Answered step by step

Verified Expert Solution

Question

1 Approved Answer

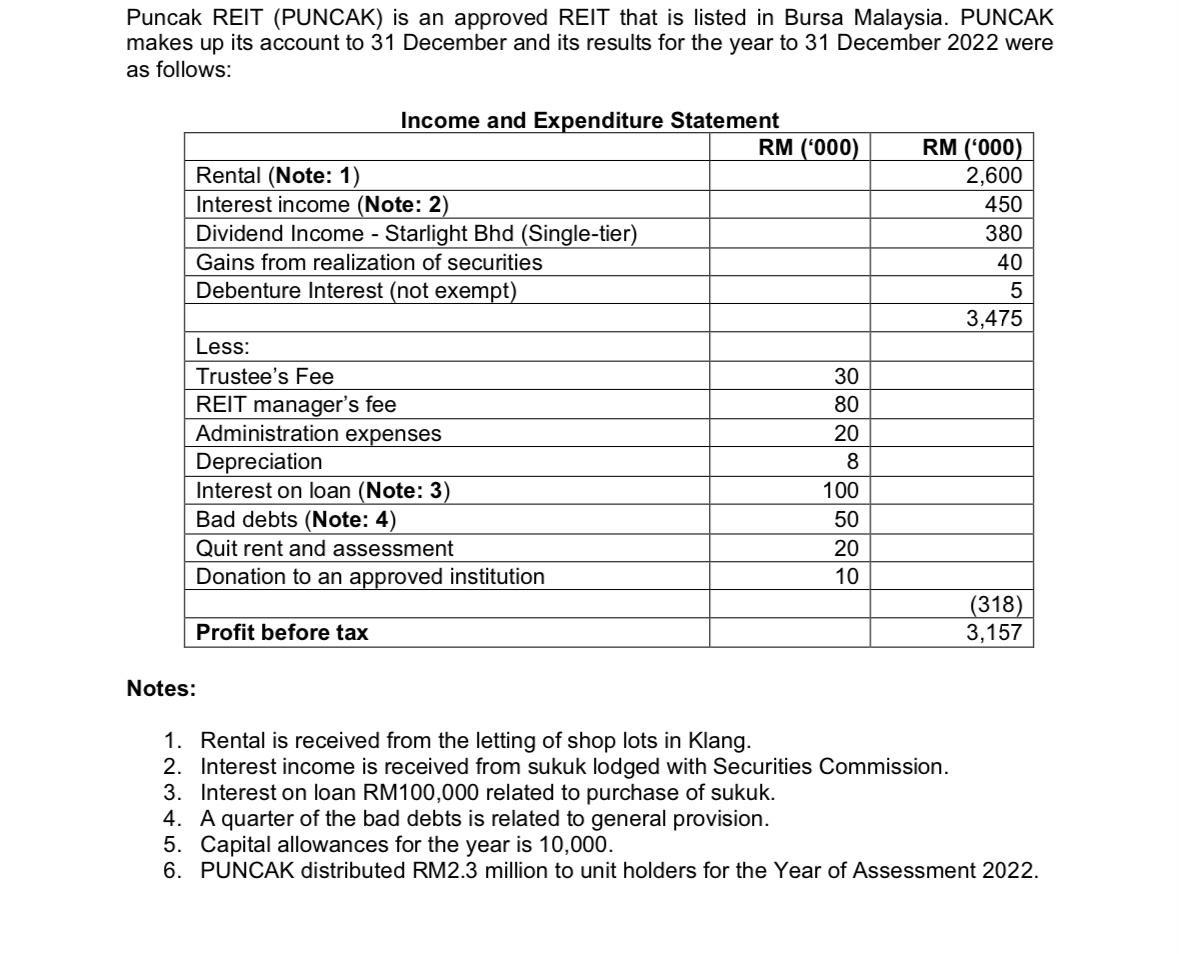

Puncak REIT (PUNCAK) is an approved REIT that is listed in Bursa Malaysia. PUNCAK makes up its account to 31 December and its results

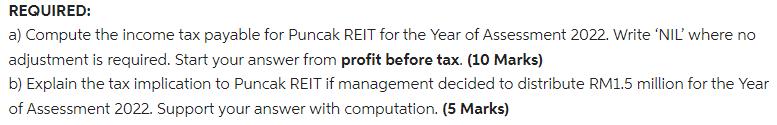

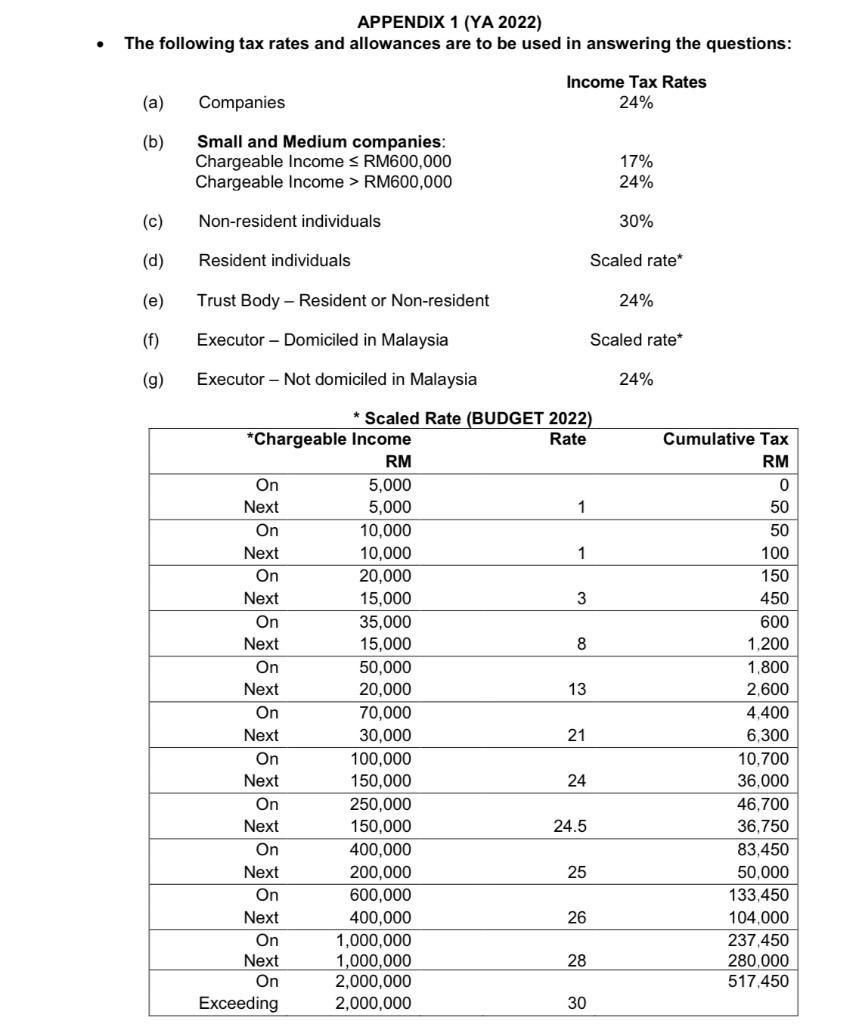

Puncak REIT (PUNCAK) is an approved REIT that is listed in Bursa Malaysia. PUNCAK makes up its account to 31 December and its results for the year to 31 December 2022 were as follows: Rental (Note: 1) Interest income (Note: 2) Dividend Income - Starlight Bhd (Single-tier) Gains from realization of securities Debenture Interest (not exempt) Income and Expenditure Statement Less: Trustee's Fee REIT manager's fee Administration expenses Depreciation Interest on loan (Note: 3) Bad debts (Note: 4) Quit rent and assessment Donation to an approved institution Profit before tax Notes: RM ('000) 30 80 20 8 100 50 20 10 RM ('000) 2,600 1. Rental is received from the letting of shop lots in Klang. 2. Interest income is received from sukuk lodged with Securities Commission. 3. Interest on loan RM100,000 related to purchase of sukuk. 450 380 40 5 3,475 (318) 3,157 4. A quarter of the bad debts is related to general provision. 5. Capital allowances for the year is 10,000. 6. PUNCAK distributed RM2.3 million to unit holders for the Year of Assessment 2022. REQUIRED: a) Compute the income tax payable for Puncak REIT for the Year of Assessment 2022. Write 'NIL' where no adjustment is required. Start your answer from profit before tax. (10 Marks) b) Explain the tax implication to Puncak REIT if management decided to distribute RM1.5 million for the Year of Assessment 2022. Support your answer with computation. (5 Marks) APPENDIX 1 (YA 2022) The following tax rates and allowances are to be used in answering the questions: (a) (b) (c) (d) (e) (f) (g) Companies Small and Medium companies: Chargeable Income RM600,000 Chargeable Income > RM600,000 Non-resident individuals Resident individuals Trust Body - Resident or Non-resident Executor - Domiciled in Malaysia Executor Not domiciled in Malaysia *Chargeable Income On Next On Next On Next On Next On Next On Next On Next On Next On Next On Next On Next On Exceeding RM 5,000 5,000 * Scaled Rate (BUDGET 2022) Rate 10,000 10,000 20,000 15,000 35,000 15,000 50,000 20,000 70,000 30,000 100,000 150,000 250,000 150,000 400,000 200,000 600,000 400,000 Income Tax Rates 24% 1,000,000 1,000,000 2,000,000 2,000,000 1 1 3 8 13 21 24 24.5 25 26 28 30 17% 24% 30% Scaled rate* 24% Scaled rate* 24% Cumulative Tax RM 0 50 50 100 150 450 600 1,200 1,800 2,600 4,400 6,300 10,700 36,000 46,700 36.750 83,450 50,000 133,450 104,000 237,450 280,000 517,450 Personal reliefs (BUDGET 2022) Self Disabled self, additional Spouse relief (normal) - no income/ joint assessment Disabled spouse - additional spouse relief Child basic rate Child - more than 18 years old and study at higher institution Disabled child Disabled child more than 18 years old and study at higher Childcare (below six years old) Medical expenses expended on parents Medical expenses expended on self, spouse or child with serious disease, including up to RM1,000 medical examination Parental care Basic supporting equipment for disabled self, spouse, child or parent Study course fees for skills or qualifications Lifestyle allowance Rate of Capital Allowances Industrial buildings Plant and machinery - general Motor vehicles and heavy machinery Office equipment, furniture and fittings Computers Agriculture allowance Buildings for the welfare of or as living accommodation for farm employees Other buildings used in the business All other qualifying agricultural expenditure Rebates Chargeable income not exceeding RM35,000 Individual basic rate Husband and wife are separately assessed Individual entitled to a deduction in respect of a spouse or a former wife Initial allowance (IA) Rate % 10 20 20 20 20 (each) (each) (each) (each) Nil Nil Nil (maximum) (maximum) (maximum) (each) (maximum) (maximum) (maximum) RM 9,000 6,000 4,000 5,000 2,000 8,000 6,000 14,000 20 10 50 3,000 8,000 8,000 1,000 6,000 7,000 2,500 RM 400 400 each 800 Annual allowance (AA) Rate % 3 14 20 10 20

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started