Answered step by step

Verified Expert Solution

Question

1 Approved Answer

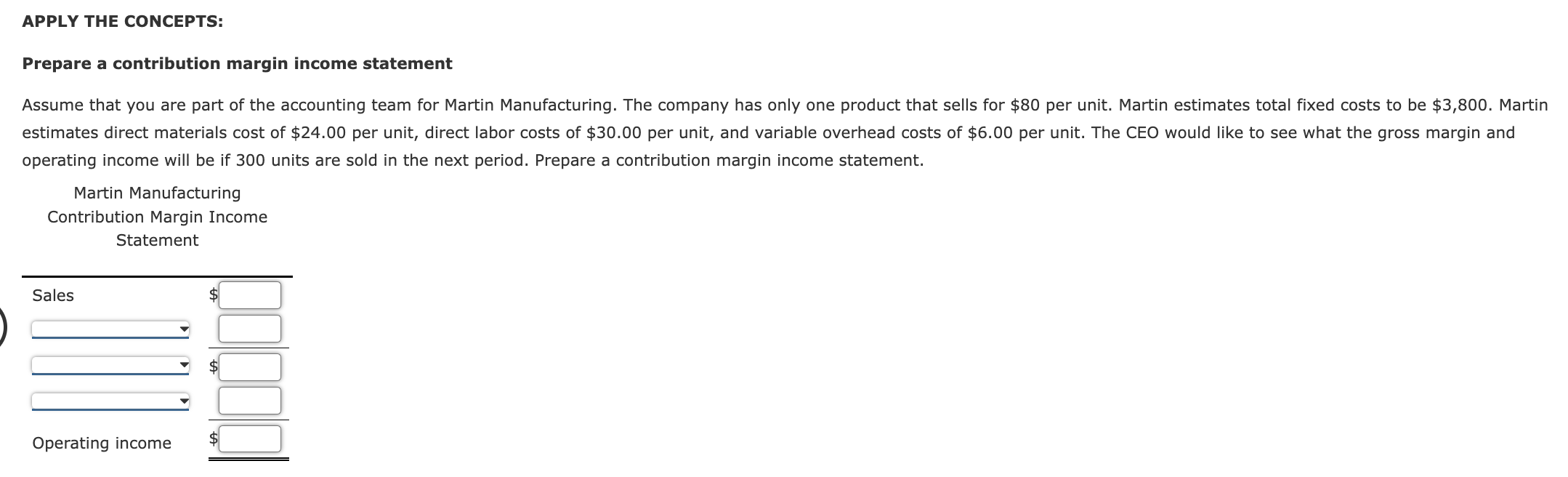

APPLY THE CONCEPTS: Prepare a contribution margin income statement operating income will be if 300 units are sold in the next period. Prepare a contribution

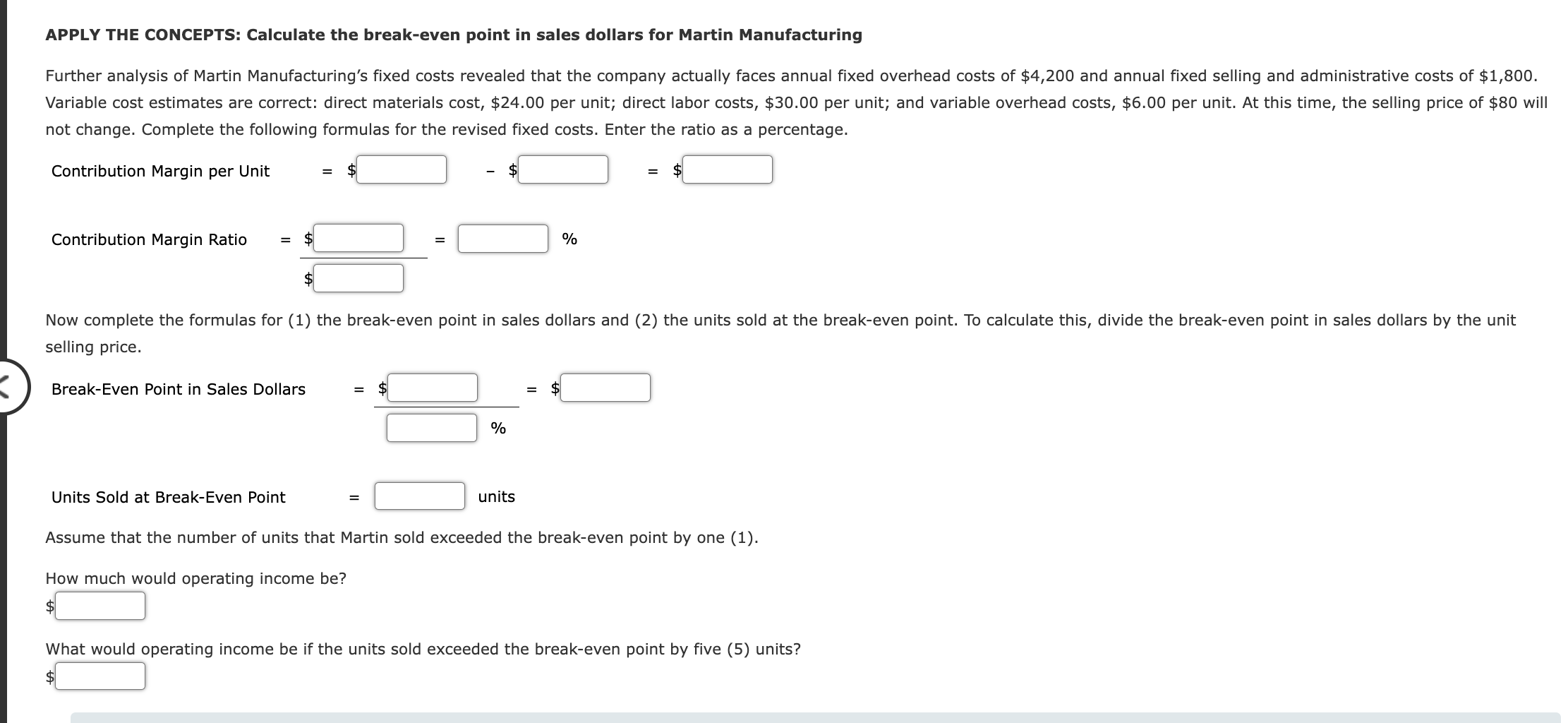

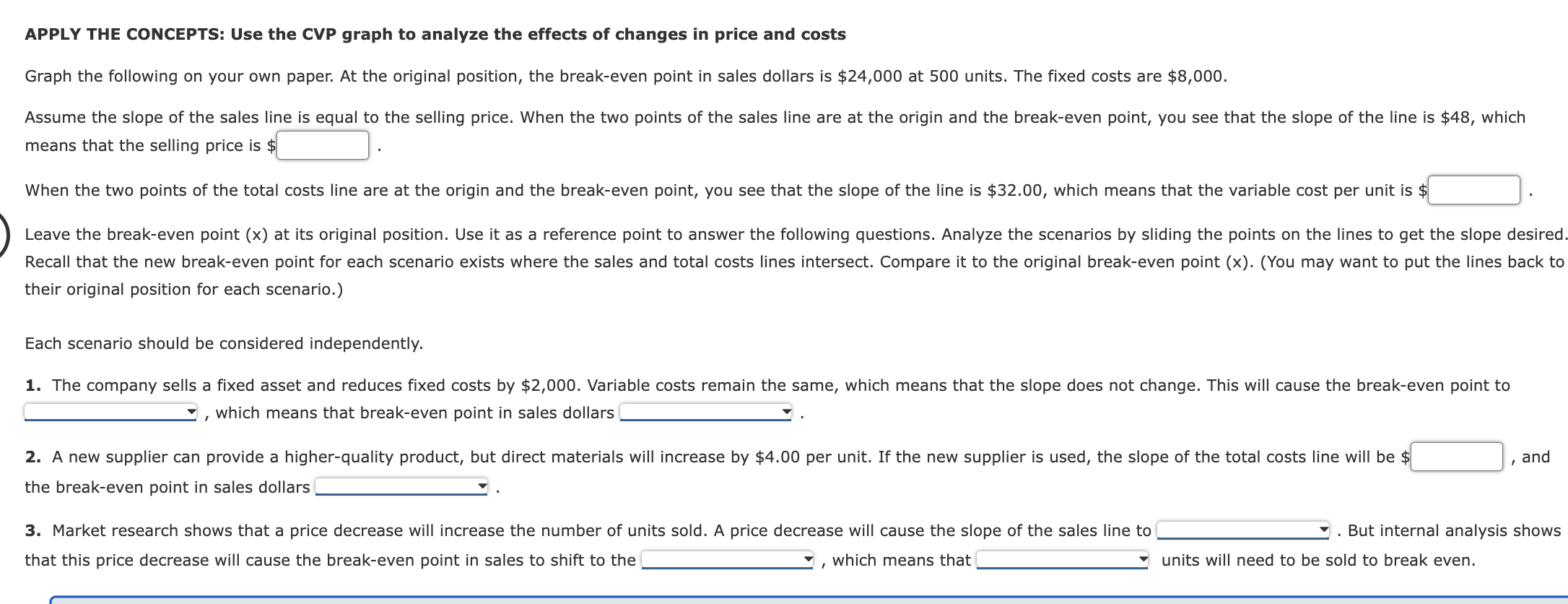

APPLY THE CONCEPTS: Prepare a contribution margin income statement operating income will be if 300 units are sold in the next period. Prepare a contribution margin income statement. Martin Manufacturing Contribution Margin Income Statement APPLY THE CONCEPTS: Calculate the break-even point in sales dollars for Martin Manufacturing not change. Complete the following formulas for the revised fixed costs. Enter the ratio as a percentage. Contribution Margin per Unit =$$=$ selling price. Units Sold at Break-Even Point = units Assume that the number of units that Martin sold exceeded the break-even point by one (1). How much would operating income be? $ What would operating income be if the units sold exceeded the break-even point by five (5) units? $ APPLY THE CONCEPTS: Use the CVP graph to analyze the effects of changes in price and costs Graph the following on your own paper. At the original position, the break-even point in sales dollars is $24,000 at 500 units. The fixed costs are $8,000. means that the selling price is & their original position for each scenario.) Each scenario should be considered independently. , which means that break-even point in sales dollars , and the break-even point in sales dollars 3. Market research shows that a price decrease will increase the number of units sold. A price decrease will cause the slope of the sales line to But internal analysis shows that this price decrease will cause the break-even point in sales to shift to the , which means that units will need to be sold to break even

APPLY THE CONCEPTS: Prepare a contribution margin income statement operating income will be if 300 units are sold in the next period. Prepare a contribution margin income statement. Martin Manufacturing Contribution Margin Income Statement APPLY THE CONCEPTS: Calculate the break-even point in sales dollars for Martin Manufacturing not change. Complete the following formulas for the revised fixed costs. Enter the ratio as a percentage. Contribution Margin per Unit =$$=$ selling price. Units Sold at Break-Even Point = units Assume that the number of units that Martin sold exceeded the break-even point by one (1). How much would operating income be? $ What would operating income be if the units sold exceeded the break-even point by five (5) units? $ APPLY THE CONCEPTS: Use the CVP graph to analyze the effects of changes in price and costs Graph the following on your own paper. At the original position, the break-even point in sales dollars is $24,000 at 500 units. The fixed costs are $8,000. means that the selling price is & their original position for each scenario.) Each scenario should be considered independently. , which means that break-even point in sales dollars , and the break-even point in sales dollars 3. Market research shows that a price decrease will increase the number of units sold. A price decrease will cause the slope of the sales line to But internal analysis shows that this price decrease will cause the break-even point in sales to shift to the , which means that units will need to be sold to break even Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started