Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Apply to each scenario. Each case is insured under the OASDI program. SUMMARY 411 CASE APPLICATION Sam, age 35, and Kristy, age 33, are married

Apply to each scenario. Each case is insured under the OASDI program.

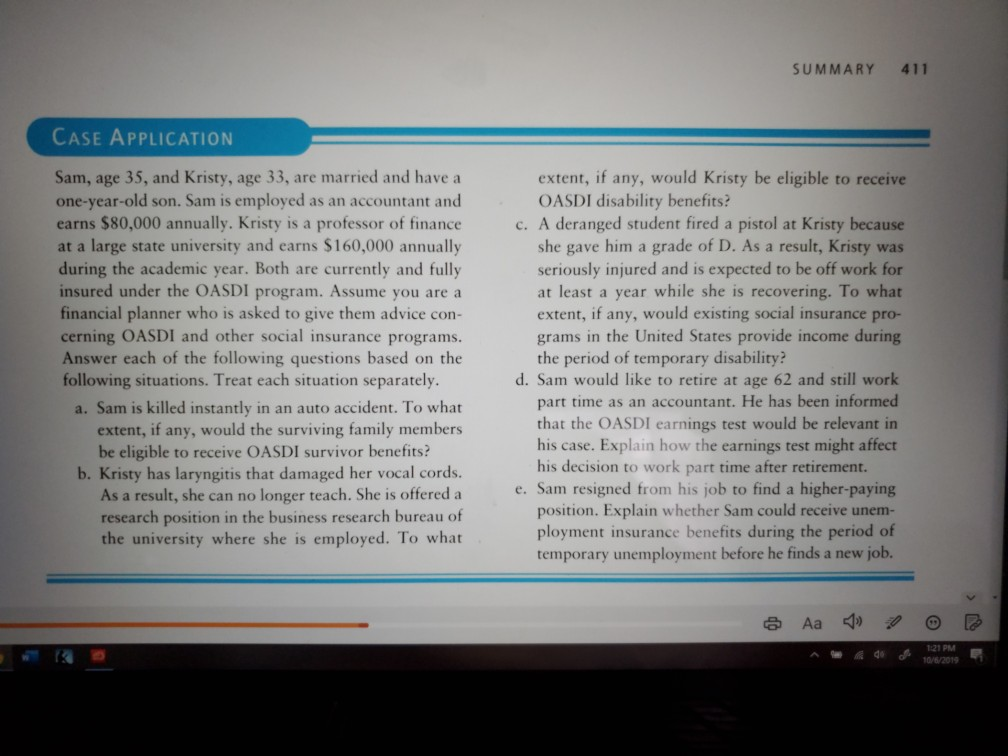

SUMMARY 411 CASE APPLICATION Sam, age 35, and Kristy, age 33, are married and have a one-year-old son. Sam is employed as an accountant and earns $80,000 annually. Kristy is a professor of finance at a large state university and earns $160,000 annually during the academic year. Both are currently and fully insured under the OASDI program. Assume you are a financial planner who is asked to give them advice con- cerning OASDI and other social insurance programs. Answer each of the following questions based on the following situations. Treat each situation separately. a. Sam is killed instantly in an auto accident. To what extent, if any, would the surviving family members be eligible to receive OASDI survivor benefits? b. Kristy has laryngitis that damaged her vocal cords. As a result, she can no longer teach. She is offered a research position in the business research bureau of the university where she is employed. To what extent, if any, would Kristy be eligible to receive OASDI disability benefits? c. A deranged student fired a pistol at Kristy because she gave him a grade of D. As a result, Kristy was seriously injured and is expected to be off work for at least a year while she is recovering. To what extent, if any, would existing social insurance pro- grams in the United States provide income during the period of temporary disability? d. Sam would like to retire at age 62 and still work! part time as an accountant. He has been informed that the OASDI earnings test would be relevant in his case. Explain how the earnings test might affect his decision to work part time after retirement. e. Sam resigned from his job to find a higher-paying position. Explain whether Sam could receive unem- ployment insurance benefits during the period of temporary unemployment before he finds a new job. Aa 1 de 121 PM 10/8/2019 21 PM SUMMARY 411 CASE APPLICATION Sam, age 35, and Kristy, age 33, are married and have a one-year-old son. Sam is employed as an accountant and earns $80,000 annually. Kristy is a professor of finance at a large state university and earns $160,000 annually during the academic year. Both are currently and fully insured under the OASDI program. Assume you are a financial planner who is asked to give them advice con- cerning OASDI and other social insurance programs. Answer each of the following questions based on the following situations. Treat each situation separately. a. Sam is killed instantly in an auto accident. To what extent, if any, would the surviving family members be eligible to receive OASDI survivor benefits? b. Kristy has laryngitis that damaged her vocal cords. As a result, she can no longer teach. She is offered a research position in the business research bureau of the university where she is employed. To what extent, if any, would Kristy be eligible to receive OASDI disability benefits? c. A deranged student fired a pistol at Kristy because she gave him a grade of D. As a result, Kristy was seriously injured and is expected to be off work for at least a year while she is recovering. To what extent, if any, would existing social insurance pro- grams in the United States provide income during the period of temporary disability? d. Sam would like to retire at age 62 and still work! part time as an accountant. He has been informed that the OASDI earnings test would be relevant in his case. Explain how the earnings test might affect his decision to work part time after retirement. e. Sam resigned from his job to find a higher-paying position. Explain whether Sam could receive unem- ployment insurance benefits during the period of temporary unemployment before he finds a new job. Aa 1 de 121 PM 10/8/2019 21 PMStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started