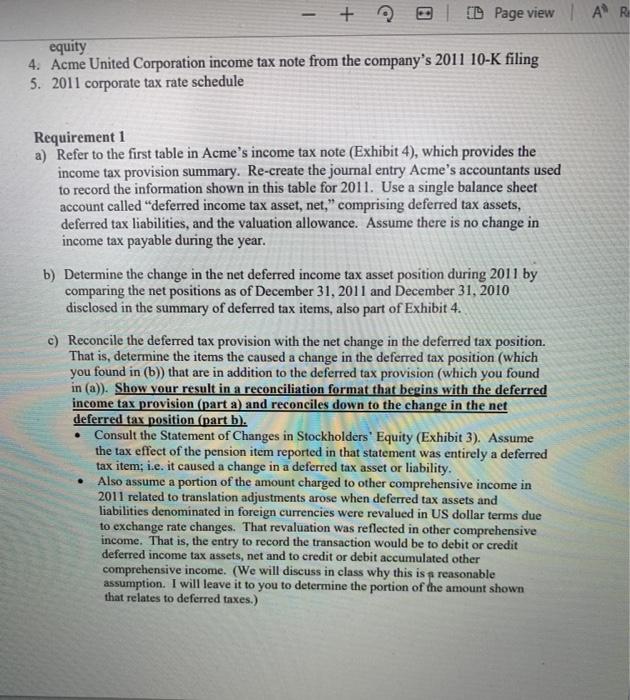

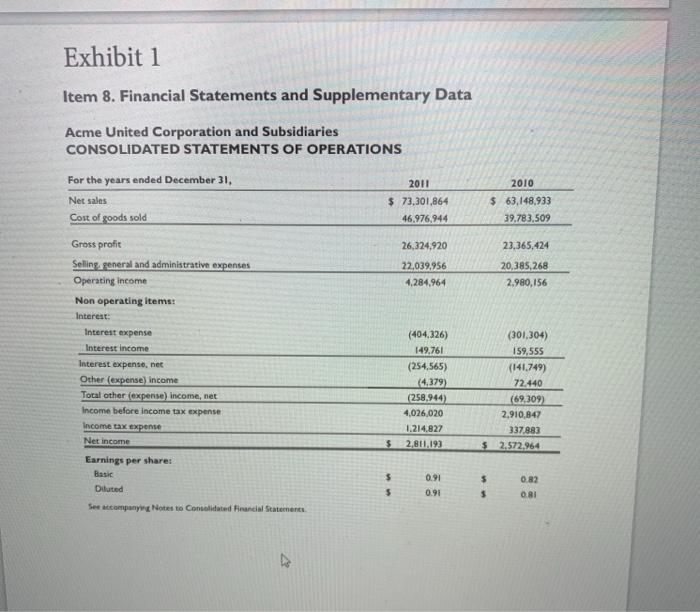

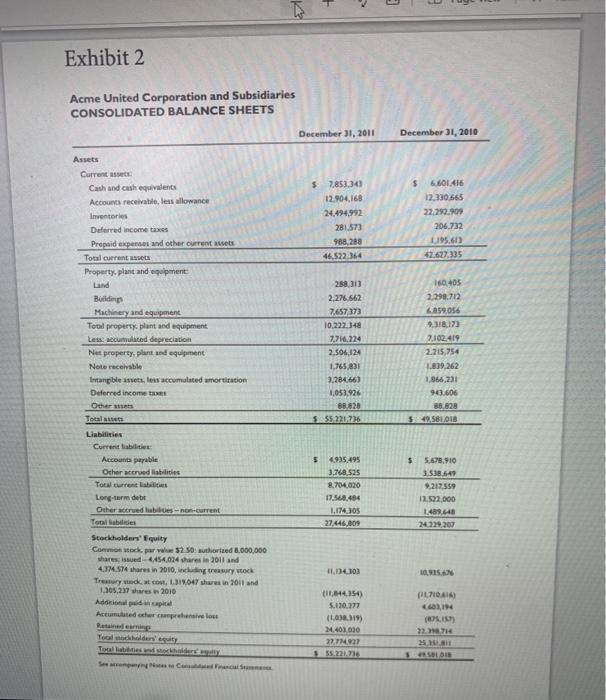

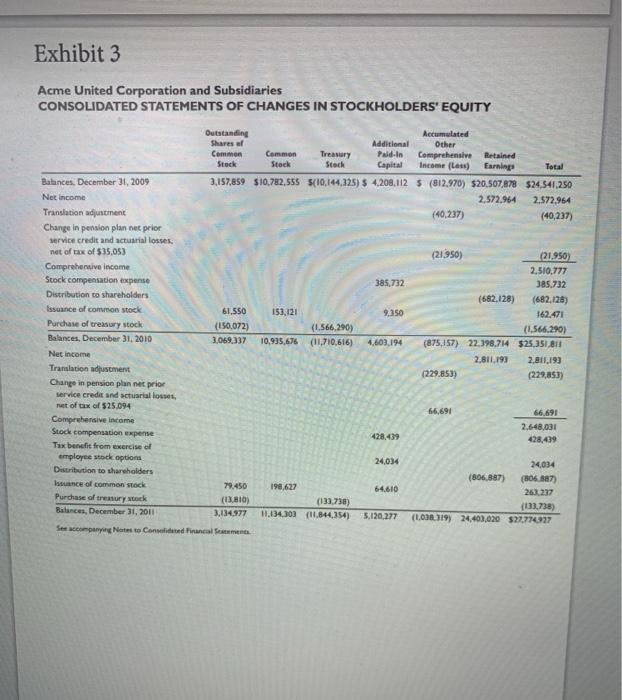

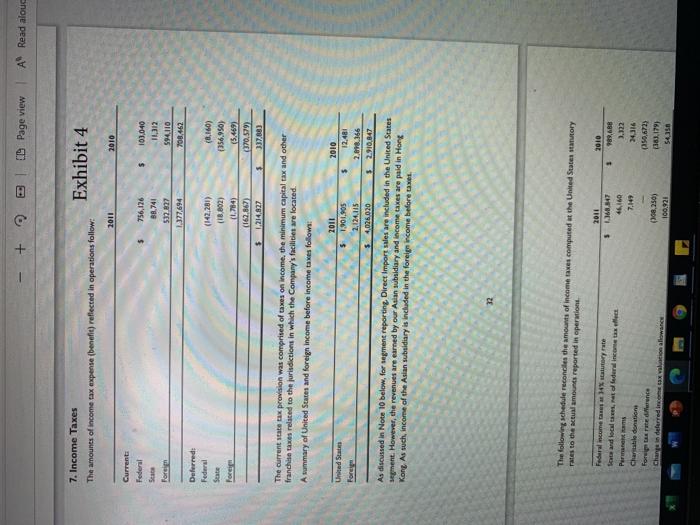

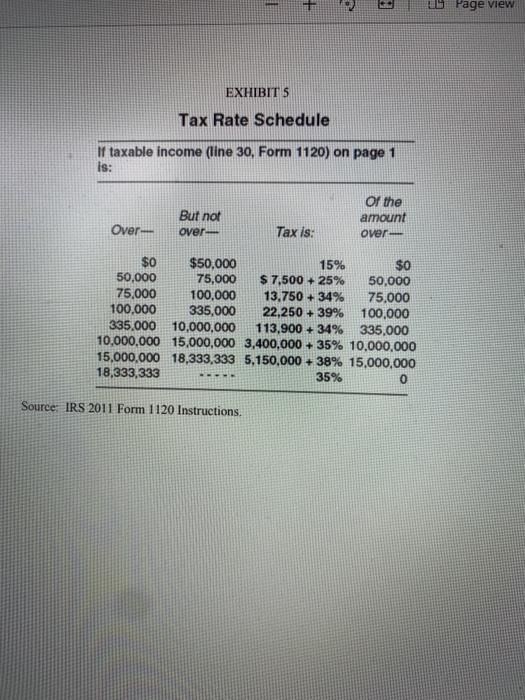

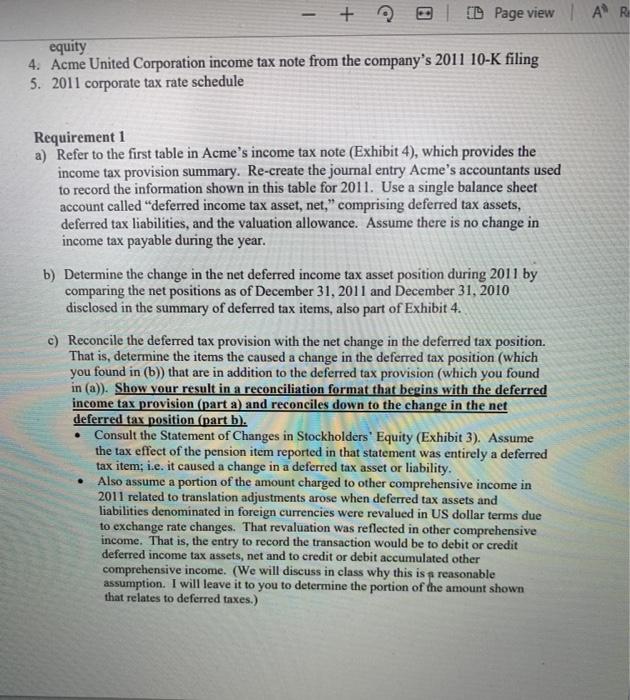

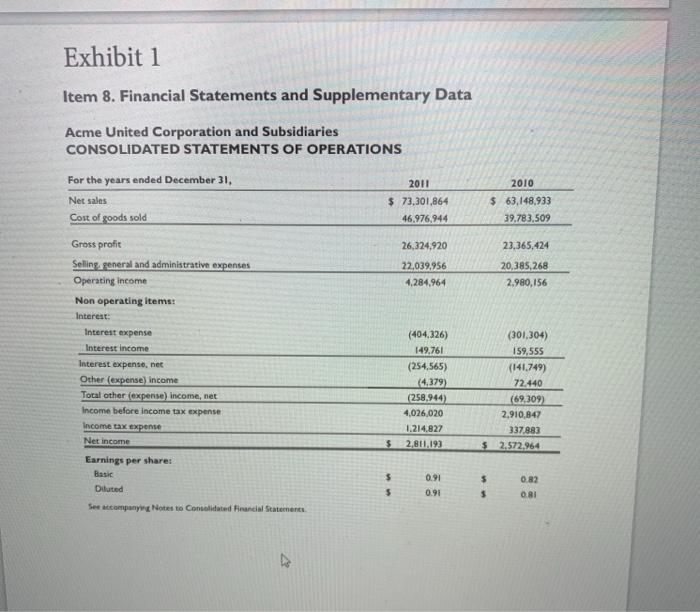

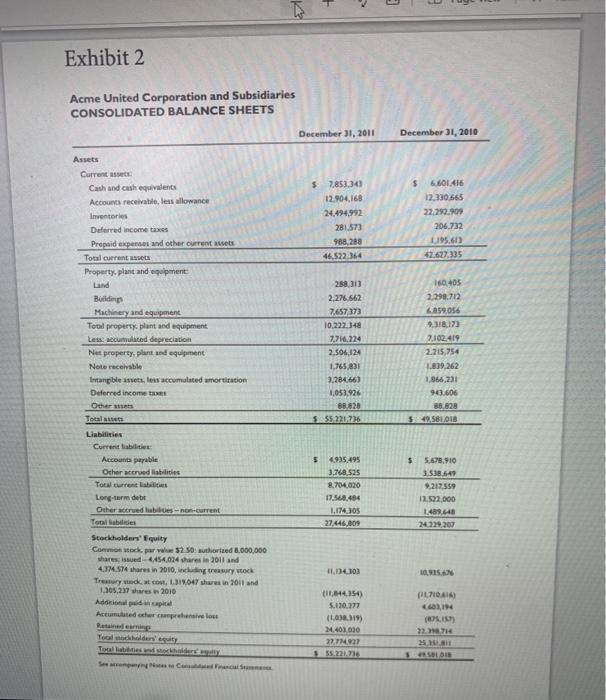

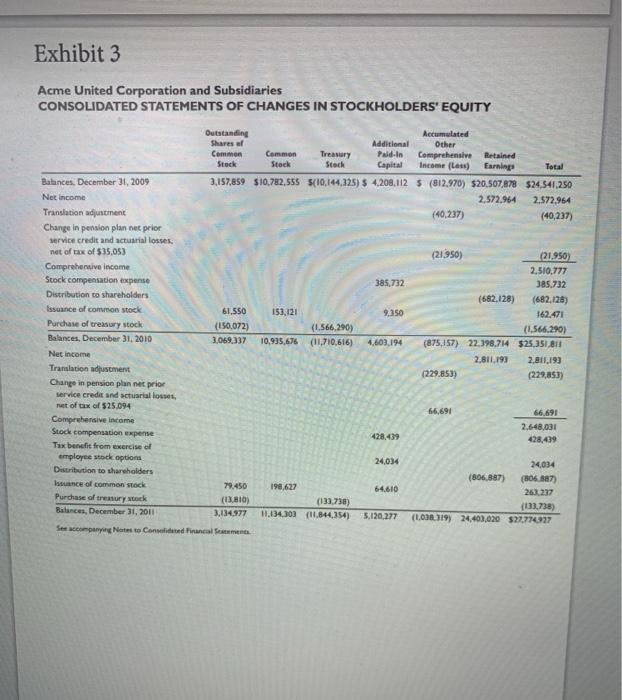

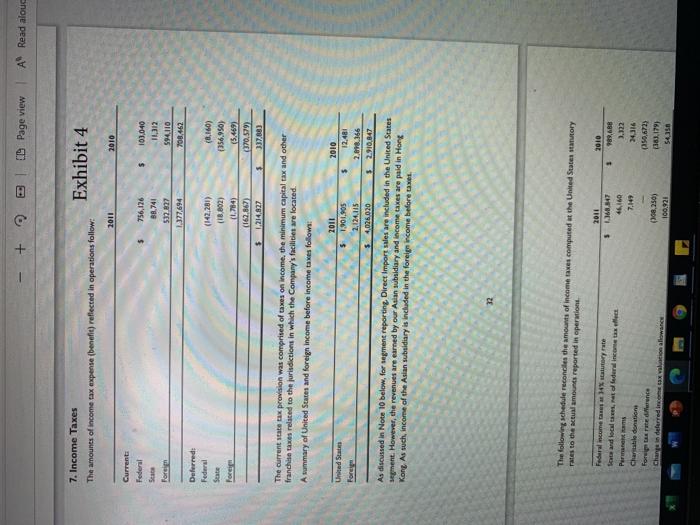

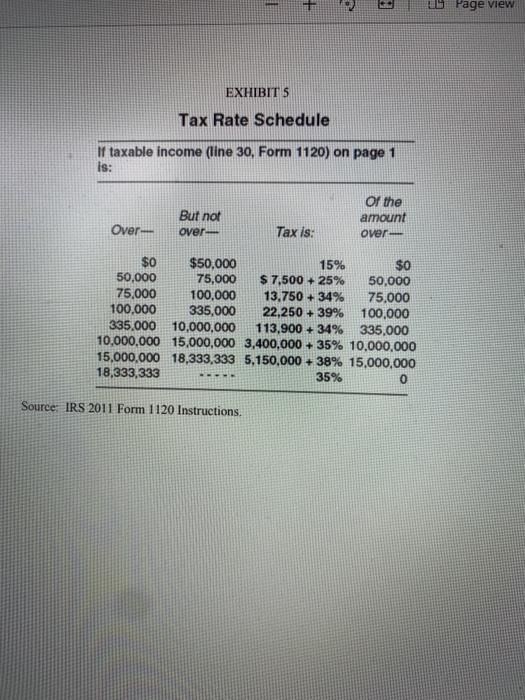

AR D Page view equity 4. Acme United Corporation income tax note from the company's 2011 10-K filing 5. 2011 corporate tax rate schedule Requirement 1 a) Refer to the first table in Acme's income tax note (Exhibit 4), which provides the income tax provision summary. Re-create the journal entry Acme's accountants used to record the information shown in this table for 2011. Use a single balance sheet account called "deferred income tax asset, net," comprising deferred tax assets, deferred tax liabilities, and the valuation allowance. Assume there is no change in income tax payable during the year. b) Determine the change in the net deferred income tax asset position during 2011 by comparing the net positions as of December 31, 2011 and December 31, 2010 disclosed in the summary of deferred tax items, also part of Exhibit 4. c) Reconcile the deferred tax provision with the net change in the deferred tax position. That is, determine the items the caused a change in the deferred tax position (which you found in (b)) that are in addition to the deferred tax provision (which you found in (a)). Show your result in a reconciliation format that begins with the deferred income tax provision (part a) and reconciles down to the change in the net deferred tax position (part b). Consult the Statement of Changes in Stockholders' Equity (Exhibit 3). Assume the tax effect of the pension item reported in that statement was entirely a deferred tax item; i.e. it caused a change in a deferred tax asset or liability. Also assume a portion of the amount charged to other comprehensive income in 2011 related to translation adjustments arose when deferred tax assets and liabilities denominated in foreign currencies were revalued in US dollar terms due to exchange rate changes. That revaluation was reflected in other comprehensive income. That is, the entry to record the transaction would be to debit or credit deferred income tax assets, net and to credit or debit accumulated other comprehensive income. (We will discuss in class why this is a reasonable assumption. I will leave it to you to determine the portion of the amount shown that relates to deferred taxes.) Exhibit 1 Item 8. Financial Statements and Supplementary Data Acme United Corporation and Subsidiaries CONSOLIDATED STATEMENTS OF OPERATIONS For the years ended December 31, Net sales Cost of goods sold 46.976.944 2011 $ 73,301,864 2010 $ 63,148,933 39.783,509 26,324,920 22,039,956 4,284,964 23.365,424 20,385,268 2.980,156 Gross profit Selling general and administrative expenses Operating income Non operating items: Interest Interest expense Interest income Interest expense, net Other (expense) Income Total other (expense) income, net Income before income tax expense Income tax expense Net Income Earnings per share: Basic Diluted See accompanying Notes to Consolidated Financial Statements (404,326) 149,761 (254,565) (4.379) (258,944) 4,026,020 1.214.827 2,811,193 (301,304) 159,555 (141.749) 72.440 (69.309 2,910,847 337.883 $ 2,572,964 $ $ $ 0.91 0.91 $ $ 0.82 0.81 + 3 Exhibit 2 Acme United Corporation and Subsidiaries CONSOLIDATED BALANCE SHEETS December 31, 2011 December JI, 2010 $ 6.61416 12.330.665 Assets Current Cash and cash equivalents Accounts receivable, less allowance Inventories Deferred Income taxes Prepaid expenses and other current sets Total carrent Property, plant and equipment 7.853.34 12.904,168 24.494992 281.573 988,288 46.522.364 22.292.909 206,732 L195.00 42.627.335 288.213 2.276.662 7.657373 10.222.148 7,716,224 2.506,124 1.765,831 3.284.663 1,053,926 88.820 555221,736 160.405 2.299.712 59,056 9.38.172 7.102.419 2.215,754 1809,262 1966,231 96.606 88.628 59.581 OIB Buildings Machinery and equipment Total property, plant and equipment Less accumulated depreciation Ne property, plant and equipment Note recette Intan ble svets, les accumulated amortization Deferred income Others Totalt Liabilities Current abil Accounts payable Other scored liabilities Tocal current abilities Long-term debe Other served Babes-on-current Total Babies Stockholders' Equity Com ock, por 32 50 wuthorized 8,000,000 whares sud-4454.034 hares in 2011 and 4.574 shares in 2010, ingresso Trek, 31.07 shwe in 2011 and 105,237 dares 2010 Aariraal pasa) Acumulated charcorelos 5 935.495 3.768.525 8.704,020 17.560.454 1.174305 27.446.609 5 5.698.910 3.538.649 9.217.559 12522,000 149.40 229.207 11,13003 10.915.4 (11.844.54) 5.110.277 (1.03.31 2440100 27.774.921 (10 4611 (075.8) 22.0TH Telder Codec Exhibit 3 Acme United Corporation and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY Outstanding Accumulated Shares of Additional Other Common Common Treasury Pald-in Comprehensive Retained Stock Stock Stock Capital Income (Lau) Earning Total Balances. December 31, 2009 3,157,859 $10.782,555 5(10,144.15) $ 4,208,112 5 (812.970) $20.507,878 $24.541.250 Net Income 2.572.964 2.572,964 Translation adjustment (40,237) (40,237) Change in pension plan net prior service credit and actuarial losses: net of tax of $35,053 (21.950) (21.950) Comprehensive income 2.510.777 Stock compensation expense 385,732 385.732 Distribution to shareholders (682.128) (682.128) Issuance of common stock 61.550 153,121 9.350 162.471 Purchase of treasury stock (150.072) (1.566,290) (1.566.290) Balances, December 31, 2010 3,069,337 10,935,676 (11,710,616) 4.603,194 (875,157) 22.198,714 $25,351,81 Net income 2,811,193 2.811,193 Translation adjustment (229.853) (229.853) Change in pension plan net prior service credit and actuarial losses, net of tax of $25,094 66,691 66.691 Comprehensive income 2,648,031 Stock compensation expense 428,409 428,439 Tax benefit from exercise of employee stock option 24,034 24,034 Distribution to shareholders (806,887) (806.387) Issue of common stock 79.450 198,627 64.610 263.237 Purchase of tremur stock (13.810) (132.738) (133.738) Balance, December 31, 2011 3.134.977 11.134.300 (11,844,354) 5.120.277 (1.076.319) 24,403,020 $27.774027 Ser companying Notes to considered ancies - + | D Page view A Read aloud 7. Income Taxes The amounts of income tax expense benefit) reflected in operations follow: Exhibit 4 2011 2010 $ Current Federal S Forei 756,126 B8.741 532.827 1.377,694 103,040 11.312 594,110 708,462 Deferred: Federal Sate Ford (142.281) (18,802) (1.784) (162.867) 1.214,827 (8.160) (156,950) 5.469) (370.579) 337.08) $ The current state tax provision was comprised of taxes on income, the minimum capital tax and other franchise taxes related to the jurisdictions in which the Company's facilities are located. A summary of United States and foreign income before income taxes follows: United States Foreign 2011 $ 1.901.905 2,124, 115 $4,026020 2010 $ 12.481 2.098.366 $2.910,847 As discussed in Note 10 below, for segment reporting Direct Import sales are included in the United States ment. However, the revenues are earned by our Asian subsidiary and income taxes are paid in Hong Kong As such, income of the Asian subsidiary is included in the foreign income before te 12 The following schedule reconcile the amounts of income taxes computed at the United States story rates to the actual amounts reported in operation 2011 2010 Federicometry 5 1.168.547 989,68 we and local et ledere con tax elect 46.160 1.122 Perm 7.149 24316 Charle donatione 90,672) For parte derente 108,250) (6. Charte delurred income tax volation allowance 109.9221 5435 + L Page view EXHIBITS Tax Rate Schedule If taxable income (line 30, Form 1120) on page 1 Is: Of the amount over- But not over Over- Tax is: $0 $50,000 15% $0 50,000 75,000 $ 7,500 + 25% 50,000 75,000 100,000 13.750 + 34% 75,000 100,000 335,000 22,250 + 39% 100,000 335.000 10.000.000 113,900 + 34% 335,000 10,000,000 15,000,000 3,400,000 + 35% 10,000,000 15,000,000 18,333,333 5,150,000 + 38% 15,000,000 18,333,333 35% 0 --- Source: IRS 2011 Form 1120 Instructions. AR D Page view equity 4. Acme United Corporation income tax note from the company's 2011 10-K filing 5. 2011 corporate tax rate schedule Requirement 1 a) Refer to the first table in Acme's income tax note (Exhibit 4), which provides the income tax provision summary. Re-create the journal entry Acme's accountants used to record the information shown in this table for 2011. Use a single balance sheet account called "deferred income tax asset, net," comprising deferred tax assets, deferred tax liabilities, and the valuation allowance. Assume there is no change in income tax payable during the year. b) Determine the change in the net deferred income tax asset position during 2011 by comparing the net positions as of December 31, 2011 and December 31, 2010 disclosed in the summary of deferred tax items, also part of Exhibit 4. c) Reconcile the deferred tax provision with the net change in the deferred tax position. That is, determine the items the caused a change in the deferred tax position (which you found in (b)) that are in addition to the deferred tax provision (which you found in (a)). Show your result in a reconciliation format that begins with the deferred income tax provision (part a) and reconciles down to the change in the net deferred tax position (part b). Consult the Statement of Changes in Stockholders' Equity (Exhibit 3). Assume the tax effect of the pension item reported in that statement was entirely a deferred tax item; i.e. it caused a change in a deferred tax asset or liability. Also assume a portion of the amount charged to other comprehensive income in 2011 related to translation adjustments arose when deferred tax assets and liabilities denominated in foreign currencies were revalued in US dollar terms due to exchange rate changes. That revaluation was reflected in other comprehensive income. That is, the entry to record the transaction would be to debit or credit deferred income tax assets, net and to credit or debit accumulated other comprehensive income. (We will discuss in class why this is a reasonable assumption. I will leave it to you to determine the portion of the amount shown that relates to deferred taxes.) Exhibit 1 Item 8. Financial Statements and Supplementary Data Acme United Corporation and Subsidiaries CONSOLIDATED STATEMENTS OF OPERATIONS For the years ended December 31, Net sales Cost of goods sold 46.976.944 2011 $ 73,301,864 2010 $ 63,148,933 39.783,509 26,324,920 22,039,956 4,284,964 23.365,424 20,385,268 2.980,156 Gross profit Selling general and administrative expenses Operating income Non operating items: Interest Interest expense Interest income Interest expense, net Other (expense) Income Total other (expense) income, net Income before income tax expense Income tax expense Net Income Earnings per share: Basic Diluted See accompanying Notes to Consolidated Financial Statements (404,326) 149,761 (254,565) (4.379) (258,944) 4,026,020 1.214.827 2,811,193 (301,304) 159,555 (141.749) 72.440 (69.309 2,910,847 337.883 $ 2,572,964 $ $ $ 0.91 0.91 $ $ 0.82 0.81 + 3 Exhibit 2 Acme United Corporation and Subsidiaries CONSOLIDATED BALANCE SHEETS December 31, 2011 December JI, 2010 $ 6.61416 12.330.665 Assets Current Cash and cash equivalents Accounts receivable, less allowance Inventories Deferred Income taxes Prepaid expenses and other current sets Total carrent Property, plant and equipment 7.853.34 12.904,168 24.494992 281.573 988,288 46.522.364 22.292.909 206,732 L195.00 42.627.335 288.213 2.276.662 7.657373 10.222.148 7,716,224 2.506,124 1.765,831 3.284.663 1,053,926 88.820 555221,736 160.405 2.299.712 59,056 9.38.172 7.102.419 2.215,754 1809,262 1966,231 96.606 88.628 59.581 OIB Buildings Machinery and equipment Total property, plant and equipment Less accumulated depreciation Ne property, plant and equipment Note recette Intan ble svets, les accumulated amortization Deferred income Others Totalt Liabilities Current abil Accounts payable Other scored liabilities Tocal current abilities Long-term debe Other served Babes-on-current Total Babies Stockholders' Equity Com ock, por 32 50 wuthorized 8,000,000 whares sud-4454.034 hares in 2011 and 4.574 shares in 2010, ingresso Trek, 31.07 shwe in 2011 and 105,237 dares 2010 Aariraal pasa) Acumulated charcorelos 5 935.495 3.768.525 8.704,020 17.560.454 1.174305 27.446.609 5 5.698.910 3.538.649 9.217.559 12522,000 149.40 229.207 11,13003 10.915.4 (11.844.54) 5.110.277 (1.03.31 2440100 27.774.921 (10 4611 (075.8) 22.0TH Telder Codec Exhibit 3 Acme United Corporation and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY Outstanding Accumulated Shares of Additional Other Common Common Treasury Pald-in Comprehensive Retained Stock Stock Stock Capital Income (Lau) Earning Total Balances. December 31, 2009 3,157,859 $10.782,555 5(10,144.15) $ 4,208,112 5 (812.970) $20.507,878 $24.541.250 Net Income 2.572.964 2.572,964 Translation adjustment (40,237) (40,237) Change in pension plan net prior service credit and actuarial losses: net of tax of $35,053 (21.950) (21.950) Comprehensive income 2.510.777 Stock compensation expense 385,732 385.732 Distribution to shareholders (682.128) (682.128) Issuance of common stock 61.550 153,121 9.350 162.471 Purchase of treasury stock (150.072) (1.566,290) (1.566.290) Balances, December 31, 2010 3,069,337 10,935,676 (11,710,616) 4.603,194 (875,157) 22.198,714 $25,351,81 Net income 2,811,193 2.811,193 Translation adjustment (229.853) (229.853) Change in pension plan net prior service credit and actuarial losses, net of tax of $25,094 66,691 66.691 Comprehensive income 2,648,031 Stock compensation expense 428,409 428,439 Tax benefit from exercise of employee stock option 24,034 24,034 Distribution to shareholders (806,887) (806.387) Issue of common stock 79.450 198,627 64.610 263.237 Purchase of tremur stock (13.810) (132.738) (133.738) Balance, December 31, 2011 3.134.977 11.134.300 (11,844,354) 5.120.277 (1.076.319) 24,403,020 $27.774027 Ser companying Notes to considered ancies - + | D Page view A Read aloud 7. Income Taxes The amounts of income tax expense benefit) reflected in operations follow: Exhibit 4 2011 2010 $ Current Federal S Forei 756,126 B8.741 532.827 1.377,694 103,040 11.312 594,110 708,462 Deferred: Federal Sate Ford (142.281) (18,802) (1.784) (162.867) 1.214,827 (8.160) (156,950) 5.469) (370.579) 337.08) $ The current state tax provision was comprised of taxes on income, the minimum capital tax and other franchise taxes related to the jurisdictions in which the Company's facilities are located. A summary of United States and foreign income before income taxes follows: United States Foreign 2011 $ 1.901.905 2,124, 115 $4,026020 2010 $ 12.481 2.098.366 $2.910,847 As discussed in Note 10 below, for segment reporting Direct Import sales are included in the United States ment. However, the revenues are earned by our Asian subsidiary and income taxes are paid in Hong Kong As such, income of the Asian subsidiary is included in the foreign income before te 12 The following schedule reconcile the amounts of income taxes computed at the United States story rates to the actual amounts reported in operation 2011 2010 Federicometry 5 1.168.547 989,68 we and local et ledere con tax elect 46.160 1.122 Perm 7.149 24316 Charle donatione 90,672) For parte derente 108,250) (6. Charte delurred income tax volation allowance 109.9221 5435 + L Page view EXHIBITS Tax Rate Schedule If taxable income (line 30, Form 1120) on page 1 Is: Of the amount over- But not over Over- Tax is: $0 $50,000 15% $0 50,000 75,000 $ 7,500 + 25% 50,000 75,000 100,000 13.750 + 34% 75,000 100,000 335,000 22,250 + 39% 100,000 335.000 10.000.000 113,900 + 34% 335,000 10,000,000 15,000,000 3,400,000 + 35% 10,000,000 15,000,000 18,333,333 5,150,000 + 38% 15,000,000 18,333,333 35% 0 --- Source: IRS 2011 Form 1120 Instructions