Answered step by step

Verified Expert Solution

Question

1 Approved Answer

= Consider a representative household in the static consumption-leisure model with prefer- ences given by u(c, l) Ac+1. The household has a unit time

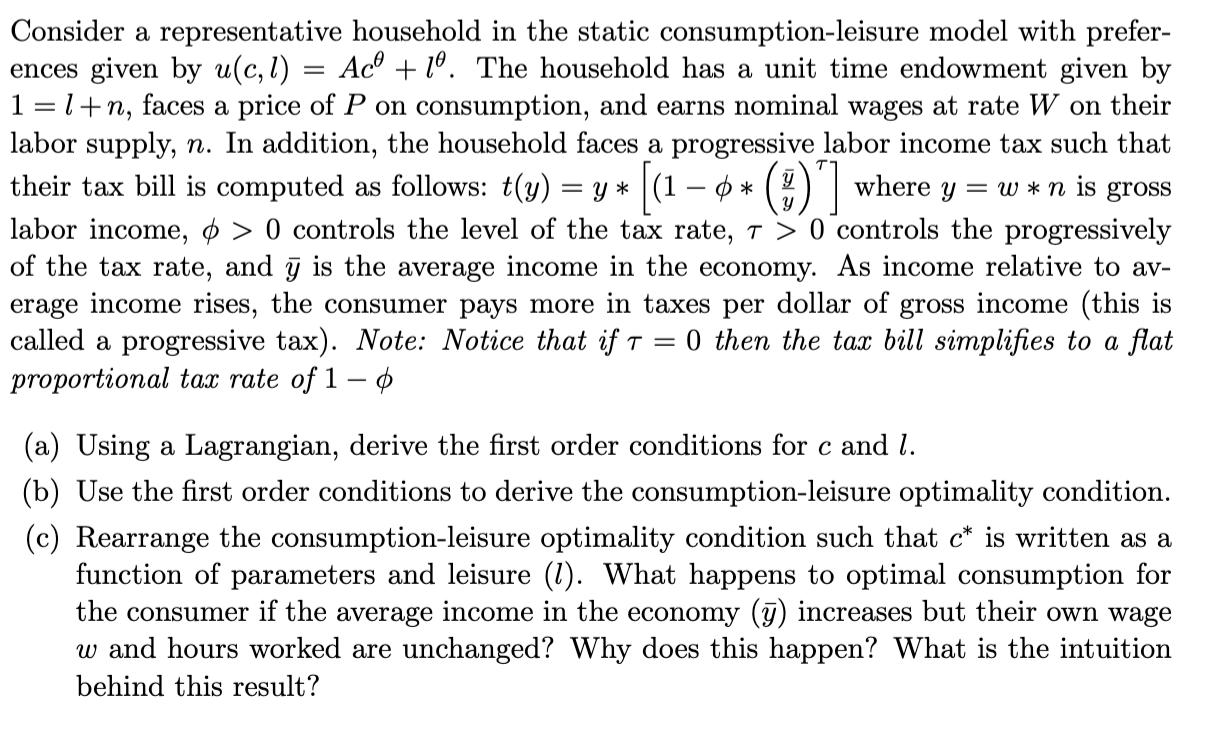

= Consider a representative household in the static consumption-leisure model with prefer- ences given by u(c, l) Ac+1. The household has a unit time endowment given by 1=1+n, faces a price of P on consumption, and earns nominal wages at rate W on their labor supply, n. In addition, the household faces a progressive labor income tax such that their tax bill is computed as follows: t(y) = y* [(1 * (#)"] where y =w*n is gross labor income, > 0 controls the level of the tax rate, 7> 0 controls the progressively of the tax rate, and y is the average income in the economy. As income relative to av- erage income rises, the consumer pays more in taxes per dollar of gross income (this is called a progressive tax). Note: Notice that if T=0 then the tax bill simplifies to a flat proportional tax rate of 1- (a) Using a Lagrangian, derive the first order conditions for c and 1. (b) Use the first order conditions to derive the consumption-leisure optimality condition. (c) Rearrange the consumption-leisure optimality condition such that c* is written as a function of parameters and leisure (1). What happens to optimal consumption for the consumer if the average income in the economy (y) increases but their own wage w and hours worked are unchanged? Why does this happen? What is the intuition behind this result?

Step by Step Solution

★★★★★

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer 2 b FOC L ac c de L mas uz c l consumption expo 2 tell...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started