APPENDIX B

APPENDIX B

APPENDIX C

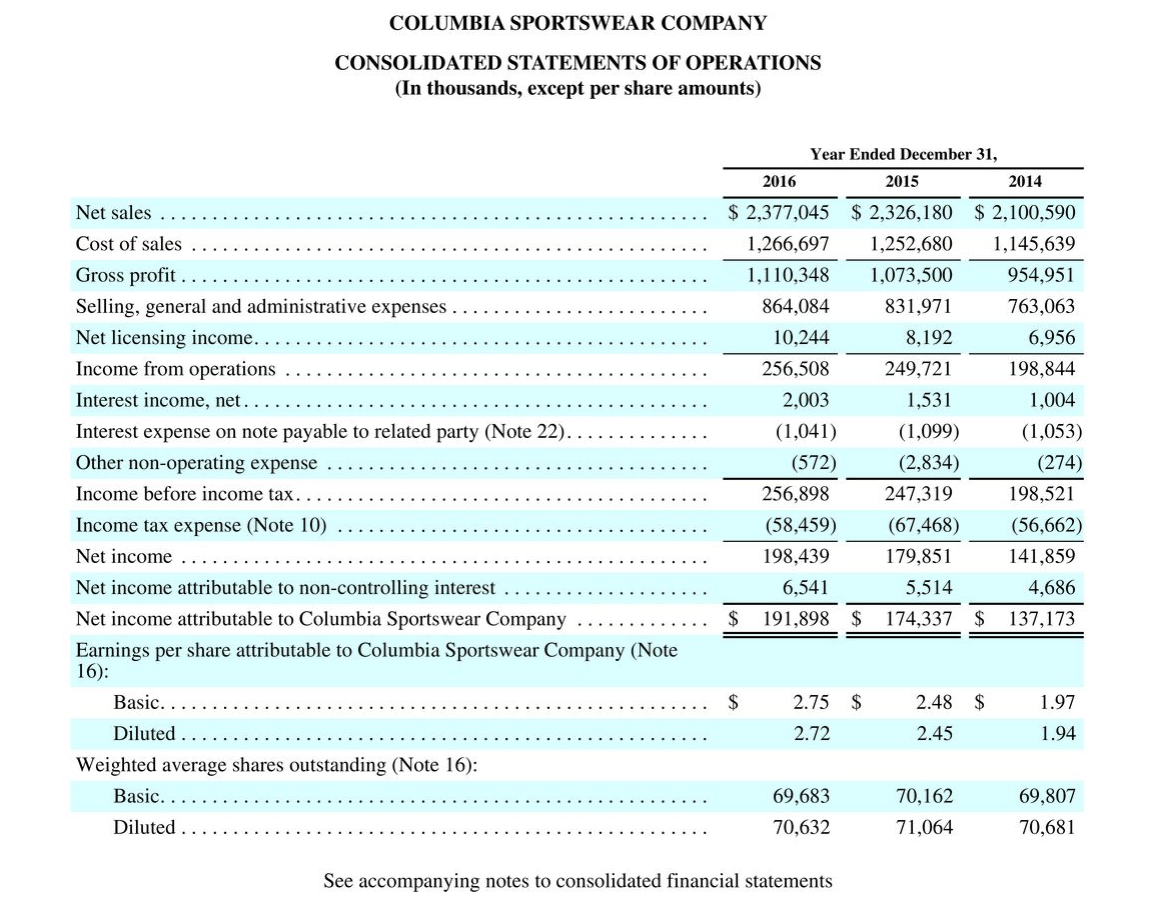

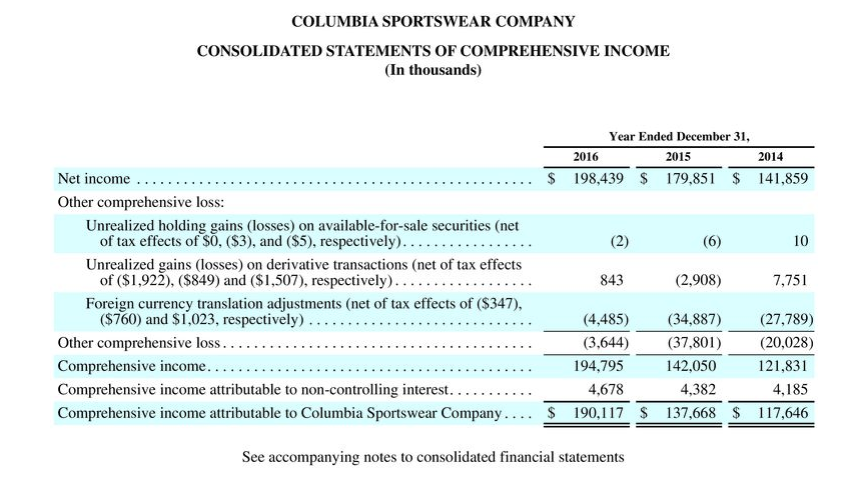

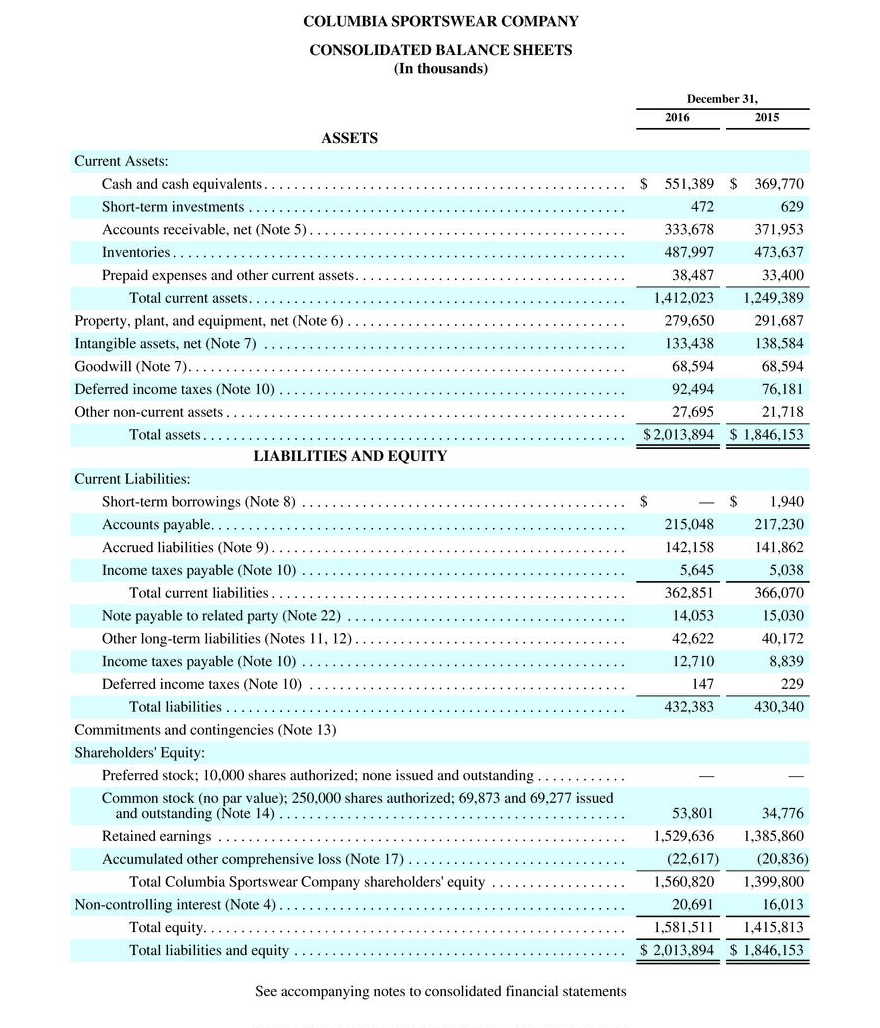

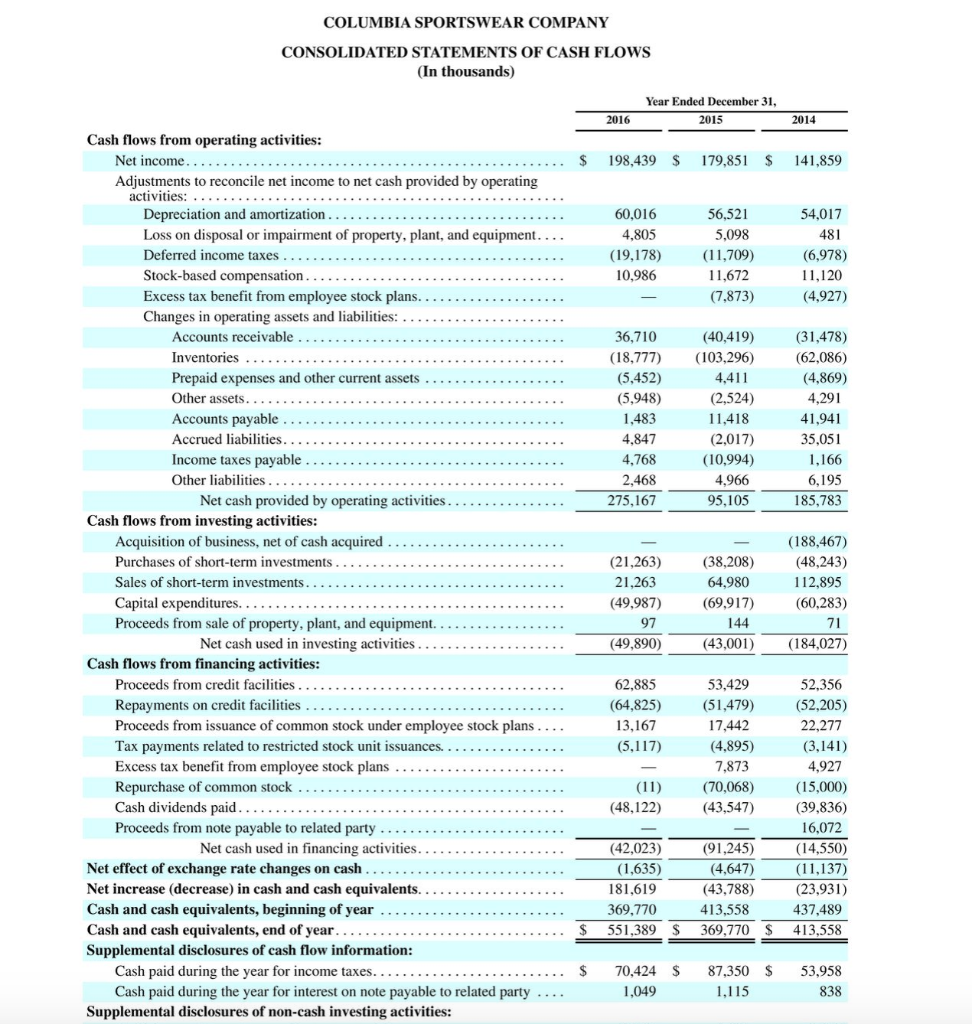

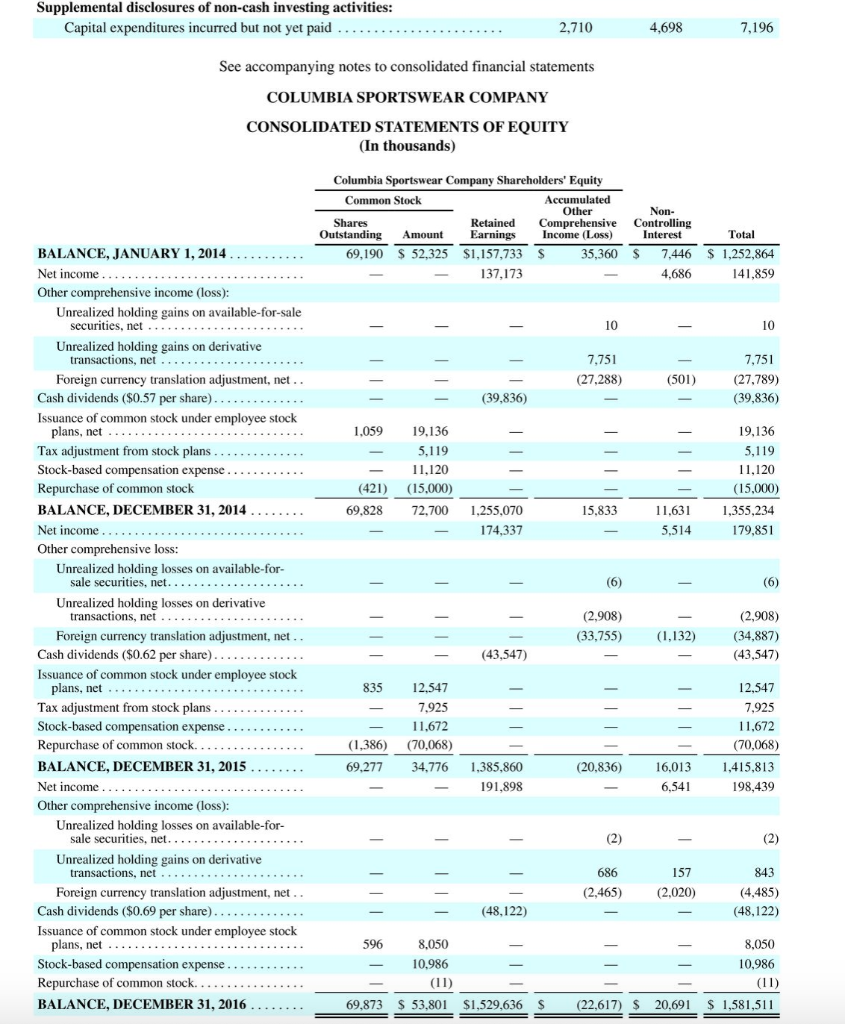

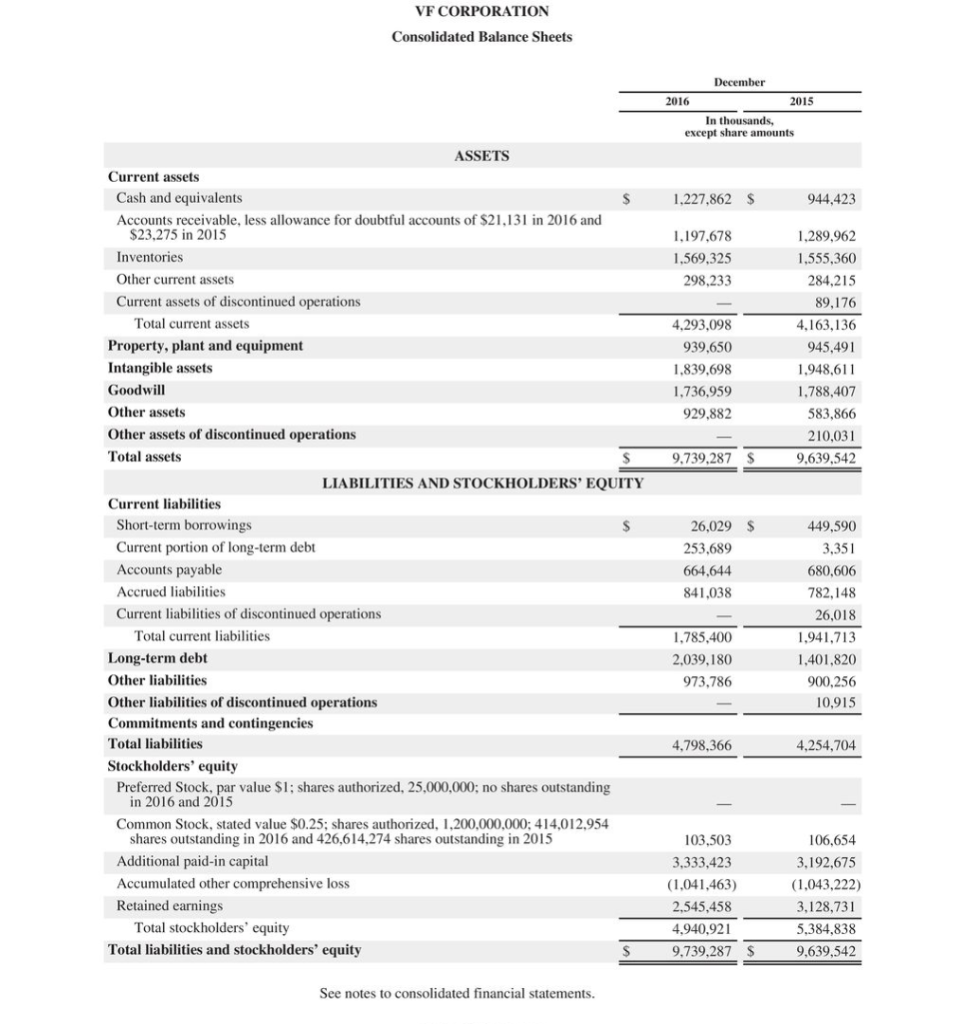

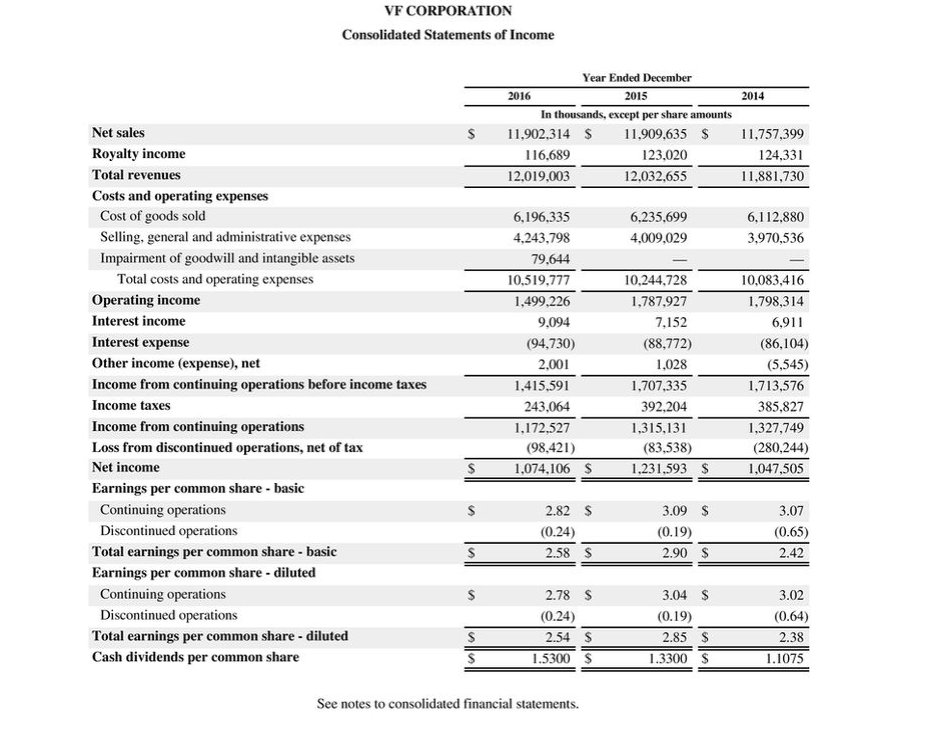

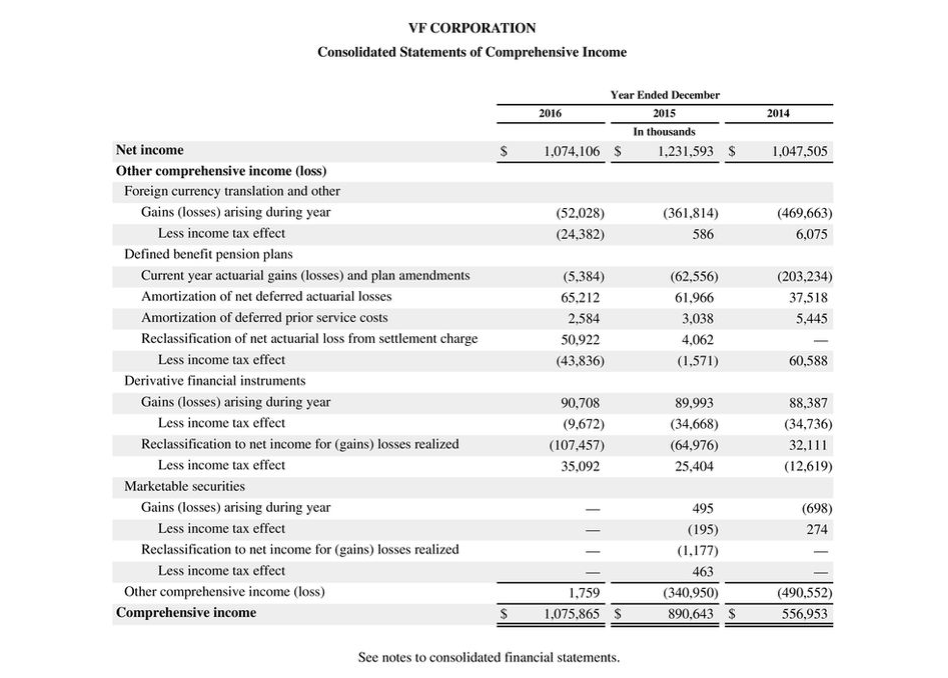

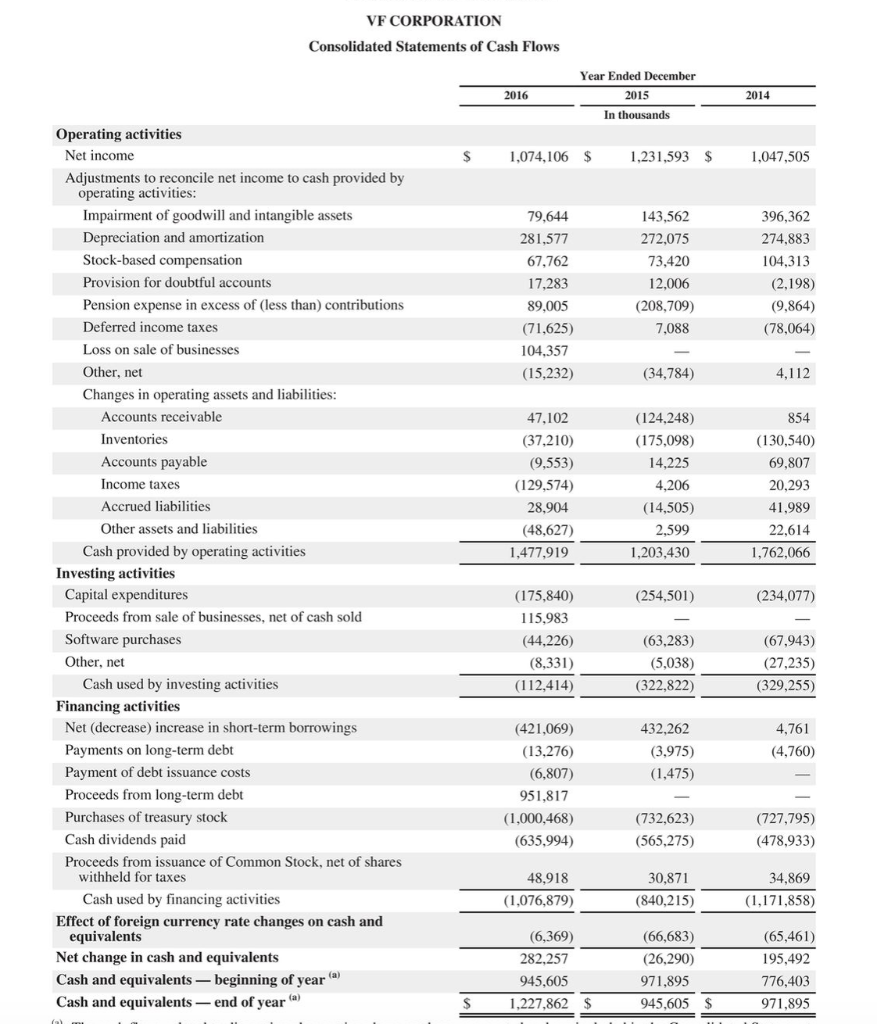

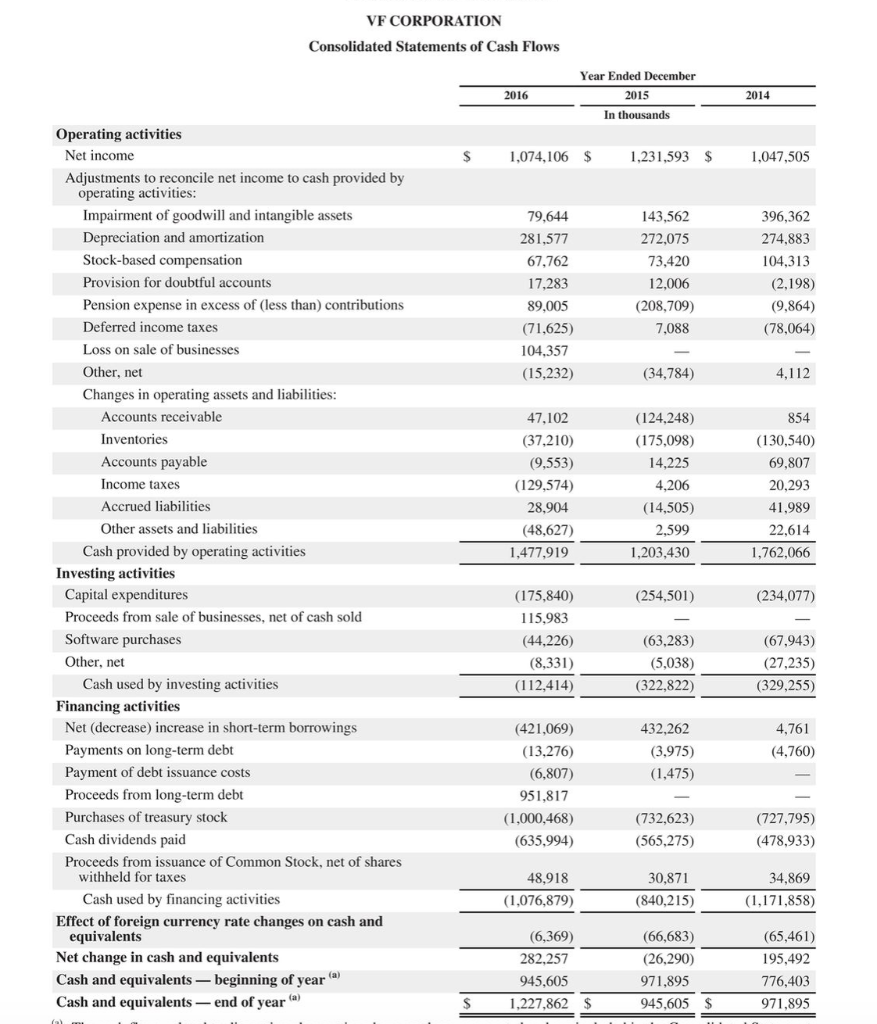

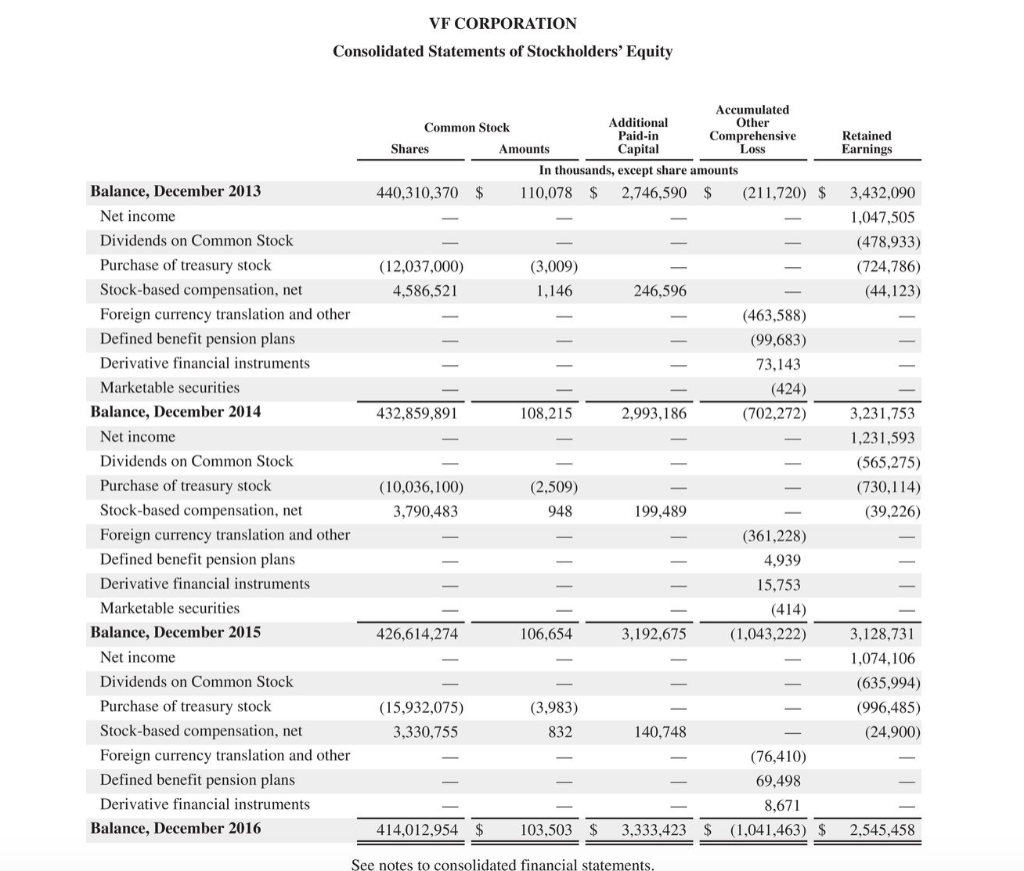

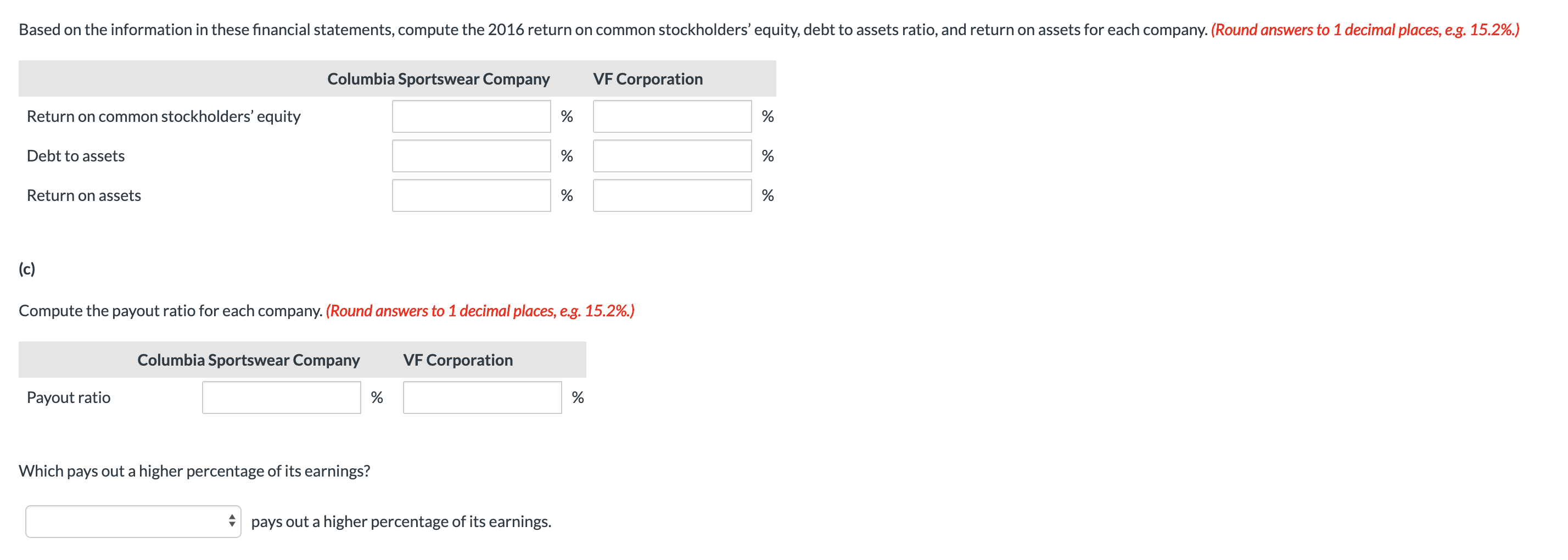

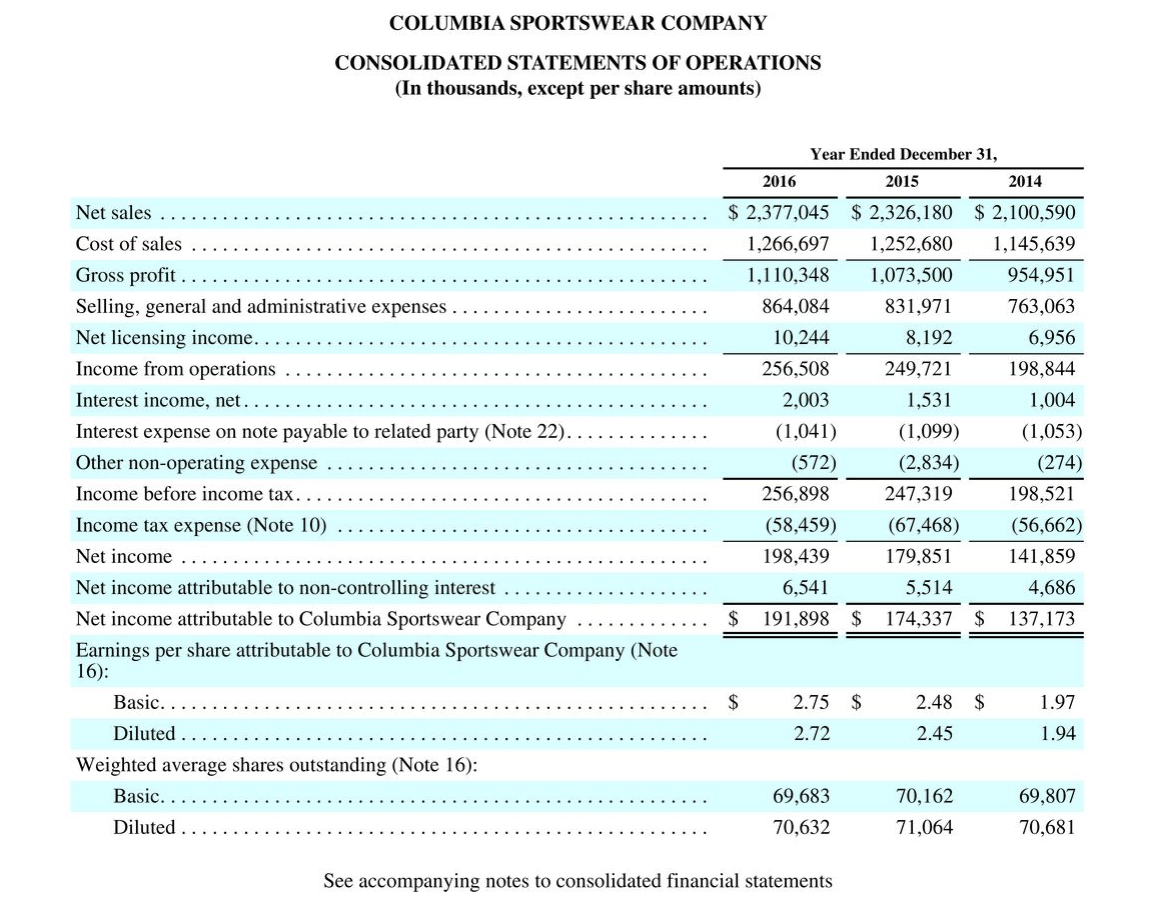

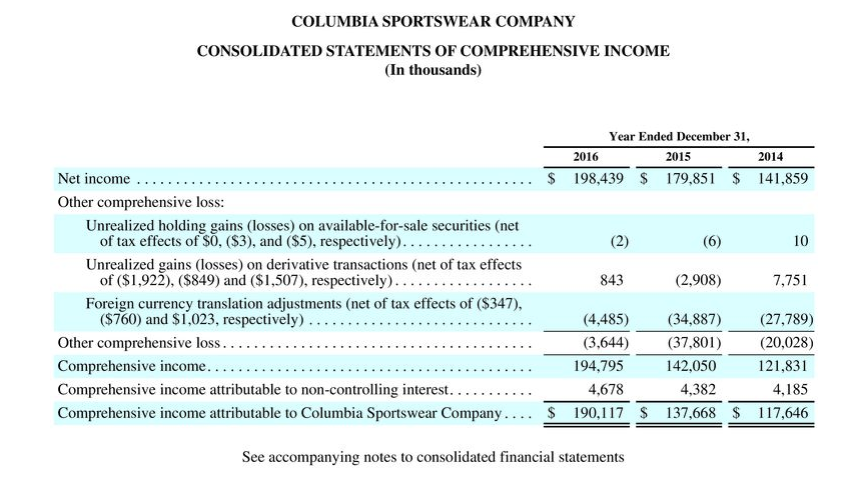

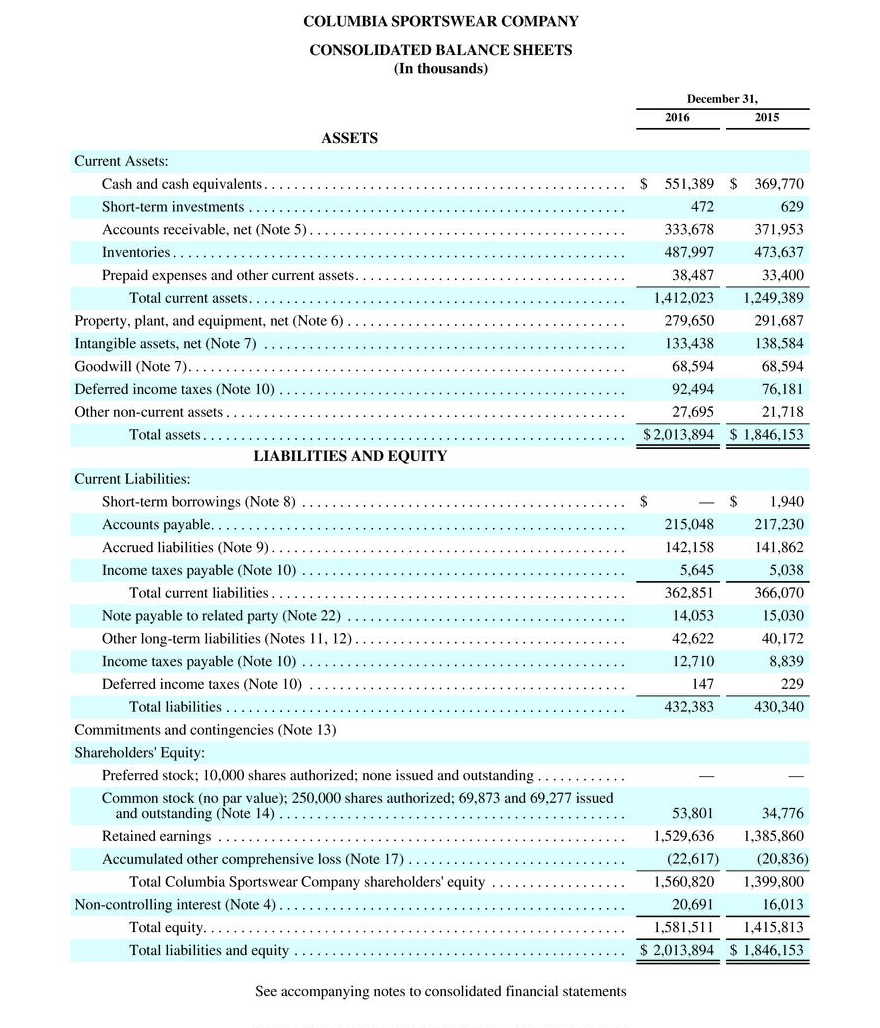

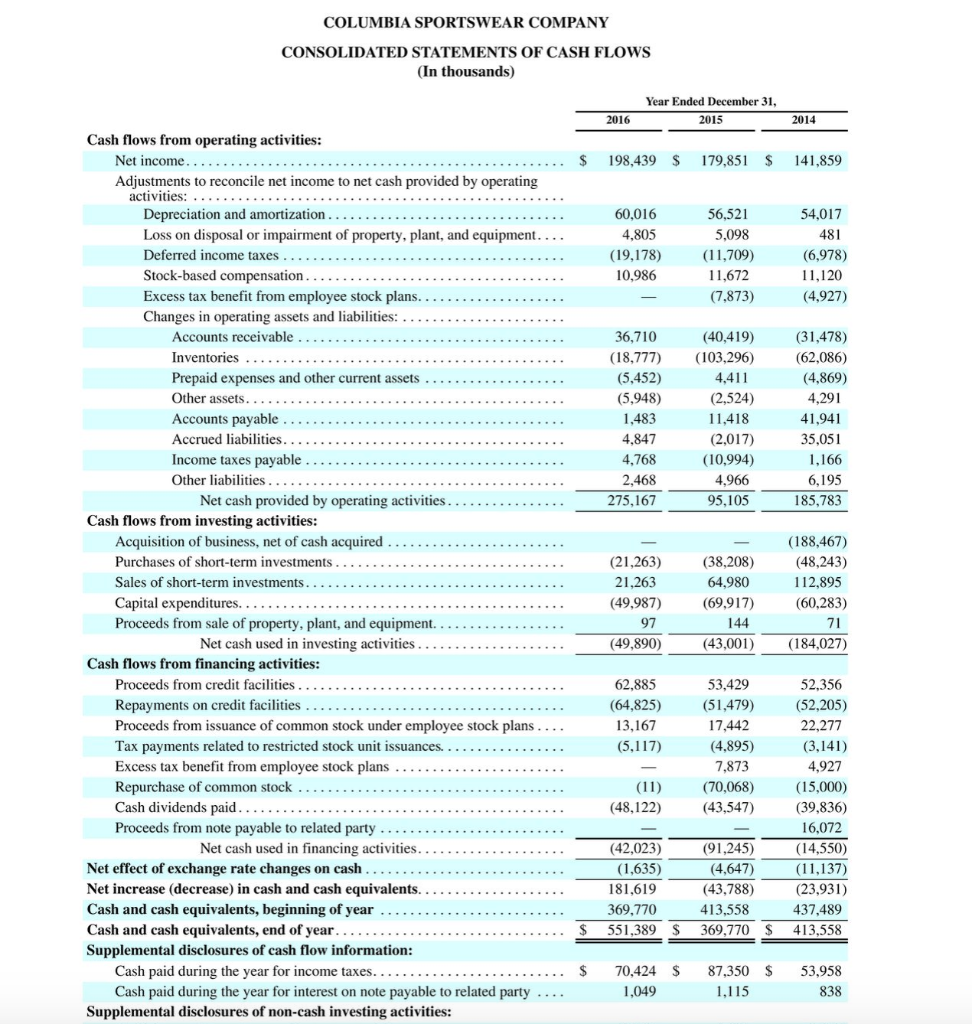

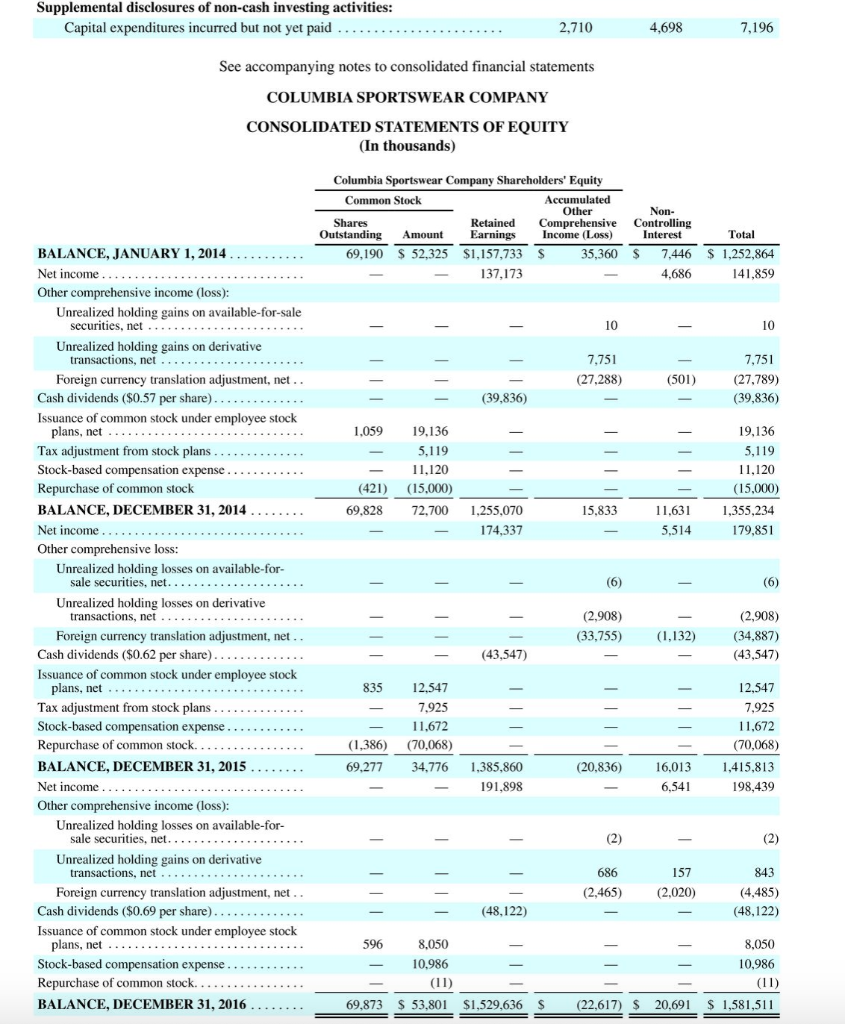

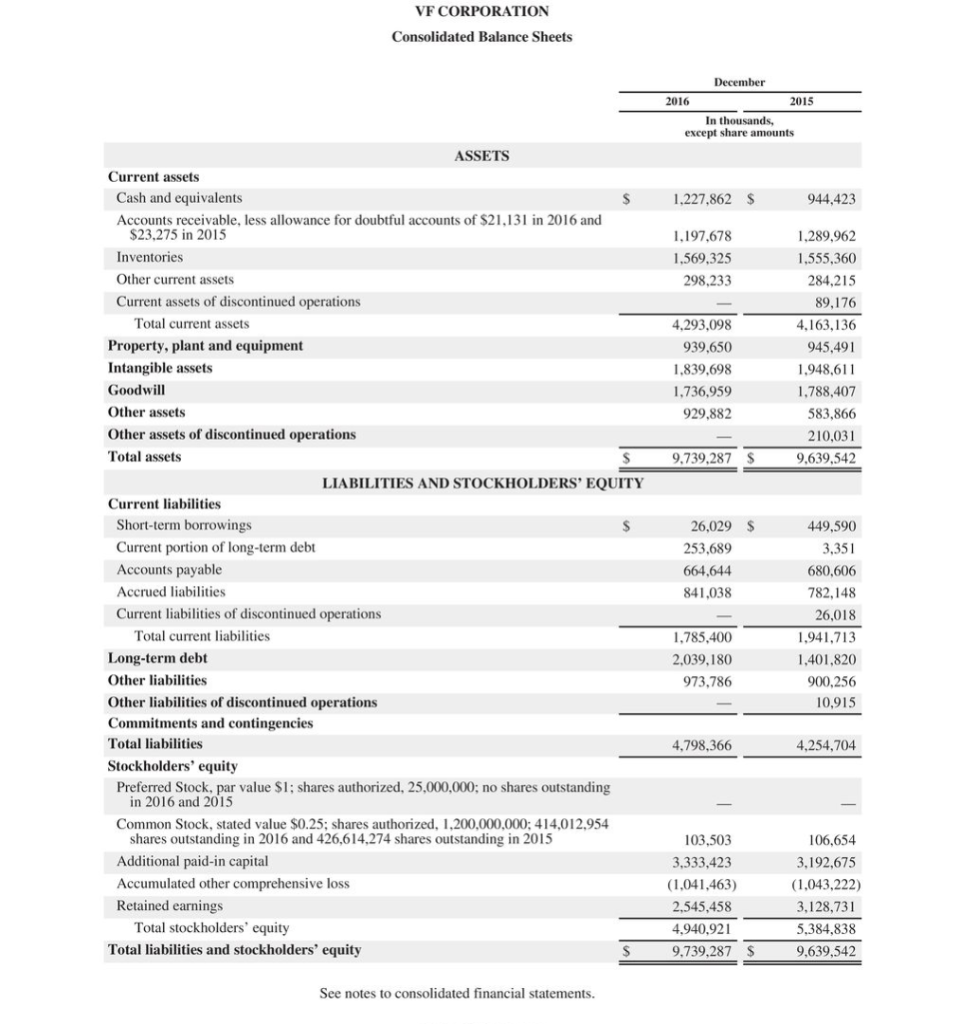

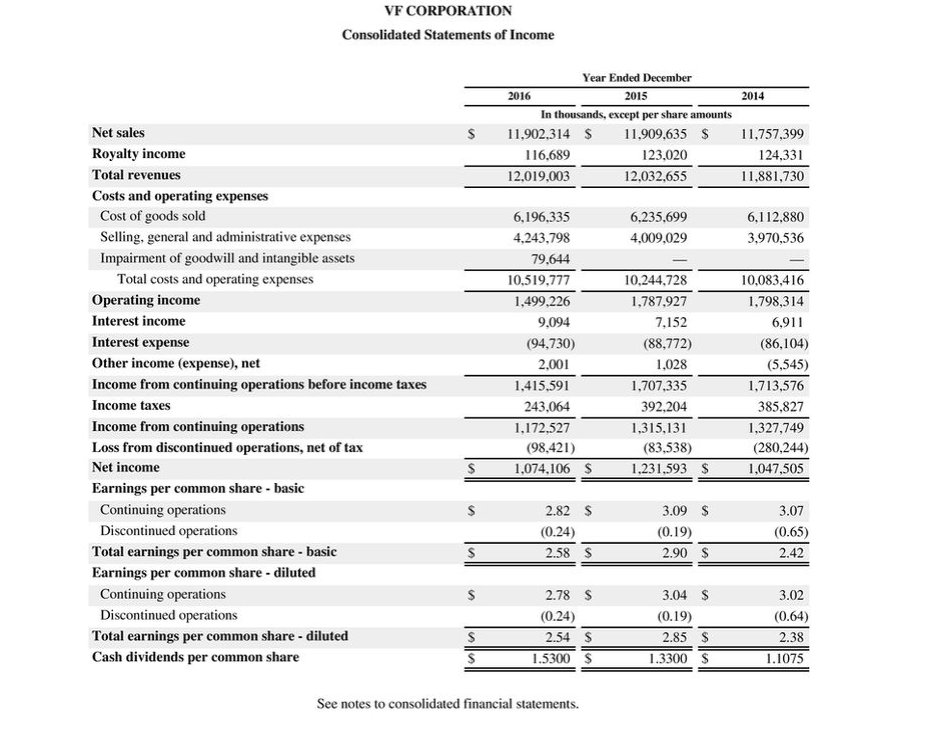

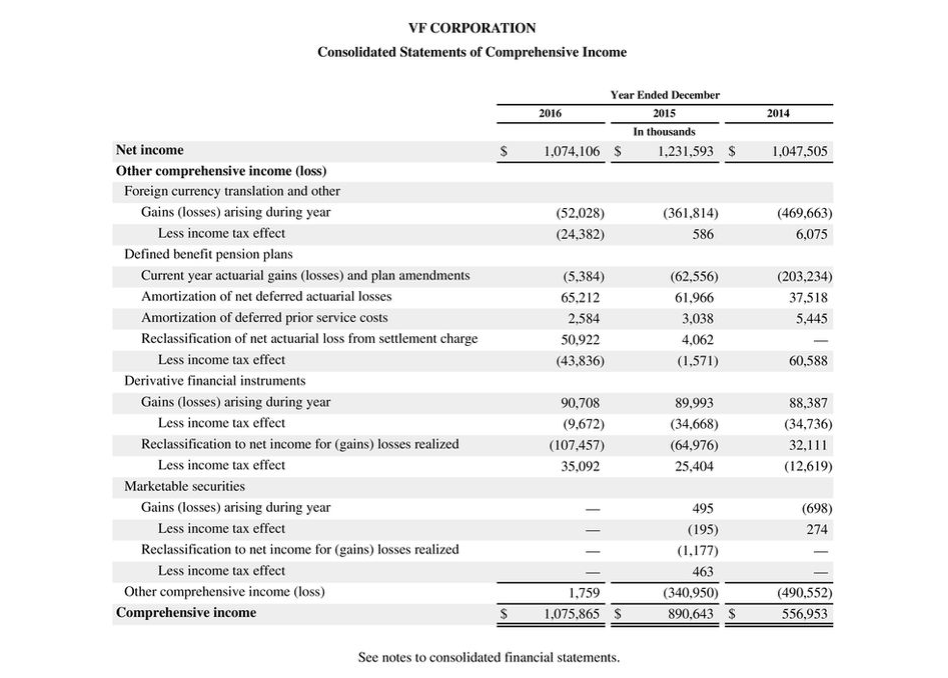

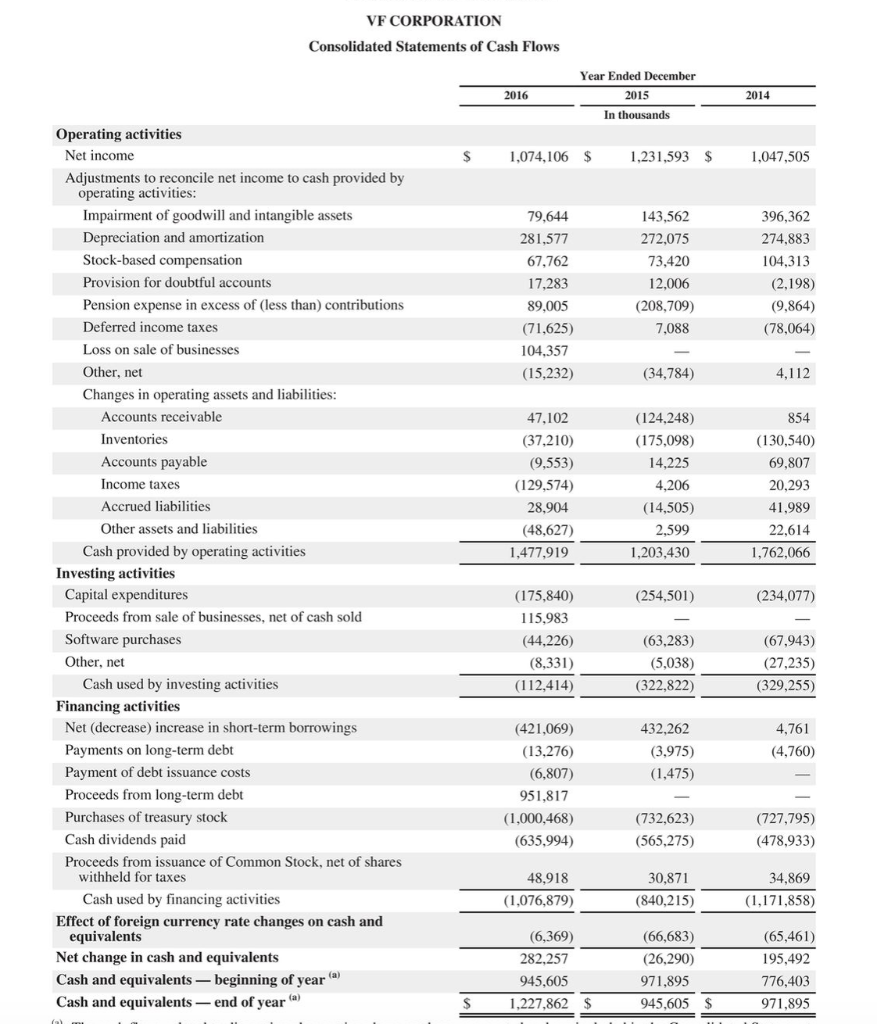

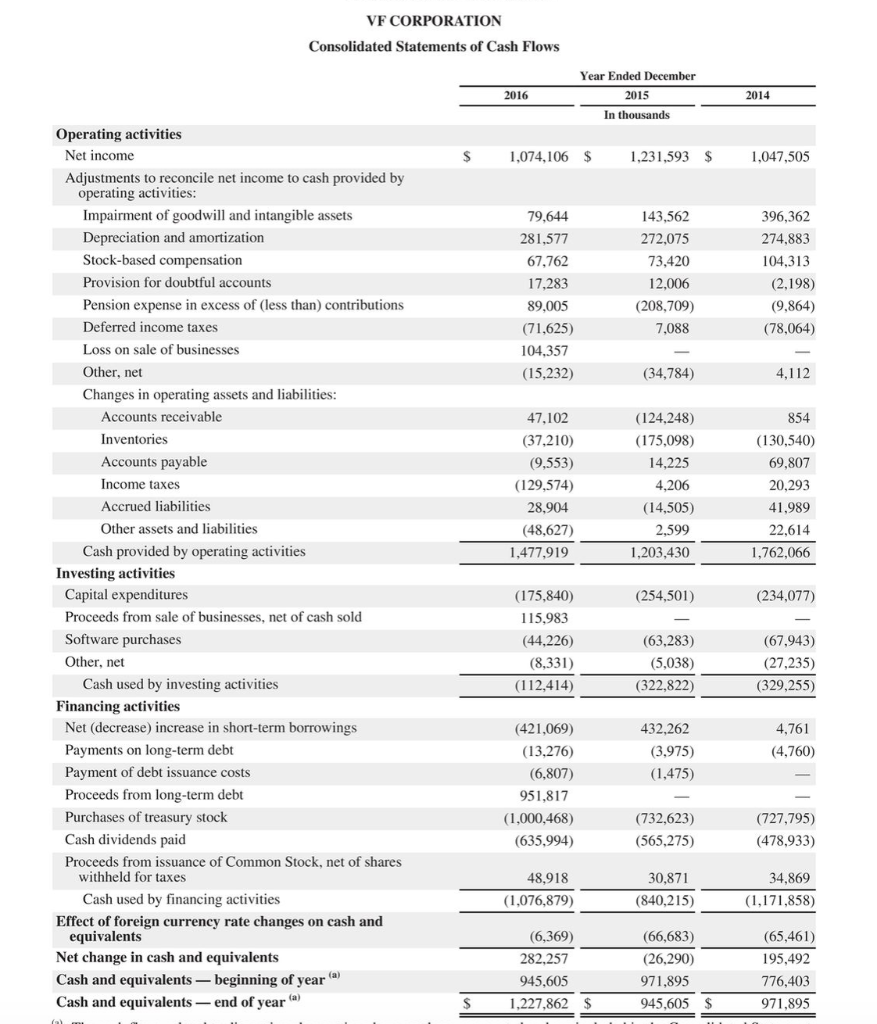

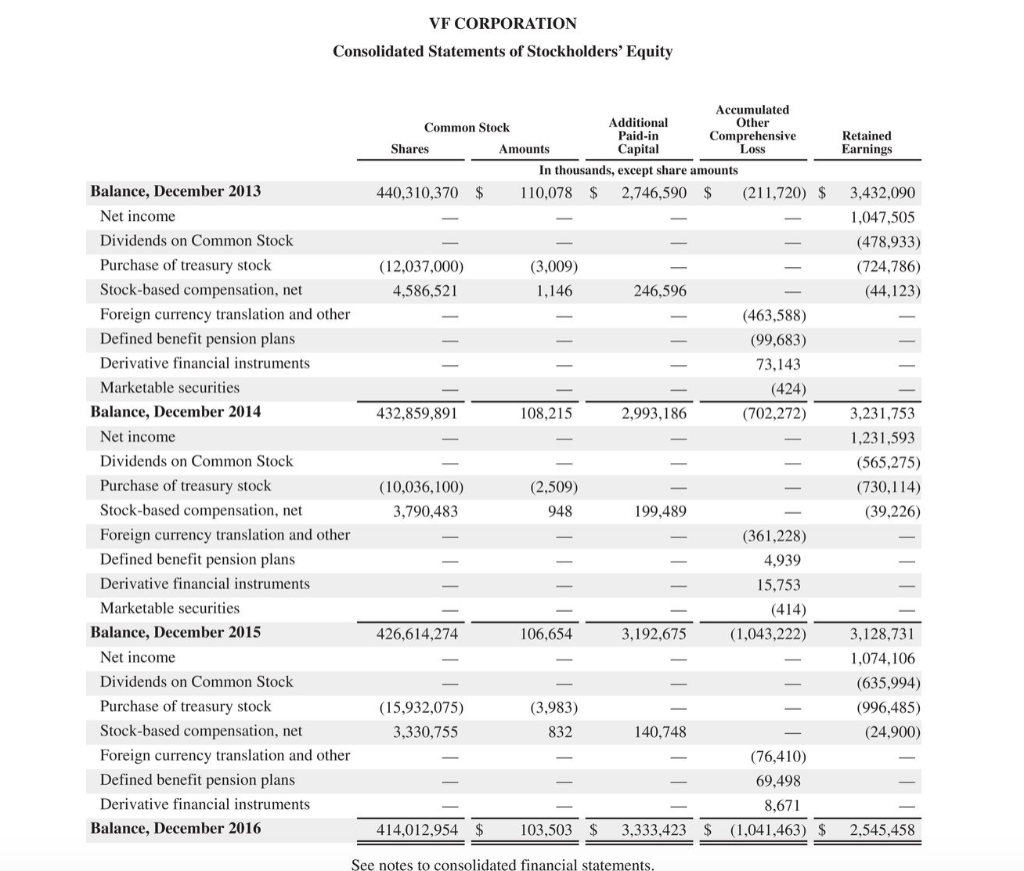

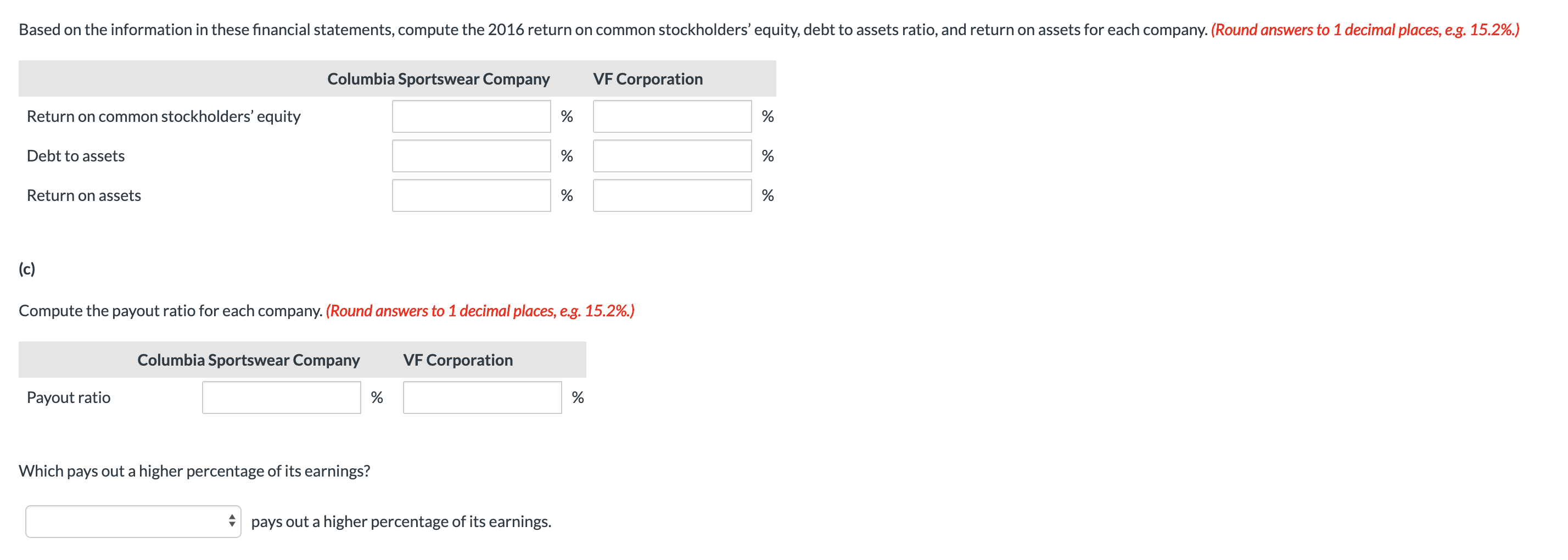

Based on the information in these financial statements, compute the 2016 return on common stockholders' equity, debt to assets ratio, and return on assets for each company. (Round answers to 1 decimal places, e.g. 15.2%.) Columbia Sportswear Company VF Corporation Return on common stockholders'equity Debt to assets Return on assets (c) Compute the payout ratio for each company. (Round answers to 1 decimal places, e.g. 15.2%.) Columbia Sportswear Company VF Corporation Payout ratio Which pays out a higher percentage of its earnings? A pays out a higher percentage of its earnings. COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands) Year Ended December 31, 2016 2015 198,439 $ 179,851 $ 2014 141,859 Net income ...... ..... $ Other comprehensive loss: Unrealized holding gains (losses) on available-for-sale securities (net of tax effects of $0,($3), and ($5), respectively)................. R Unrealized gains (losses) on derivative transactions (net of tax effects of ($1,922), ($849) and ($1,507), respectively).................. Foreign currency translation adjustments (net of tax effects of ($347), ($760) and $1,023, respectively)...... Other comprehensive loss. Comprehensive income. Comprehensive income attributable to non-controlling interest..... Comprehensive income attributable to Columbia Sportswear Company.... $ (2) 843 (4,485) (3,644) 194,795 4,678 190,117 (6) (2,908) (34,887) (37,801) 142,050 4,382 137,668 10 7,751 (27,789) (20,028) 121,831 4,185 117,646 $ $ See accompanying notes to consolidated financial statements COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) .................... .. December 31, 2016 2015 ASSETS Current Assets: Cash and cash equivalents........ .......... $ 551,389 $ 369,770 Short-term investments ........ 472 629 Accounts receivable, net (Note 5)... 333,678 371,953 Inventories 487,997 473,637 Prepaid expenses and other current assets..... 38,487 33,400 Total current assets... 1,412.023 1.249,389 Property, plant, and equipment, net (Note 6) 279,650 291,687 Intangible assets, net (Note 7) ...... 133,438 138,584 Goodwill (Note 7)....................................................... 68,594 68,594 Deferred income taxes (Note 10)... 92,494 76,181 Other non-current assets... 27,695 21,718 Total assets......... $ 2,013,894 $ 1,846,153 LIABILITIES AND EQUITY Current Liabilities: Short-term borrowings (Note 8)..... - $ 1,940 Accounts payable. 215,048 217,230 Accrued liabilities (Note 9)........... 142,158 141,862 Income taxes payable (Note 10) .......... 5,645 5,038 Total current liabilities............. 362,851 366,070 Note payable to related party (Note 22).... 14.053 15,030 Other long-term liabilities (Notes 11, 12)............. 42,622 40,172 Income taxes payable (Note 10) 12,710 8.839 Deferred income taxes (Note 10) 229 Total liabilities .. 432,383 430,340 Commitments and contingencies (Note 13) Shareholders' Equity: Preferred stock: 10,000 shares authorized; none issued and outstanding........... Common stock (no par value); 250,000 shares authorized; 69,873 and 69,277 issued and outstanding (Note 14)........ 53,801 34,776 Retained earnings. 1,529,636 1,385,860 Accumulated other comprehensive loss (Note 17)... (22,617) (20,836) Total Columbia Sportswear Company shareholders' equity 1,560,820 1.399,800 Non-controlling interest (Note 4).......... 20,691 16,013 Total equity........ 1,581,5111,415,813 Total liabilities and equity ...... $ 2,013,894 $ 1,846,153 147 See accompanying notes to consolidated financial statements VF CORPORATION Consolidated Statements of Income 2014 S Year Ended December 2016 2015 In thousands, except per share amounts 11,902,314 $ 11,909,635 $ 116,689 123.020 12.019,003 1 2.032,655 11,757,399 124,331 11.881,730 6,235,699 4,009,029 6,112,880 3,970,536 Net sales Royalty income Total revenues Costs and operating expenses Cost of goods sold Selling, general and administrative expenses Impairment of goodwill and intangible assets Total costs and operating expenses Operating income Interest income Interest expense Other income (expense), net Income from continuing operations before income taxes Income taxes Income from continuing operations Loss from discontinued operations, net of tax Net income Earnings per common share - basic Continuing operations Discontinued operations Total earnings per common share - basic Earnings per common share - diluted Continuing operations Discontinued operations Total earnings per common share - diluted Cash dividends per common share 6.196.335 4.243.798 79,644 10.519,777 1,499,226 9,094 (94.730) 2,001 1.415.591 243,064 1.172.527 (98,421) 1,074,106 10,244,728 1,787,927 7,152 (88,772) 1,028 1,707,335 392,204 1.315,131 (83,538) 1.231.593 $ 10,083,416 1.798,314 6,911 (86,104) (5,545) 1,713,576 385,827 1,327,749 (280,244) 1,047,505 $ $ $ 2.82 $ 3.07 3.09 $ (0.19) 2.90 $ (0.65) 2.42 2.58 S $ $ 3.02 2.78 (0.24) 2.54 1.5300 3.04 (0.19) 2.85 1.3300 $ $ S (0.64) 2.38 1.1075 S See notes to consolidated financial statements. VF CORPORATION Consolidated Statements of Comprehensive Income 2016 2014 Year Ended December 2015 In thousands $ 1,231,593 $ $ 1,074,106 1,047,505 (52,028) (24,382) (361.814) 586 (469,663) 6,075 (5.384) 65,212 2,584 50,922 (43,836) (62,556) 61,966 3,038 4,062 (1,571) (203,234) 37,518 5,445 60,588 Net income Other comprehensive income (loss) Foreign currency translation and other Gains (losses) arising during year Less income tax effect Defined benefit pension plans Current year actuarial gains (losses) and plan amendments Amortization of net deferred actuarial losses Amortization of deferred prior service costs Reclassification of net actuarial loss from settlement charge Less income tax effect Derivative financial instruments Gains (losses) arising during year Less income tax effect Reclassification to net income for (gains) losses realized Less income tax effect Marketable securities Gains (losses) arising during year Less income tax effect Reclassification to net income for (gains) losses realized Less income tax effect Other comprehensive income (loss) Comprehensive income 90,708 (9,672) (107,457) 35,092 89.993 (34,668) (64,976) 25,404 88,387 (34.736) 32,111 (12.619) (698) 274 495 (195) (1,177) 463 (340,950) 890,643 (490.552) 556,953 $ 1,075,865 $ $ See notes to consolidated financial statements. Based on the information in these financial statements, compute the 2016 return on common stockholders' equity, debt to assets ratio, and return on assets for each company. (Round answers to 1 decimal places, e.g. 15.2%.) Columbia Sportswear Company VF Corporation Return on common stockholders'equity Debt to assets Return on assets (c) Compute the payout ratio for each company. (Round answers to 1 decimal places, e.g. 15.2%.) Columbia Sportswear Company VF Corporation Payout ratio Which pays out a higher percentage of its earnings? A pays out a higher percentage of its earnings. COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands) Year Ended December 31, 2016 2015 198,439 $ 179,851 $ 2014 141,859 Net income ...... ..... $ Other comprehensive loss: Unrealized holding gains (losses) on available-for-sale securities (net of tax effects of $0,($3), and ($5), respectively)................. R Unrealized gains (losses) on derivative transactions (net of tax effects of ($1,922), ($849) and ($1,507), respectively).................. Foreign currency translation adjustments (net of tax effects of ($347), ($760) and $1,023, respectively)...... Other comprehensive loss. Comprehensive income. Comprehensive income attributable to non-controlling interest..... Comprehensive income attributable to Columbia Sportswear Company.... $ (2) 843 (4,485) (3,644) 194,795 4,678 190,117 (6) (2,908) (34,887) (37,801) 142,050 4,382 137,668 10 7,751 (27,789) (20,028) 121,831 4,185 117,646 $ $ See accompanying notes to consolidated financial statements COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) .................... .. December 31, 2016 2015 ASSETS Current Assets: Cash and cash equivalents........ .......... $ 551,389 $ 369,770 Short-term investments ........ 472 629 Accounts receivable, net (Note 5)... 333,678 371,953 Inventories 487,997 473,637 Prepaid expenses and other current assets..... 38,487 33,400 Total current assets... 1,412.023 1.249,389 Property, plant, and equipment, net (Note 6) 279,650 291,687 Intangible assets, net (Note 7) ...... 133,438 138,584 Goodwill (Note 7)....................................................... 68,594 68,594 Deferred income taxes (Note 10)... 92,494 76,181 Other non-current assets... 27,695 21,718 Total assets......... $ 2,013,894 $ 1,846,153 LIABILITIES AND EQUITY Current Liabilities: Short-term borrowings (Note 8)..... - $ 1,940 Accounts payable. 215,048 217,230 Accrued liabilities (Note 9)........... 142,158 141,862 Income taxes payable (Note 10) .......... 5,645 5,038 Total current liabilities............. 362,851 366,070 Note payable to related party (Note 22).... 14.053 15,030 Other long-term liabilities (Notes 11, 12)............. 42,622 40,172 Income taxes payable (Note 10) 12,710 8.839 Deferred income taxes (Note 10) 229 Total liabilities .. 432,383 430,340 Commitments and contingencies (Note 13) Shareholders' Equity: Preferred stock: 10,000 shares authorized; none issued and outstanding........... Common stock (no par value); 250,000 shares authorized; 69,873 and 69,277 issued and outstanding (Note 14)........ 53,801 34,776 Retained earnings. 1,529,636 1,385,860 Accumulated other comprehensive loss (Note 17)... (22,617) (20,836) Total Columbia Sportswear Company shareholders' equity 1,560,820 1.399,800 Non-controlling interest (Note 4).......... 20,691 16,013 Total equity........ 1,581,5111,415,813 Total liabilities and equity ...... $ 2,013,894 $ 1,846,153 147 See accompanying notes to consolidated financial statements VF CORPORATION Consolidated Statements of Income 2014 S Year Ended December 2016 2015 In thousands, except per share amounts 11,902,314 $ 11,909,635 $ 116,689 123.020 12.019,003 1 2.032,655 11,757,399 124,331 11.881,730 6,235,699 4,009,029 6,112,880 3,970,536 Net sales Royalty income Total revenues Costs and operating expenses Cost of goods sold Selling, general and administrative expenses Impairment of goodwill and intangible assets Total costs and operating expenses Operating income Interest income Interest expense Other income (expense), net Income from continuing operations before income taxes Income taxes Income from continuing operations Loss from discontinued operations, net of tax Net income Earnings per common share - basic Continuing operations Discontinued operations Total earnings per common share - basic Earnings per common share - diluted Continuing operations Discontinued operations Total earnings per common share - diluted Cash dividends per common share 6.196.335 4.243.798 79,644 10.519,777 1,499,226 9,094 (94.730) 2,001 1.415.591 243,064 1.172.527 (98,421) 1,074,106 10,244,728 1,787,927 7,152 (88,772) 1,028 1,707,335 392,204 1.315,131 (83,538) 1.231.593 $ 10,083,416 1.798,314 6,911 (86,104) (5,545) 1,713,576 385,827 1,327,749 (280,244) 1,047,505 $ $ $ 2.82 $ 3.07 3.09 $ (0.19) 2.90 $ (0.65) 2.42 2.58 S $ $ 3.02 2.78 (0.24) 2.54 1.5300 3.04 (0.19) 2.85 1.3300 $ $ S (0.64) 2.38 1.1075 S See notes to consolidated financial statements. VF CORPORATION Consolidated Statements of Comprehensive Income 2016 2014 Year Ended December 2015 In thousands $ 1,231,593 $ $ 1,074,106 1,047,505 (52,028) (24,382) (361.814) 586 (469,663) 6,075 (5.384) 65,212 2,584 50,922 (43,836) (62,556) 61,966 3,038 4,062 (1,571) (203,234) 37,518 5,445 60,588 Net income Other comprehensive income (loss) Foreign currency translation and other Gains (losses) arising during year Less income tax effect Defined benefit pension plans Current year actuarial gains (losses) and plan amendments Amortization of net deferred actuarial losses Amortization of deferred prior service costs Reclassification of net actuarial loss from settlement charge Less income tax effect Derivative financial instruments Gains (losses) arising during year Less income tax effect Reclassification to net income for (gains) losses realized Less income tax effect Marketable securities Gains (losses) arising during year Less income tax effect Reclassification to net income for (gains) losses realized Less income tax effect Other comprehensive income (loss) Comprehensive income 90,708 (9,672) (107,457) 35,092 89.993 (34,668) (64,976) 25,404 88,387 (34.736) 32,111 (12.619) (698) 274 495 (195) (1,177) 463 (340,950) 890,643 (490.552) 556,953 $ 1,075,865 $ $ See notes to consolidated financial statements

APPENDIX B

APPENDIX B