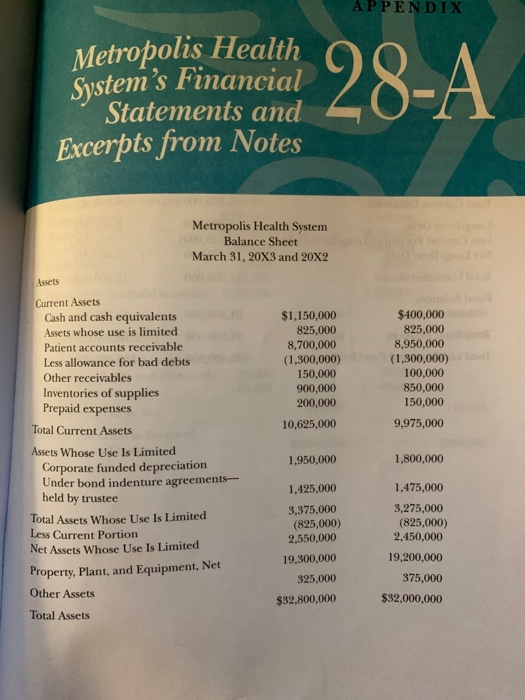

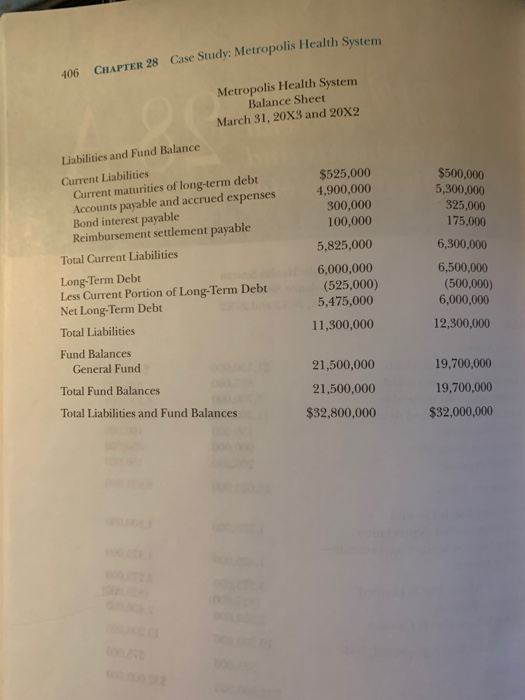

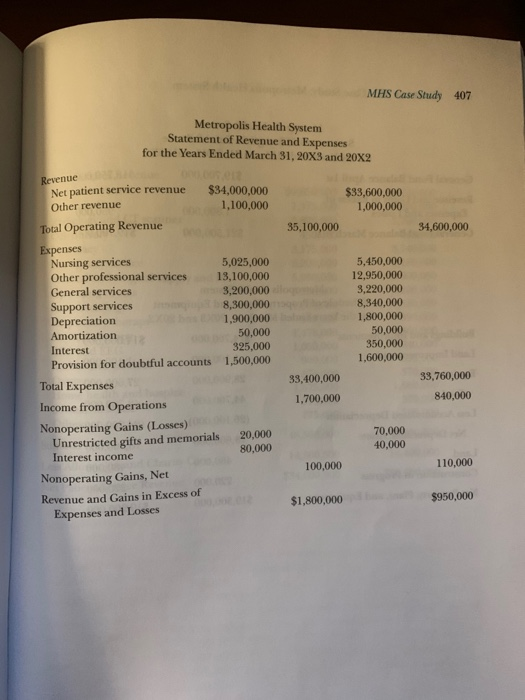

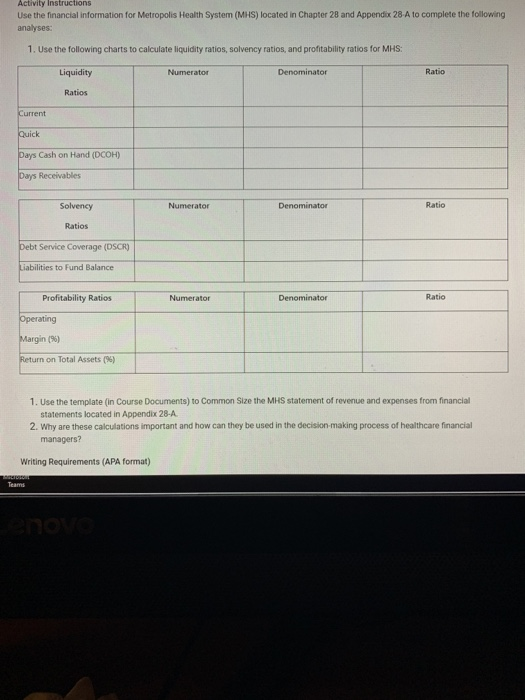

APPENDIX Metropolis Health System's Financial Statements and Excerpts from Notes Metropolis Health System Balance Sheet March 31, 20X3 and 20X2 Assets $1,150,000 825,000 8,700,000 (1,300,000) 150,000 900,000 200,000 10,625,000 $400,000 825,000 8,950,000 (1,300,000) 100,000 850,000 150,000 9,975,000 Current Assets Cash and cash equivalents Assets whose use is limited Patient accounts receivable Less allowance for bad debts Other receivables Inventories of supplies Prepaid expenses Total Current Assets Assets Whose Use Is Limited Corporate funded depreciation Under bond indenture agreements- held by trustee Total Assets Whose Use Is Limited Less Current Portion Net Assets Whose Use Is Limited Property, Plant, and Equipment, Net Other Assets Total Assets 1,950,000 1,800,000 1,425,000 3,375,000 (825,000) 2,550,000 19,300,000 325,000 $32,800,000 1,475,000 3,275,000 (825,000) 2,450,000 19,200,000 375,000 $32,000,000 406 CHAPTER 28 Case Study: Metropolis Health System Metropolis Health System Balance Sheet March 31, 20X3 and 20X2 Liabilities and Fund Balance Current Liabilities Current maturities of long-term debt Accounts payable and accrued expenses Bond interest payable Reimbursement settlement payable Total Current Liabilities Long-Term Debt Less Current Portion of Long-Term Debt Net Long-Term Debt $500,000 5,300,000 325,000 175,000 $525,000 4,900,000 300,000 100,000 5,825,000 6,000,000 (525,000) 5,475,000 11,300,000 6,300,000 6,500,000 (500,000) 6,000,000 12,300,000 19,700,000 Total Liabilities Fund Balances General Fund Total Fund Balances Total Liabilities and Fund Balances 21,500,000 21,500,000 $32,800,000 19,700,000 $32,000,000 MHS Case Study 407 Metropolis Health System Statement of Revenue and Expenses for the Years Ended March 31, 20X3 and 20X2 $33,600,000 1,000,000 35,100,000 34,600,000 Revenue Net patient service revenue $34,000,000 Other revenue 1,100,000 Total Operating Revenue Expenses Nursing services 5,025,000 Other professional services 13,100,000 General services 3,200,000 Support services 8,300,000 Depreciation 1,900,000 Amortization 50,000 Interest 325,000 Provision for doubtful accounts 1,500,000 5,450,000 12,950,000 3,220,000 8,340,000 1,800,000 50,000 350,000 1,600,000 Total Expenses 33,400,000 1,700,000 33,760,000 840,000 20,000 80,000 70,000 40,000 Income from Operations Nonoperating Gains (Losses) Unrestricted gifts and memorials Interest income Nonoperating Gains, Net Revenue and Gains in Excess of Expenses and Losses 100,000 110,000 $1,800,000 $950,000 Activity Instructions Use the financial information for Metropolis Health System (MHS) located in Chapter 28 and Appendix 28.A to complete the following analyses: 1. Use the following charts to calculate liquidity ratios, solvency ratios, and profitability ratios for MHS: Liquidity Numerator Denominator Ratios Quick Days Cash on Hand (DCOH) Days Receivables Solvency Numerator Denominator Ratio Ratios Debt Service Coverage (DSCR) Liabilities to Fund Balance Profitability Ratios Numerator Operating Margin (%) Return on Total Assets (96) 1. Use the template (in Course Documents) to Common Size the MHS statement of revenue and expenses from financial statements located in Appendix 28-A. 2. Why are these calculations important and how can they be used in the decision-making process of healthcare financial managers? Writing Requirements (APA format)