Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finally, you have saved up a little money and have decided to get your feet wet with some investing. While there is still a

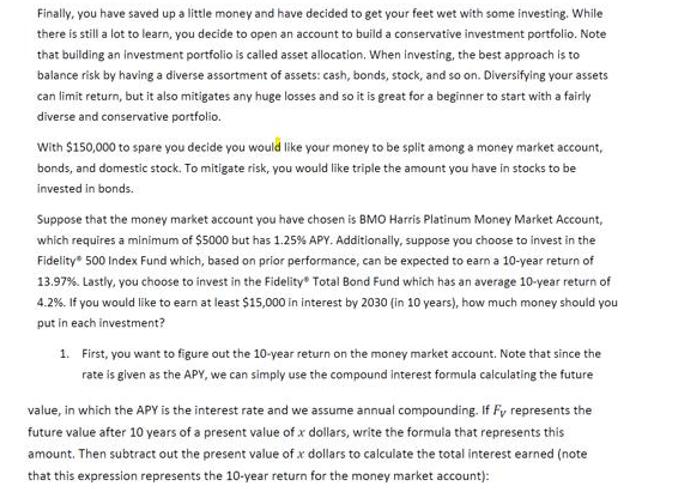

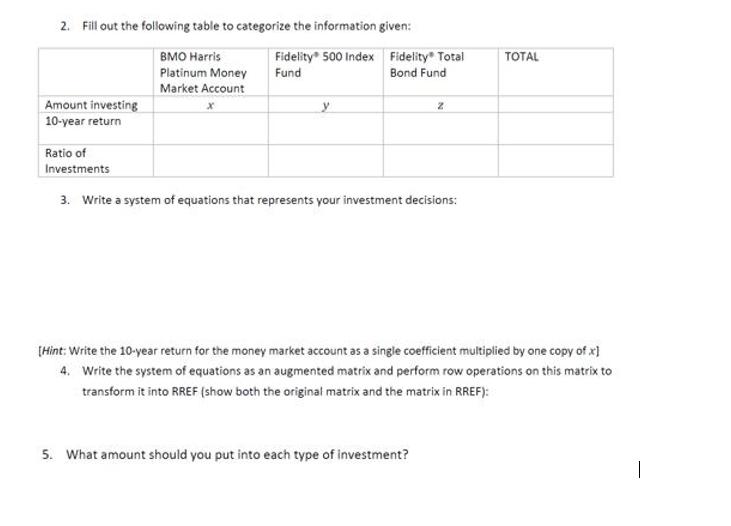

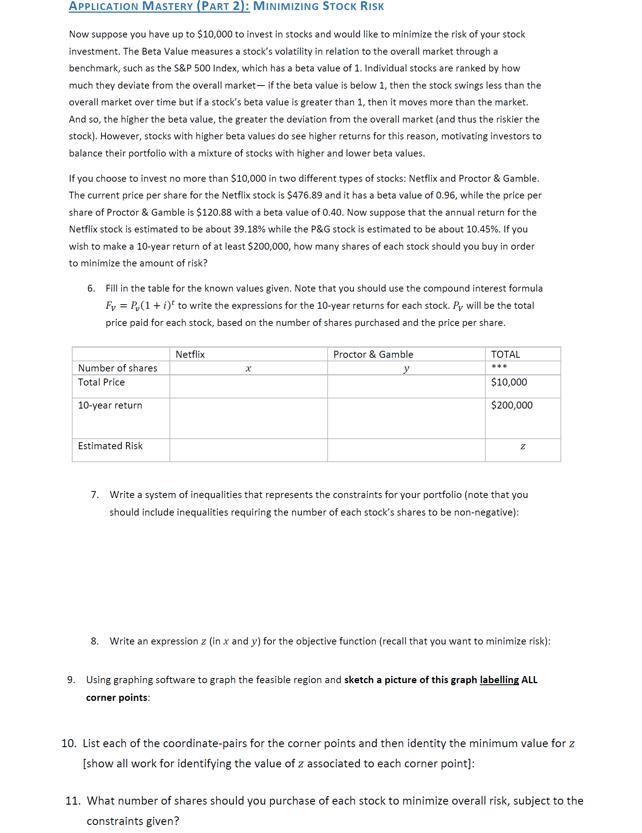

Finally, you have saved up a little money and have decided to get your feet wet with some investing. While there is still a lot to learn, you decide to open an account to build a conservative investment portfolio. Note that building an investment portfolio is called asset allocation. When investing, the best approach is to balance risk by having a diverse assortment of assets: cash, bonds, stock, and so on. Diversifying your assets can limit return, but it also mitigates any huge losses and so it is great for a beginner to start with a fairly diverse and conservative portfolio. With $150,000 to spare you decide you would like your money to be split among a money market account, bonds, and domestic stock. To mitigate risk, you would like triple the amount you have in stocks to be invested in bonds. Suppose that the money market account you have chosen is BMO Harris Platinum Money Market Account, which requires a minimum of $5000 but has 1.25% APY. Additionally, suppose you choose to invest in the Fidelity 500 Index Fund which, based on prior performance, can be expected to earn a 10-year return of 13.97%. Lastly, you choose to invest in the Fidelity Total Bond Fund which has an average 10-year return of 4.2%. If you would like to earn at least $15,000 in interest by 2030 (in 10 years), how much money should you put in each investment? 1. First, you want to figure out the 10-year return on the money market account. Note that since the rate is given as the APY, we can simply use the compound interest formula calculating the future value, in which the APY is the interest rate and we assume annual compounding. If Fy represents the future value after 10 years of a present value of x dollars, write the formula that represents this amount. Then subtract out the present value of x dollars to calculate the total interest earned (note that this expression represents the 10-year return for the money market account): 2. Fill out the following table to categorize the information given: BMO Harris Platinum Money Market Account Fidelity 500 Index Fund Amount investing 10-year return Ratio of Investments y Fidelity Total Bond Fund Z 3. Write a system of equations that represents your investment decisions: 5. What amount should you put into each type of investment? TOTAL [Hint: Write the 10-year return for the money market account as a single coefficient multiplied by one copy of x] 4. Write the system of equations as an augmented matrix and perform row operations on this matrix to transform it into RREF (show both the original matrix and the matrix in RREF): APPLICATION MASTERY (PART 2): MINIMIZING STOCK RISK Now suppose you have up to $10,000 to invest in stocks and would like to minimize the risk of your stock investment. The Beta Value measures a stock's volatility in relation to the overall market through a benchmark, such as the S&P 500 Index, which has a beta value of 1. Individual stocks are ranked by how much they deviate from the overall market- if the beta value is below 1, then the stock swings less than the overall market over time but if a stock's beta value is greater than 1, then it moves more than the market. And so, the higher the beta value, the greater the deviation from the overall market (and thus the riskier the stock). However, stocks with higher beta values do see higher returns for this reason, motivating investors to balance their portfolio with a mixture of stocks with higher and lower beta values. If you choose to invest no more than $10,000 in two different types of stocks: Netflix and Proctor & Gamble. The current price per share for the Netflix stock is $476.89 and it has a beta value of 0.96, while the price per share of Proctor & Gamble is $120.88 with a beta value of 0.40. Now suppose that the annual return for the Netflix stock is estimated to be about 39.18% while the P&G stock is estimated to be about 10.45%. If you wish to make a 10-year return of at least $200,000, how many shares of each stock should you buy in order to minimize the amount of risk? 6. Fill in the table for the known values given. Note that you should use the compound interest formula Fy = P(1 + i) to write the expressions for the 10-year returns for each stock. Py will be the total price paid for each stock, based on the number of shares purchased and the price per share. Number of shares Total Price 10-year return Estimated Risk Netflix X Proctor & Gamble y TOTAL $10,000 $200,000 Z 7. Write a system of inequalities that represents the constraints for your portfolio (note that you should include inequalities requiring the number of each stock's shares to be non-negative): 8. Write an expression z (in x and y) for the objective function (recall that you want to minimize risk): 9. Using graphing software to graph the feasible region and sketch a picture of this graph labelling ALL corner points: 10. List each of the coordinate-pairs for the corner points and then identity the minimum value for z [show all work for identifying the value of z associated to each corner point]: 11. What number of shares should you purchase of each stock to minimize overall risk, subject to the constraints given?

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To complete the requirements in Part 1 and Part 2 of the application mastery lets solve the problems step by step Part 1 Building an Investment Portfo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started