Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Applying the gordon growth model to altria group(MO). 3. Applying the Gordon Growth Model to Altria Group (MO). a. What is the consensus estimate for

Applying the gordon growth model to altria group(MO).

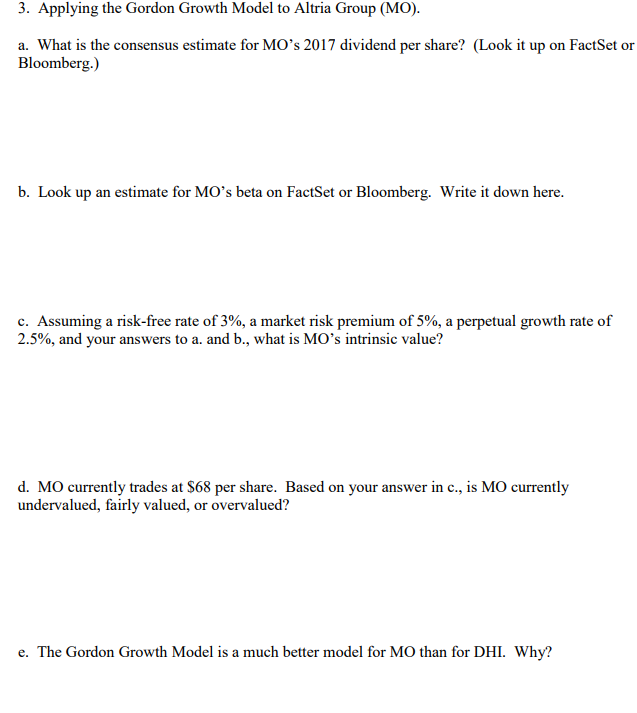

3. Applying the Gordon Growth Model to Altria Group (MO). a. What is the consensus estimate for MO's 2017 dividend per share? (Look it up on FactSet or Bloomberg.) b. Look up an estimate for MO's beta on FactSet or Bloomberg. Write it down here. c. Assuming a risk-free rate of 3%, a market risk premium of 5%, a perpetual growth rate of 2.5%, and your answers to a. and b., what is Mo's intrinsic value? d. MO currently trades at $68 per share. Based on your answer in c., is MO currently undervalued, fairly valued, or overvalued? e. The Gordon Growth Model is a much better model for MO than for DHI. Why? 3. Applying the Gordon Growth Model to Altria Group (MO). a. What is the consensus estimate for MO's 2017 dividend per share? (Look it up on FactSet or Bloomberg.) b. Look up an estimate for MO's beta on FactSet or Bloomberg. Write it down here. c. Assuming a risk-free rate of 3%, a market risk premium of 5%, a perpetual growth rate of 2.5%, and your answers to a. and b., what is Mo's intrinsic value? d. MO currently trades at $68 per share. Based on your answer in c., is MO currently undervalued, fairly valued, or overvalued? e. The Gordon Growth Model is a much better model for MO than for DHI. Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started