Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aprovide accounting records to take account of the information in (i)-(vi) above B) prepare a draft income statement and statement of financial position for the

Aprovide accounting records to take account of the information in (i)-(vi) above

B) prepare a draft income statement and statement of financial position for the year to 31st Dec.28

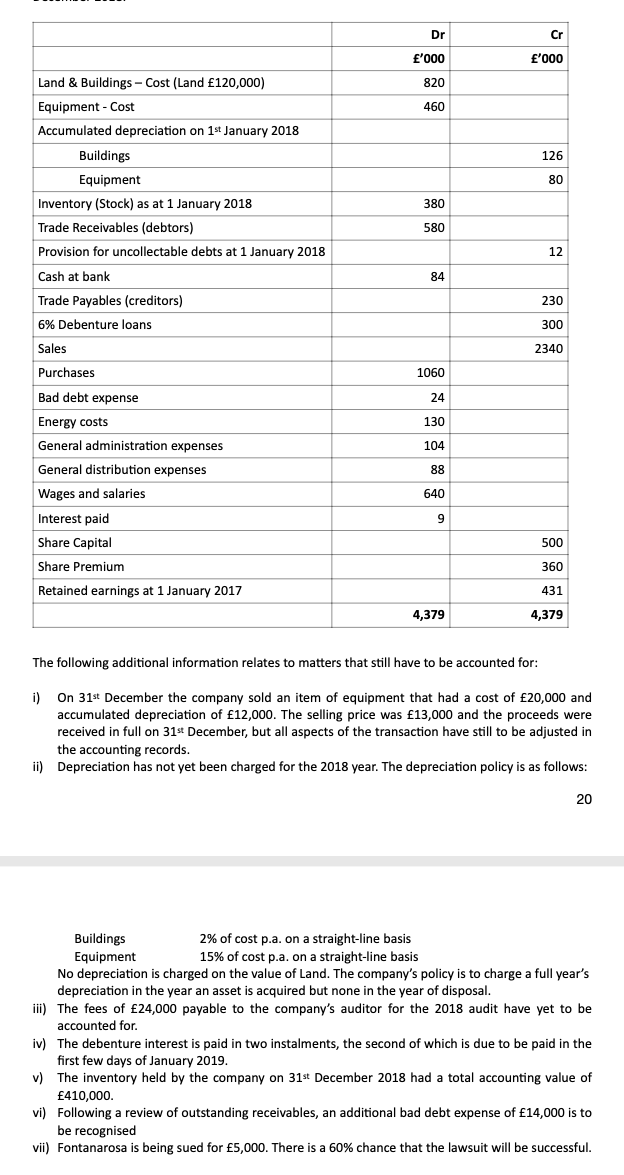

Dr Cr '000 '000 820 460 Land & Buildings - Cost (Land 120,000) Equipment - Cost Accumulated depreciation on 1st January 2018 Buildings 126 80 380 Equipment Inventory (Stock) as at 1 January 2018 Trade Receivables (debtors) Provision for uncollectable debts at 1 January 2018 580 12 84 Cash at bank Trade Payables (creditors) 6% Debenture loans 230 300 Sales 2340 Purchases 1060 Bad debt expense 24 130 104 Energy costs General administration expenses General distribution expenses Wages and salaries 88 640 9 Interest paid Share Capital Share Premium 500 360 Retained earnings at 1 January 2017 431 4,379 4,379 The following additional information relates to matters that still have to be accounted for: i) On 31st December the company sold an item of equipment that had a cost of 20,000 and accumulated depreciation of 12,000. The selling price was 13,000 and the proceeds were received in full on 31st December, but all aspects of the transaction have still to be adjusted in the accounting records. ii) Depreciation has not yet been charged for the 2018 year. The depreciation policy is as follows: 20 Buildings 2% of cost p.a. on a straight-line basis Equipment 15% of cost p.a. on a straight-line basis No depreciation is charged on the value of Land. The company's policy is to charge a full year's depreciation in the year an asset is acquired but none in the year of disposal. iii) The fees of 24,000 payable to the company's auditor for the 2018 audit have yet to be accounted for. iv) The debenture interest is paid in two instalments, the second of which is due to be paid in the first few days of January 2019. v) The inventory held by the company on 31st December 2018 had a total accounting value of 410,000 vi) Following a review of outstanding receivables, an additional bad debt expense of 14,000 is to be recognised vii) Fontanarosa is being sued for 5,000. There is a 60% chance that the lawsuit will be successfulStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started