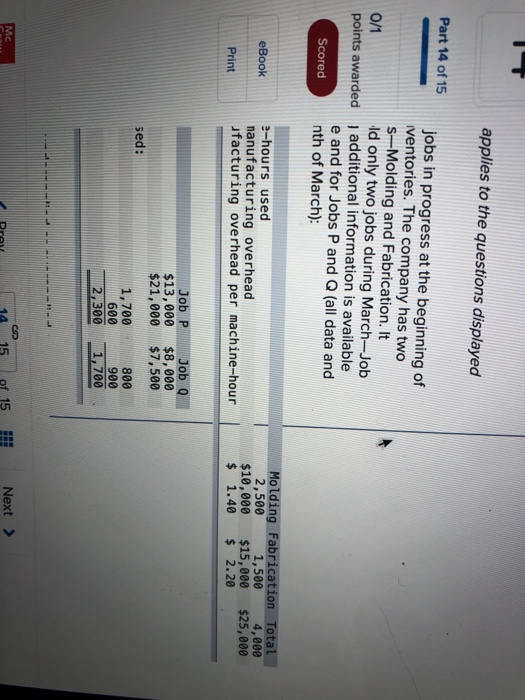

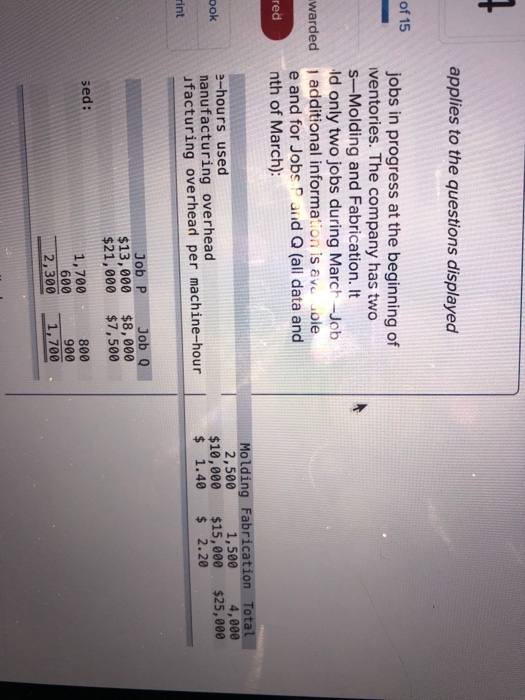

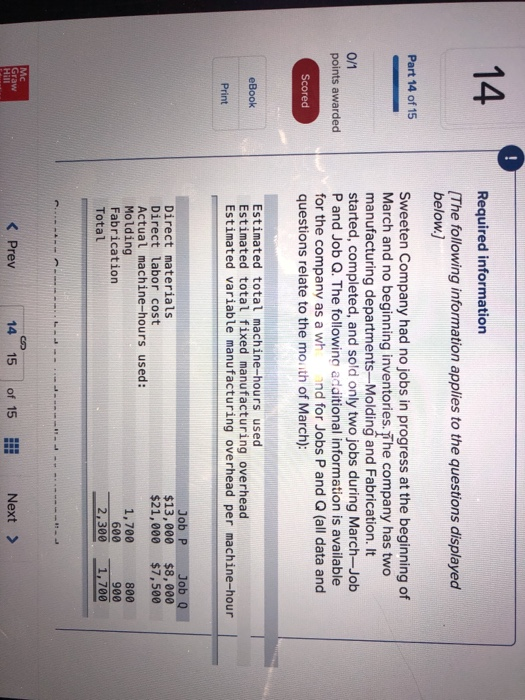

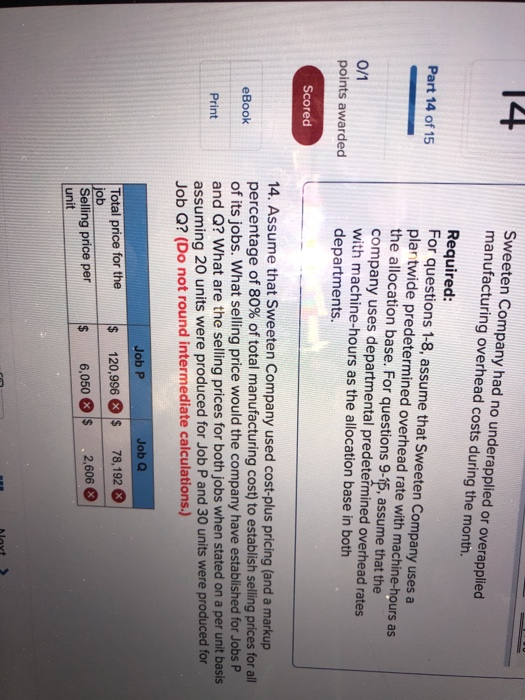

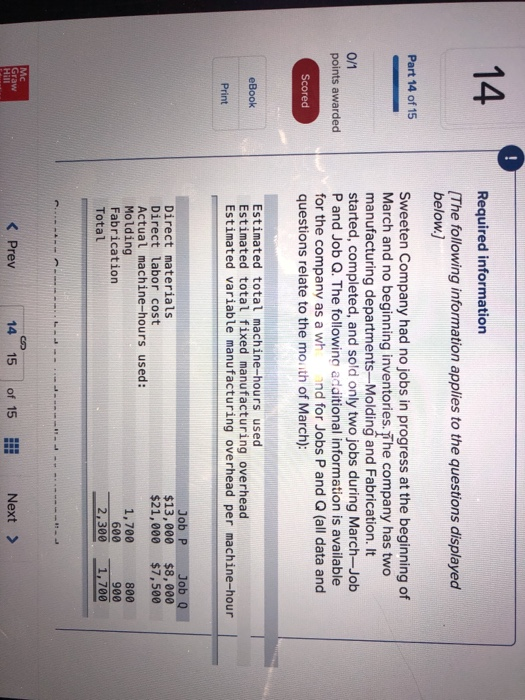

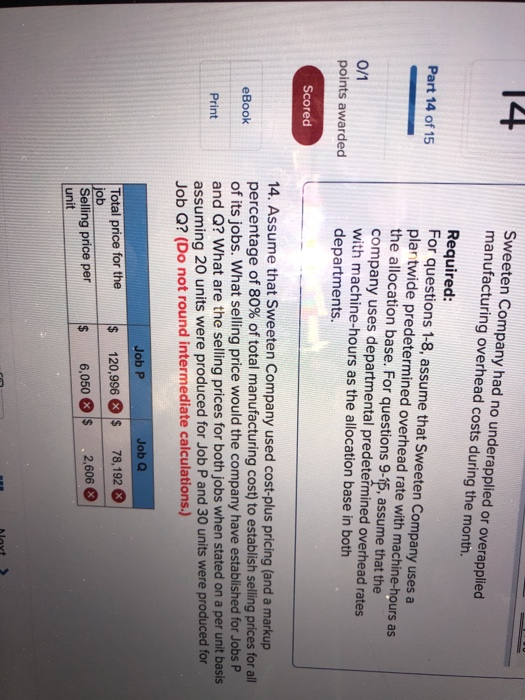

applies to the questions displayed Part 14 of 15 jobs in progress at the beginning of iventories. The company has two s-Molding and Fabrication. It 0/1 Id only two jobs during March-Job points awarded additional information is available e and for Jobs P and Q (all data and Scored nth of March): eBook 2-hours used nanufacturing overhead ufacturing overhead per machine-hour Molding Fabrication Total 2,500 1,500 4,000 $10,000 $15,000 $25,000 $ 1.40 $ 2.20 Print Job P $13,000 $21,000 Job O $8,000 $7,500 sed: 1,700 600 800 900 1,700 2,300 Mc CP # 15 of 15 Next > 7 applies to the questions displayed of 15 jobs in progress at the beginning of ventories. The company has two s-Molding and Fabrication. It Id only two jobs during March --Job warded additional information is ava sole e and for Jobs and Q (all data and red nth of March): Molding Fabrication Total 2,500 1,500 4,000 $10,000 $15,000 $25,000 $ 1.40 $ 2.20 ook 2-hours used nanufacturing overhead ufacturing overhead per machine-hour Tint Job P $13,000 $21,000 Job $8,000 $7,500 sed: 1,700 600 2,300 800 900 1,700 14 Required information [The following information applies to the questions displayed below.) Part 14 of 15 0/1 points awarded Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments --Molding and Fabrication. It started, completed, and sold only two jobs during March-Job P and Job Q. The following additional information is available for the company as a wh and for Jobs P and Q (all data and questions relate to the month of March): Scored eBook Estimated total machine-hours used Estimated total fixed manufacturing overhead Estimated variabl manufacturing overhead per machine-hour Print Job P Job $13,000 $8,000 $21,000 $7,500 Direct materials Direct labor cost Actual machine-hours used: Molding Fabrication Total 1,700 600 2,300 800 900 1,700 --- Mc Graw Hill 14 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Part 14 of 15 Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. 0/1 points awarded Scored eBook 14. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis assuming 20 units were produced for Job P and 30 units were produced for Job Q? (Do not round intermediate calculations.) Print Job P Job Q Total price for the 120,996 $ 78,192 job Selling price per unit $ 6,050 2,606