciation. Note 3: The goodwill relates to the acquisition of Nordberg Otto Inc., a small car dealership in Moose Jaw in 2014. As the sales from this small dealership have not been in line with the expected sales, an impairment loss on the goodwill was recorded. Note 4: During 2021, Apollo obtained a new bank loan to help finance its office renovations. No principal loan repayments were made during 2021. Note 5: All dividends that were declared in 2021 were paid prior to the year end. Required: Prepare Apollo's cash flow statement using the indirect method for the year ending December 31, 2021. (12.5 marks)