Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Apple decides to issue debt for the first time. They are going to raise ( $ 4.2 ) billion dollars to help finance their first

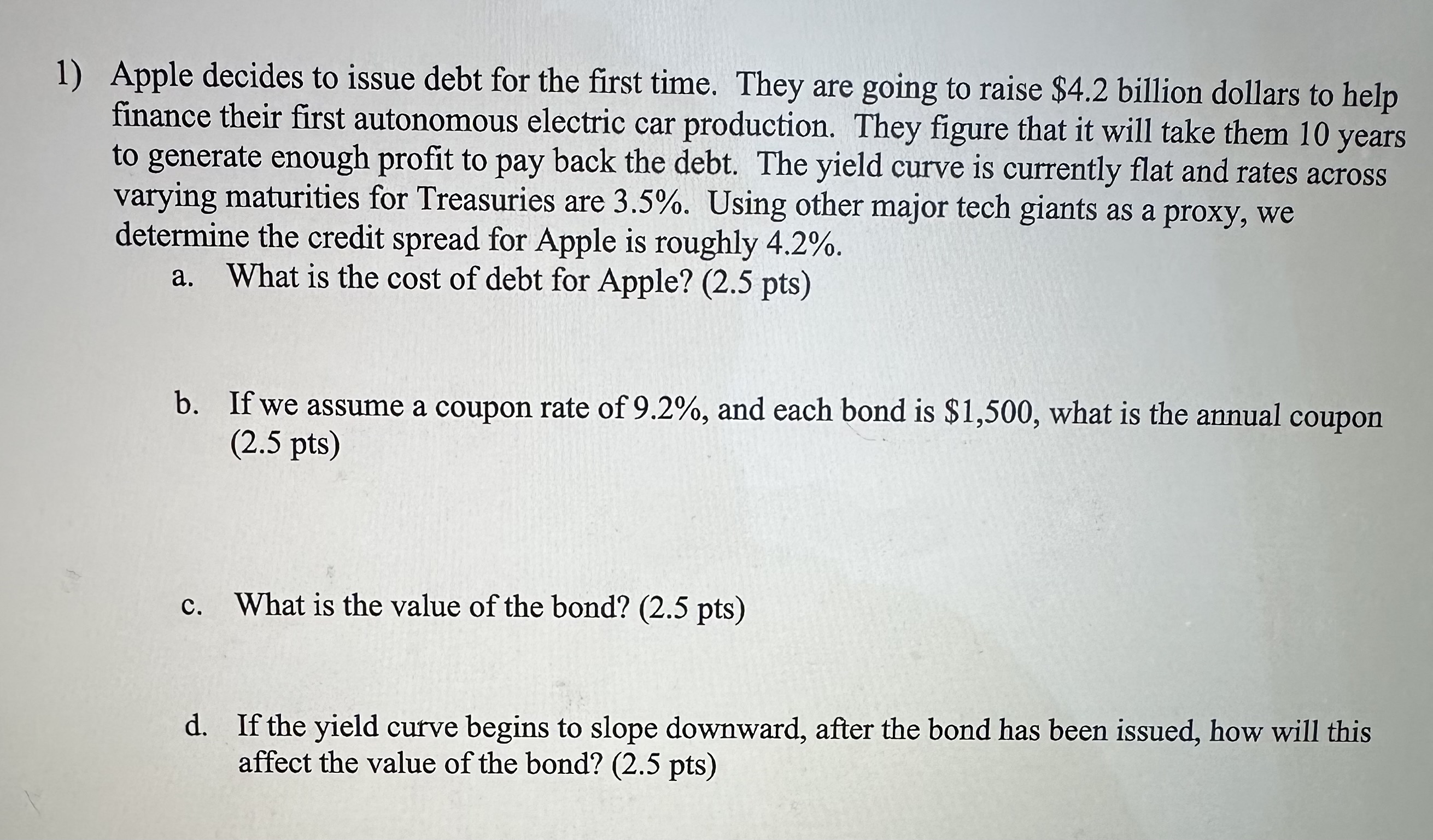

Apple decides to issue debt for the first time. They are going to raise \\( \\$ 4.2 \\) billion dollars to help finance their first autonomous electric car production. They figure that it will take them 10 years to generate enough profit to pay back the debt. The yield curve is currently flat and rates across varying maturities for Treasuries are 3.5\\%. Using other major tech giants as a proxy, we determine the credit spread for Apple is roughly 4.2\\%. a. What is the cost of debt for Apple? (2.5 pts) b. If we assume a coupon rate of \9.2, and each bond is \\( \\$ 1,500 \\), what is the annual coupon \\( (2.5 \\mathrm{pts}) \\) c. What is the value of the bond? ( \\( 2.5 \\mathrm{pts}) \\) d. If the yield curve begins to slope downward, after the bond has been issued, how will this affect the value of the bond? ( \\( 2.5 \\mathrm{pts}) \\)

Apple decides to issue debt for the first time. They are going to raise \\( \\$ 4.2 \\) billion dollars to help finance their first autonomous electric car production. They figure that it will take them 10 years to generate enough profit to pay back the debt. The yield curve is currently flat and rates across varying maturities for Treasuries are 3.5\\%. Using other major tech giants as a proxy, we determine the credit spread for Apple is roughly 4.2\\%. a. What is the cost of debt for Apple? (2.5 pts) b. If we assume a coupon rate of \9.2, and each bond is \\( \\$ 1,500 \\), what is the annual coupon \\( (2.5 \\mathrm{pts}) \\) c. What is the value of the bond? ( \\( 2.5 \\mathrm{pts}) \\) d. If the yield curve begins to slope downward, after the bond has been issued, how will this affect the value of the bond? ( \\( 2.5 \\mathrm{pts}) \\) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started