Answered step by step

Verified Expert Solution

Question

1 Approved Answer

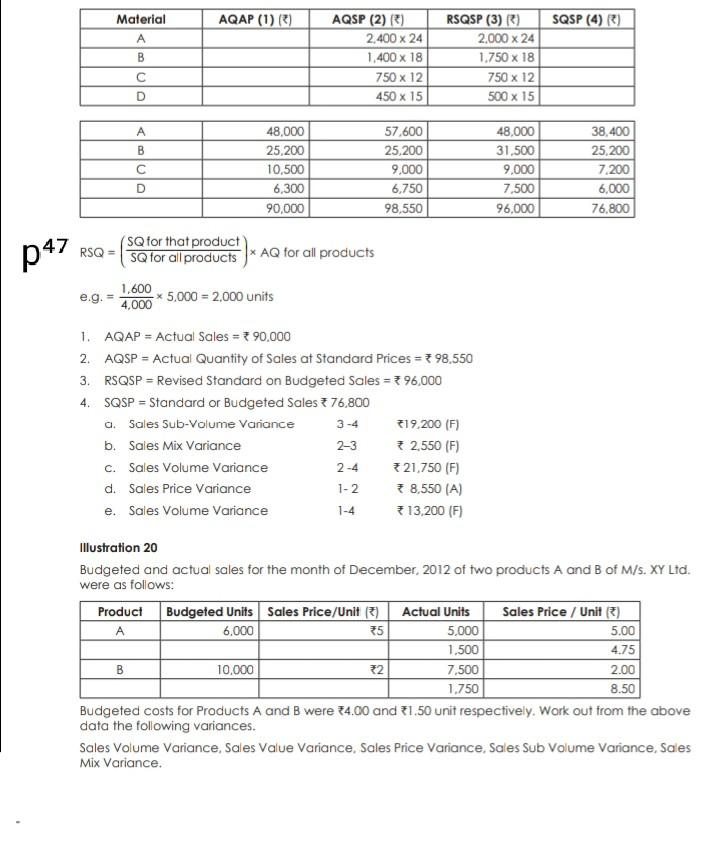

AQAP (1) (8) SQSP (4) R) Material A B AQSP (2) R) 2.400 x 24 1.400 x 18 750 x 12 450 x 15 RSQSP

AQAP (1) (8) SQSP (4) R) Material A B AQSP (2) R) 2.400 x 24 1.400 x 18 750 x 12 450 x 15 RSQSP (3) R) 2.000 x 24 1.750 x 18 750 x 12 500 x 15 D A B D 48,000 25,200 10,500 6.300 90,000 57,600 25,200 9,000 6,750 98,550 48.000 31.500 9,000 7,500 96,000 38,400 25,200 7.200 6.000 76,800 p 47 (SQ for that product RSQ = SQ for all products AQ for all products 1,600 - 5.000 = 2,000 units 4,000 1. AQAP = Actual Sales = + 90.000 2. AQSP = Actual Quantity of Sales at Standard Prices = 398,550 3. RSQSP = Revised Standard on Budgeted Sales = + 96,000 4. SQSP = Standard or Budgeted Sales 76,800 a. Sales Sub-Volume Variance 19,200 (F) b. Sales Mix Variance 2,550 (F) C. Sales Volume Variance 2-4 321,750 (F) d. Sales Price Variance 1-2 * 8,550 (A) e. Sales Volume Variance 313,200 (F) 3-4 2-3 1-4 Illustration 20 Budgeted and actual sales for the month of December 2012 of two products A and B of M/s. XY Ltd. were as follows: Product Budgeted Units Sales Price/Unit (3) Actual Units Sales Price / Unit) . 6,000 35 5,000 5.00 1,500 4.75 10,000 2 7,500 2.00 1.750 8.50 Budgeted costs for Products A and B were 34.00 and 31.50 unit respectively. Work out from the above data the following variances. Sales Volume Variance, Sales Value Variance, Sales Price Variance, Sales Sub Volume Variance, Sales Mix Variance. B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started