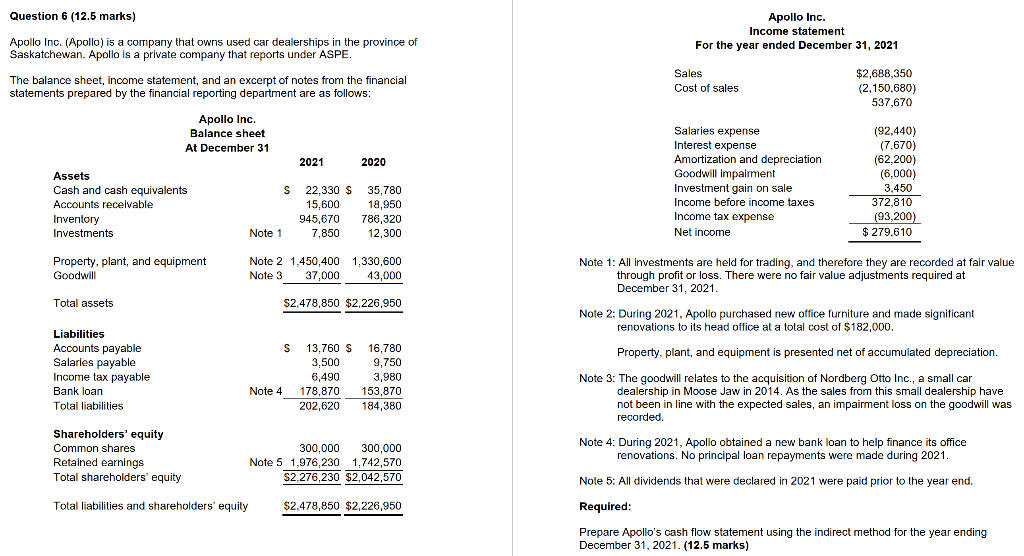

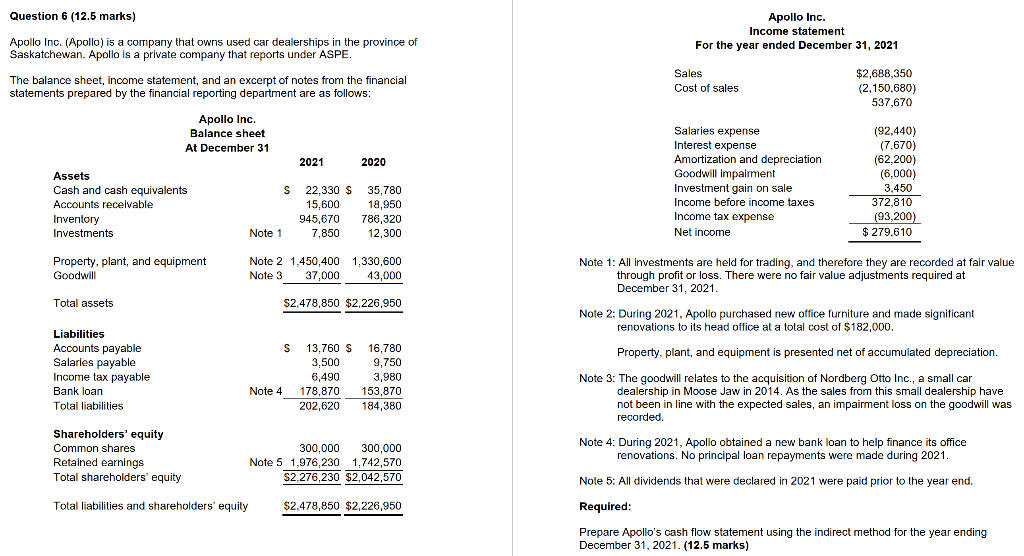

Apollo Inc. Income statement For the year ended December 31, 2021 Sales Cost of sales $2,688,350 (2,150,680) 537,670 Question 6 (12.5 marks) Apollo Inc. (Apollo) is a company that owns used car dealerships in the province of Saskatchewan. Apollo is a private company that reports under ASPE. The balance sheet, income statement, and an excerpt of notes from the financial statements prepared by the financial reporting department are as follows: Apollo Inc. Balance sheet At December 31 2021 2020 Assets Cash and cash equivalents S 22.330 S 35,780 Accounts receivable 15,600 18,950 Inventory 945,670 786,320 Investments Note 1 7,850 12,300 Salaries expense Interest expense Amortization and depreciation Goodwill impairment Investment gain on sale Income before income taxes Income tax expense Net income (92,440) (7.670) (62,200) (6,000) 3,450 372,810 (93,200) $ 279,610 Property, plant, and equipment Goodwill Note 2 1.450,400 1.330.600 Note 3 37,000 43,000 Total assets $2.478,850 $2,226,950 Liabilities Accounts payable Salarles payable Income tax payable Bank loan Total liabilities Note 1: All investments are held for trading, and therefore they are recorded at fair value : , through profit or loss. There were no fair value adjustments required at December 31, 2021. Note 2: During 2021, Apollo purchased new office furniture and made significant renovations to its head office at a total cost of $182,000. Property, plant, and equipment is presented net of accumulated depreciation. Note 3: The goodwill relates to the acquisition of Nordberg Otto Inc., a small car dealership in Moose Jaw in 2014. As the sales from this small dealership have not been in line with the expected sales, an impairment loss on the goodwill was recorded. S 13,760 $ 3,500 6,490 Note 4 178,870 202,620 16,780 9,750 3,980 153,870 184,380 Shareholders' equity Common shares Retained earnings Total shareholders' equity 300,000 300,000 Note 5 1,976,230 1,742,570 $2,276,230 $2,042,570 Note 4: During 2021, Apollo obtained a new bank loan to help finance its office renovations. No principal loan repayments were made during 2021. Note 5: All dividends that were declared in 2021 were paid prior to the year end. Total liabilities and shareholders' equily $2,478,850 $2,226,950 Required: Prepare Apollo's cash flow statement using the indirect method for the year ending December 31, 2021. (12.5 marks)