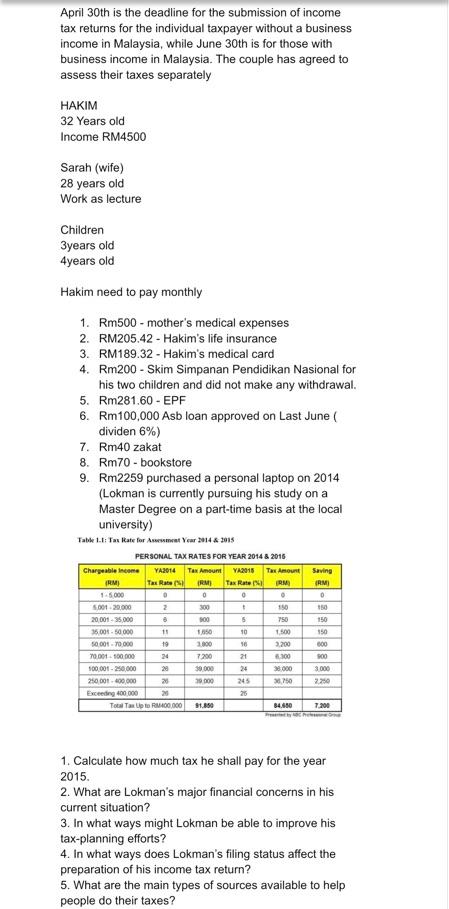

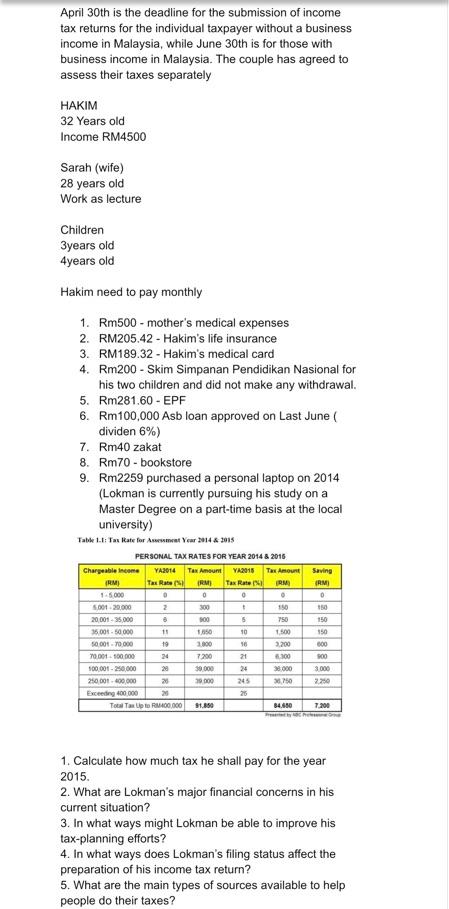

April 30th is the deadline for the submission of income tax returns for the individual taxpayer without a business income in Malaysia, while June 30th is for those with business income in Malaysia. The couple has agreed to assess their taxes separately HAKIM 32 Years old Income RM4500 Sarah (wife) 28 years old Work as lecture Children 3years old 4years old Hakim need to pay monthly 1. Rm500 - mother's medical expenses 2. RM205.42 - Hakim's life insurance 3. RM189.32 - Hakim's medical card 4. Rm200 - Skim Simpanan Pendidikan Nasional for his two children and did not make any withdrawal. 5. Rm281.60 - EPF 6. Rm100,000 Asb loan approved on Last June dividen 6%) 7. Rm40 zakat 8. Rm70 - bookstore 9. Rm2259 purchased a personal laptop on 2014 (Lokman is currently pursuing his study on a Master Degree on a part-time basis at the local university) Table 1.1: Tas Rate for Amst Year 2014 & 2015 PERSONAL TAX RATES FOR YEAR 2014 & 2016 Tax Amount RM 0 YA2015 Tax Rate 0 Tax Amount IRM o Saving RM 0 300 150 150 00 5 750 150 10 1.500 Chargeable income YA2014 RM Tax 1.5000 0 500120.000 2 20,001 - 35.000 35.001. 50.000 11 50001 - 70.000 19 70001 100 000 24 100001 - 250.000 20 250 0.400.000 20 Exceeding 400.000 23 Total Tap to 400.000 150 100 16 2.200 3.000 7.200 21 100 100 39000 24 38000 3000 39.000 245 250 2.250 91.850 34.650 7.200 1. Calculate how much tax he shall pay for the year 2015. 2. What are Lokman's major financial concerns in his current situation? 3. In what ways might Lokman be able to improve his tax-planning efforts? 4. In what ways does Lokman's filing status affect the preparation of his income tax return? 5. What are the main types of sources available to help people do their taxes? April 30th is the deadline for the submission of income tax returns for the individual taxpayer without a business income in Malaysia, while June 30th is for those with business income in Malaysia. The couple has agreed to assess their taxes separately HAKIM 32 Years old Income RM4500 Sarah (wife) 28 years old Work as lecture Children 3years old 4years old Hakim need to pay monthly 1. Rm500 - mother's medical expenses 2. RM205.42 - Hakim's life insurance 3. RM189.32 - Hakim's medical card 4. Rm200 - Skim Simpanan Pendidikan Nasional for his two children and did not make any withdrawal. 5. Rm281.60 - EPF 6. Rm100,000 Asb loan approved on Last June dividen 6%) 7. Rm40 zakat 8. Rm70 - bookstore 9. Rm2259 purchased a personal laptop on 2014 (Lokman is currently pursuing his study on a Master Degree on a part-time basis at the local university) Table 1.1: Tas Rate for Amst Year 2014 & 2015 PERSONAL TAX RATES FOR YEAR 2014 & 2016 Tax Amount RM 0 YA2015 Tax Rate 0 Tax Amount IRM o Saving RM 0 300 150 150 00 5 750 150 10 1.500 Chargeable income YA2014 RM Tax 1.5000 0 500120.000 2 20,001 - 35.000 35.001. 50.000 11 50001 - 70.000 19 70001 100 000 24 100001 - 250.000 20 250 0.400.000 20 Exceeding 400.000 23 Total Tap to 400.000 150 100 16 2.200 3.000 7.200 21 100 100 39000 24 38000 3000 39.000 245 250 2.250 91.850 34.650 7.200 1. Calculate how much tax he shall pay for the year 2015. 2. What are Lokman's major financial concerns in his current situation? 3. In what ways might Lokman be able to improve his tax-planning efforts? 4. In what ways does Lokman's filing status affect the preparation of his income tax return? 5. What are the main types of sources available to help people do their taxes