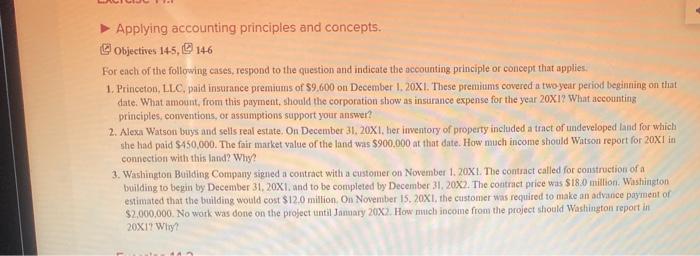

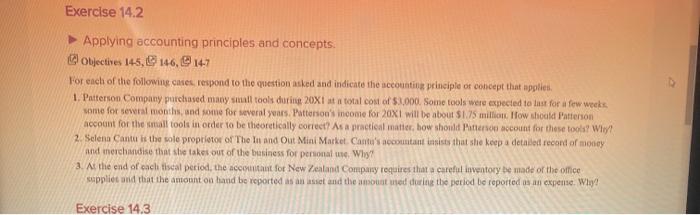

>> Applying accounting principles and concepts. Objectives 145, 146 For each of the following cases, respond to the question and indicate the accounting principle or concept that applies. 1. Princeton, LLC, paid insurance premiums of S9,600 on December 1, 20X1. These premiums covered a two-year period beginning on that date. What amount, from this payment should the corporation show as insurance expense for the year 20X1? What accounting principles, conventions, or assumptions support your answer? 2. Alexa Watson buys and sells real estate. On December 31, 20X1. her inventory of property included a tract of undeveloped and for which she had paid $450,000. The fair market value of the land was $900,000 at that date. How much income should Watson report for 20X1 in connection with this land? Why? 3. Washington Building Company signed a contract with a customer on November 1, 20X1. The contract called for construction of a building to begin by December 31, 20X1. and to be completed by December 31, 20X2. The contract price was $18.0 million. Washington estimated that the building would cost $12.0 million On November 15, 20XI, the customer was required to make an advance payment of $2.000.000. No work was done on the project until January 20x2. How much income from the project should Washington report in 20X1? Wit? Exercise 14.2 Applying accounting principles and concepts. Qobjectives 145, 146, 147 For each of the following cases, respond to the question asked and indicate the accounting principle or concept that applies 1. Patterson Company purchased many small tools during 20X1st total cost of $3.000. Some tools were expected to last for a few weeks. some for several months, and some for several years. Patterson's income for 20x1 will be about $1.75 million How should Patterson account for the small tools in order to be theoretically correct? As a practical matter how should Person account for these tools? W 2. Selena Canta is the sole proprietor of The In and Out Mini Market. Cantu's accountant insists that she keep a detailed record of money and merchandise that she takes out of the business for personal use. Why? 2. At the end of each tiscal period, the account for New Zealand Company requires that a careful inventory be made of the office suppliet and that the amount on hand be reported is an isset and the amount sed during the period be reported as an expense. Why! Exercise 14.3